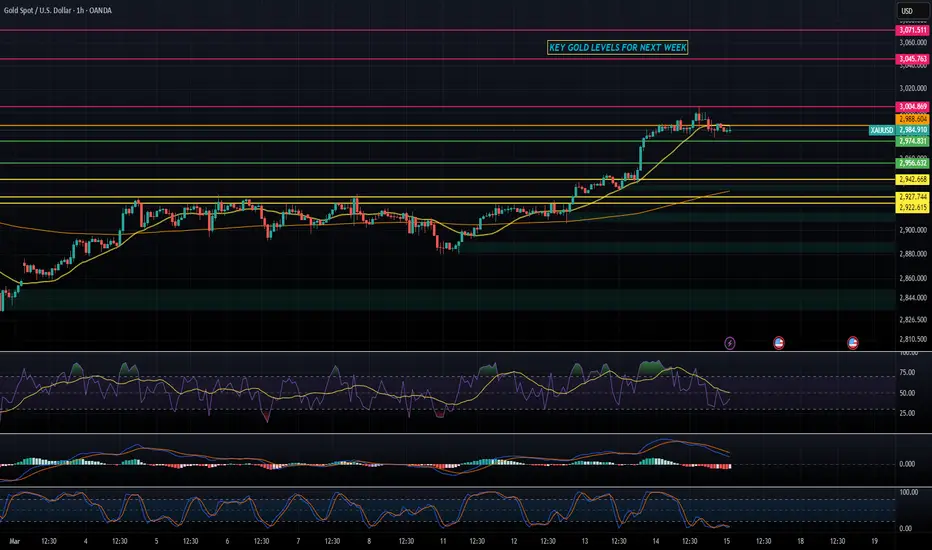

Let's analyze the potential movements for gold (XAU/USD) over the coming week.

### Current Market Overview:

Gold is currently trading within a tight range, with two key weighted levels identified: a resistance gap above at 2988 and a support gap below at 2968. The market appears to be consolidating between these two levels, creating an environment where price action may lead to potential opportunities for both bullish and bearish trades.

### Key Levels to Watch:

- Resistance Levels:

- 2988: A pivotal level. A confirmed break above with a 1-hour candle close can lead to bullish momentum.

- 3005: The immediate target if the price breaks above 2988.

- 3013: If the price continues to rise, a break above this will target 3045.

- 3045: A critical level indicating stronger bullish sentiment; targeted move could extend to 3071.

- Support Levels:

- 2968: This gap indicates potential for support. A bounce here could lead to a retracement upwards.

- 2956: A breach below this level indicates bearish sentiment and opens the door to lower targets.

- 2942: Further bearish pressure would target this level if 2956 fails to hold.

- 2922: A critical support level; if broken, it suggests a deeper retracement toward the swing range.

- Swing Range 2909-2881: If bearish momentum continues, this range may become the target area.

### Trading Strategy:

- Bullish Scenario:

- Entry: Look for potential buy opportunities if the price closes above 2988, ideally waiting for confirmation with a strong bullish 1-hour candle.

- Targets: Profit-taking levels at 3005 and 3045. Adjust stop-loss to break-even once reaching initial target to mitigate risk.

- Bearish Scenario:

- Entry: Consider short positions if the price breaks below 2974, ideally confirmed with a 1-hour close.

- Targets: 2956 and 2942 should be primary targets, with further downside potential down to 2922 in case bearish momentum persists.

- Stop-Loss: Placed above the last swing high to manage risk effectively.

### Conclusion:

This week’s trading strategy on gold will hinge upon the market's ability to break and hold above or below the identified key levels. The presence of defined composite targets allows traders to gauge the market sentiment and enter trades with measurable risk and reward ratios. As always, remain adaptable and ready to respond to market changes, while utilizing the identified support and resistance levels for effective trade management.

Regular updates throughout the week will be essential to keep track of price action and adjust trading strategies accordingly. Happy trading!

### Current Market Overview:

Gold is currently trading within a tight range, with two key weighted levels identified: a resistance gap above at 2988 and a support gap below at 2968. The market appears to be consolidating between these two levels, creating an environment where price action may lead to potential opportunities for both bullish and bearish trades.

### Key Levels to Watch:

- Resistance Levels:

- 2988: A pivotal level. A confirmed break above with a 1-hour candle close can lead to bullish momentum.

- 3005: The immediate target if the price breaks above 2988.

- 3013: If the price continues to rise, a break above this will target 3045.

- 3045: A critical level indicating stronger bullish sentiment; targeted move could extend to 3071.

- Support Levels:

- 2968: This gap indicates potential for support. A bounce here could lead to a retracement upwards.

- 2956: A breach below this level indicates bearish sentiment and opens the door to lower targets.

- 2942: Further bearish pressure would target this level if 2956 fails to hold.

- 2922: A critical support level; if broken, it suggests a deeper retracement toward the swing range.

- Swing Range 2909-2881: If bearish momentum continues, this range may become the target area.

### Trading Strategy:

- Bullish Scenario:

- Entry: Look for potential buy opportunities if the price closes above 2988, ideally waiting for confirmation with a strong bullish 1-hour candle.

- Targets: Profit-taking levels at 3005 and 3045. Adjust stop-loss to break-even once reaching initial target to mitigate risk.

- Bearish Scenario:

- Entry: Consider short positions if the price breaks below 2974, ideally confirmed with a 1-hour close.

- Targets: 2956 and 2942 should be primary targets, with further downside potential down to 2922 in case bearish momentum persists.

- Stop-Loss: Placed above the last swing high to manage risk effectively.

### Conclusion:

This week’s trading strategy on gold will hinge upon the market's ability to break and hold above or below the identified key levels. The presence of defined composite targets allows traders to gauge the market sentiment and enter trades with measurable risk and reward ratios. As always, remain adaptable and ready to respond to market changes, while utilizing the identified support and resistance levels for effective trade management.

Regular updates throughout the week will be essential to keep track of price action and adjust trading strategies accordingly. Happy trading!

👇 Website

srfxglobal.com/

👇 Telegram

t.me/SRFXGlobal

👇 YouTube

youtube.com/@srfxglobalsl?si=hbM2z2PURtIHCQvz

👇 X

x.com/SRFL1111

👇 Facebook

web.facebook.com/Friendship0002

srfxglobal.com/

👇 Telegram

t.me/SRFXGlobal

👇 YouTube

youtube.com/@srfxglobalsl?si=hbM2z2PURtIHCQvz

👇 X

x.com/SRFL1111

web.facebook.com/Friendship0002

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👇 Website

srfxglobal.com/

👇 Telegram

t.me/SRFXGlobal

👇 YouTube

youtube.com/@srfxglobalsl?si=hbM2z2PURtIHCQvz

👇 X

x.com/SRFL1111

👇 Facebook

web.facebook.com/Friendship0002

srfxglobal.com/

👇 Telegram

t.me/SRFXGlobal

👇 YouTube

youtube.com/@srfxglobalsl?si=hbM2z2PURtIHCQvz

👇 X

x.com/SRFL1111

web.facebook.com/Friendship0002

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.