Gold market analysis:

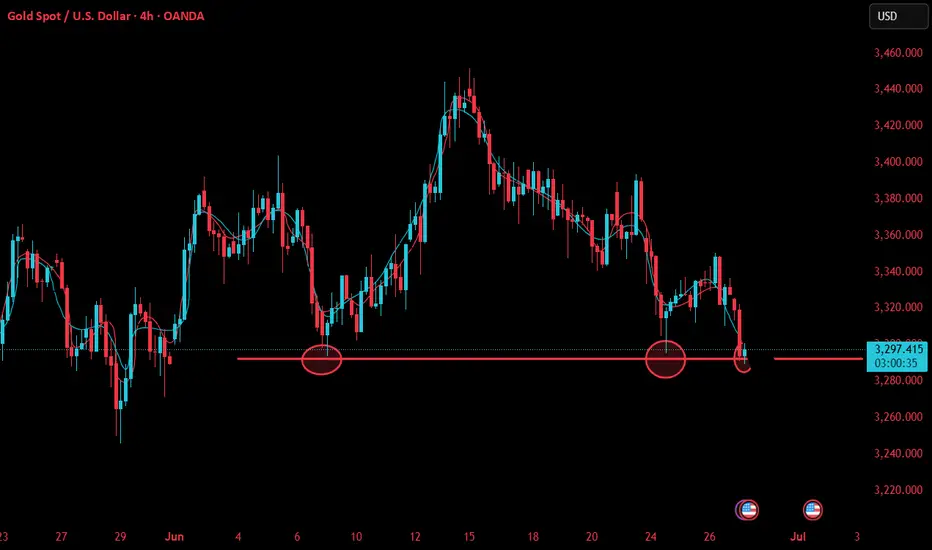

Yesterday, gold touched the daily moving average pressure, the highest reached 3350, but only broke the daily pressure in vain. Finally, driven by the data, gold began to dive. Gold continued to decline in the direction of the general trend. Today, we continue to be bearish, and we firmly see the position of 3292. Don't intercept such a market, and don't guess where the bottom is. Rebound is an opportunity to sell. The daily line shows that it has little room for shocks. It will either continue to fall or continue to fall after a wave of structural retracement. In the end, it will fall. The daily line has formed a sloping roof. It is difficult for short-term bulls to change the trend. It takes time and space. Today is still the closing of the weekly line. If there is no accident, the weekly line will also close in the negative, so there may be a big dive next week. As mentioned in the previous analysis, 3292 is the support platform of the daily line. We estimate that it will break this position in today's Asian session. Wait for the opportunity of a small rebound to continue selling. The high point of the Asian session rebound is 3322. The Asian session is in an extremely weak state below 3322. The high point of the rebound at night is 3336. If this position is not broken, the selling idea does not need to change. Pay attention to the recent crazy fundamentals. If the war starts again, gold will rocket again. In the absence of fundamentals and data, we maintain our thinking.

Suppress 3322 and 3336, and then 3292 again. The watershed of strength and weakness in the market is 3322.

Fundamental analysis:

The previous fundamentals were mostly caused by geopolitical factors. Recently, there is no geopolitical influence. Gold and crude oil are expected to enter a wave of declines, and the Fed's policy may continue to remain unchanged.

Operation suggestions:

Gold-----sell near 3322, target 329-3280

Yesterday, gold touched the daily moving average pressure, the highest reached 3350, but only broke the daily pressure in vain. Finally, driven by the data, gold began to dive. Gold continued to decline in the direction of the general trend. Today, we continue to be bearish, and we firmly see the position of 3292. Don't intercept such a market, and don't guess where the bottom is. Rebound is an opportunity to sell. The daily line shows that it has little room for shocks. It will either continue to fall or continue to fall after a wave of structural retracement. In the end, it will fall. The daily line has formed a sloping roof. It is difficult for short-term bulls to change the trend. It takes time and space. Today is still the closing of the weekly line. If there is no accident, the weekly line will also close in the negative, so there may be a big dive next week. As mentioned in the previous analysis, 3292 is the support platform of the daily line. We estimate that it will break this position in today's Asian session. Wait for the opportunity of a small rebound to continue selling. The high point of the Asian session rebound is 3322. The Asian session is in an extremely weak state below 3322. The high point of the rebound at night is 3336. If this position is not broken, the selling idea does not need to change. Pay attention to the recent crazy fundamentals. If the war starts again, gold will rocket again. In the absence of fundamentals and data, we maintain our thinking.

Suppress 3322 and 3336, and then 3292 again. The watershed of strength and weakness in the market is 3322.

Fundamental analysis:

The previous fundamentals were mostly caused by geopolitical factors. Recently, there is no geopolitical influence. Gold and crude oil are expected to enter a wave of declines, and the Fed's policy may continue to remain unchanged.

Operation suggestions:

Gold-----sell near 3322, target 329-3280

Trade active

Today we sold gold at 3310. Now the market price has reached our strategic target and even exceeded our expectations. We have made a profit. Now we will analyze the next trading signal. If you need it, please contact me!Trade closed: target reached

The goal has been reached, we will analyze the next trading signal. If you need it, please click Contact Me to get it.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.