Gold price final game: 3300

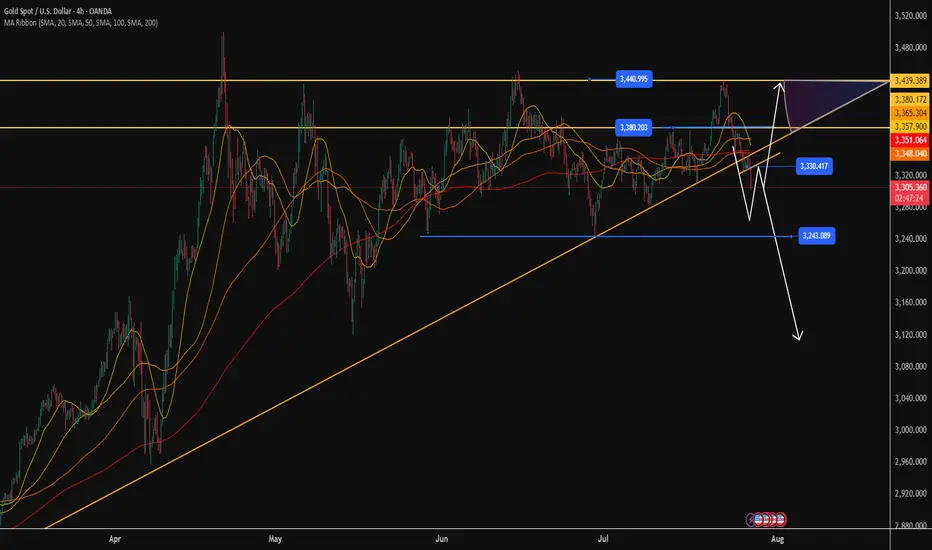

Today's gold price is on the verge of collapse, but the direction divergence still exists, with long and short intertwined.

Pay attention to the 3300 support.

The entire triangle convergence and oscillation pattern has been broken, and the important support platform before 3330 points has been broken.

Regardless of how the policy is announced,

shorting is inevitable.

Next, the bulls will enter the final bottom-picking stage:

Buy: 3300-3310

Stop loss: 3290

Target: 3330-3340+

Technical analysis:

Short-term support level: 3300

Short-term resistance level: 3330-3345

Market sentiment: The gold market sentiment presents a pattern of long and short intertwined and weak volatility.

In the short term, pay attention to the $3300 support level and the Fed's interest rate cut policy signal.

If the Fed turns to interest rate cuts or geopolitical conflicts escalate, gold may resume its upward trend.

Daily operation suggestions:

Long-term thinking: Bottom-picking thinking: Bottom-picking range: 3300-3310

Stop loss: 3290

Target: 3330-3345+

Short-term thinking: Trend-following thinking: High-altitude range: 3320-3330

Stop loss: 3345

Target: 3300-3280-3250

Final game of gold price: 3300

Today's gold price is on the verge of collapse, but the direction divergence still exists, and long and short positions are intertwined.

Pay attention to the 3300 support.

The entire triangle convergence and oscillation pattern has been broken, and the important support platform before 3330 points has been broken.

Regardless of how the policy is announced,

shorting is inevitable.

Next, the bulls will enter the final bottom-picking stage:

Buy: 3300-3310

Stop loss: 3290

Target: 3330-3340+

Technical analysis:

Short-term support: 3300

Short-term resistance: 3330-3345

Market sentiment: The gold market sentiment shows a pattern of mixed long and short positions and weak volatility.

In the short term, pay attention to the $3,300 support level and the Fed's interest rate cut policy signal.

If the Fed turns to interest rate cuts or geopolitical conflicts escalate, gold may resume its upward trend.

Daily operation suggestions:

Long-term thinking: bottom-picking thinking: bottom-picking range: 3300-3310

Stop loss: 3290

Target: 3330-3345+

Short-term thinking: trend-following thinking: high-altitude range: 3320-3330

Stop loss: 3345

Target: 3300-3280-3250

Today's gold price is on the verge of collapse, but the direction divergence still exists, with long and short intertwined.

Pay attention to the 3300 support.

The entire triangle convergence and oscillation pattern has been broken, and the important support platform before 3330 points has been broken.

Regardless of how the policy is announced,

shorting is inevitable.

Next, the bulls will enter the final bottom-picking stage:

Buy: 3300-3310

Stop loss: 3290

Target: 3330-3340+

Technical analysis:

Short-term support level: 3300

Short-term resistance level: 3330-3345

Market sentiment: The gold market sentiment presents a pattern of long and short intertwined and weak volatility.

In the short term, pay attention to the $3300 support level and the Fed's interest rate cut policy signal.

If the Fed turns to interest rate cuts or geopolitical conflicts escalate, gold may resume its upward trend.

Daily operation suggestions:

Long-term thinking: Bottom-picking thinking: Bottom-picking range: 3300-3310

Stop loss: 3290

Target: 3330-3345+

Short-term thinking: Trend-following thinking: High-altitude range: 3320-3330

Stop loss: 3345

Target: 3300-3280-3250

Final game of gold price: 3300

Today's gold price is on the verge of collapse, but the direction divergence still exists, and long and short positions are intertwined.

Pay attention to the 3300 support.

The entire triangle convergence and oscillation pattern has been broken, and the important support platform before 3330 points has been broken.

Regardless of how the policy is announced,

shorting is inevitable.

Next, the bulls will enter the final bottom-picking stage:

Buy: 3300-3310

Stop loss: 3290

Target: 3330-3340+

Technical analysis:

Short-term support: 3300

Short-term resistance: 3330-3345

Market sentiment: The gold market sentiment shows a pattern of mixed long and short positions and weak volatility.

In the short term, pay attention to the $3,300 support level and the Fed's interest rate cut policy signal.

If the Fed turns to interest rate cuts or geopolitical conflicts escalate, gold may resume its upward trend.

Daily operation suggestions:

Long-term thinking: bottom-picking thinking: bottom-picking range: 3300-3310

Stop loss: 3290

Target: 3330-3345+

Short-term thinking: trend-following thinking: high-altitude range: 3320-3330

Stop loss: 3345

Target: 3300-3280-3250

Enjoy trading Enjoy life The best trading team

Free Signals:t.me/+02C2YBHOJw4yZTdh

Free Signals:t.me/+02C2YBHOJw4yZTdh

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Enjoy trading Enjoy life The best trading team

Free Signals:t.me/+02C2YBHOJw4yZTdh

Free Signals:t.me/+02C2YBHOJw4yZTdh

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.