On Thursday, the US Federal Open Market Committee (FOMC) announced its interest rate decision and summarized economic expectations; Federal Reserve Chairman Powell held a press conference on monetary policy.

The FOMC kept its policy rate unchanged at 4.25% - 4.50% after the Trump administration imposed tariffs, while officials raised their inflation forecasts for this year and lowered their economic growth forecasts.

After concluding a two-day monetary policy meeting, the Federal Reserve announced at 2 p.m. ET on Wednesday that it would maintain its benchmark interest rate at 4.25% to 4.5% and announced it would slow the pace of its balance sheet reduction starting in April.

The Fed also released its FOMC statement, predicting rising U.S. inflation and lowering its economic growth forecast.

Amid signs of stagflation, the Fed still announced that it would cut interest rates twice by 2025, similar to the dovish signal it gave when it cut interest rates sharply last September.

The statement noted that recent indicators show that economic activity continues to grow at a solid pace. In recent months, unemployment has remained low, labor market conditions have remained strong, and inflation has remained moderately elevated.

Federal Reserve Chairman Powell first mentioned tariffs at a press conference after the meeting, acknowledging that Trump’s policies have affected the economy. Powell also indicated that the policies of the new Trump administration will affect the economy, but he will be careful to avoid making too clear assessments of this impact. Powell also used the word “uncertainty” several times. He reiterated that there is still uncertainty about the potential impact of tariffs on the U.S. economy and highlighted the risks to the Fed’s expectations for employment and inflation. – Bloomberg –

Last week, US President Trump raised tariffs on steel and aluminum imports to 25% and said new reciprocal tariffs and industrial duties would take effect on April 2.

On the geopolitical front, hostilities between Russia and Ukraine continued despite a 30-day ceasefire aimed at halting attacks on energy facilities. Meanwhile, conflict in the Middle East escalated as Reuters reported that an Israeli airstrike on Tuesday killed 400 people.

Two UN staff were killed in an attack on the UN building in Deir el Balah, central Gaza Strip, a UN source told AFP on Wednesday.

Gold prices have risen more than 15% this year. Gold has long been seen as a safe investment in times of economic or geopolitical uncertainty, and since it does not yield interest, it is even more attractive in a low-interest-rate environment.

Technical outlook for

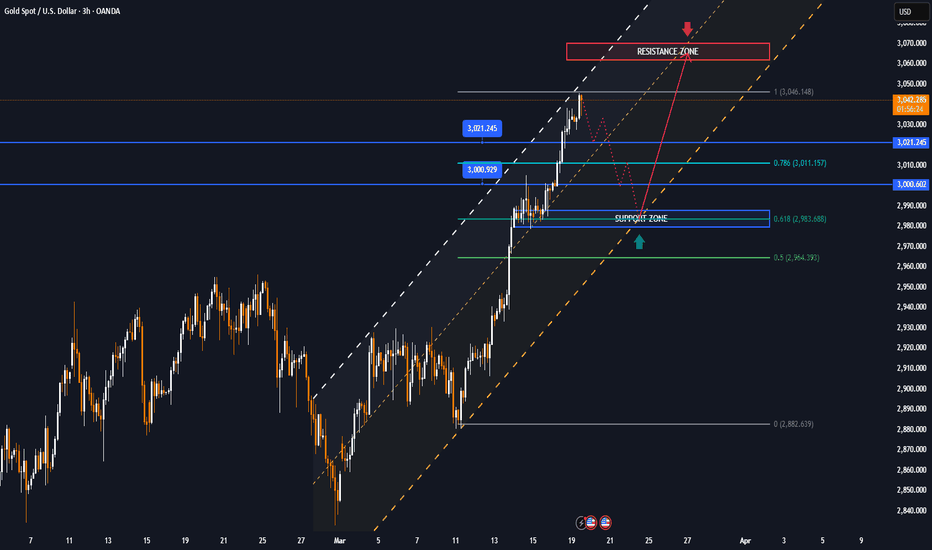

Gold continues to refresh its all-time highs as it finds support from the 0.50% Fibonacci extension noted by readers in yesterday’s edition and currently has no technical barriers ahead, with the next upside target being the 0.618% Fibonacci extension.

While all technical conditions are in favor of the upside with the channel acting as short-term support and the RSI showing no signs of a significant downside correction, downside corrections when they do occur are typically strong after a long period of hot growth like the current one.

Traders can definitely prepare for a downside correction with a target of around $3,037 in the short term and the 0.618% Fibonacci extension is a position that can fit this expectation.

I will try to describe that if you try to sell around the 0.618% Fibonacci level is a counter-trend decision, but since the RSI has been operating in the overbought area and 6 consecutive bullish sessions have occurred, there is a possibility for a downside correction. However, the need to do for the expectation (Adjustment) means that the open short positions should be completed in the short term because it is counter-trend.

During the day, the uptrend in gold prices with the expectation of a downside correction will be noticed again by the following technical levels.

Support: $3,037 – $3,021 – $3,000

Resistance: $3,065

SELL XAUUSD PRICE 3101 - 3099⚡️

↠↠ Stoploss 3105

→Take Profit 1 3093

↨

→Take Profit 2 3087

BUY XAUUSD PRICE 2999 - 3001⚡️

↠↠ Stoploss 2995

→Take Profit 1 3007

↨

→Take Profit 2 3013

Note

⚫The gold price outlook remains positive, with further upside potential towards $3,100/oz, while key support levels lie at $3,000/oz and $2,954/oz.Note

💰 For the first time in history, the global gold market capitalization surpassed the $20 trillion mark, reaching $20.8 trillion on March 14, 2025.Trade closed: target reached

Plan BUY Hit Full TP2 + 135pips🤕🤕🤕. Congratulations everyone.Note

⚫Gold prices stabilized around $3,022 an ounce after falling slightly two days earlier, reflecting strong safe-haven demand due to economic and geopolitical uncertainty.Note

⚫Trump and Musk questioned the gold reserves at Fort Knox, raising concerns similar to the conspiracy theories of the 1970s, when the US left the gold standard.Note

▫️Gold SPOT lost $3,020 an ounce, down 0.01% on the day.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

![GOLD MARKET ANALYSIS AND COMMENTARY - [March 24 - March 28]](https://s3.tradingview.com/k/KXU745fj_mid.png)