Educational: Grid Trading, What is it? How it works?Grid trading is often marketed as a way to win every trade. People usually get away with this type of marketing of the trading style due to the fact that grid trading does not care for market execution in the sense of market direction because you will close profitable trades if the market goes up or down. But it's not as simple as that.

What is Grid trading?

Grid trading is a type of trading strategy that makes use of market price variations by placing buy and sell orders at regular intervals around a base price. The foreign exchange market is where grid trading is most frequently employed, but it can also be used on other markets, like those for futures contracts.

How to execute trades on a grid

The image above explains exactly how positions that run in the upper direction are executed. Let's break down the process:

(1) At the start of your grid trading system, you execute a buy and a sell position with the same lot size.

(2) You will only set a take profit and a buy limit/sell limit, but no stop loss.

(3) Assuming the price runs in the direction of the buy and you have a 10-pip stop loss, once the price hits your 10-pip stop loss, you will also execute a sell position via the sell limit. This sell position will have a 10-pip take profit in the opposite direction.

See demonstration below:

There is no restriction on the size of the grid. It does not have to be 10 pips apart. The distance of the grid is explained further in the publication.

Here is a video using a trading simulator to show you how these positions would be executed

:

So, as you can see, with this style of trading, you can potentially make money whether the price goes up or down. However, it can be quite challenging to execute and maintain a large number of trades. Therefore, individuals typically employ automated systems or use trading software to manage and monitor these trades.

Trending Market

Grid trading can be used to profit from both trending and ranging markets. In a trending market, grid trading involves placing buy orders above the base price and sell orders below the base price. This way, the trader can capitalize on the price movement in a sustained direction. For example, if the base price of Bitcoin futures is $60,000, the trader can place buy orders every $1,000 above the base price. This is also sometimes wrong referred to as dollar cost averaging or compounding your trade which are very different investment strategies.

Grid trading's key benefit is that it can be readily automated using trading bots and does not require a lot of forecasting of market direction. Grid trading's main disadvantage is that, if the market goes against the grid and the trader does not apply appropriate risk management strategies like stop-loss limits or position sizing, it may result in significant losses.

Grid Size

Choosing a grid spacing is one of the most important aspects of grid trading. This depends on a number of elements, including:

- The volatility of the market: The more volatile the market is, the wider the grids should be to avoid frequent executions and commissions.

- The personal preference of the trader: The trader should choose a grid size that suits their trading style and risk tolerance.

Technical indicators like moving averages or Bollinger bands are sometimes used to calculate the spacing between the grids. These indicators can be used to determine the market's volatility and average price over a specific time frame. You can also use basic price action to determine what range the market is likely to tstay within and then calculate the grid in-between

Ranging or Trending:

Identifying whether the market is trending or range is another important aspect of grid trading. This can be used to determine whether to employ grids that move with the trend or against it. There are a number of approaches to determine if the market is trending or fluctuating, including:

- Using trend lines or channels: A trend line or channel is a line that connects higher highs or lower lows in a trending market. A break of a trend line or channel can indicate a change in trend or a range-bound market.

- Using trend indicators such as ADX or MACD: The average directional index (ADX) measures the strength of a trend on a scale from 0 to 100. A high ADX value (above 25) indicates a strong trend while a low ADX value (below 20) indicates a weak trend or a range-bound market. The moving average convergence divergence (MACD) measures the difference between two moving averages of different lengths. A positive MACD value indicates an uptrend while a negative MACD value indicates a downtrend. A crossover of MACD lines or zero line can indicate a change in trend or a range-bound market.

Link to a publication on MACD :

- Using range indicators such as RSI or Stochastic: The relative strength index (RSI) measures how overbought or oversold a market is on a scale from 0 to 100. A high RSI value (above 70) indicates an overbought market while a low RSI value (below 30) indicates an oversold market. A reversal of RSI from extreme levels can indicate a change in trend or a range-bound market. Link to related publication:

Bollinger Bands (BB)

2nd Pine Script Lesson: Coding the Entry Logic - Bollinger BandWelcome back to our Trading View tutorial series! In this second lesson, be learning how to code the entry logic for a Bollinger Band indicator using Pine Script.

If you're new here and missed the first lesson, we highly recommend starting there as it provides a solid foundation for understanding the concepts we'll be covering today:

In this hands-on lesson, we'll guide you through every step of coding the entry logic for your own Bollinger Band indicator using Pine Script. By the end of this lesson, you'll have a functional indicator that you can use to inform your trading decisions. So, sit back, grab a cup of coffee, and let's get started!

Code the entry logic

a) This is where we are calling the Mikilap function with two arguments:

- the coinpair and

- the timeframe we want to use.

// Calling the Mikilap function to start the calculation

int indi_value = Function_Mikilap(symbol_full, time_frame)

b) In the function initiation we convert the strings into simple strings.

// Definition of a Pine Script individual function to handle the Request and avoid Repainting Errors

Function_Mikilap(simple string coinpair, simple string tf_to_use) =>

c) As we are calling the function to get an integer value, we have to define an output variable as an integer and place this variable as the last line in the local scope of the function code to return the integer value.

int function_result = 0

// placeholder for indicator calculations

function_result

Step 1:

Using the lower bandwidth of the Bollinger Band based on SMA (close, 21) and a standard deviation of 2.0 and try to highlight bars, where close is next to the lower band

a) Requesting the values for the coinpair with request.security()

= request.security(coinpair, tf_to_use, )

We recommend using repainting functions like request or barstate only in a local scope (inside a function) and not to request complex calculated values. For saving calculation capacity it is useful to only request the classic four OHLCs and do any calculation with these four after the r equest.security() .

b) Calculation of the lower Bollinger Bands values as we need the global info, which type of source, length, and deviation value to use for the calculation, let‘s cut & paste the input for the Bollinger Band in the general starting section of the code and as we want to look for close values „next“ to the lower bandwidth, we need to define what „next“ means; let‘s do it in another input variable, perhaps we want to play with the definition later.

string symbol_full = input.symbol(defval = "BINANCE:BTCUSDT", title = "Select Pair:", group = "General")

string time_frame = input.string(defval = "60", title = "Timeframe:", tooltip = "Value in minutes, so 1 hour = 60", group = "General")

int length = input.int(defval = 21, title = "BB Length:", group = "Bollinger Band Setting")

src = input(defval = close, title="BB Source", group = "Bollinger Band Setting")

float mult = input.float(defval = 2.0, title="BB Standard-Deviation", group = "Bollinger Band Setting")

float lower_dev = input.float(defval = 0.1, title="BB Lower Deviation in %", group = "Bollinger Band Setting")/100

First, let‘s make it visible on the chart by re-writing the Bollinger Bandplot, which is not needed anymore.

// Calling the Mikilap function to start the calculation

int indi_value = Function_Mikilap(symbol_full, time_frame)

// Output on the chart

// Part 2 - plotting a Band around the lower bandwidth of a Bollinger Band for the active CoinPair on the chart

lower_bb = ta.sma(src, length) - (mult*ta.stdev(src, length))

lower_bb_devup = lower_bb + lower_bb * lower_dev

lower_bb_devdown = lower_bb - lower_bb * lower_dev

upper = plot(lower_bb_devup, "BB Dev UP", color=#faffaf)

lower = plot(lower_bb_devdown, "BB Dev DOWN", color=#faffaf)

fill(upper, lower, title = "BB Dev Background", color=color.rgb(245, 245, 80, 80))

c) Now we use the same calculation for the coinpair inside the function and start with the selection of the source (OHLC) to use, which is activein the respective input variable.

// Defintion of a Pine Script individual function to handle the Request and avoid Repainting Errors

Function_Mikilap(simple string coinpair, simple string tf_to_use) =>

int function_result = 0

bool barstate_info = barstate.isconfirmed

= request.security(coinpair, tf_to_use, )

src_cp = switch src

open => open_R

high => high_R

low => low_R

=> close_R

lower_band_cp = ta.sma(src_cp,length) - (mult*ta.stdev(src_cp, length))

lower_band_cp_devup = lower_band_cp + lower_band_cp * lower_dev

lower_band_cp_devdown = lower_band_cp - lower_band_cp * lower_dev

// placeholder for indicator calculations

d) As the bandwidth for the interesting close values is defined by our band, the only thing missing for the part of the Bollinger Band in our Mikilap indicator is to check if the close value of a bar is inside our band. As we are talking about closed bars, let‘s be sure that it is really closed by using barstate.isconfirmed (repainting built-in function!) and save it in a variable in the head of the function to avoid requesting this info too often.

bool barstate_info = barstate.isconfirmed

Now let‘s check if the close value of a bar is inside our band.

bool bb_entry = close_R < lower_band_cp_devup and close_R > lower_band_cp_devdown and barstate_info

And increase the output variable by 1 in case the close value is inside.

if bb_entry

function_result += 1

By using bb_entry , we are referring to the last bar next to the actual bar, because we want to enter on the opening of the bar after the criteria has been met.

e) And to make these possible entries visible, we want to place a label below the bar and show the entry price (=open value of the bar) as mouseover (tooltip). This should only happen if the active coinpair on the chart is the same coinpair, which is in the calculation of the function.

if function_result == 1 and ticker.standard(syminfo.tickerid) == coinpair

label LE_arrow = label.new(x = bar_index, y = low_R, text = " ↑ LE", yloc = yloc.belowbar, color = color.rgb(255,255,255,25),style = label.style_none, textcolor = color.white, tooltip = str.tostring(open_R))

Note:

You will love labels (!) and in case you are looking for text symbols that can be used as labels, look here: www.messletters.com

If you need help use the Pine Script Reference Manual, which explains 99% of everything in Pine Script, here: www.tradingview.com

f) As our function now returns different integer values (0 or 1), we can use this info to color the background on the actual chart in case it is 1.

// Calling the Mikilap function to start the calculation

int indi_value = Function_Mikilap(symbol_full, time_frame)

color bg_color = indi_value ? color.rgb(180,180,180,75) : color.rgb(25,25,25,100)

bgcolor(bg_color)

g) To finish this little Pine Script lesson and to achieve our initial targets, we just need to integrate the second indicator (RSI) into the function. We want to use the RSI for 0,5 days (12 hours) and use it to ensure to not go into a long entry in an oversold (< 25) or overbought (> 70) market. We will use RSI (low, 12) within 25 to 45 as the range to go for.

Your tasks:

define new input variables for RSI: src_rsi and length_rsi

define new input variables for the RSI range we want to use: rsi_minand rsi_max(please use the „inline“ format of an input type)

calculate the RSI (src_rsi, length_rsi) inside our Mikilap-function

define a boolean variable (rsi_entry) to check if the calculated RSI value is inside the range (please add as last check the barstate_info)

add the RSI entry check to the Bollinger Band entry check to combine them

Congratulations on finishing the second lesson on Trading View - we hope you found it informative and engaging!

We're committed to providing you with valuable insights and practical knowledge throughout this tutorial series. So, we'd love to hear from you! Please leave a comment below with your suggestions on what you'd like us to focus on in the next lesson.

Thanks for joining us on this learning journey, and we're excited to continue exploring Trading View with you!

📊Bollinger Bands In A Trending MarketBollinger Bands are a widely used chart indicator for technical analysis created by John Bollinger in the 1980s. They offer insights into price and volatility and are used in many markets, including stocks, futures, and currencies. Bollinger Bands have multiple uses, such as determining overbought and oversold levels, as a trend following tool, and for monitoring for breakouts.

📍 Strategy

Bollinger Bands measure deviation and can be helpful in diagnosing trends. By generating two sets of bands using different standard deviation parameters, traders can gauge trends and define buy and sell zones. The bands adapt dynamically to price action, widening and narrowing with volatility to create an accurate trending envelope. A touch of the upper or lower band is not a signal in and of itself, and attempting to "sell the top" or "buy the bottom" can lead to losses. Standard deviation is a statistical measure of the amount of variation or dispersion of a set of prices or returns from its average value. The higher the standard deviation, the wider the Bollinger Bands, indicating greater price volatility, and vice versa. Traders may use standard deviation to set stop-loss and take-profit levels or to help determine the risk-to-reward ratio of a trade.

📍 Calculation

First, calculate a simple moving average. Next, calculate the standard deviation over the same number of periods as the simple moving average. For the upper band, add the standard deviation to the moving average. For the lower band, subtract the standard deviation from the moving average.

Typical values used:

Short term: 10 day moving average, bands at 1.5 standard deviations. (1.5 times the standard dev. +/- the SMA)

Medium term: 20 day moving average, bands at 2 standard deviations.

Long term: 50 day moving average, bands at 2.5 standard deviations.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

Educational Series: Trading with Bollinger Bands (Part 2)The Bollinger Reversal is my absolute favorite and most valuable perspective of the Bollinger Bands.

Have you ever

- seen the price move strongly in a direction, but the moment you get into a trade, the price reverses almost immediately?

or

- held on to a profitable trade, hoping to hit a take-profit level, only to see your profits whittle away as the price reverses.

The Bollinger Band can help prevent

1) FOMO leading to Late Entry and

2) Greed leading to Late Exit

Look at the yellow spots on the charts

- The spots indicate when the price had traded outside of the 2std deviation of the Bollinger Band (either the lower or the upper bound).

- When the price trades outside of the Bollinger Band, two things are highly likely to happen :

1) the price reverses back before the current candle loses , leading to possibly the development of a pin bar (which usually signals a strong reversal candlestick pattern).

2) the price closes outside of the Bollinger Band and the subsequent candle is a strong retracement , back toward the Moving Average and possibly a stronger reversal.

The Bollinger Reversal can be applied to ANY timeframe (M1 through to D1)

When the price is outside of the Bollinger Band, you should choose to avoid entering a trade , as the price is likely to reverse. And if you are currently in a trade, and the price has broken out of the Bollinger Band, you might want to consider securing the profit .

However, some more aggressive traders could even choose to trade the short-term reversal.

Remember....

- This is a technical indicator. You shouldn't use technical indicators solely.

- Combine it with other forms of analysis, Price Action, Fundamental Analysis, Sentiment, and Other types of indicators.

The more confluences you can have, the more confidence you will have

Bollinger Bands Explained, All you need to know Hello everyone, as we all know the market action discounts everything :)

_________________________________Make sure to Like and Follow if you like the idea_________________________________

In today’s video we are going to be talking about the Bollinger bands , How are they constricted and how to use to try to identify trades in different financial markets.

Some people think about the Bollinger bonds as a complicated indicator but after you watch this video you will see how easy it is to use.

Lets start with the theory before we see a real life example :

The Bollinger bands were developed by a man called John Bollinger, so no surprised where the name came from.

So the Bollinger breaks down to a Moving average and some volatility bands around that, What we have first is a moving average and on the top and bottom of that moving average we have our bands and they usually are located 2 standard deviations away from the Moving Average.

The idea here is to describe how prices are dispersed around an average value, so basically, these bands are here to show where the price is going and how it's moving for about 95% of the time.

So how do we use this indicator :

1) The first way people use this indicator is when the market price reaches the edges of the Bands, The upper end for example shows that it's possible that the market is overextended and a drop in price will happen, if the price reached the lower end then the market will be oversold and a bounce in price is due.

2) The second way to use this indicator is called Targets, It simply allows us to set up targets for the trade, if we buy near the lower Band then we could set a target above the Moving average or near the higher Band.

Because these bands are based on price volatility they won't stay at the same place from the MA, That means if the volatility drops then the bands will get tighter (Squeeze) , and if the volatility goes up then the bands will go further away from each other (Width).

People use this method to try to understand what's going on with the current trend, so basically if the bands are really far away then it’s a sign that the trend is currently ending, and if they are really close then we could be seeing an explosive move in the trend

IMPORTANT

I always say that you always need to use different indicators when you analyze any chart, this way you will minimize your risk and have a better understanding on how the market is currently doing.

I hope I’ve made the Bollinger Bands easy for you to understand and please ask if you have any questions .

Hit that like if you found this helpful and check out my other video about the Moving Average, Stochastic oscillator, The Dow Jones Theory, How To Trade Breakouts, The RSI and The MACD, links will be bellow

How To Measure Volatility Easily|Advanced Usage Of BBHi traders!

As we said in the last article it’s kinda complicated problem to measure volatility. However, it’s one of the most important features of market. Any strategy directly depends on the volatility level of coin. Moreover, it provides signals of entry and exit. BB Width is one of the most accurate tool to measure volatility.

The Bollinger Band Width is the difference between the upper and the lower Bollinger Bands

divided by the middle band. This technical indicator provides an easy way to visualize consolidation before price movements (low bandwidth values) or periods of higher volatility (high bandwidth values). The Bollinger Band Width uses the same two parameters as the Bollinger Bands: a simple moving- average period (for the middle band) and the number of standard deviations by which the upper and lower bands should be offset from the middle band.

How does it works?

During a period of rising price volatility, the distance between the two bands will widen and Bollinger Band Width will increase. Conversely, during a period of low market volatility, the distance between the two bands will contract and Bollinger Band Width will decrease. There is a tendency for bands to alternate between expansion and contraction.

When the bands are relatively far apart, that is often a sign that the current trend may be ending. When the distance between the two bands is relatively narrow that is often a sign that a market or security may be about to initiate a pronounced move in either direction.

Bollinger Bands Width Squeeze - Script ReleaseThis video idea is the tutorial for the script I just released that can be used to filter out meaningful Bollinger Bands Squeezes. If you use this indicator pattern to trade this additional filter will help you filter out and set alerts for contractions in the Bollinger Bands.

You can search for this script under indicators as "Bollinger Bands Width Donchian" or see linked script below to add to your Favorites.

Bitcoin facing the abyss - need a daily close above....OMGNOT ADVICE DYOR. Caveat - small sample size.

Here's the construction. You need BB %B indicator. Then do MACD on that indicator. Mark all instances signal line turns positive (yellow). Mark (white) first instance histogram turns red. If both these cross month end then mark that month end (blue). Box both months in white. Bulls need to push daily close above $7933.4. Come on! If not will first lines of defence hold. NOT ADVICE. DYOR.

Using Multiple Timeframes to Enter a TradeHello Traders!

As many of you know, I use the Stoch RSI as my main cycle indicator. As an indicator of an indicator, it normalizes the RSI indicator itself and provides excellent guidance on the price cycles of Gold. And while I base my daily analysis on the Daily time frame, I use 2 shorter time frames to enter my positions. These time frames are 30 minutes and 60 minutes.

Let me give you a real life example from yesterday of how I added to an existing short position.

Last week ended with a beautiful down candle on the daily chart. Long upper wick and a full body that closed just a few points above the bottom of our wedge. With plenty of room left on the Stoch RSI before it crossed the 20 line, I wanted to add another position to my existing short. But I new that I didn't want to jump in at Friday's closing price. So how could I gauge any potential pullback and set an entry price?

The first thing I did was to look at the 30 and 60 min charts, specifically to find where price was on those charts in relation to the overall down cycle.

Here is the 30 min chart on Sunday night at 11 pm PST. It's clear from the Stoch RSI that price was at the bottom of it's cycle. Not an ideal time to enter a trade. And the same was true on the 60 min chart (bottom chart). Therefore, I wanted the Stoch RSI to cycle up to get the best possible entry price. Looking at the BB, I placed a limit order at the inner BB (1.0 Std. Dev) @ 1321, thinking that would give both Stoch RSIs enough time to complete an up cycle. Turns out that was pretty close to the high of the day!

I have had the best entries when I wait for the cycle indicators across multiple time frames to get in sync. Waiting for harmony across multiple time frames is a great way to create a repeatable system for entries and really helps to remove emotions from your trading.

I would love to hear if this technique is helpful!

Safe Trading and Protect Your Profits!

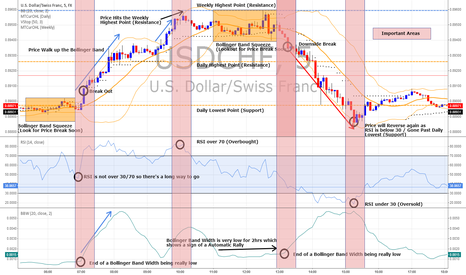

Maximize your Profits with Bollinger BandsBollinger Band Strategy is One of the Most Profitable Strategy Used by the Trades who earn lots of Money!!!

You can't just use Bollinger Bands to Trade and Earn Money as you need to confirm the Break Out Signal that you get after a Bollinger Band Squeeze.

Here are some tips how to confirm that:

1. Always looks for Bollinger Band Squeezes as you will find Price Break Outs most of the times

2. Use RSI to confirm the Price Break Out

3. Make sure RSI is not Overbought/Oversold to have a Major Price Break Out

4. Look for Bollinger Band Width to see whether its Rising as well

5. When there's a Major Price Break out it will go on for 1 -3hrs so you can take multiple entry points to Maximize your profits

6. Always check the Support/Resistance levels as there's possibility of the Price reversing the other way

7. I would also recommend to check the investing.com and look for Strong Buy/Sell Signal before you enter your Trade

8. There will be fake break outs where the price go the otherway

9. You can have stop losses and enter the Trades on the otherway if there's a fake breakout

Few other Tips to Enhance the above:

1. Use default MACD to reconfirm the Trend Direction (Thanks for the Idea from HamzaLeith)

2. Check the Direction of the Upper/Lower Bands.

For Bullish reversal's and continuations (opposite is true for bearish reversals or continuations)

1.) Price approaches the Buy Zone and the upper and lower bands remain flat. Reversal - Likely a sharp reversal to the lower band. Because both bands are flat this will likely be short lived.

2.) Price approaches the Buy Zone and the upper band goes up and the lower band is flat or moving up slightly. Continuation - Price will likely continue up slowly for a time.

3.) Price approaches the Buy Zone and the upper band goes up and the lower band goes down. Continuation - Price will likely move up fast and furious. This is the best continuation pattern for the bands. This is a rapid expansion of volatility. You will experience "fake out's" sometimes but most of the time this set-up will produce some good profits when executed properly.

4.) Price approaches the Buy Zone and the upper and lower bands both go down. - Reversal - This is likely to result in a reversal

Source: www.eezybooks.com

Summary: Use RSI / Bollinger Band Width & MACD Indicators to Confirm the Signal

Hope this Helps Anyone who like to maximize the profits