On Tuesday (July 29), in the Asian market, the spot  XAUUSD traded in a narrow range after yesterday's sharp decline, and the current gold price is around 3,315 USD/ounce.

XAUUSD traded in a narrow range after yesterday's sharp decline, and the current gold price is around 3,315 USD/ounce.

The XAUUSD fell to its lowest level in nearly 3 weeks on Monday, mainly due to the trade agreement reached between the United States and the European Union over the weekend, which boosted the Dollar and risk sentiment.

XAUUSD fell to its lowest level in nearly 3 weeks on Monday, mainly due to the trade agreement reached between the United States and the European Union over the weekend, which boosted the Dollar and risk sentiment.

The previous report released by the US Bureau of Labor Statistics showed that the number of US JOLTS jobs unexpectedly increased in May, reaching the highest level since November last year.

The number of JOLTS job vacancies in the US in May was 7.769 million, far exceeding the forecast of all economists surveyed.

Looking back at the data in April, the number of JOLTS job vacancies also showed an unexpected increase.

The JOLTS jobs report is a closely watched labor market data by the Federal Reserve.

In addition, the Conference Board of America's Consumer Confidence Index for July is scheduled to be released on the same day and is expected to be 95.8, compared to the previous value of 93.0.

The fundamental pressure that gold is under

XAUUSD came under pressure yesterday and fell to a near three-week low, mainly due to the trade deal between the United States and the European Union (EU) over the weekend, which boosted the Dollar and risk sentiment. Moreover, US President Trump announced “global tariffs” of 15% to 20% on most countries, a change from his previous statement last week.

XAUUSD came under pressure yesterday and fell to a near three-week low, mainly due to the trade deal between the United States and the European Union (EU) over the weekend, which boosted the Dollar and risk sentiment. Moreover, US President Trump announced “global tariffs” of 15% to 20% on most countries, a change from his previous statement last week.

The deal reached by U.S. President Donald Trump and the European Union late last week will impose a 15% tariff on EU goods, half the rate Trump had threatened, easing fears of a wider trade war.

The U.S. and Japan also reached a deal last week, and U.S. and Chinese officials resumed talks in Stockholm, Sweden, this week with the goal of extending the tariff deadline by 90 days.

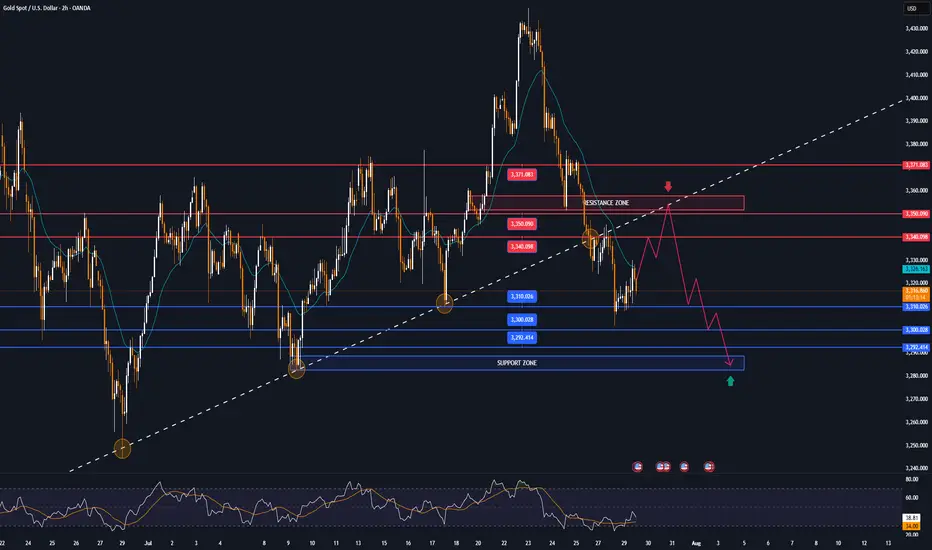

Technical Outlook Analysis XAUUSD

XAUUSD

Gold has been on a four-day losing streak, a decline that threatens bullish expectations as its current position gradually deprives it of any room for further upside.

Specifically, gold has recovered from the psychological level of $3,300 but the actual recovery is not significant, while it is under pressure from the EMA21 which is currently the closest resistance.

On the other hand, gold has fallen below both the long-term and short-term trend channels. If it continues to sell below the 0.382% Fibonacci retracement level, this will confirm a break below the psychological level of $3,300, then the downside target will be around $3,246 in the short term, rather than $3,228.

RSI is pointing down, below 50 and still far from the 20-0 area, also showing that in terms of momentum, gold is also under pressure and there is still a lot of room for decline ahead.

For gold to be eligible for an increase, it needs to at least bring price activity back above the EMA21, back inside the price channels. On the current daily chart, the technical conditions are more inclined towards the possibility of a decrease.

Notable positions will be listed as follows.

Support: 3,310 - 3,300 - 3,292 USD

Resistance: 3,340 - 3,350 - 3,371 USD

SELL XAUUSD PRICE 3355 - 3353⚡️

↠↠ Stop Loss 3359

→Take Profit 1 3347

↨

→Take Profit 2 3341

BUY XAUUSD PRICE 3285 - 3287⚡️

↠↠ Stop Loss 3281

→Take Profit 1 3293

↨

→Take Profit 2 3299

The

The previous report released by the US Bureau of Labor Statistics showed that the number of US JOLTS jobs unexpectedly increased in May, reaching the highest level since November last year.

The number of JOLTS job vacancies in the US in May was 7.769 million, far exceeding the forecast of all economists surveyed.

Looking back at the data in April, the number of JOLTS job vacancies also showed an unexpected increase.

The JOLTS jobs report is a closely watched labor market data by the Federal Reserve.

In addition, the Conference Board of America's Consumer Confidence Index for July is scheduled to be released on the same day and is expected to be 95.8, compared to the previous value of 93.0.

The fundamental pressure that gold is under

The deal reached by U.S. President Donald Trump and the European Union late last week will impose a 15% tariff on EU goods, half the rate Trump had threatened, easing fears of a wider trade war.

The U.S. and Japan also reached a deal last week, and U.S. and Chinese officials resumed talks in Stockholm, Sweden, this week with the goal of extending the tariff deadline by 90 days.

Technical Outlook Analysis

Gold has been on a four-day losing streak, a decline that threatens bullish expectations as its current position gradually deprives it of any room for further upside.

Specifically, gold has recovered from the psychological level of $3,300 but the actual recovery is not significant, while it is under pressure from the EMA21 which is currently the closest resistance.

On the other hand, gold has fallen below both the long-term and short-term trend channels. If it continues to sell below the 0.382% Fibonacci retracement level, this will confirm a break below the psychological level of $3,300, then the downside target will be around $3,246 in the short term, rather than $3,228.

RSI is pointing down, below 50 and still far from the 20-0 area, also showing that in terms of momentum, gold is also under pressure and there is still a lot of room for decline ahead.

For gold to be eligible for an increase, it needs to at least bring price activity back above the EMA21, back inside the price channels. On the current daily chart, the technical conditions are more inclined towards the possibility of a decrease.

Notable positions will be listed as follows.

Support: 3,310 - 3,300 - 3,292 USD

Resistance: 3,340 - 3,350 - 3,371 USD

SELL XAUUSD PRICE 3355 - 3353⚡️

↠↠ Stop Loss 3359

→Take Profit 1 3347

↨

→Take Profit 2 3341

BUY XAUUSD PRICE 3285 - 3287⚡️

↠↠ Stop Loss 3281

→Take Profit 1 3293

↨

→Take Profit 2 3299

Note

Gold prices recovered slightly after a sharp drop, hovering around $3,330/oz, as investors awaited the Fed's interest rate decision, US Q2 GDP data and the ADP employment report. The Fed is expected to keep interest rates unchanged but may send a "dove" signal, especially when the US bond market shows high demand for shelter.Note

Trump Reacts to 3% Q2 GDP: It's Too Late to Cut Rates Now. No Inflation! Let People Buy and Refinance Their Homes!Note

▫️Spot gold price reached 3310 USD/ounce, up 1.07% on the day.Note

Gold prices rose to a record high of $3,314.71 an ounce amid growing global concerns over US-international trade tensions, rising US inflation and escalating geopolitical tensions in the Middle East. President Trump’s executive order to increase import tariffs on many countries has caused investors to flock to gold as a safe haven asset.Note

Spot gold prices rose sharply, surpassing the threshold of 3,360 USD/ounce, showing investor interest in safe-haven assets.Note

Last Friday (August 1), spot gold prices rose 2.23% to a one-week high of $3,363.37/ounce as a weaker-than-expected US non-farm payrolls report for July, coupled with concerns over new tax policies from the Trump administration, boosted demand for safe havens.🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔰| Forex trading

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

🧩Get an average of 1200 pips per month

🧩Consulting on Risk Management

🧩Account management

🧩Forex signals have a high win rate

🚨🚨🚨FREE SIGNALS: t.me/+8q3AxDD9CsRjYzI1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.