Current Market Overview:

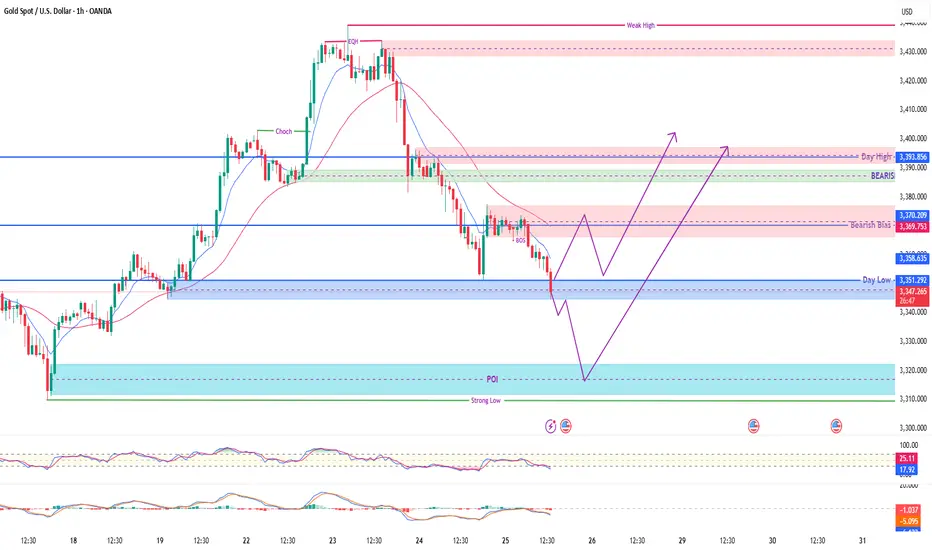

Gold is currently trading around 3345, sitting just above a strong intraday pivot point and previous Day Low support. Price recently experienced a Break of Structure (BOS) confirming bearish pressure from the higher OB (Order Block) and rejection near the bearish breaker zone.

📍 Key Levels to Watch:

🔴 Bearish OB (Resistance): 3369 – 3370

🟣 Bearish Breaker Zone: ~3380

🔵 Day High OB (Major Supply): 3393 – 3395

🟢 POI / Strong Low: 3310 – 3320 (Reversal Zone)

🔵 Day Low & Pivot: 3351 – 3345 (Short-Term Support)

📈 Possible Scenarios:

Scenario A – Bounce from Pivot (Aggressive Entry):

If price respects the pivot at 3345–3351, we may see a short-term bullish reversal toward 3369–3370, with extended targets at the Day High OB.

Scenario B – Deeper Sweep & Bullish Reversal:

A liquidity sweep below 3340 into the POI zone (3310–3320) may offer a premium long opportunity targeting 3370 → 3395.

⚠️ Bias:

🔻 Short-Term Bearish below 3370

🔼 Potential Bullish Reversal from 3320–3350 zones

✅ Technical Confluence:

✅ BOS confirms supply control

✅ POI aligned with historical reaction zones

✅ RSI and MACD showing signs of divergence – early reversal signals

✅ Multiple OBs mapped out for precision entries

🎯 Trade Setup Example (Scenario B):

Buy Limit: 3318

SL: 3305 (Below Strong Low)

TP1: 3370

TP2: 3393 (Day High OB)

Risk-Reward: ~1:4+

Gold is currently trading around 3345, sitting just above a strong intraday pivot point and previous Day Low support. Price recently experienced a Break of Structure (BOS) confirming bearish pressure from the higher OB (Order Block) and rejection near the bearish breaker zone.

📍 Key Levels to Watch:

🔴 Bearish OB (Resistance): 3369 – 3370

🟣 Bearish Breaker Zone: ~3380

🔵 Day High OB (Major Supply): 3393 – 3395

🟢 POI / Strong Low: 3310 – 3320 (Reversal Zone)

🔵 Day Low & Pivot: 3351 – 3345 (Short-Term Support)

📈 Possible Scenarios:

Scenario A – Bounce from Pivot (Aggressive Entry):

If price respects the pivot at 3345–3351, we may see a short-term bullish reversal toward 3369–3370, with extended targets at the Day High OB.

Scenario B – Deeper Sweep & Bullish Reversal:

A liquidity sweep below 3340 into the POI zone (3310–3320) may offer a premium long opportunity targeting 3370 → 3395.

⚠️ Bias:

🔻 Short-Term Bearish below 3370

🔼 Potential Bullish Reversal from 3320–3350 zones

✅ Technical Confluence:

✅ BOS confirms supply control

✅ POI aligned with historical reaction zones

✅ RSI and MACD showing signs of divergence – early reversal signals

✅ Multiple OBs mapped out for precision entries

🎯 Trade Setup Example (Scenario B):

Buy Limit: 3318

SL: 3305 (Below Strong Low)

TP1: 3370

TP2: 3393 (Day High OB)

Risk-Reward: ~1:4+

Note

I am here ask any time Note

Wait for proper and Clear Confirmation Note

wait for full body closing after that can go for sell Trade active

let's go bearsNote

Don't be panic will be bear and i am here, wah what a qout hahahaha ( will be bear and i am here )hahahaNote

Convert SL's to BE and enjoyNote

Just comment me how get profit and who are stuck and who are hit with BE ( breek even )comment comment and comment's

Note

Amazing carzzy man are following us likely gentel kid hahahah profit in water fall,share your comments for my motivation and support.

Note

Ahhhahahaha Man love you Gold hahah, now close some parcially in profit and hold some with tight BEDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.