XAUMO DAILY STRATEGY EXECUTION

🧠 VERDICT: MARKET IS IN PRE-BREAKOUT COIL — TODAY IS BAIT DAY 🎣

❗ We are in a trap zone today.

Market makers are doing jackhammer distribution under VWAP/POC zones.

They faked the breakdown, and now they’re baiting buyers just under the critical breakout level at 3,045–3,050.

They want retail to pile in too early — and get trapped.

🎯 TRADING STANCE TODAY:

📛 NO CHASING ABOVE 3,033.

🚨 Set trap orders below if sweep happens.

🧨 Watch volume reaction at 3,045–3,050 for breakout fake.

Institutional players just reset liquidity. They're loading before the real expansion leg. Today’s game is about catching the breakout above 3,045 or waiting for the final dip below 3,020. Either way, retail will get eaten.

📌 TANGIBLE STRATEGY FOR THE DAY:

1. Sell Limit @ 3,048

SL: 3,058

TP1: 3,025

TP2: 3,000

Confidence: 75%

Justification: MM trap zone + confluence of VWAP/VAH

2. Buy Limit @ 2,990 (If dumped)

SL: 2,972

TP1: 3,020

TP2: 3,045

Confidence: 70%

Justification: Below VAL, institutional demand zone

🌍 SESSION OUTLOOKS – 7 APRIL 2025

🇬🇧 LONDON OPEN (10AM Cairo)

📌 Scenario 1: Bullish breakout continuation

Trigger: Break & hold above 3,045

Target: 3,065–3,085 (4H POC / 1D POC)

Entry: Buy Stop @ 3,046

SL = 3,034

TP1 = 3,065

TP2 = 3,085

Confidence: 75%

📌 Scenario 2: Fakeout + Rejection

Trigger: Rejection at 3,048–3,055, fail to hold VWAP

Setup: Sell limit @ 3,050

SL = 3,058

TP1 = 3,032

TP2 = 3,018

Confidence: 70%

🇺🇸 NYC PREMARKET (2PM Cairo)

📌 Likely Play: Whipsaw or Liquidity Sweep

Watch for spike above 3,055 into FVG, then dump.

Key confluence at VWAP +1σ + FRVP VAH = sell opportunity.

Entry: Sell stop @ 3,045 (after wick above 3,055)

SL = 3,058

TP1 = 3,030

TP2 = 3,018

Confidence: 85%

🇺🇸 NYC OPEN (3:30PM Cairo)

📌 Big Decision Zone

MM may either run all short stops to hit 4H POC @ 3,085 or drop to VWAP -2σ zone 2,990.

🔀 Scenarios: 1. Trend Reversal Buy:

Entry: Buy limit @ 2,990

SL = 2,975

TP1 = 3,020

TP2 = 3,045

Confidence = 90%

2. Trend Continuation Sell:

Entry: Sell stop @ 3,020

SL = 3,030

TP1 = 3,000

TP2 = 2,970

Confidence = 80%

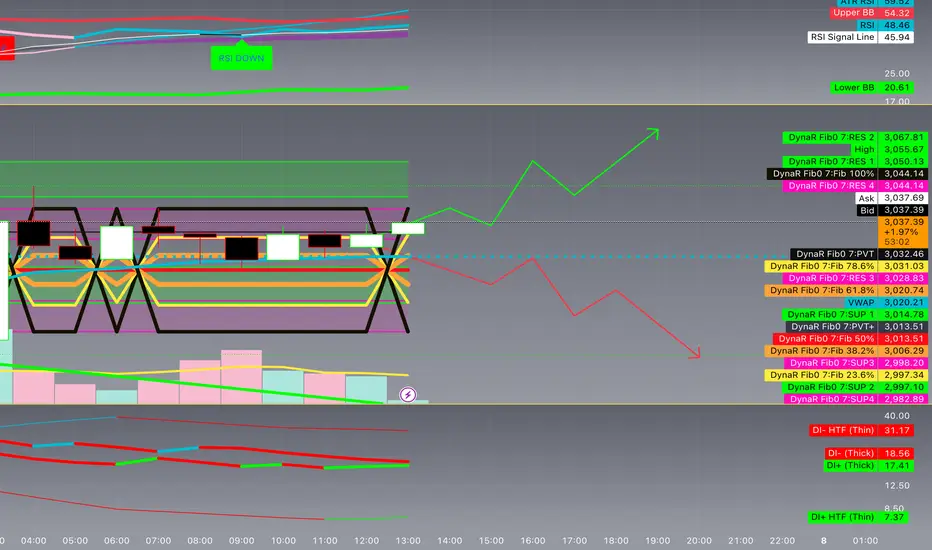

🕐 DAILY CHART (480m + 1D)

🔸 Trend: Clear macro correction phase after a vertical bullish leg up into 3,167.88 (ATH).

🔸 Candle Structure: Engulfing and high-volume rejection from top, large tail wick shows liquidity sweep to trap breakout buyers.

🔸 VWAP (Anchored Monthly):

VWAP: ~3,048.20

VWAP -1σ: 3,018.50 (support zone)

VWAP -2σ: 2,989.70 (ideal long zone if tapped with rejection)

VWAP +1σ: 3,076.00 (retest rejection zone)

🔸 Volume: Spike on the sell-off = institutional exit from highs. Distribution confirmed.

🟩 VAL (1D): ~2,969.87 (critical support tested)

🟥 VAH (1D): ~3,128.00

🟨 POC (1D): ~3,085.50 (magnet zone)

📍Bias: Bearish correction phase unless price flips POC 3,085.50 and holds. We're currently inside value zone, stuck between VAL and POC.

🕓 4H CHART (240m)

🔸 Structure:

Descending channel forming after ATH rejection.

Current price consolidating after reclaiming VWAP -2σ zone.

🔸 FRVP (Swing High to Low - April):

POC: ~3,048.80

VAL: ~3,015.60

VAH: ~3,086.50

🔸 MA Confluence:

Price is below 50 SMA / 200 SMA = medium-term bearish.

Short-term EMA/HMA crossover possible = watch for breakout.

📍Bias: Range-bound bearish. 4H POC/VWAP aligns resistance around 3,048–3,055, short scalp zone.

🕐 1-HOUR CHART

🔸 VWAP Anchored 1H (April start):

VWAP = 3,033.20

Lower Band: 3,015.00 (support)

Upper Band: 3,050.00 (resistance)

🔸 VSA Confirmation:

Demand tail on high volume from 2,969.87 confirms smart money absorption.

Low-volume rally = possible bull trap before NYC session.

📍Bias: Chop zone. Need breakout from 3,033–3,050 range. Confirm w/ volume.

⏰ 15-MIN CHART

🔸 Price Action:

Liquidity sweep under 2,970 has been filled with high-efficiency rally.

Consolidation with higher lows = potential bullish structure.

🔸 FRVP (5M SWING LOW–HIGH):

VAL: 3,020.10

VAH: 3,040.90

POC: 3,032.10

🔸 VWAP 15m:

VWAP = 3,031.40

-1σ = 3,021.90

+1σ = 3,045.00

🔸 Footprint Volume:

Passive buyers absorbing sell pressure under VWAP = stealth accumulation.

📍Bias: Intraday bullish if price holds above VWAP and POC. Scalping long above 3,034 is valid if confirmed.

✅ FINAL ORDER (DAY TRADE)

⚔️ Trade Type: Hypothetical Buy Stop

Entry: 3,046

Stop Loss: 3,034

Take Profit:

TP1: 3,065

TP2: 3,085

TP3: 3,128

Confidence Level: 82%

Justification:

Price has reclaimed VWAP + 15m/1H POC with VSA confirming demand. Break of 3,045 confirms MM breakout sweep with upside potential to 1D POC/VAH. Volume footprint confirms buyer absorption. Aligned with FVRP, VWAP, VSA, and MM logic.

🧠 VERDICT: MARKET IS IN PRE-BREAKOUT COIL — TODAY IS BAIT DAY 🎣

❗ We are in a trap zone today.

Market makers are doing jackhammer distribution under VWAP/POC zones.

They faked the breakdown, and now they’re baiting buyers just under the critical breakout level at 3,045–3,050.

They want retail to pile in too early — and get trapped.

🎯 TRADING STANCE TODAY:

📛 NO CHASING ABOVE 3,033.

🚨 Set trap orders below if sweep happens.

🧨 Watch volume reaction at 3,045–3,050 for breakout fake.

Institutional players just reset liquidity. They're loading before the real expansion leg. Today’s game is about catching the breakout above 3,045 or waiting for the final dip below 3,020. Either way, retail will get eaten.

📌 TANGIBLE STRATEGY FOR THE DAY:

1. Sell Limit @ 3,048

SL: 3,058

TP1: 3,025

TP2: 3,000

Confidence: 75%

Justification: MM trap zone + confluence of VWAP/VAH

2. Buy Limit @ 2,990 (If dumped)

SL: 2,972

TP1: 3,020

TP2: 3,045

Confidence: 70%

Justification: Below VAL, institutional demand zone

🌍 SESSION OUTLOOKS – 7 APRIL 2025

🇬🇧 LONDON OPEN (10AM Cairo)

📌 Scenario 1: Bullish breakout continuation

Trigger: Break & hold above 3,045

Target: 3,065–3,085 (4H POC / 1D POC)

Entry: Buy Stop @ 3,046

SL = 3,034

TP1 = 3,065

TP2 = 3,085

Confidence: 75%

📌 Scenario 2: Fakeout + Rejection

Trigger: Rejection at 3,048–3,055, fail to hold VWAP

Setup: Sell limit @ 3,050

SL = 3,058

TP1 = 3,032

TP2 = 3,018

Confidence: 70%

🇺🇸 NYC PREMARKET (2PM Cairo)

📌 Likely Play: Whipsaw or Liquidity Sweep

Watch for spike above 3,055 into FVG, then dump.

Key confluence at VWAP +1σ + FRVP VAH = sell opportunity.

Entry: Sell stop @ 3,045 (after wick above 3,055)

SL = 3,058

TP1 = 3,030

TP2 = 3,018

Confidence: 85%

🇺🇸 NYC OPEN (3:30PM Cairo)

📌 Big Decision Zone

MM may either run all short stops to hit 4H POC @ 3,085 or drop to VWAP -2σ zone 2,990.

🔀 Scenarios: 1. Trend Reversal Buy:

Entry: Buy limit @ 2,990

SL = 2,975

TP1 = 3,020

TP2 = 3,045

Confidence = 90%

2. Trend Continuation Sell:

Entry: Sell stop @ 3,020

SL = 3,030

TP1 = 3,000

TP2 = 2,970

Confidence = 80%

🕐 DAILY CHART (480m + 1D)

🔸 Trend: Clear macro correction phase after a vertical bullish leg up into 3,167.88 (ATH).

🔸 Candle Structure: Engulfing and high-volume rejection from top, large tail wick shows liquidity sweep to trap breakout buyers.

🔸 VWAP (Anchored Monthly):

VWAP: ~3,048.20

VWAP -1σ: 3,018.50 (support zone)

VWAP -2σ: 2,989.70 (ideal long zone if tapped with rejection)

VWAP +1σ: 3,076.00 (retest rejection zone)

🔸 Volume: Spike on the sell-off = institutional exit from highs. Distribution confirmed.

🟩 VAL (1D): ~2,969.87 (critical support tested)

🟥 VAH (1D): ~3,128.00

🟨 POC (1D): ~3,085.50 (magnet zone)

📍Bias: Bearish correction phase unless price flips POC 3,085.50 and holds. We're currently inside value zone, stuck between VAL and POC.

🕓 4H CHART (240m)

🔸 Structure:

Descending channel forming after ATH rejection.

Current price consolidating after reclaiming VWAP -2σ zone.

🔸 FRVP (Swing High to Low - April):

POC: ~3,048.80

VAL: ~3,015.60

VAH: ~3,086.50

🔸 MA Confluence:

Price is below 50 SMA / 200 SMA = medium-term bearish.

Short-term EMA/HMA crossover possible = watch for breakout.

📍Bias: Range-bound bearish. 4H POC/VWAP aligns resistance around 3,048–3,055, short scalp zone.

🕐 1-HOUR CHART

🔸 VWAP Anchored 1H (April start):

VWAP = 3,033.20

Lower Band: 3,015.00 (support)

Upper Band: 3,050.00 (resistance)

🔸 VSA Confirmation:

Demand tail on high volume from 2,969.87 confirms smart money absorption.

Low-volume rally = possible bull trap before NYC session.

📍Bias: Chop zone. Need breakout from 3,033–3,050 range. Confirm w/ volume.

⏰ 15-MIN CHART

🔸 Price Action:

Liquidity sweep under 2,970 has been filled with high-efficiency rally.

Consolidation with higher lows = potential bullish structure.

🔸 FRVP (5M SWING LOW–HIGH):

VAL: 3,020.10

VAH: 3,040.90

POC: 3,032.10

🔸 VWAP 15m:

VWAP = 3,031.40

-1σ = 3,021.90

+1σ = 3,045.00

🔸 Footprint Volume:

Passive buyers absorbing sell pressure under VWAP = stealth accumulation.

📍Bias: Intraday bullish if price holds above VWAP and POC. Scalping long above 3,034 is valid if confirmed.

✅ FINAL ORDER (DAY TRADE)

⚔️ Trade Type: Hypothetical Buy Stop

Entry: 3,046

Stop Loss: 3,034

Take Profit:

TP1: 3,065

TP2: 3,085

TP3: 3,128

Confidence Level: 82%

Justification:

Price has reclaimed VWAP + 15m/1H POC with VSA confirming demand. Break of 3,045 confirms MM breakout sweep with upside potential to 1D POC/VAH. Volume footprint confirms buyer absorption. Aligned with FVRP, VWAP, VSA, and MM logic.

Mohamed

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Mohamed

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

THE Ichimoku MAN on the Nile

#traders4traders

you are welcome to join my Telegram channel, Ichimokuonthenile.

for GOLD follow this link: t.me/GOLDontheNILE

youtube youtube.com/@ICHIMOKUontheNILE

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.