As investors focused on US economic data, which raised concerns about an economic slowdown, and escalating tensions in the Middle East, the precious metal's appeal as a safe haven was highlighted.

Israel Strikes Hamas Targets Across Gaza, Killing Over 200

Israel said it carried out military airstrikes on Hamas targets in the Gaza Strip, a move that risks derailing a fragile ceasefire. Palestinians reported multiple airstrikes by Israel on various areas of the Gaza Strip. Traders were also looking at U.S. retail sales data, which showed a smaller-than-expected increase in February. Falling yields on 10-year U.S. Treasury notes also helped boost non-interest-bearing gold.

Israel has launched a series of airstrikes on the Gaza Strip as a nearly two-month-old ceasefire appeared to be rapidly unraveling, with Prime Minister Benjamin Netanyahu saying his government would “increase its military force” against Hamas.

Palestinians reported Israeli airstrikes in several areas of Gaza on Tuesday morning, and an Israeli statement confirmed the attacks took place across Gaza.

Hamas’ media office said on Tuesday that Israeli airstrikes on the Gaza Strip had killed more than 200 people.

The attack shattered a fragile ceasefire that had been suspended for 15 months in the war ravaging the Gaza Strip. It was the heaviest bombing since a ceasefire brokered by Egypt, Qatar and other countries took effect in January.

![GOLD MARKET ANALYSIS AND COMMENTARY - [March 17 - March 21]](https://s3.tradingview.com/t/tbcbOdSh_mid.png)

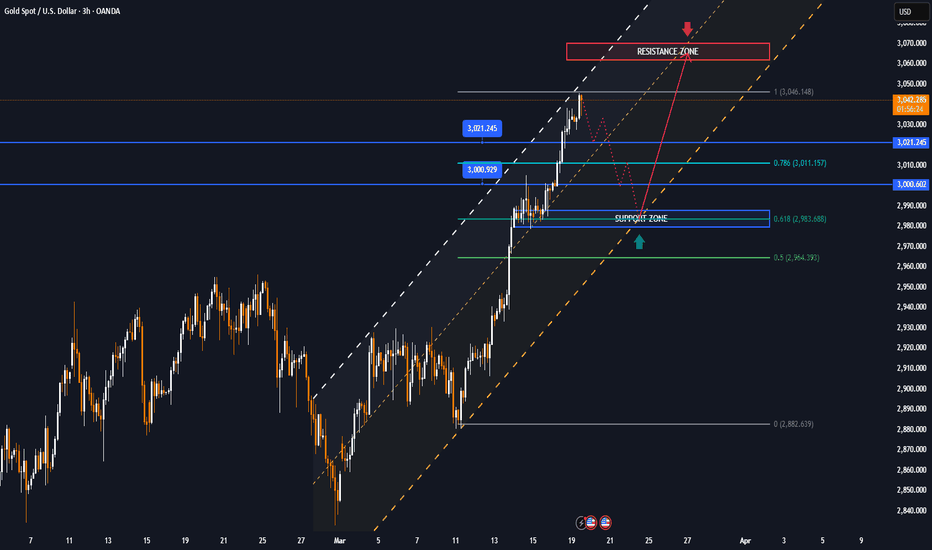

Technical Outlook Analysis

After reaching and breaking the original price level which is also the bullish price target of 3,000 USD, gold is continuing to aim for the target level behind that, pay attention to readers last week at 3,021 USD in the short term, which is the location of the 0.50% Fibonacci extension level.

Meanwhile, the Relative Strength Index (RSI) is sloping up with a significant slope and has not completely moved above the overbought area, showing that momentum and room for growth is still ahead.

Next, the main trend and outlook remains bullish with price channels and mid- to short-term trend. The main support is seen by the EMA21.

As long as gold remains above the EMA21, it remains technically bullish, the current dips should only be considered as a short-term correction or a buying opportunity.

The following areas of interest will also be noted.

Support: $3,000 – $2,977

Resistance: $3,021 – $3,065

SELL XAUUSD PRICE 3036 - 3034⚡️

↠↠ Stoploss 3040

→Take Profit 1 3028

↨

→Take Profit 2 3022

BUY XAUUSD PRICE 2949 - 2951⚡️

↠↠ Stoploss 2945

→Take Profit 1 2957

↨

→Take Profit 2 2963

Trade closed: target reached

Plan SEL HIT TP1 +100pips. Heading to TP2 😵😵😵Note

💡Gold Price Hits Record High of $3055.56/oz Due to Geopolitical Tensions🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.