Hi Guys,

the situation is the following.

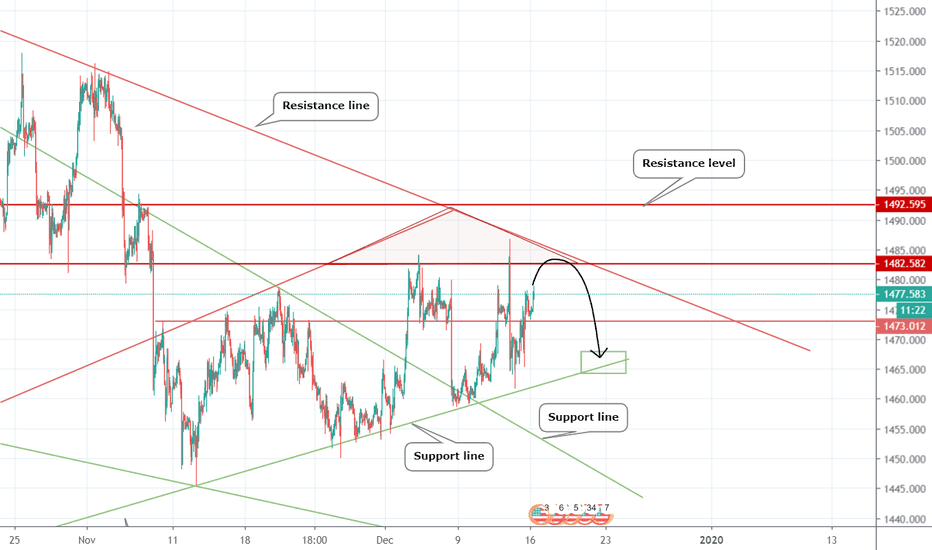

On Nov.7h Gold breached support at 1479/80 (light blue bold horizontal line). The break was favoured by a big Gap-Up in US stocks, prompted by growing optimism in respect of US-China Trade Deal as detailed in the following idea posted on Nov.9th (Tradingview did not allow for this idea to be public because timeframe is 5 minutes).

If it was for me all ideas should be public regardless timeframe.

Apex of this optimism was reached when news came out about U.S. willingness to lift tariffs.

When Trump said the reports were incorrect, optimism stumbled for support and formed (B). From (B) Gold retraced 0,382 Fibonacci of AB to make (C).

BC may have been a Bear Rally but under these circumstances I am not 100% convinced it can be called so.

At (C), test of support become resistance, the 100SMA pushed price down again towards (B). Such push from the 100SMA represents the "Bearish Pressure". Same "Bearish Pressure" that was defeated when pulling back from (D).

Click & Play the above to see how the rounding bottom forming (D) unfolds.

(D) is a rounding bottom at same level of (B). Such structure provides a nice support for bulls to try to attack the descending "Bearish Pressure". Infact price pullback from (D) and breaks the 100SMA to run into 200SMA on the upper band of the 100BB at 1479/80 as detailed in the following Public post:

I really liked the idea of a CUP & HANDLE (Gold likes it too) but good NFP above expectation boosted optimism on US economy and pushed Gold price down. I am not labelling the circled area because I don't know what it could be yet. If you have any idea please share it in the comments.

TO NOTE: RSI primary chart modified to follow price moves above & below 100SMA. This shows that sentiment returned positive before NFP. NFP pushed sentiment back into bearish territory. Gold price is still above double bottom which provides support.

The following ideas may help to make some planning:

For additional infos about Gold please refer to the related ideas linked at the end of this post.

If you have any questions or comment to add please do not hesitate to post it.

Thank you for your support and for sharing your ideas.

Disclaimer:

Please note that I am not a professional trader and these are my personal ideas only. The information contained in this presentation is solely for educational purposes and does not constitute investment advice. The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation. Cozzamara is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

IMHO: The point of trading is to make money. To make money you must have money. Depending on the money at your disposal, you can decide what to do and how to do it. By having stops you decide how much you are willing to lose. By having targets you decide how much you want to earn. Be disciplined with your protocol and with your strategies for trading. Sometime you win, sometime you lose. Don't be greedy. Be realistic. Be wary but not afraid. Be curious. Use your brain. As long as your working process make sense and your spirit is calm, everything will be fine. Be patient and be prepared for any circumtances.

the situation is the following.

On Nov.7h Gold breached support at 1479/80 (light blue bold horizontal line). The break was favoured by a big Gap-Up in US stocks, prompted by growing optimism in respect of US-China Trade Deal as detailed in the following idea posted on Nov.9th (Tradingview did not allow for this idea to be public because timeframe is 5 minutes).

If it was for me all ideas should be public regardless timeframe.

Apex of this optimism was reached when news came out about U.S. willingness to lift tariffs.

When Trump said the reports were incorrect, optimism stumbled for support and formed (B). From (B) Gold retraced 0,382 Fibonacci of AB to make (C).

BC may have been a Bear Rally but under these circumstances I am not 100% convinced it can be called so.

At (C), test of support become resistance, the 100SMA pushed price down again towards (B). Such push from the 100SMA represents the "Bearish Pressure". Same "Bearish Pressure" that was defeated when pulling back from (D).

Click & Play the above to see how the rounding bottom forming (D) unfolds.

(D) is a rounding bottom at same level of (B). Such structure provides a nice support for bulls to try to attack the descending "Bearish Pressure". Infact price pullback from (D) and breaks the 100SMA to run into 200SMA on the upper band of the 100BB at 1479/80 as detailed in the following Public post:

I really liked the idea of a CUP & HANDLE (Gold likes it too) but good NFP above expectation boosted optimism on US economy and pushed Gold price down. I am not labelling the circled area because I don't know what it could be yet. If you have any idea please share it in the comments.

TO NOTE: RSI primary chart modified to follow price moves above & below 100SMA. This shows that sentiment returned positive before NFP. NFP pushed sentiment back into bearish territory. Gold price is still above double bottom which provides support.

The following ideas may help to make some planning:

For additional infos about Gold please refer to the related ideas linked at the end of this post.

If you have any questions or comment to add please do not hesitate to post it.

Thank you for your support and for sharing your ideas.

Disclaimer:

Please note that I am not a professional trader and these are my personal ideas only. The information contained in this presentation is solely for educational purposes and does not constitute investment advice. The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation. Cozzamara is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

IMHO: The point of trading is to make money. To make money you must have money. Depending on the money at your disposal, you can decide what to do and how to do it. By having stops you decide how much you are willing to lose. By having targets you decide how much you want to earn. Be disciplined with your protocol and with your strategies for trading. Sometime you win, sometime you lose. Don't be greedy. Be realistic. Be wary but not afraid. Be curious. Use your brain. As long as your working process make sense and your spirit is calm, everything will be fine. Be patient and be prepared for any circumtances.

Note

Only the 1st T changes as it remains inside the BBNote

For those who may be interested, here the link to Lagarde's livestream ECB press conference following monetary policy decision:ecb.europa.eu/press/tvservices/webcast/html/webcast_pc_m.en.html

Note

Our captain advises that we are approaching an area of expected turbulence.For your comfort, please remain seated with your seat belt fastened until the fasten seat belt sign is

switched off.

Thanks for your attention.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.