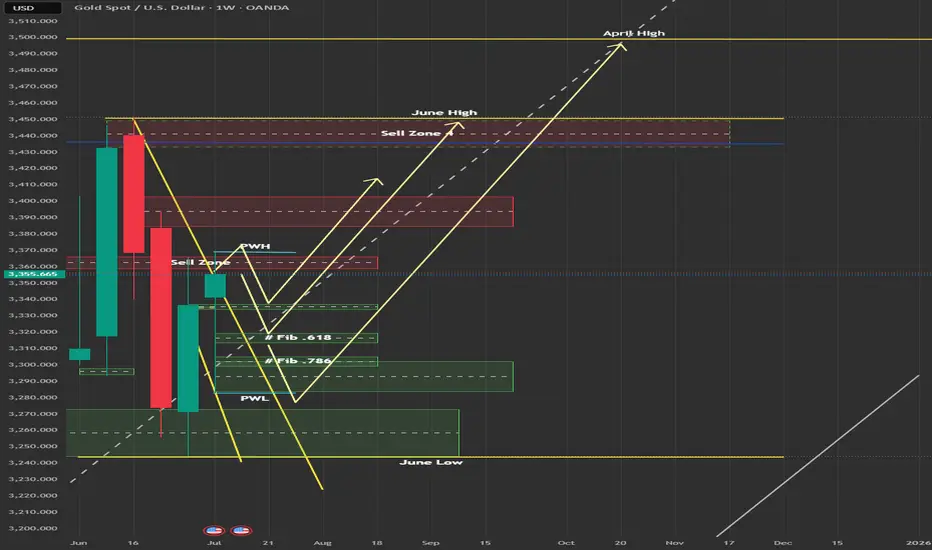

🟡 Gold Weekly Outlook – Bullish Momentum Tested at Key Support

Welcome to a new trading week! Gold remains in a broader uptrend, though recent price action is testing a critical support zone that could define the next directional move.

🔹 Key Zone in Focus: $3,308

Gold is currently testing the $3,308 level, a major support area from previous consolidation. How price reacts here will shape the near-term outlook.

🔼 Upside Scenario (Rebound from $3,308):

$3,387 – Initial resistance and breakout target

$3,400 – Key psychological and structural level

$3,435 – Long-term resistance zone from weekly charts

🔽 Downside Scenario (Break below $3,308):

$3,290 – Minor support

$3,268 – Stronger demand zone with historical buying interest

Outlook: The bullish bias remains valid as long as Gold holds above $3,308. A daily close below would shift momentum to the downside, opening up lower support levels.

📉 Weekly Chart (High Timeframe Outlook)

Bias: Bullish, but signs of exhaustion are emerging

Current Candle: Bearish rejection forming after last week’s lower high

Trend: Still upward, but stalling inside a distribution-like pattern

Weekly Structure:

Major CHoCH in early 2023 triggered the ongoing uptrend

Price made a Higher High near $3,500, but it appears weak

Now consolidating inside a premium range, rejecting upper levels

🔑 Weekly Confluence Zones:

Type Price Zone Confluence Factors

🔼 Resistance $3,490–$3,500 Weak high + RSI divergence + FVG

🔼 Supply $3,450–$3,470 Imbalance fill + overextended EMA5

🔽 Support $3,355–$3,320 Weekly order block + FVG zone

🔽 Deep Demand $3,200–$3,170 Last strong demand + BOS origin

Fibonacci: 50% retracement sits near $3,250

Weekly RSI: Rolling over from overbought – potential early trend cracks

EMAs (5/21/50): Still bullish but flattening – short-term caution

🔍 Key Weekly Watchpoints:

Close above $3,470 → possible sweep into $3,500 resistance

Failure to hold $3,355–$3,320 → deeper drop toward $3,200

Watch for lower high formation inside premium = bearish shift

A bounce from $3,320 must be supported by volume and FVG reaction

📊 Daily Chart (D1) – Compression Near Supply

Bias: Neutral with rising bearish pressure

Trend: Still bullish overall, but compressing between supply and mid-range zones

Current Position:

Price capped below $3,395

Bearish CHoCH formed, but no daily BOS yet

EMAs are narrowing; RSI is flat → signs of indecision

🔑 Daily Zones to Watch:

Type Price Range Highlights

🔼 Supply $3,448–$3,465 Daily OB + EMA divergence + trap zone

🔼 LH OB $3,385–$3,395 Internal supply + EMA21 rejection

🔽 Mid FVG $3,328–$3,310 Fib midpoint + previous reaction zone

🔽 Strong OB $3,260–$3,245 Unmitigated OB + 61.8% fib retracement

Fibonacci: Pullback to $3,310 = mid-point of the last bullish impulse

EMAs (5/21/50): Bearish crossover, but no strong divergence

RSI: Neutral – awaiting price action confirmation

📌 Trade Scenarios:

Bearish: Rejection at $3,385–$3,395 → fall toward $3,310, then $3,245

Bullish: Clean break + retest above $3,395 → short squeeze into $3,460 liquidity

⏱️ 4H Chart – Intraday Bias: Bearish (Below $3,420)

Bias: Bearish unless price reclaims and holds above $3,420

Structure: Lower high formation likely; recent CHoCH may be inducement

Context: Filled FVGs + untested OBs in premium → caution warranted

RSI: Near exhaustion

🔼 Zones Above Price:

$3,445–$3,465 – Weak high + unfilled FVG = likely bull trap

$3,405–$3,420 – Lower high resistance zone; likely turning point

$3,360–$3,385 – Core supply from CHoCH + EMA21 dynamic resistance

🔽 Zones Below Price:

$3,340–$3,355 – Minor support; could break easily

$3,300–$3,280 – Key demand zone at 50% fib retracement

$3,240–$3,210 – Major support; origin of the last HL

$3,185–$3,160 – Final liquidity zone; break here would invalidate June rally

🎯 Intraday Trade Setups:

🔻 Bearish Setup (Preferred):

Rejection from $3,405–$3,420

Forms a lower high → clean drop toward $3,300

Confirmation: bearish engulfing or wick rejection on M30–H1

🔺 Bullish Breakout (Less Likely):

Strong break + hold above $3,420

Upside extension into $3,445–$3,465 zone

Must be supported by dovish macro events (e.g., soft CPI or FOMC tone)

Note: That zone remains weak liquidity, so not ideal for holding longs

📌 Final Word

Gold’s bullish trend is intact while price holds above $3,308, but momentum is slowing.

The battle between bulls and bears is happening in the $3,300–$3,395 range. A break outside this zone will likely define the trend for the week ahead.

Stay disciplined, watch for key confirmations, and manage risk carefully.

Welcome to a new trading week! Gold remains in a broader uptrend, though recent price action is testing a critical support zone that could define the next directional move.

🔹 Key Zone in Focus: $3,308

Gold is currently testing the $3,308 level, a major support area from previous consolidation. How price reacts here will shape the near-term outlook.

🔼 Upside Scenario (Rebound from $3,308):

$3,387 – Initial resistance and breakout target

$3,400 – Key psychological and structural level

$3,435 – Long-term resistance zone from weekly charts

🔽 Downside Scenario (Break below $3,308):

$3,290 – Minor support

$3,268 – Stronger demand zone with historical buying interest

Outlook: The bullish bias remains valid as long as Gold holds above $3,308. A daily close below would shift momentum to the downside, opening up lower support levels.

📉 Weekly Chart (High Timeframe Outlook)

Bias: Bullish, but signs of exhaustion are emerging

Current Candle: Bearish rejection forming after last week’s lower high

Trend: Still upward, but stalling inside a distribution-like pattern

Weekly Structure:

Major CHoCH in early 2023 triggered the ongoing uptrend

Price made a Higher High near $3,500, but it appears weak

Now consolidating inside a premium range, rejecting upper levels

🔑 Weekly Confluence Zones:

Type Price Zone Confluence Factors

🔼 Resistance $3,490–$3,500 Weak high + RSI divergence + FVG

🔼 Supply $3,450–$3,470 Imbalance fill + overextended EMA5

🔽 Support $3,355–$3,320 Weekly order block + FVG zone

🔽 Deep Demand $3,200–$3,170 Last strong demand + BOS origin

Fibonacci: 50% retracement sits near $3,250

Weekly RSI: Rolling over from overbought – potential early trend cracks

EMAs (5/21/50): Still bullish but flattening – short-term caution

🔍 Key Weekly Watchpoints:

Close above $3,470 → possible sweep into $3,500 resistance

Failure to hold $3,355–$3,320 → deeper drop toward $3,200

Watch for lower high formation inside premium = bearish shift

A bounce from $3,320 must be supported by volume and FVG reaction

📊 Daily Chart (D1) – Compression Near Supply

Bias: Neutral with rising bearish pressure

Trend: Still bullish overall, but compressing between supply and mid-range zones

Current Position:

Price capped below $3,395

Bearish CHoCH formed, but no daily BOS yet

EMAs are narrowing; RSI is flat → signs of indecision

🔑 Daily Zones to Watch:

Type Price Range Highlights

🔼 Supply $3,448–$3,465 Daily OB + EMA divergence + trap zone

🔼 LH OB $3,385–$3,395 Internal supply + EMA21 rejection

🔽 Mid FVG $3,328–$3,310 Fib midpoint + previous reaction zone

🔽 Strong OB $3,260–$3,245 Unmitigated OB + 61.8% fib retracement

Fibonacci: Pullback to $3,310 = mid-point of the last bullish impulse

EMAs (5/21/50): Bearish crossover, but no strong divergence

RSI: Neutral – awaiting price action confirmation

📌 Trade Scenarios:

Bearish: Rejection at $3,385–$3,395 → fall toward $3,310, then $3,245

Bullish: Clean break + retest above $3,395 → short squeeze into $3,460 liquidity

⏱️ 4H Chart – Intraday Bias: Bearish (Below $3,420)

Bias: Bearish unless price reclaims and holds above $3,420

Structure: Lower high formation likely; recent CHoCH may be inducement

Context: Filled FVGs + untested OBs in premium → caution warranted

RSI: Near exhaustion

🔼 Zones Above Price:

$3,445–$3,465 – Weak high + unfilled FVG = likely bull trap

$3,405–$3,420 – Lower high resistance zone; likely turning point

$3,360–$3,385 – Core supply from CHoCH + EMA21 dynamic resistance

🔽 Zones Below Price:

$3,340–$3,355 – Minor support; could break easily

$3,300–$3,280 – Key demand zone at 50% fib retracement

$3,240–$3,210 – Major support; origin of the last HL

$3,185–$3,160 – Final liquidity zone; break here would invalidate June rally

🎯 Intraday Trade Setups:

🔻 Bearish Setup (Preferred):

Rejection from $3,405–$3,420

Forms a lower high → clean drop toward $3,300

Confirmation: bearish engulfing or wick rejection on M30–H1

🔺 Bullish Breakout (Less Likely):

Strong break + hold above $3,420

Upside extension into $3,445–$3,465 zone

Must be supported by dovish macro events (e.g., soft CPI or FOMC tone)

Note: That zone remains weak liquidity, so not ideal for holding longs

📌 Final Word

Gold’s bullish trend is intact while price holds above $3,308, but momentum is slowing.

The battle between bulls and bears is happening in the $3,300–$3,395 range. A break outside this zone will likely define the trend for the week ahead.

Stay disciplined, watch for key confirmations, and manage risk carefully.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.