Dangerous Lies Your Backtest TellsDangerous Lies Your Backtest Tells

We are easily hooked on the dopamine rush of seeing profitable equity curves during backtesting. The allure of parabolic returns is often so strong it is blinding to the inherent flaws that exist, to varying degrees, in every backtest.

Backtesting, while often seen as an essential step in designing and verifying trading strategies - is far from a foolproof method. Many traders place too much confidence in their backtested results, only to see their strategies fail when used in the live markets. The reality is that backtesting is riddled with limitations and biases that lead to a false sense of security in a strategy’s effectiveness. Let’s take a comprehensive look into the many flaws of backtesting, and explore the common pitfalls of using a simple back test as your only method of verifying a strategy's efficacy.

1. Choosing the Winning Team After the Game is Already Over

(Selection Bias)

When selecting which instruments for backtesting, it is common to choose assets you are already interested in or those that performed well in the past. This introduces selection bias, as the strategy is tested on assets that may have been outliers. While this may produce impressive backtest results, it creates an illusion of reliability that may not hold up when applied to other assets or future market conditions - a theme that will be common for most of the explored backtesting drawbacks.

Example:

Imagine backtesting a Long only strategy using only tech stocks that surged during a market boom. The strategy might look incredibly successful in the backtest, but when applied to other sectors or different market phases it will most likely fail to perform - because the selection was based on past winners rather than a broader, more balanced approach.

2. You Only See the Ships that Make it to Shore

(Survivorship Bias)

Similar to the above, survivorship bias occurs when backtests only include assets that have survived of the test period - excluding those that were delisted, went bankrupt, or failed entirely. This creates a skewed dataset, inflating performance metrics beyond reasonable levels once again. By only focusing on assets that are still around, you overlook the fact that many others didn’t make it - and these failures could have significantly impacted the strategy’s results. By ignoring delisted companies, or rug-pulled crypto projects, you inherently induce a selection bias - as purely because your chosen instruments didn’t go to zero they must have performed better.

Example:

Suppose you backtest a low-cap cryptocurrency strategy. If your backtest spans for, say, five years the test can give the illusion of success - but what’s missing is the hundreds of tokens that were launched and failed during the same period. How can we possibly assume that we will be lucky enough to only pick tokens that survive the next five years?

3. Reading Tomorrow’s News Today

(Look-Ahead Bias)

Look ahead bias occurs when future information is unintentionally used in past decision making during a backtest. This can often occur due to coding errors in an automated system which leads to unreasonable and unrepeatable results. Look-ahead bias isn’t limited to algorithmic backtesting - it can also affect manual backtests. Traders will often miss false signals because they can already see the outcome of the trade. This knowledge of the future can affect the accuracy of a manual backtest - both as a conscious decision by the trader but also subconsciously.

if Current_Price < Tomorrows_Close

strategy.entry("Enter a Long Position", strategy.long)

// An extreme example

4. Perfecting the Final Chord, but Forgetting the Song

(Recency Bias)

Recency bias occurs when traders place too much emphasis on the most recent data or market conditions in a backtest. This usually occurs when a trader feels they missed an opportunity in the past few months - and tries to develop a strategy that would have captured that specific move. By focusing too heavily on recent history, it is easy to neglect the fact that markets usually move in long cyclical phases. This over optimisation for recent conditions will, at best, result in a strategy that performs well in the short term but fails as soon as market dynamics shift.

Example

Frustrated by missing the most recent leg of the bull market, a trader develops a strategy that would have perfectly performed during this period. However, when the trader begins live trading at the top of the market, the strategy quickly fails. It was only optimized for that short and specific market phase and was unable to adapt to the changing market conditions.

5. Forcing the Square into the Round Hole

(Overfitting)

Overfitting occurs when a strategy is excessively optimized for historical data, capturing noise and random fluctuations rather than meaningful patterns. Overfitting is common when traders test too many parameter combinations, tweaking their strategy until it fits the past data perfectly. In contrast to the previous point, this over optimisation can occur on data of any length, whether years or even longer periods.

Example

Adjusting a large range of parameters in a high frequency strategy by incredibly small increments and deciding to use the calibrations that yield the highest performance.

6. Mixing Oil and Water

(Conflating Trend and Mean Reversion Systems)

Traders often attempt to design strategies that perform well in both trending and mean reverting environments, which leads to muddled logic and poor performance in ALL environments. A trend following strategy is meant to capitalize on sustained price movements, and should naturally underperform during mean-reverting or ‘ranging’ periods. In a range-bound market, a trend-following strategy will often buy near the top of the range after detecting strength, only for the price to reverse. Conversely, a mean reversion strategy is built to profit from oscillations around a stable point and forcing both approaches into a single system results in unrealistic backtest performance and poor real-world results.

One of the common mistakes is when a trend following strategy ‘accidently’ performs well during mean-reverting periods. This skews the backtest metrics because any gains during non-trending markets are multiplied significantly during actual trends. As a result, the backtest shows artificially positive performance - but the strategy quickly falls apart in live trading. Normally, a trend following strategy would incur losses during a range-bound market and only begin to recover once a new trend emerges. However, if a strategy is overfit to handle both the trend and mean reversion periods of the past, it doesn’t need to recover losses and instead compounds gains during the entire trend. This creates inflated backtest results that won’t hold up in real trading.

Example:

A trader develops a trend following system that, through over-optimization, performs surprisingly well during mean-reversion phases. In the backtest, the strategy shows strong returns, even in ranging markets. However, in live trading, the system fails, leaving the trader with poor performance. Instead, the trader should have accepted ‘lower’ returns from a strategy that wasn’t overfit - because in live markets robust strategies with mediocre backtests perform better than overfit strategies that only excel in backtesting.

7. Seeing the World Through a Keyhole

(Limited Data Skewed by Outliers)

Strategies built on assets with limited data are highly susceptible to skew results, especially when outliers dominate the dataset. Without sufficient data, it becomes nearly impossible to assess whether a strategy can consistently perform into the future. Some strategies, like trend following, are designed to capture outliers, that is, the periods of performance above the norm. The issue arises when testing on a small sample as it’s difficult to determine if the strategy can consistently capture trends or just got lucky.

Example:

A trader develops a trend following strategy for a cryptocurrency that has recently launched. The backtest shows massive gains, as it is common for projects to make large returns as soon as they are listed. However without enough data history, it is impossible to assess the actual effectiveness of this strategy, as its performance metrics are positively skewed by the ‘listing pump.’

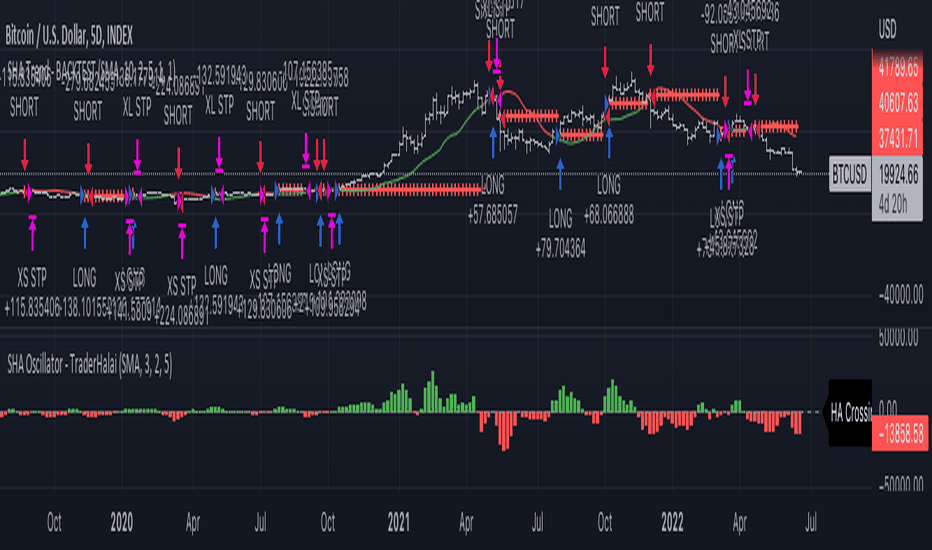

The image shows a cryptocurrency project launched in October 2020. At first glance, the EMA Crossover strategy appears profitable, but a closer look reveals that most of the profit comes from the first trade, which is considered an outlier. If that trade was removed, the strategy as a whole would become unprofitable. Following this strategy is essentially betting on the project to experience another sharp rise similar to what occurred in 2020. While technically this isn’t impossible, it is much riskier - a more proven and verified strategy would increase your probability of success.

8. Designing a Car that Doesn’t Fit on the Road

(Execution Constraints and Positions Sizing)

In backtesting, real world constraints such as minimum or maximum order sizes are often ignored, leading to unrealistic trade execution. Traders may find that they either don’t have enough capital to satisfy the minimum order size - either immediately or after a small drawdown. Additionally, compounded returns on a backtest can lead to absurd positions sizes that could never be bought or sold in the real market. This particularly is more problematic for deep backtestests.

Example:

A backtest shows spectacular growth, with the account size ballooning overtime and resulting in an extremely high profit percentage. However, in real-word conditions, the required position size to continue executing the strategy becomes so large that it exceeds the liquidity of the market - making it impossible to receive comparable profit percentages on real world trading.

9. Death by a Thousand Paper Cuts

(Not Accounting for Fees, Commissions and Slippage)

When performing a backtest, traders often overlook critical transaction costs such as fees, slippages and spreads. These seemingly small costs can accumulate and significantly erode profits, especially strategies that rely on frequent trades with a low average return per trade. Slippage also should include execution slippage - the time delay between receiving a signal from a system, placing an order and its execution. This is particularly problematic for lower timeframe trading where even minor delays can drastically swing a strategy from profitable to unprofitable

Example:

A day trader runs a backtest on a scalping strategy and sees parabolic returns. However in live trading, the small profits from each trade are wiped out by broker commissions, spreads and the slippage that occurs from both position sizing, and when trades are executed slightly later than expected. This strategy, while successful in the backtest, failed to account for the ‘death by a thousand paper cuts.’

10. Filling Half of the Grocery Cart

(Partial Order Fills)

In low liquidity environments, or when trading large position sizes, partial order fills are common - meaning traders only get a portion of their order executed at their desired price. This can significantly impact returns. Backtests will usually assume complete fills at the exact target price. However, in reality a trader experiencing a partial order fill must decide whether to complete the position at a worse price or leave a portion of the target position size out of the market. Both choices will lead to results that are not comparable to the backtested results.

Example:

A trader places a limit order to buy 100 shares of a low-liquidity stock at a price of $10. The order is only partially filled, with 60 shares bought at $10, while the remaining 40 shares require the new, higher price. The trader now faces the choice of paying more, or leaving part of the trade out. This is a major deviation from the backtest, which assumed the complete position was bought at $10.

11. Betting on Lightning Striking Twice

(Black Swan Events)

Black swan events are rare, inherently unpredictable, and have a significant impact on financial markets. Strategies designed to avoid drawdowns during these events are at risk of being overfit. Traders often fall into the trap of building systems that avoid drawdowns during past black swan events - overfitting their strategies to these rare occurrences. These strategies are unlikely to succeed in regular market conditions and contain no extra edge in protecting a trader from future black swans events.

Example:

After the FTX collapse caused a sharp drop in crypto prices, a trader chooses to develop a swing trading strategy designed to avoid all losses during this event. However, by optimizing the strategy to exit positions before the collapse, the trader unintentionally overfits it. As a result, the strategy begins to sell off positions too early in other situations, cutting profits short. Prior to the FTX collapse, the market was still in an uptrend, and there were no clear signs of an impending downturn - so attempting to optimize for such a rare event ends up compromising the strategy’s performance in more typical market conditions.

12. Expecting a Weeks Pay After Only Working One Shift

(Time of Day and Day of Week Restrictions)

Many traders are only able to trade during specific hours or days of the week, yet their backtests often include data from periods where they are unavailable - such as overnight sessions. This creates an unrealistic expectation of returns. For example, in markets like crypto that trade 24/7, backtesting a day trading strategy on the full market period gives a false impression of potential profits if you can only trade during certain hours. Additionally, market participants also differ depending on the time of day, as entire countries wake up and go to sleep at different times of day. One could make the assumption that human behavior as a whole might be the same, but the number of participants and liquidity will definitely change.

Example:

A day trader backtests a strategy using 24/7 crypto market data - but is only able to trade on weekday afternoons due to other commitments.

13. Siphoning Gas from a Moving Car

(Capital Drain and Addition)

Backtests frequently assume infinite compounding, where no capital is ever added or withdrawn from the trading account. In practice, however, traders will regularly add or remove funds - which significantly impacts the performance of a strategy. For instance, withdrawing money during a drawdown forces the strategy to work harder to recover losses, as it now requires higher returns to break even. Similarly, adding capital can skew results by altering position sizing. While it is necessary to manage capital in this way, backtests usually don’t account for these changes and once again, leads to results that are not repeated in practice.

Example:

A trader consistently pulls a portion of profits from their account each month. In the backtest, no withdrawals are considered, and the strategy appears highly profitable. However, in live trading these regular withdrawals put pressure on the account, and especially over longer periods of time, this reduced level of compound will lead to significant underperformance relative to the backtest due to the reduced compounding effect on returns.

14. Your Subscription Service Increase Price Without You Realizing

(Interest Rates and Funding Costs)

The ‘cost of capital’ - such as leverage costs, interest rate and funding fees - can fluctuate over time, but backtests often overlook these dynamic costs or even fail to account for them altogether. In live markets, these changes can significantly erode profit margins. Not considering these costs, especially the factors affecting their variability, can easily turn a profitable backtest into an unprofitable strategy in live trading.

Example:

A trader backtests a strategy for use in cryptocurrency perpetual futures. The strategy is designed for bull markets but fails to account for the rising funding rates frequently seen during periods of high demand. As the cost to maintain an open position skyrockets, the trader’s profit margins quickly shrink, making the strategy far less viable than the backtest indicated. This is particularly dangerous because as the funding fees erode the position’s margin, the liquidation price rises faster than expected, potentially resulting in the entire position being liquidated - even though the trade appeared profitable on paper.

15. You Can’t Ride the Wave Past the Shore

(Alpha Decay)

In highly competitive markets, especially in high-frequency trading, the edge of a strategy (alpha) can erode over time as more participants exploit similar inefficiencies. This gradual loss of profitability - known as alpha decay - often isn’t captured in backtesting, which assumes static market conditions. Alpha decay is particularly relevant in high-frequency trading, where competition and frontrunning are more intense, while it tends to be less of an issue in higher time-frame swing trading.

16. Playing Chess Against Yourself and Expecting to Win Every Time

(Psychological Factors)

Psychological biases still affect fully systematic traders. The assumption that traders will follow their strategy without hesitation or emotional interference rarely holds true in live trading, especially during periods of drawdown or high volatility. Manual and automated traders alike feel the same compulsion after experiencing drawdown. The temptation to tweak or abandon a strategy during this period is strong and often leads to the worst decision. It is well documented anecdotally that many traders find that after modifying a ‘losing’ strategy, the new version performs worse than the original, as it has been adjusted to avoid the losses of the past and misses future gains by virtue of overfitting.

Example:

An algorithmic trader watches as their automated strategy experiences a significant drawdown. Panicking, the trader tweaks the parameters in order to avoid further losses. Shortly after, the original strategy would have recovered, but the modified version continues to struggle as the adjustments were made in reaction to short term losses instead of accounting for long term performance.

Final Note:

Congratulations if you made it this far! This might not be the most exciting topic, but it’s essential knowledge for every trader and investor. This article was written to warn you of the dangers of relying on backtests - and provides a checklist of common pitfalls to watch out for. Whether you’re running your own backtest or reviewing someone else’s, it’s critical to look beyond the shiny numbers and assess the real-world viability. What looks great on paper may not hold up in the real world.

Best of luck in the markets - but remember: stay prudent, and you’ll make your own luck!

Backtest

Backtesting strategies using TradingView's replay featureBacktesting trading strategies using TradingView's replay feature is a valuable tool to evaluate the effectiveness of your strategy in different market conditions and timeframes. Here's a step-by-step guide on how to backtest strategies using TradingView's replay feature:

**1. Define Your Strategy:**

- Clearly define the rules and parameters of your trading strategy, including entry and exit conditions, stop-loss and take-profit levels, and any other relevant criteria.

**2. Access the Replay Feature:**

- Open the chart for the GBP/USD pair on TradingView.

- Click on the "Replay" button located at the bottom of the chart. This will activate the replay feature, allowing you to scroll back and forth through historical price data.

**3. Set the Timeframe and Date Range:**

- Choose the timeframe (e.g., 1-hour, 4-hour, daily) that matches the trading frequency of your strategy.

- Select the specific date range you want to backtest your strategy on. You can adjust the date range using the timeline at the bottom of the chart.

**4. Apply Indicators and Drawing Tools:**

- Apply any indicators, drawing tools, or overlays that are part of your trading strategy to the chart.

- Ensure that the parameters of your indicators are set according to your strategy's rules.

**5. Start the Replay:**

- Begin the replay by clicking on the play button in the replay control panel.

- You can adjust the playback speed using the speed slider to simulate different market conditions and trading environments.

**6. Execute Trades:**

- As the replay progresses, identify potential trade setups according to your strategy's rules.

- Manually execute trades (open, close, or modify positions) based on your predefined entry and exit conditions.

**7. Record Results and Observations:**

- Keep track of the performance of each trade, including entry and exit prices, profit or loss, and any deviations from your strategy's rules.

- Take note of any observations or insights gained during the backtesting process, such as areas of strength or weakness in your strategy.

**8. Analyze Results and Refine Strategy:**

- Analyze the overall performance of your strategy, including profitability, win rate, maximum drawdown, and risk-adjusted returns.

- Identify areas for improvement or optimization based on the results of your backtesting.

- Consider making adjustments to your strategy's parameters, entry/exit rules, or risk management techniques to enhance its effectiveness.

**9. Repeat and Iterate:**

- Repeat the backtesting process on different timeframes, market conditions, and historical periods to validate the robustness of your strategy.

- Continuously iterate and refine your strategy based on feedback from backtesting results and real-time trading experience.

By utilizing TradingView's replay feature for backtesting, you can gain valuable insights into the performance of your trading strategy and make informed decisions about its suitability for live trading.

HOW-TO: Build your strategy with Protervus Trading ToolkitHi Traders! This tutorial will show you how to build your own strategy and link it to Protervus Trading Toolking (PTT) .

First of all, let me remind everyone that this content should be considered educational material, and backtesting results are not a guarantee. My goal is not to provide ready-made strategies, signals, or infallible methods, but rather indicators and tools to help you focus on your own research and build a reliable trading plan based on discipline.

So, without further ado let's start building our first strategy!

For this tutorial we'll build a simple EMA Cross strategy and add the Chaining Snippet to link it to PTT.

The first step is to create a new indicator in Pine Editor and add the initial requirements:

//@version=5

indicator("EMA Cross (data chaining)", overlay = true)

Let's now create the inputs where we will be editing EMAs' length:

FastEmaLen = input.int(50, title = "Fast EMA Length")

SlowEmaLen = input.int(200, title = "Fast EMA Length")

At this point we can proceed by calculating the two EMAs:

FastEma = ta.ema(close, FastEmaLen)

SlowEma = ta.ema(close, SlowEmaLen)

We are now ready to script our Entry conditions:

BullishCross = ta.crossover(FastEma, SlowEma)

BearishCross = ta.crossunder(FastEma, SlowEma)

We also wish to see the two EMAs plotted on the chart, so we will add the following code:

plot(FastEma, color = color.new(color.green, 0))

plot(SlowEma, color = color.new(color.red, 0))

At this point, our code should look like this:

Great, we are now ready to add PTT Snippet by pasting all the code at the end of the one we just wrote.

Let's head to the CONDITIONS INPUTS section and replace the placeholder text for EntryCondition_1 , giving it a proper name:

EntryCondition_1 = input.bool(true, 'Ema Cross', group = 'Entry Conditions')

We can also add null to the unused inputs to clear the settings panel:

ADDING ENTRY CONDITIONS

We'll now be adding our Long and Short Entry conditions in the ENTRY \ FILTER CONDITIONS section.

In LongEntryCondition_1 we should replace null with BullishCross :

LongEntryCondition_1 = BullishCross

Same for ShortEntryCondition_1 down below:

ShortEntryCondition_1 = BearishCross

Guess what? We're done! We just added our Entry conditions:

We can now compile the script and add our indicator to the chart, along with PTT.

Let's open PTT and select "EMA Cross (data chaining): Chained Data" in the Source Selection drop-down menu - the data will now be forwarded to PTT and we can start tweaking the settings to experiment with our new strategy:

ADDING EXIT CONDITIONS

Let's say we now also want to add an Exit condition for when the price goes above (or below) the fast EMA, signaling a trend reversal: we can do that in no time!

Go back at the top of the code, and right after our EMA calculations, add:

PriceAboveFastEma = ta.crossover(close, FastEma)

PriceBelowFastEma = ta.crossunder(close, FastEma)

Of course, we also need to add the newly created conditions in the snippet code. Let's find the section EXIT CONDITIONS and, just like our Entry conditions, we can replace the null placeholder with our actual conditions:

LongExitCondition_1 = PriceBelowFastEma

...

ShortExitCondition_1 = PriceAboveFastEma

If we also want to use these conditions as Stops, we can add them to the STOP CONDITIONS section:

Note: Exit Conditions will close the trade in profit, while Stop Conditions will close the trade in loss. Still, you should not worry about scripting it yourself: PTT will take care of analyzing the trade and separate Exits from Stops when the signal to close the position is received.

ADDING FILTER CONDITIONS

Besides using our indicator to open and close trades, we can also use it to filter the signal from another, chained indicator.

To keep this tutorial simple, let's use the same EMA Cross script, so we can add it again to the chart and use the first one as Signal, and the second as Filter.

Let's add our Filter conditions in the script:

FastAboveSlow = FastEma > SlowEma

SlowAboveFast = FastEma < SlowEma

Just like we did in the previous steps, we should now add the option in the settings panel and the Filter conditions in the snippet code:

CHAINING INDICATORS

We currently have one EMA Cross indicator working as Signal in the chain, linked to PTT on the chart:

Let's copy-and-paste the EMA Cross indicator (or add it again) to have two of them.

The first one on the chain will act as Filter, so in the settings let's give the two EMAs a longer length (e.g. 250 and 300) in order to verify the trend and discard signals received when it's not favorable. Remember to set output mode as Filter, and tick the Filter box.

The second one will be our Signal: we can choose the length of the two EMAs we will use as Entry \ Exit when a cross happens (e.g. 100 and 200), enabling our Entry and Exit conditions by ticking the boxes. This time, we will tick the "Receive Data" box, and select the Chained source of the Filter:

If before linking the Filter you already had the Signal linked to PTT, you will notice it automatically recalculates the data - and if our Filter works as intended, the improvements will be visible ;)

EXTRAS

If your indicator doesn't plot anything on the chart, we must enable a "Dummy Plot" in order to prevent issues, since we are sending chained data as an invisible plot and it cannot be the only plot in the code.

Just un-comment the line plot(close < 0 ? close : na, title='Dummy Plot') to avoid this problem:

ADDING SIGNALS MARKERS

PTT will show all labels and markers for trades, but if you wish to have them on the indicator or just to debug your signals, you can enable and customize the last lines in the snippet:

CHAINING SCHEMA

|-- Filters (optional, any number of filters - linked one to another)

|---- Signal (mandatory, only one indicator must be set to Signal - in case of multiple Filters, Signal must be linked to the last Filter in the chain)

|------ Protervus Trading Toolkit (linked to Signal)

|-------- PTT Plugins (Strategy Wrapper, Trade Progression, etc - linked to PTT)

NOTES

- When you chain an indicator, its source remains "locked" even if you un-tick the Receive Data box. If you wish to use that source on another indicator you should un-link it first (just select "Close" as source to free the indicator's chain output).

- If you remove indicators in the chain, all other indicators linked AFTER it will be deleted - to prevent this, you should un-link chained indicators before removing them.

- Pine Script is limited to one source input per indicator, so you cannot chain indicators that let you choose another source to calculate data: for example, if you have an RSI indicator with a source selection ( input.source ) you must remove that input and only use the one for chaining. You can read more on PineScript Reference page.

Education: Why your trading strategy win rate doesn't matter!What makes a profitable automated strategy?

Probably the biggest misconception for trading perpetuated in the mainstream is that you need to have a greater than 50% win rate to be profitable.

This is followed by a close second, of constantly assuming you need to have a risk-reward ratio of greater than 1:1 (e.g. 1:2, 1:3 etc). This one is perpetuated mostly by forex and stock market gurus.

By the end of this article, I hope to dispel these myths and aim to shed some truths on how to assess a profitable strategy.

Why your win rate doesn't matter:

Let's simplify this down using an example. Consider the following two strategies. Which one would you rather trade?

Strategy A: 50% win rate - When you win you make 2 dollars, but when you lose, you lose 1 dollar

Strategy B: 50% win rate - When you win you make 5 dollars, but when you lose, you lose 1 dollar

This one was a very obvious case of choosing Strategy B. In this case, both strategies have the same win rate, but Strategy B nets you 5 dollars per win, whereas Strategy A only makes you 2.

Let's take another example. A little less obvious this time. Which one would you rather trade here?

Strategy A: 90% win rate - When you win you make 1 dollar, but when you lose you lose 50 dollars

Strategy B: 10% win rate - When you win you make 200 dollars, but when you lose, you lose 1 dollar

Now the 90% win rate strategy may look attractive on the surface, but when you dig into it, you realise that you could get a massive 50 dollar loss in the 10% of times you do lose! For those of you who chose strategy B, this is the correct answer.

One way we can assess the above strategies is using Expectancy . The formula for Expectancy is as follows:

(Win % x Average Win Size) – (Loss % x Average Loss Size)

We can calculate the expectancies of the strategy below:

Strategy A:

(0.9 * 1) - (0.1 * 50) = -4.1

Meaning you are expected to lose an average of $4.10 per trade using strategy A. Not a good sign.

Strategy B:

(0.1 * 200) - (0.9*1) = 19.1

Meaning you are expected to win an average of $19.10 per trade using strategy B. This is a major winner here!

As you've probably realised. It is possible to have a profitable strategy using a low win rate. Many trend trading/breakout strategies tend to have lower win rates, but with larger rewards to risk, whilst mean-reversion strategies tend to have higher win rates with less frequent but larger drawdowns.

The backtest shown in this post shows an example of a low win rate, and high win amount strategy using the Smoothed Heikin Ashi Trend on Chart indicator which I have developed, with an overall positive expectancy, backtest (note, no strategy is perfect, should not just blindly trust backtest data).

Why you may still choose to define a risk/reward

Better consistency of your strategy

Psychological factor of knowing that you can be expected to lose only x amount (assuming no slippage etc)

As an aside, note that defining a fixed risk-reward may hurt your win rate (which could impact your expectancy) so it's important to backtest to see if you get better results with defined risk-reward parameters. This is beyond the scope of the current article, but an important consideration.

Why do traders gravitate toward a higher win rate?

The simple answer here is that everyone wants to be a winner! It's human nature to want to be right, whether this be about a market direction or when to open or close a trade. It's often easier to brag about how much you win whether that be on social media or just feeling good about yourself.

For algorithmic traders, having a higher win rate may also provide psychological benefits, as losing 20 times in a row can sometimes be very daunting for traders and can throw doubt into the efficacy of your system.

I hope that through this article, I have managed to convey that it may be prudent consider strategies with low win rates also, as these can be very profitable in their own right.

Digging further:

This article is only just scratching the surface of how to create and validate if a strategy is something that you should consider trading. There are many aspects of backtesting including Monte Carlo simulation, understanding standard deviation of returns and risk, Sharpe ratio, Sortino ratio, walk-forward analysis, and out-of-sample analysis to name a few that you should conduct before you evaluate a strategy as suitable for live trading.

If you've made it this far, thanks for reading. If you like the content, feel free to like and share, as well as check out some of the free scripts, strategies and indicators that I have published under the scripts tab.

Thank you!

Disclaimer: Not to be taken as financial advice, anything published by me is purely for education and entertainment purposes

How To Backtest Further In The Past On Low TimeframesQuick video to show this little trick using the Replay mode that allows us to load more historical bars than real time, and thus get a better picture at how a strategy can perform over time.

The Strategy Tester re-calculate the results everytime we load new bars, as the indicator strategy is correctly applied to these new bars.

I got the confirmation from the awesome TradingView Support Team that the extra data that you get this way is real and relevant, and can be used to test your strategies.

That means we are no more limited to 15/30 days backtest data in the 5min timeframe for example.

Do You Have an Edge in The Market?Hello, traders!

Have you ever wondered why it feels so hard to be consistently profitable in trading?

If you have, It's okay. You're not the only one

In fact 90% of traders lose money consistently.

What have they done to deserve that?

This is what 90% of traders do:

- looking for holy grail strategy

- when it fails, they jump to other strategy

- they never verify the strategy by doing their own research (back testing, forward testing, live account demonstration)

- rinse and repeat

With this mentality, they've become jack of all trades and masters of none. They took every possible opportunity without knowing the probability of the outcome. With so much strategy in their mind, the trading outcome become random and haphazard. If you include the emotional damage factor, this approach in trading will bring negative equity expectancy in the long run.

Instead of jumping from one method to another, ask yourself this question:

1. What specific method do you use?

2. What timeframe?

3. What kind of market work with the method?

4. How many sample do you have in your back test?

5. How much is your average win rate, risk reward?

The clearer your answer, the better. It will give you more confidence in your strategy execution. You'll also be calmer when losing streak comes. Less emotional damage = better outcome and more consistent result. Here's an example from one of my backtest (not a recommendation to use my method, please do your homework):

1. What specific method do I use?

In this example, I use trend continuation chart pattern (mostly flag, rising/falling wedge, pennant, symmetrical triangle).

I use ema200 as filter. If the price is below ema200 I have sell bias. If the price is above ema200 I have buy bias. So if I see bullish chart pattern while the price is far below ema200, I won't take the trade

I add MACD as momentum indicator. If the setup accompanied with MACD crossover, it shows momentum shift and good potential entry point.

2. What timeframe?

I use m30 timeframe in this back test

3. What kind of market work with the method?

I tested with best results in JPY forex pairs (especially AUDJPY, GBPJPY, CADJPY) and AUDUSD

4. How many sample do you have in your back test?

in GBPJPY I have collected 110 trade sample with the same method from January 2021 to December 2021. (I recorded the screenshot of the back test too)

5. How much is your average win rate, risk reward?

In those 110 sample, I got 72 wins and 38 losses with 1:1.5 risk to reward ratio. This means I have about 65.45% win rate. So this system gives me positive return expectancy based on the back test.

After you've answered these 5 questions, you can do forward testing with a small account (if you want to use demo account first, It's okay. But take into account you won't experience the emotional factor). Record your trading result until you've gathered enough data and you feel comfortable with the result.

Congratulation, you've got yourself a proven strategy that you're comfortable to trade with. After that, all you need to do is be so good with that system until it becomes very intuitive to you.

Stick to one method and become the master of that method.

Just as Bruce Lee said:

"I fear not the man who practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times"

Don't be lazy and do your homework dear traders!

5 Key Advices To Share With Trader Who Is Struggling In TradingHello everyone:

Lately many of you have messaged me about getting FOMO and entering trades without confirmations.

In addition you can't seem to “not” enter trades when the market hasn't shaped up to your strategy and entry criteria.

I am hoping in today’s educational video it can help some of you guys to get back on track.

I want to share 5 main pieces of advice that can help out traders who are currently struggling.

These are experiences and lessons that I accumulate throughout the 8 years of trading and in hope to help some of you who are struggling in your current journey of trading.

1. Do “NOT” think about get rich quick in trading

-Trading is a marathon, not a sprint

-90-95% traders fail due to a combination of: Greed, FOMO, mindset/emotion, risk management, trading psychology.

-Trading is not a get rich quick scheme, but it can produce consistent, sustainable passive income if you can put in the time and effort

-Most try to jump to the result right away, without going through the journey, that is not how life works.

2. No trading strategies, style, method can give you 100% strike rate

-Trading is probability, not right or wrong.

-Understand you can have the best strategy in the world, and still not be profitable.

- Technical, Fundamental, Algo, EA...etc can all not work. This is why risk management is important to not over risk, over trade, over leverage your trading account

3. Backtest and journal

-Backtest your strategy so your brain acknowledges and recognizes it over and over again.

-Slowly build up confidence in your strategy and method. IT will come to you like second nature

-Journal all your wins and losses so you can review them. Work on them, accept your mistakes to grow and improve.

4. Control your EGO

-Human beings have ego to prove others are wrong and they are right

-We refuse to admit we made the error/mistakes, and blame others/external as the cause.

-Acknowledge that in trading, stop blaming the market, the broker, the mentor, the strategy...etc.

-Don't take things personally and be offended by it.

5. Never Give Up

-I blew several accounts in the beginning of trading career, gave up and quit trading multiple times

-I always ended up coming back to trading. After taking time off. Whether that is weeks or months in the beginning journey.

-No one is born into a trader, just like no one is born into a doctor, lawyer.

-If trading was that easy, then everyone would be rich.

-Success is measure by how many times you get back up when you failed

I hope these pointers can help you guys to get more focus and get back on track in trading.

Any questions, comments or feedback welcome to let me know, thank you

Jojo

Below I will share others educational videos that have direct relations to the topics above:

Trading Psychology: How to deal & manage losses/consecutive losses in trading ?

Trading Psychology: Revenge Trading

Trading Psychology: Fear Of Missing Out

Trading Psychology: Over Leveraged Trading

Trading Psychology: Is there Stop Loss Hunting in Trading ? How to deal with it ?

Prevent Blowing an account by backtesting:

Risk Management 101

Backtesting Bitcoin: From bullish to bearishHi there,

Personally, I think it's important to backtest prices. In this way, you better understand why a price reacts to events.

Today I backtested bitcoin. I was especially curious about how to recognize the switch from bullish to bearish. I use the daily chart for this because I invest in the long term.

Are you a day trader? Then you can also backtest on lower timeframes. Keep in mind that the uncertainty factor is a lot bigger.

The backtest

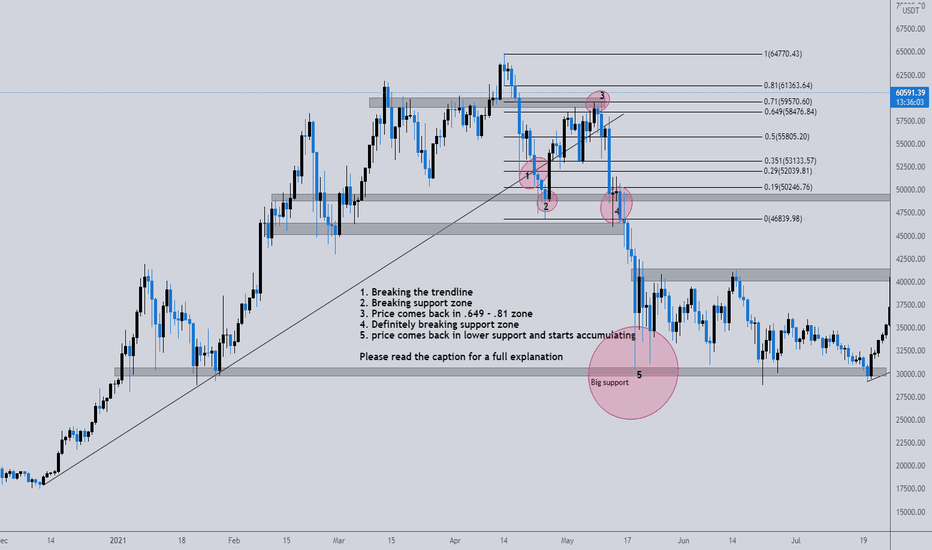

Before a bullish period turns into a bearish period, you need several confirmations.

1. We saw the trendline break. This is not yet a reason to become bearish because you can determine a trend in several ways

2. The support zone is broken. Combine this with the broken trend line and the higher low that is no longer valid.

3. Reason enough for me to make a Fibonacci from the highest point to the lower point. On the chart, you can see that I go from spike to spike. The price is looking for a retest before the big drop starts. This to me is the .649, .71 or .81 zone.

4. the price breaks the support zone, retests, and finally drops to the next larger support zone. At that moment a new accumulation starts and it is again waiting for new confirmations.

STOP Playing Weekly Options Lottery: Backtest Proven!Since 2020 the retail trading market has exploded with Weekly Options buying. Weekly Options are "cheap" and can, occasionally, give their buyers big exciting wins. Do they make sense over the long run? NO! A backtest of NASDAQ:TSLA proves that over the long run options are PRICED EFFICIENTLY to make traders lose and underperform buying shares!

US Indices Backtesting and Charting Session On Price Action Hello everyone:

As promised I will periodically make these backtesting/chart work videos on different markets, pairs and timeframes.

This is for me to present the importance of backtesting in trading consistency.

Not only it will help traders to not have emotional decisions such as FOMO or fear of losing, it will give traders confidence at identifying trade opportunities and execute them when the time comes.

The more we do backtesting, the easier we spot an entry, setting a SL/TP, and remove any emotional decisions.

Today I want to go into the US Indices, specifically the SPY, NASDAQ, DOW. I will pick a few market crashed examples and dig deeper into them.

Few educational videos below on the topic of backtesting, and why it will help you in your trading journey.

How & Why I backtest:

Prevent Blowing an account by backtesting:

Backtesting & Chartwork on USDCAD:

Any questions, comments, or feedback please let me know :)

Thank you

Jojo

USDCAD Backtesting & Chart Work session on Price Action AnalysisHello everyone:

Welcome to a backtesting/charting session on price action analysis.

Many have inquired about how to properly identify market phrases (Impulse phrase vs corrective phrase).

In addition, how to use trendline properly to identify a structure/pattern as a continuation or reversal correction.

This session will be the start to all these.

So let's take a look into this. To start, make sure you have a new chart layout just for backtesting/charting work.

his won't get overlapped on your current chart for your normal analysis.

Utilizing tradingview’s feature on “replay”, this is how we can backtest and do chart work on previous price action that has already happened.

As we already see the price moved in that period of time, we then look for potential buy/sell bias entries to get familiar with the move within the market.

1. Start from the Higher time frames, top down approach. Utilize multi-time frame analysis to your advantage.

2. Identify what market phrase you are in, is the current price in a HTF impulse phrase ? or in a corrective phrase.

3. Now that you have a more clear bias on the HTF, then go down to the lower time frame to confirm your bias.

Do we see the same bearish/bullish price action on the LTF as well ? If so then that's a good indication that both HTF and LTF have the same buy/sell opportunity.

Look for possible entries on the LTF.

4. Repeat this process with different pairs, different markets to “program” our minds into looking for the similar buy/sell setups in the current, live market.

This is how we don't get FOMO, or fear of losing. If you have done enough backtesting and charting, then you simply remove the emotion out of the equation.

You have seen the move play out over and over again, then it comes down to probabilities.

Feel free to ask me questions, comments or feedback :)

Thank you

4 simple steps to create your perfect strategyHello traders,

Introduction

How many times did you find a perfect strategy giving great results in backtest but wasn't working for LIVE trading?

This effect is due to "overfitting" your past signals giving great historical results in a past environment.

Overfitting means you're forcing the results to look great; hence not realistic; knowing the historical price action.

Unfortunately, new traders don't know how random financial markets could be.

Then, a backtest with very controlled and precised conditions is often irrelevant for real/live trading.

Building a trading system is like solving a puzzle.

We don't define the entries and exits separately - entries are defined relative to the exits and vice-versa.

Imagine a RubixCube where solving one face of the cube could mess up with the other faces of that cube.

Step 1 - Define your entries

Finding entries is the easiest step.

Most indicators on a big timeframes give great entries but poor exits.

I appreciate low timeframes a lot as it gives me a better control of my RISK.

Thinking that low timeframes require more reactivity is a myth...

If we use the standard values from our trading indicators - yes sure, we often enter/exit dozen of times before the real move happens - and when it happens we're too exhausted to trade it well.

This is weird that many traders use common indicators with their standard values regardless of the timeframe.

Think about using the MACD with the 12/26/9 or RSI with a 14 period for example.

Using indicators with low values doesn't work neither for manual or automated trading.

The new traders wreck themselves either via exhaustion (manual trading) or with paying too many fees (both manual and automated trading).

If your high timeframes trades get invalidated/stopped-out, the drawdown is painful - and you really feel the pain if you use a big position size or a too high leverage... (please don't).

What I'm going to say is going to shock a lot of our readers I know.

Entries don't matter by themselves.

If your exits are not well-thought, you're guaranteed to lose regardless of how great your entries are.

Step 2 - Define your exits

A strategy without exits (Stop-Loss for example), gives a win-rate by design of 100%.

This is the most-common mistake apprentice quant traders make: they think first about PROFIT when actually they must think about the RISK first.

How much you can lose is more important than how much you can win (by far).

If you don't think about your RISK first, I tell you what's going to happen

Maybe you would have predicted the correct directions, but the unrealized drawdown + trading fees + funding will get you bankrupt before the move.

Anyone else already experienced this?

Step 3 - Backtest

From here, you don't even need to use a backtest system.

What I do is setting my chart days/weeks before the current date and then scrolling-right from there until the current date.

The goal is visually checking a few crucial things (in that order exactly):

A) Are my entries early enough?

B) If stopped-out how much do I lose in average?

C) What's the average profit I can make per trade? per day? per week?

You probably noticed that I don't mind the statistical data like win-rate, profit-factor, etc - I don't mind them because they're not relevant.

A backtest with a high win-rate, high profit-factor, high EVERYTHING could still not perform well for LIVE trading if the system is "overfitted".

Let's dig-in quickly into those 3 steps.

A) Are my entries early enough?

There is nothing worse than entering too late - this is obvious because it increases your drawdown if any and reduces your potential profit.

B) If stopped-out how much do I lose in average?

The most important item of the list If your entries are late, we get now that your stops are painful for your capital and psychology.

Even early entries could have terrible exits - and you may still lose

I don't use a price/percentage level stop-loss.

This is too subjective and to speak frankly... not working.

There is a great chance to get filled because of slippage even if the candles never hit your stop-loss order level and then we .... cry and rage because we predicted the correct direction but not the correct potential drawdown.

I'm 100% convinced it happens too often (to be profitable) for all traders using those stop-losses.

I won't say it enough...

Use a hard-exit for your stop-loss - it could be an indicator or multiple indicators giving an opposite signal.

Of course, it should be based on candle close - not candle high/low to remove almost completely the slippage risk .

For the take-profits, that's exactly the same concept.

I don't use price/percentage levels but a combination of Simple Moving Average(s), Traditional Pivots and Fibonacci Pivots

C) What's the average profit I can make per trade? per day? per week?

The goal of any trader: making money and quitting their jobs... I know.

That's why we shall not forget about the average profit we can make per trade and per period (day, week, month, ...).

Here it's important to have written goals and stick to them.

Assuming I want to make 500 USD a day, then I build a system giving me in average 500 USD a day with the lowest risk possible.

Step 4 - Rinse and Repeat

Creating your strategy is a continuous process - not a one step and you're "done".

After the previous step, you may notice some irregularities, some errors, some disturbing elements.

If my entries are late, or exits are late/too big then I go back to the first step and repeat the whole process.

With some experience, building a successful model for the asset and timeframe you want to trade shall take you no more than a few hours.

This is quite fast by the way and you'll already be ahead of most traders out there.

Conclusion

Building your perfect strategy becomes easier with experience and after a lot of trials.

There is no shortcut for becoming rich - you have to put up the work and be/stay focused.

Dave

ICHIMOKU AND RVI BEGINNERS PLAY BOOKNow ichimoku is relatively simple look for buys above the cloud and look for sells under the cloud. so when we backtest that over our 5/5 winners with rvi we get two less entrys, however as a beginner to avoid them whipsaw movements that isnt always a bad thing. The cloud itself offers dynamic support and resistance based of averages. price breaking through the cloud signals a breakout and a change in the trend usually. if new to trading I recommend learning about ichimoku on youtube, its not the all time great plan but if you have no plan its better than that. to keep discipline and entry requirements.

Using the Strategy Tester to Evaluate a StrategyThis video idea explains how to use the strategy tester on TradingView to evaluate the performance of your strategy. We go over all of the data presented for you regarding your strategy, and if we make mistakes along the way you can always check out the TradingView help section that is specifically for the Strategy Tester.

I highlight the overview of your strategy, dive into the details of the performance summary for your strategy, and show how we can review all of our trades including our commission paid.

Finally, we show how changes to the strategy can alter your Strategy Tester results and how accounting for commission(fees) and selective testing windows can alter perceptions on strategies.

XRP/USD Swing StrategyHi guys, here is a simple Swing Trading strategy for Ripple BINANCE:XRPUSDT

To trade this strategy manually you will need the SuperTrend indicator, paired with a 25 bars EMA as trend filter.

Set the ATR multiplier to 2 and the lookback to 3 bars.

Filter trades whose ADX on the 1 Day timeframe is below 12.

Backtest results below.

Configuration:

To get the indicator and automate the strategy, use the link below, thanks.

Eduational: Example of a descending broadening wedge. A descending broadening wedge is bullish chart pattern (said to be a reversal pattern). It is formed by two diverging bullish lines.

A descending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines . The upper line is the resistance line; the lower line is the support line.

Each of these lines must have been touched at least twice to validate the pattern.

NB: a line is said to be "valid" if the price line touches the support or resistance at least 3 times.

This implies that the descending broadening wedge pattern is considered valid if the price touches the support line at least 3 times and the resistance line twice (or the support line at least twice and the resistance line 3 times).

A descending broadening wedge does not mark the exhaustion of the selling current, but the buyers’ ambition to take control. The divergence of the two lines in the same direction (increase in price magnitude) informs us that the price continues to fall with movements that are increasingly low in magnitude. The sellers manage to make the price rebound on the resistance line but lose control after the formation of a new lowest point. The highest point reached during the first correction on the descending broadening wedge’s resistance line forms the resistance. A second wave of decline then occurs of more magnitude, signalling the sellers' loss of control after a new lowest point. A third wave forms afterwards but the sellers lose control again after the formation of new lowest points.

During the formation of a descending broadening wedge, volumes do not behave in any particular way but they increase strongly when the support line breaks. source:Centralcharts

Backtesting Became Cool Again!Hello traders

Hope you're all doing fantastic

I learned a few weeks ago that TradingView released a CSV Export feature. Basically, you can export any indicator outputs/plots and get the data in your favorite Excel/Google Sheet/Open office, etc.

Using that software is relatively easy and learning how to construct pivot tables/charts will expand your analytics beyond the realm of what you thought was even possible... #way #too bold #statement

In that video:

I exported the data provided by Backtest Premium Suite in Google Sheet

In Google Sheet, I built a pivot table and a few pivot charts (requires a few clicks only)

Allows me to get insightful analytics and understand better where I can improve (how much opportunity do I capture? for which risk? are my winners increasing faster than my losers are decreasing?...)

Thank you TradingView for enabling this feature.

All the BEST

Dave

MATIC/BTC StrategyHi guys, here is a strategy for BINANCE:MATICBTC in 4 hour timeframe with 70% profitability so far.

Built upon my private indicator Cyatophilum Altcoins Trader

The input parameters are the following:

Sar value : 5

Trend Detector : Disabled

Security : 10% stop loss with a trailing speed of 4 (both long and short)

Take profit : 6% with 1% trailing deviation (both long and short)

Long & Short Trades

HOW TO USE

Apply the Alert Setup indicator to your chart called Altcoins Trader (PSAR Bot V2)

Configure in the parameters

Make sure you are on the BINANCE:MATICBTC pair in 4H (240) timeframe

Create alerts using 'Once per bar close'. Use the following alerts: 'LONG ENTRY', 'LONG EXIT', 'SHORT ENTRY', 'SHORT EXIT'

Backtest results below.

Have a nice trading!

BATTLE OF THE SUPERTRENDS. And The Winner Is...BATTLE OF THE SUPERTRENDS

Here is an interesting comparison of many of the Top "Supertrend Strategies" that are published here on Tradingview (Including my own: "SUPER SMART ST") . Please note that all test shown here were done using Heikin Ashi candles, which seem to improve Supertrends functionality ...

15 MINUTE (BTC/USD) COMPARISONS

ONE HOUR (BTC/USD) COMPARISONS

FOUR HOUR (BTC/USD) COMPARISONS

Recently I released several SUPERTREND based indicators, studies and strategies. In fact, I created an entire " Trading Toolkit " that incorporates Supertrend along with many other built-in Indicators, Oscillators and Technical Analysis Tools.

--- SCROLL TO BOTTOM HERE FOR LINKS TO THEM ALL ---

I decided to compare my "Super Smart" SuperTrend with the SuperTrend strategies others had published. As you can see in screenshots above, the results were very interesting. What follows is a summary of my experiences and journey surrounding this super topic.

IT STARTED WITH BACKTESTING

After a lot of thought and "playing around" with SuperTrend over the past few months, I was compelled to perform hundreds of backtests across many cryptocurrencies and all the common timeframes. I was seeking to improve upon SuperTrend (if I could) without degrading any of it's many inherent qualities.

But before I jump into my personal journey toward a "Smart" Supertrend, let me share a few thoughts with those of you who are new to Supertrend...

WHAT IS SUPERTREND?

As the name suggests (and as many of you likely already know) , 'Supertrend' is a trend-following indicator that is notably popular.

WHY?

Well, it does a remarkably great job of recognizing a trend (once in progress) and signaling you to when to jump into a trade after the trend is clear. However, many traders feel the greater value of Supertrend is that it helps KEEP YOU IN your position until that trend is over by ignoring minor dips and retracements along the way. Yes, supertrend has it's short comings (detailed later) , but boy... when it's right, it can be very profitable.

IT SOUNDS SO EASY

When you look at any Supertrend chart (in history) it looks so impressive. You begin to fantasize about gains and profits. After all, Supertrend maps out many impressive price movements. It just seems so easy, right? But you soon realize that "trusting" what Supertrend is telling you is hard... "BUY, BUY, BUY... this is a friggin' trend." But you doubt yourself and what Supertrend is telling you and you hesitate. Been there?

Then you finally get in and Supertrend starts yelling... "STAY IN, STAY IN, STAY IN"... but you're up a percentage point (or two) already and you don't want to lose your profit. You exit. Usually way too soon. You're super happy until you see Supertrend continuing to track along with a monster trend. You missed out! Bummer.

SECRETS OF SUPERTREND

You have to remember a couple of secrets to get Supertrend to work the way you've fantasized:

1) Trust it, get in when it signals and stay in until it signals you to exit.

2) Accept the fact that Supertrend does not work well in sideways markets, so if you detect that this is what is forthcoming in the market... lay back, go do some GRID TRADING or have a beer. Wait for a trending market (unfortunately this is usually less than 30% of the time).

3) Should you enter on a Supertrend signal and discover after-the-fact you are in a flat or sideways market, exit as soon as this is clear or at the latest, when Supertrend signals an exit. Yes, you might have a loss. But don't assume Supertrend didn't work, it did work but the market did not have a trend worth following, so you'll have to enter again on the next signal. For every big Supertrend trade you nail, you'll have to wade through perhaps 6 or 7 not so great trades.

4) To improve your odds, try combining Supertrend with other indicators. Often it's a combination of things that gives you your optimal ins and outs.

Speaking of combinations...

STONEHENGE SUPERTREND PLUS (Toolkit)

It was "Secret #4" (above) that lead me to create the " Stonehenge Supertrend Plus Toolkit. "

This features THREE Supertrends:

A CURRENT timeframe Supertrend,

A HIGHER timeframe Supertrend and

My exclusive SUPER SMART Auto-Adjusting Supertrend.

In addition, it is closely integrated with dozens of other indicators and data points.

BUT WHY THE FUNNY MEGALITHIC NAME?

Well, it looks like Stonehenge! Check it out... it displays an array of stones arranged in a manner that does a pretty good job of predicting the future. Learn to read these stones and you can sometimes predict the future!

And best of all, these Stonehenge "predictive stones" not only incorporate Supertrend data but they also enhance Supertrend as you consider entry and exit points along the way.

LET ME CLARIFY

1) There is Supertrend (the standard indicator)

2) There is SUPER SMART SUPERTREND (a version I optimized)

3) Then there is STONEHENGE (a multi-indicator toolset that incorporates Supertrend and Super Smart Supertrend)

LET ME CLARIFY FURTHER

My indicators here have TWO parts that work together:

1) An overlay that appears on the chart with your candles.

2) A separate stand-along indicator that presents data as an array of colored "stones" which help predict future price movement.

AND YET FURTHER CLARIFICATION

1) I have both free and paid versions of everything.

2) I have both Strategy and Study versions of everything.

3) Strategy versions allow BACKTESTING, while Study versions have ALARMS.

IT MIGHT SOUND COMPLICATED, BUT...

If you're confused, just install a free version ( part 1 and part 2 ) and explore this for a few days. If you like what you see, you might consider the more advanced STONEHENGE TOOLKIT . That's all there is to it!

Now back to our regularly scheduled programming!!!

WHAT'S SO SMART ABOUT SUPER SMART SUPERTREND?

As I built the Stonehenge Toolkit, I kept noticing that the Supertrend part had a very annoying downside: Entry signals lagged and Exit signals came late. If those two things could be improved, Supertrend would be really "Super."

After much trial and error and even more backtesting I developed a solution that achieved my goals without OVER modifying Supertrends' inherent qualities. In a nutshell, I made Supertrend smarter!

MANY PEOPLE ASK...

What's the best ATR period and multiplier setting for Supertrend? After all, there are typically only two important data points we must enter for Supertrend to work, namely the 'period (ATR number of candles or days)' and the 'multiplier (value by which ATR is multiplied).' BTW, in case you don't know, ATR signals the degree of price volatility. A common default setting is 10 for the ATR period and 3 for the multiplier.

While this is good to know, Super Smart Supertrend already has well tested default settings built-in, so you can install it and use it right away, without adjusting settings in the beginning. Just plug and play.

HOW IT WORKS

So here's what I did. Using data from other indicators I came up with a SMART SUPERTREND that auto-adjusts as the market changes. It still has settings so you can fine tune for specific assets and timeframes (if you like) , but once the settings are entered, it auto-adjusts as the market and prices evolve.

With "Super Smart SuperTrend" there is no ATR period setting (ATR is determined programmatically) and now there are TWO multipliers you can experiment with... (a lower one set at 1.7 default and a higher one at 2.5). These multiplier settings create a multiplier range that can be used programmatically to adjust the multiplier automatically as the market and prices evolve.

BTW, there is also a separate STANDARD Supertrend that you can run parallel or turn on/off to compare things if you like.

THE RESULTS

Across all time frames and assets I've tested, I generally get better results with my "Smart" version. Better entries, better exits and well defined trends. However, when compared with a STANDARD Supertrend, "Super Smart" is not radically different, but when it does differ it is almost always better. All this is substantiated by backtesting of course.

BATTLE OF THE SUPERTRENDS

How good is SUPER SMART SUPERTREND? You can decide for yourself. I ran backtests on 8 Supertrend strategies I found here at Tradingview (sample results posted above). I set my charts to use Heikin Ashi candles as these seem to improve Supertrend in general. These comparisons were the best 8 I could find and I commend each author/coder for their fine work. I was not trying to out-do any one, I just wanted to improve my trading results. I'm also rather sure some other strategy will eventually out perform Super Smart Supertrend. And if they do, great! I believe in making more money, not making more indicators!

I tested all of the scripts found here:

www.tradingview.com

I used the timeframes of 15 minutes, 1 hour and 4 hours (as published above) . And I used the default settings built-in to each script strategy and again, with Heikin Ashi candles. I fully understand that you can tweak the settings on any Supertrend strategy and get different results.

I hope you have as much fun with this "BATTLE OF THE SUPERTRENDS" as I had creating it. But at the end of the day, I hope you install and try one of my indicators in the very near future and try the Supertrend indicators by these other authors (linked above).

#########################################

MY SUPERTREND BASED INDICATORS

#########################################

The free versions are extremely powerful and will serve you well, they will also give you a preview of the even more powerful "STONEHENGE SUPERTREND PLUS TRADING TOOLKIT." I recommend you use both Stonehenge AND a Companion overlay.

###################################################

STONEHENGE SUPERTREND PLUS TOOLSET (paid versions)

###################################################

DH: (Strategy) Stonehenge SuperTrend Plus Toolkit / Stones

DH: (Companion) Stonehenge SuperTrend Plus Toolkit / Overlay

#########################################

STONEHENGE BASIC TOOLSET (free versions)

#########################################

STONEHENGE SUPERTREND BASIC (Double Stone Indicator Version)

(You may use either of the SUPERTREND overlays below as a companion with this "double stone" indicator)

DH: (Study) Basic Stonehenge SuperTrend - Double Stone Version

SUPER SMART SUPERTREND (Overlay Companion Indicators)

DH: (Study) Super Smart SuperTrend: Self Adjusting

DH: (Strategy) Super SmartSuper Trend: Backtest Version

#########################################

That's it. Get "SMART" Today!

PLEASE HIT THE LIKE BUTTON (and follow me... lots of other SMART STUFF in the works!)

As always, I appreciate your support. Please share with others.

ENJOY!

Dan Hollings

Master Crypto Grid Trader

Stonehenge Master Mason

Host of the "High Leverage Lounge"

Please Explore My Other Indicators, Scripts, Grids and Educational Ideas.

@DanHollings on Tradingview.

Additional Links Below...