All of a sudden the bull flag from July 2018 came to mind. I remember the market was shouting both ways as well back then just like. Volumes were much higher back then, but there was simply more money in the market and the Bitcoin' price was double as well.

Alts look good at the moment as well, but we should not forget, alts jumped up in second week of Jan a month ago around the 4000/4050. They started to break up with a stable Bitcoin', i went to sleep and when i woke up the Bitcoin got dumped and the rest followed. Volume was then was similar to the past days. Alts show similar pictures as well.

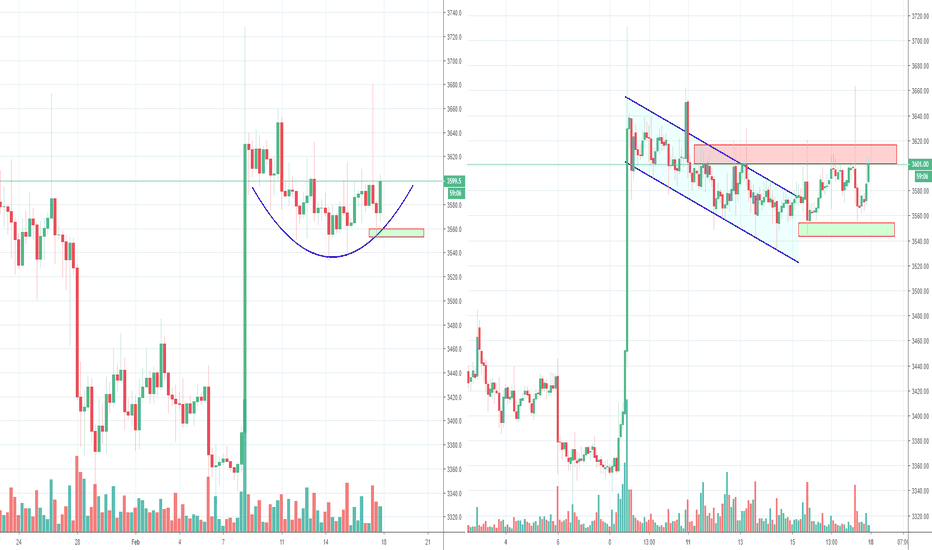

But this fractal looks good as well, only thing lacking, is real aggressive big buying volume. The fractal from the previous analysis is also still in play. For now i think we can se that blue channel as a good indication of what the next step will be. If it breaks down, we will probably drop like the previous fractal, if we stay inside of it ans slowly move up again and break the 3620ish, we could see a reaction happening and see another push up.

All other things from the previous few analysis stay the same, so read that if you want to know what the bigger picture is. If your watching this live, you can catch the rally without risk almost. Because almost each time, we see buying volume slowly increasing 2 to 15 minutes prior to the jump up, getting more aggressive until the pop happens.

Small summary, Bitcoin may not break the 3450/80 anymore, otherwise the impulse factor is gone. A break of 3700 will probably mean a switch from mid-term bear to bull trend. I will make a new analysis if we see a break of this flag. Because until that happens, it's a lot of guessing.

Please don't forget to like if you appreciate this :)

Previous analysis:

Alts look good at the moment as well, but we should not forget, alts jumped up in second week of Jan a month ago around the 4000/4050. They started to break up with a stable Bitcoin', i went to sleep and when i woke up the Bitcoin got dumped and the rest followed. Volume was then was similar to the past days. Alts show similar pictures as well.

But this fractal looks good as well, only thing lacking, is real aggressive big buying volume. The fractal from the previous analysis is also still in play. For now i think we can se that blue channel as a good indication of what the next step will be. If it breaks down, we will probably drop like the previous fractal, if we stay inside of it ans slowly move up again and break the 3620ish, we could see a reaction happening and see another push up.

All other things from the previous few analysis stay the same, so read that if you want to know what the bigger picture is. If your watching this live, you can catch the rally without risk almost. Because almost each time, we see buying volume slowly increasing 2 to 15 minutes prior to the jump up, getting more aggressive until the pop happens.

Small summary, Bitcoin may not break the 3450/80 anymore, otherwise the impulse factor is gone. A break of 3700 will probably mean a switch from mid-term bear to bull trend. I will make a new analysis if we see a break of this flag. Because until that happens, it's a lot of guessing.

Please don't forget to like if you appreciate this :)

Previous analysis:

Note

Looks like that channel on the left is legit, dropped below it again and now moving against it. I can see a lot of buy orders waiting on Bitmex between 3550 and here. I have seen this many times before, it's like a big magnet (or they push the price towards it). The 3550 has been a support twice now the past days. So if that one breaks, we could see another drop down. But the order book on the buy side is quite full up to 3500 even. But the big question is, are those closing orders of the ones who Barted down each rally attempt? Probably yes, because that is how they do things with this low volume. So it's not likely their buy orders waiting to get for a rally. So, it's up to the bulls, if there is enough confidence and buying volume to push the price up, all these shorts will start to close and double up the buying power (in other words creating a short squeeze). Volume is higher than yesterday, which is good, but still not enough! Alts have been dropping quite a lot as well the past 12 hours, which is a bad sign as well.

So in general, at the moment it looks like the bears are in favor now, bull need to push it above the 3600 again soon, otherwise could get ugly again.

Note

7 days now of this sideways crap. Past 6 weeks it has been like, 5 minutes dump or rally and then 7 days sideways and so on.Volume still very low, but fits the picture of the flag as well. One day it looks like a Bart move, second part of the day it looks like a flag again and so on for days already. I think my LTC analysis might give us the real answer maybe. Think its good to follow that one.

Daily picture still looks bullish as well, alts move from bullish to slightly bearish all the time. So that's why LTC might be the best one to follow

Note

Small attempt being made to break up now, a small inverse H&S, bumping against the neckline. There is a good sell wall on Bitmex, so it needs some good volume buying to get through that. This could be it, either breaking up now or getting pushed down. Been exactly 7 days now, volume is at it's lowest again. Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.