Comprehensive Guide to Bull and Bear Flag PatternsBull and bear flag patterns are some of the most reliable and widely used chart patterns in technical analysis.

These patterns are particularly effective for traders who prefer trading with the trend, offering clear entry and exit points.

They appear frequently in trending markets and represent short consolidations before the trend resumes.

In this guide, we’ll cover the characteristics of bull and bear flags, trading strategies, and how to enhance your flag trading using multi-timeframe analysis.

What Are Bull and Bear Flag Patterns?

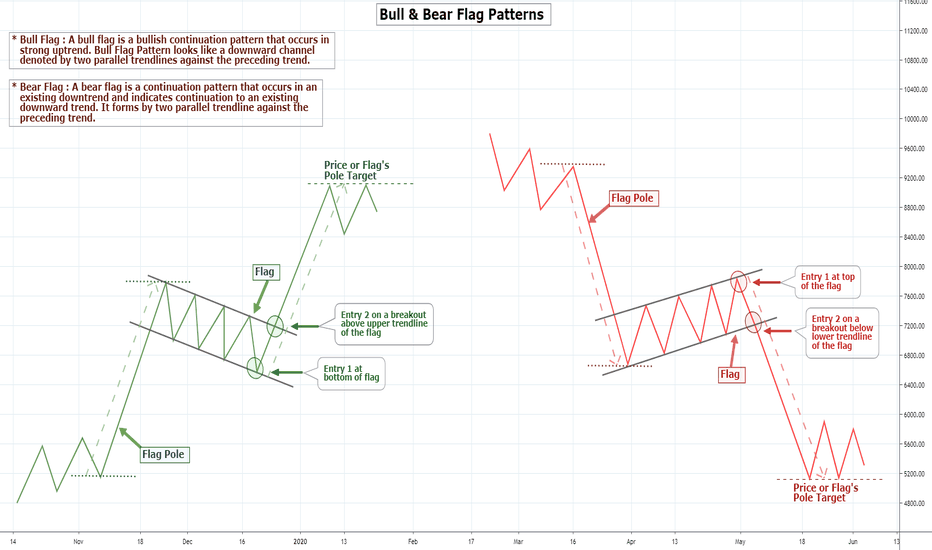

Bull and bear flags are continuation patterns, meaning they signal the potential for a price move to continue in the direction of the prior trend after a brief consolidation or retracement.

Bull Flag: This pattern occurs during an uptrend. After a sharp rise in price (the flagpole), the price begins to consolidate within a downward-sloping channel (the flag). A breakout to the upside typically follows, continuing the trend.

Bear Flag: In a downtrend, after a strong decline (the flagpole), the price consolidates in an upward-sloping channel (the flag). When the price breaks downward, it continues the downtrend.

These patterns are valuable for traders as they provide clear entry signals when the price breaks out of the flag's consolidation range.

Anatomy of a Flag Pattern

The flag pattern consists of two main components:

The Flagpole: This is the sharp price movement that occurs in the direction of the trend. It signifies strong momentum and establishes the direction in which the trend is moving.

The Flag: The flag is a period of consolidation or retracement that follows the flagpole. The price moves within parallel or slightly converging trendlines and typically retraces about 30% to 50% of the flagpole. The flag represents a pause in the market before the trend resumes.

Key Characteristics:

Bullish Flag: Occurs in an uptrend, and the consolidation takes place in a downward-sloping channel.

Bearish Flag: Occurs in a downtrend, and the consolidation takes place in an upward-sloping channel.

Volume (if you trade Crypto or stocks) tends to decrease during the consolidation phase and increases significantly at the breakout point, confirming the continuation of the trend.

Trading Strategies for Bull and Bear Flags

While bull and bear flags are relatively simple to identify, using different strategies can help enhance the effectiveness of trades. Here’s a breakdown of the most effective approaches to trading these patterns:

1. Breakout Strategy

The breakout strategy is a straightforward approach that traders use to enter a position when the price breaks out of the flag's consolidation. This marks the continuation of the trend and offers a high-probability setup.

Entry: Enter the trade when the price breaks above the upper trendline of a bull flag or below the lower trendline of a bear flag.

Stop-Loss: Place the stop just outside the flag’s opposite boundary (below the flag for bull flags or above for bear flags).

Take-Profit: Measure the length of the flagpole and project it from the breakout point. This will give you a target for where the price could potentially move.

2. Multi-Timeframe Strategy

The multi-timeframe strategy involves using multiple timeframes to analyze the flag pattern. This strategy can provide a more robust confirmation for entering the trade, as it gives you a broader perspective on the overall trend.

Higher Timeframe Analysis: Begin by analyzing a higher timeframe (e.g., the daily chart). Look for a strong trend, either bullish or bearish, and identify if a flag pattern is forming within this trend.

Lower Timeframe Confirmation: Once the pattern is identified on the higher timeframe, zoom in on a lower timeframe (e.g., the 1-hour or 4-hour chart) for precise entry points. Look for the price to break out of the flag pattern on the lower timeframe, confirming the trend continuation.

Why Use This Strategy?

Multi-timeframe analysis reduces the risk of false breakouts by confirming the broader trend on a higher timeframe.

It allows you to refine your entries by using a lower timeframe for greater precision.

Note:

A critical benefit of this strategy is its ability to significantly enhance the risk-to-reward (R:R) ratio, with the example presented achieving an impressive 1:5 ratio. This means that for every unit of risk taken, the potential reward is five times greater—a highly efficient use of capital and risk management.

3. Pullback Entry Strategy

The pullback entry strategy offers a more conservative approach to trading flag patterns. Instead of entering at the initial breakout, this strategy waits for a pullback toward the breakout level to confirm the trend’s continuation.

Entry: Enter the trade after the breakout has occurred but wait for the price to pull back to the flag’s trendline. This pullback gives you a better risk-to-reward ratio.

Stop-Loss: Place the stop just below the flag’s trendline for a bull flag or above it for a bear flag.

Take-Profit: As with the breakout strategy, project the flagpole's length from the breakout point for your target.

When Not to Trade Flag Patterns

While flag patterns are reliable, they are not always guaranteed to work. There are specific conditions when you should avoid trading them:

Choppy or Sideways Markets: Flags perform best in trending markets. If the market is choppy or moving sideways, flag patterns are less likely to lead to a strong breakout.

Weak Flags: If the flag's consolidation is too broad or the market loses momentum during the consolidation, the breakout may be weak or fail altogether.

Conclusion

Bull and bear flag patterns are essential tools in any trader's toolkit, offering high-probability setups in trending markets.

By understanding how to spot them, applying different trading strategies, and incorporating multi-timeframe analysis, traders can enhance their chances of success.

Final Tip: Always combine flag patterns with good risk management techniques, such as proper stop-loss placement and positive risk:reward.

Bearflagpattern

🚩 Bull Flags VS Bear Flags🚩What is a Flag Pattern?

A flag pattern is a commonly observed technical analysis pattern used to identify potential continuation of current market trends.

It is characterized by a period of consolidation, where the market experiences a relatively small range of movement, following a significant price movement.

This pattern is formed as the market returns to a state of equilibrium, following a large move. The flag pattern is considered a continuation pattern,

as it often indicates that the market will continue to move in the same direction as the preceding trend, once the flag breaks out.

This breakout typically occurs when the price of the security breaches the upper or lower boundary of the flag, and it is usually accompanied by an increase in trading volume.

📈📉The difference between a Bull flag VS Bear flag

The difference between a bullish and a bearish flag is in the direction of the price movement. With the bullish flag, the idea is to participate in a strong uptrend. Meanwhile, with the bearish flag pattern, the idea is to trade short in the direction of the prevailing downtrend.

- Downtrend vs uptrend: Bull flag and bear flag are both continuation patterns that form when the price of a stock or asset pulls back from the predominant trend in a parallel channel.

- Bull flag: A bull flag is a sharp, strong volume rally of an asset or stock that portrays a positive development.

- Bear flag: A bear flag is a sharp volume decline on a negative development.

- Bull flag and bear flag share the same traits: Traits of Flag Patterns include support and resistant levels, flag, flag pole, breakout points and price projections.

📍Entry opportunities

The most important component of any flag pattern trade is the entry. It’s generally advisable to wait for a candle to close beyond the breakout point before creating any orders to avoid being burned by a false signal. In the example above, the entries are made on a High risk - High reward mindset with stop loss bellow the flag pattern. Most traders will enter a flag pattern trade on the day after the price has broken beyond the trend line. The length of the flag pole is typically used to calculate the profit target. Even when the formation of a flag pattern is obvious, there is no guarantee that the price will move in the expected direction. As with most technical analysis, you will get the best results from flag patterns by applying them to longer-term charts as you will have more time to consider your strategy and analyze the price action.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work , Please like, comment and follow ❤️

How to Trade Bull & Bear Flag Pattern | Flag Pattern Tutorial !Bull & Bear Flag chart patterns Tutorial!

Bull Flag : A bull flag forms in bullish trending market, After a strong bullish movement when this pattern forms it signals the market is likely to move more higher. Bull flag pattern much similarly looks like a horizontal parallel channel or downward parallel channel along with a strong bullish vertical rally; when we draw the pattern it looks like flag on a pole, that's why they are called bull flags.

How to identify and Trade Bull Flags : - It is easy to identify a bull flag you just need to look for a Bullish Vertical Rally or Trend which is Pole of the Flag then identify the consolidation which will look like either horizontal channel or downward channel which will be the Flag. After identifying the pattern you can enter at the bottom of the flag or you can enter when price breaks the upper trendline of the flag which is more safe.

The breakout may also be a fakeout that's why we will take help of Volume and RSI Indicator to confirm the breakout. As shown on the below example you can see when price breaked the uppper trend of the flag the Trend drawn on the RSI was also broke and the Volume was high.

()

( *Key things to know : If the retracement measured from the vertical rally or Flag Pole retrace more than 50% the pattern becomes weak and it may not be a Flag Pattern but sometimes it stays valid if it breakouts above the uppertrend of the flag.)

Bear Flag : Bear Flag is just the opposite of the Bull Flag Pattern. A bear Flag forms in bearish trending market. Bear Flag pattern signals the market is likely to drop more lower. You need to identify Bear Flag in bearish trend when the price of a financial asset drops then if the price forms a horizontal channel or upward channel which will look like a inverted flag whose flag pole will be upside and the flag will be downside.

Stay Tuned; 👍

Like this tutorial & share your comment below and also

check other tutorials with example linked below;

Thank You-