Beautiful Butterfly Tells about Targets of Buyers/ Sellersthe detail is shown in the above Chart.

I made this Idea based on Harmonic pattern using Fibonacci tools.

The Butterfly pattern is a reversal pattern composed of four legs, marked X-A, A-B, B-C and C-D.

It helps you identify when a current price move is likely approaching its end. This means you can enter the market as the price reverses direction.

The above chart is a bearish version of the pattern, where you would be look to sell AMZN after the pattern has completed.

X-A

In its bearish version, the first leg forms when the price falls sharply from point X to point A.

A-B

The A-B leg then sees the price change direction and retrace 78.6% of the distance covered by the X-A leg.

The Butterfly is similar to the Gartley and Bat patterns but the final C-D leg makes a 127% extension of the initial X-A leg, rather than a retracement of it.

B-C

In the B-C leg, the price changes direction again and moves back down, retracing 38.2% to 88.6% of the distance covered by the A-B leg.

C-D

The C-D leg is the final and most important part of the pattern. As with the Gartley and Bat pattern you should also have an AB=CD structure to complete the pattern, however the C-D leg very often extends forming a 127% or 161.8% extension of the A-B leg. As a trader you would be looking to enter at point D of the pattern.

How to trade a bearish Butterfly

To trade a bearish Butterfly pattern, place your sell order at point D (the 127% Fibonacci extension of the X-A leg), position your stop loss just above the 161.8% extension of the X-A leg and place your profit target at either point A (aggressive) or point B (conservative).

Butterfly

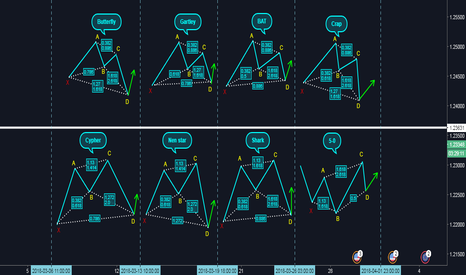

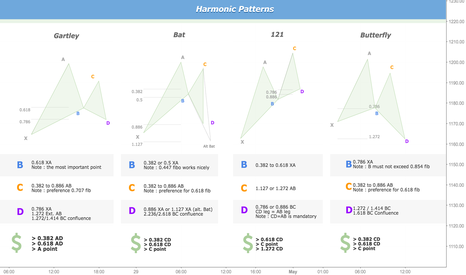

📊 Harmonic Patterns Cheat SheetHarmonic Patterns use the identification of quantified chart price action structures that have specific and consecutive Fibonacci ratio alignments that form the visual structures. Harmonic patterns calculate the Fibonacci levels of the price patterns to identify high probability reversal points on the charts. This method believes that harmonic patterns or cycles repeat on charts in cycles repeatedly. The key to using this strategy is to identify these patterns and to use them for creating good risk/reward ratio entries and to exit when a profit target is reached. Positions are taken based upon the odds that the same historic patterns will repeat after entry.

🔹 Butterfly

The structure of the Butterfly pattern requires a specific alignment of Fibonacci measurements at each point within the structure. Most important, a mandatory 0.786 retracement of the XA leg as the B point is the defining element of an Ideal Butterfly Pattern and it acts as the primary measuring point to define a specific Potential Reversal Zone. In many ways, the Ideal Butterfly Pattern is like the Gartley Pattern because it requires a specific B point retracement and possesses a tighter array of Fibonacci ratios within the structure. Specifically, the Butterfly incorporates a 1.27 XA projection with a “tame” BC projection, which is usually only a 1.618. In addition, the Butterfly usually possesses an equivalent AB=CD pattern or an alternate 1.27AB=CD pattern. Although the equivalent AB=CD is a minimum requirement, valid Butterfly structures rarely exceed the alternate 1.27 AB=CD completion point.

🔹 Shark

The Shark Pattern is dependent upon the powerful 88.6% retracement and the 113% Reciprocal Ratio, works extremely well retesting prior support/resistance points (0.886/1.13) as a strong counter-trend reaction. Represents a temporary extreme structure that seeks to capitalize on the extended nature of the Extreme Harmonic Impulse Wave. Demands immediate change in price action character immediately following pattern completion. Extreme Harmonic Impulse Wave utilized depends upon location of 88.6% level – these are minimum requirements. Requires an active management strategy to capture high probability profit segments.

🔹 Gartley

The important features of the Gartley are the specific location of the various points: X,A,B,C and D. The X-A leg is the largest price move in the pattern. It is followed by a counter move of A to B. The first leg, A to B, sets up the potential AB=CD, which is crucial to the completion of the pattern and to the indication of the reversal zone. After a brief and smaller B to C retracement, the C to D leg is established. A precise calculation of the AB=CD will provide a significant potential reversal point. Ideal Gartley The ideal Gartley set-up will be defined by specific Fibonacci retracements. One of the most important numbers in the pattern is the completion of point D at the 0.786 of XA. Although the price action might exceed this number slightly, it should not exceed point X. The pattern is a nice set-up, especially with the convergence of an AB=CD.

🔹 Bat

The Bat pattern is probably the most accurate pattern in the entire Harmonic Trading arsenal. The pattern possesses many distinct elements that define an excellent Potential Reversal Zone. The pattern typically represents a deep retest of support or resistance that can frequently be quite sharp. Quick reversals from Bat pattern PRZs are quite common. In fact, valid reversals from Bat patterns frequently possess price action that is quite extreme. The pattern incorporates the powerful 0.886XA retracement, as the defining element in the Potential Reversal Zone. The B point retracement must be less than a 0.618, preferably a 0.50 or 0.382 of the XA leg. The most ideal B point alignment is the 50% retracement of the XA leg. The B point is one of the primary ways to differentiate a Bat from a Gartley pattern. If a pattern is forming and the B point aligns at a 0.50 of the XA leg, it is likely to be a Bat.

🔹 Three Drive

The three drives pattern consists of a series of higher highs or higher lows. It is similar to the ABCD pattern. The difference is that a Three drives pattern is made of 5 legs, while an ABCD pattern has only 4. Three-Drives is a reversal pattern, so it signals an upcoming change in a trend. Point A is at the 61.8% retracement of the drive 1. Point B is at the 61.8% retracement of the drive 2. Drive 2 is at the 127.2%-161.8% extension of A. Drive 3 is at the 127.2%-161.8% extension of B. You can enter the market when you are sure that the market has formed the point B (buy in a bearish Three-Drive and sell in a bullish Three Drive). Take Profit should be around the 127.2%-161.8% extension of B.

🔹 Cypher

The Cypher pattern, which can be either bullish or bearish, has five points (X, A, B, C, and D) and four legs (XA, AB, BC, and CD). Like any other harmonic pattern, the theory behind the Cypher chart pattern is that there is a strong correlation between Fibonacci ratios and price movements. Eventually, the market is expected to reverse from point D after the four market swing wave movements – X to A, A to B, B to C, and C to D. B point retracement of the primary XA leg ranges between 38.2% to 61.8% Fibonacci levels. C point is an extension leg with a Fibonacci ratio that should be between 127.2% to 141.4% of the primary XA leg. D point should break the 78.6 retracement level of XC.

🔹 AB=CD

In this pattern, the A to B leg is the first price move. After a brief retracement from point B to point C, the pattern will complete the C to D leg, which is the same length as AB. Simply, after the AB and BC legs have been established, you project the AB length from point C… Although the price action will not always be exactly equivalent, the AB=CD legs usually will be close enough to determine the reversal points. Sometimes, this pattern will be exact but I usually wait for the CD leg to at least equal the AB leg. The Fibonacci numbers in the pattern must occur at specific points. In an ideal AB=CD Pattern, the C point must retrace to either a 38.2% at a minimum to validate the structure. The maximum retracement of the AB leg is an 88.6% level that defines a less extreme AB=CD pattern formation but still valid.

🔹 Crab

The Crab is a distinct 5-point extension structure that utilizes a 1.618 projection of the XA leg exclusively. This is the most critical aspect of the pattern and the defining level in the Potential Reversal Zone (PRZ). The extreme (2.618, 3.14, 3.618) projection of the BC compliments the 1.618 XA extension. In addition, the Crab primarily utilizes an alternate AB=CD to compliment the PRZ. Although a minimum AB=CD completion is necessary for a valid structure, the alternate 1.27 or 1.618 calculation are the most frequent cases. The 1.618 AB=CD pattern is the most common alternate calculation utilized in the structure. It is important to note that the alternate AB=CD pattern within the Crab is the least important number in the PRZ.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

Harmonic Pattern with Multiple Confluence for Point X and DThis is an example of regression channel with harmonic pattern.

By using Simple OHLC Custom Range Interactive, we able make confluence point (blue) to get Point X of Bullish Butterfly.

There are many confluence points (orange flag and teal table), which shows Point D of Butterfly starting to complete.

For Point D, best to monitor price changes using RSI or other similar RSI (Cyclic RSI, etc).

Indicator used :

1. Regression Channel Alternative MTF

2. HH-LL ZZ

3. XABCD Harmonic Pattern Custom Range Interactive

4. Simple OHLC Custom Range Interactive

5. Cyclic RSI High Low With Noise Filter

📚🎬💎#e08 : An Ultra Bond Future💍Married To The⛪💫An Education🎓

Series Continuation

Prior Episodes Found

In The Content Below

❔ What Are Bonds

Bonds Are The Foundation

Of A Debt Based Monetary

System

Bonds Define The Cost Of

Money Over Time

Put Simply Bonds Are

Future Dollars

Read That Again🔂

US Treasury Bonds Are

Future US Dollars Deliverable

At A Specified Time

In The Future I.e

30 Years Henceforth

By Purchasing A

US Treasury Bond

You Enter Into A

Legal Contract With

The Treasury Wherein

You Will Receive

The Principle Or

"Face Value" Of The

Bond Plus The Rate

Of Interest Specified

At The Time Of Purchase

❔ A Traders Role

To Make Money I Hear You Say

Well Yes Of Course

Money

But What Exactly As Bond Traders

Are We Getting Paid For ?

To Provide A Service

Our Collective Actions

Expressed Through The

Trading Of Bond Instruments

Determine The Cost Of Money

The Cost Of Money

Cost Of Money

Yes💡

Regardless Of Your Trading

Size We Are All Interacting

With The Free Market

Our Role :

To Correctly

Price The Value

Of Future Money

When We Trade Bonds

Profitably

We Win The Game

We Have Kept The

Flame🔥

We Have Served

A Most Important

Mission

We Fulfill A

Founders Vision💜

d-MR96nBa

nvrBrkagn

❔ Why Else Ultra Bonds

Low Operation Costs

Regardless Of Trade Size

Only Pay Spread Fee

As Futures Contracts

Zero Overnight Cost To Carry

Quarterly Rollover Spread Only

Operation Costs Will

Kill A Trader In Time

On Time

Every Time

Same As Any Business

Ventured

C4L

📔 Rules Of The Rodeo

Trend Is Dearest

Life-Long Friend

Bond Bull Market

40 Years Strong

So We Will

Mostly Trade Long

Positions Actively

Managed

Entry Orders Executed

At The Market

Trading 0.01 Unit

At A Time

Slow Drip💧

ℹ️ CME Group Official

Ultra Bond Trader Site

www.cmegroup.com

Keep Your Bond⚔️

Watch Your Loyalty⌚

Buy Freedom To🔥

0.96 % x Cost ♋

Behold.. The

Ultra Bond Future 🗽

☔

📚#e07🩸GG :

📚#e⏭️06 :

📚#e04 :

📚#e03 :

📚#e02 :

📚#e01 :

CBOT:UB1!

TVC:US30Y

Pluto 🛰️

Hndrxx 👩🏻🎤

Gartley Pattern Trading Strategy

Gartley patterns are harmonic chart patterns based on Fibonacci numbers.

The first stop-loss point is often positioned at Point X and the take-profit is often set at point Fibonacci retracement numbers.

I normally open 3 small positions or a big position and close partially at 0.618, 0.5 and 0.382 Fibonacci numbers.

Butterfly patternHow to trade when you see the Butterfly harmonic pattern?

Before trading the butterfly harmonic pattern, confirm from the following checklist that the pattern is real. It should have the following vital elements:

AB= an ideal target of 78.6 percent of XA leg

BC= minimum 38.2 percent and maximum 88.6 percent Fibonacci retracement of AB leg

CD= Is a target between 1.618 to 2.618 percent Fibonacci extension of AB leg between 1.272 to 1.618 of XA leg

Entry point

Determine the place where the pattern will complete at point D – this will be at the 127 percent extension of the X-A leg.

Stop-loss

Put a stop-loss just below the 161.8 percent Fibonacci extension of the X-A leg.

Take profit target

The location for placing a take-profit target with this pattern is very subjective and depends on your trading goals as well as the conditions of the market. To have an aggressive profit target, put it at point A of the pattern. For a more conservative profit target, put it at point B.

Trading a bearish butterfly harmonic pattern

Place the sell order at point D (a 127 percent extension of the XA leg). Position the stop-loss right above an extension of 161.8 percent of the XA leg. And place the profit target at A for an aggressive move at B for a defensive move.

Trading a bullish butterfly harmonic pattern

Determine the end of the pattern at point D, which is an extension of 127 percent of the XA leg. You need to put a buy order at this point. Now, below a Fibonacci extension of 161.8 percent of the XA leg, a stop-loss can be placed. Placing a profit target depends on both market conditions and your trading goals.

The Butterfly Pattern, Tutorial (Basic)The Butterfly pattern, is a harmonic pattern discovered by Bryce Gilmore using his Wave trader software program.

The pattern structure was further refined using specific Fibonacci levels by Scott Carney which he outlined in his book 'The Harmonic Trader', published in 1998.

The Butterfly pattern must include an AB=CD pattern to be a valid signal. In general, the AB=CD Pattern will possess an extended CD leg that is 127.2% or 161.8% of the AB leg.

EURUSD: butterfly pattern + the price is breaking out?Happy Easter Monday catholic traders!

Today the volatility should be low, however it could be possible, that there is a butterfly pattern forming on daily time-frame in EURUSD + the price is breaking out of the descending triangle chart pattern, which signals that the price could start going higher...

However, moving average indicates that the trend (bias) is still bearish, which means further price confirmation is needed before joining bulls.

Fundamentally, I would like to highlight some cons and pros, which might give a broader view about the current economic situation in both US and EU and might support the technical picture:

Cons:

1. COVID-19 stats in EU are still pretty bad and number of confirmed cases are growing more than 2% in major European countries, while in USA the growing pace is around 1% (as of today)

2. USD could act as safe-heaven asset once-again, if equity market provides one more leg lower, thus it's possible to see another USD bullish rally in shorter term.

3. Despite of monetary easing, interest rate is still higher in US, meaning that swaps are negative, if buying EUR against USD

4. Unemployment rate in Euro area is higher (4,4% against 7,9% forecast), than in US (as of March 2020)

5. GDP Growth rate in US is 2,1%, while in Euro area it's 0,1% ( as of Dec 2019)

6. Inflation rate in US is 1,5%, while in Euro are it's 0,7% (as of March 2020).

Pros:

1. USA has the highest number of COVID-19 confirmed cases

2. Consensus around eurobonds could support EUR and might act as a strong signal that Europe stands together

3. FED liquidity injection must have weakening impact on USD and lot's of companies are still going to default

4. Current account to GDP in US is -2,3%, while in Euro area it's +3,1% (as of Dec 2019)

5. Government debt to GDP in US is 107%, while in Euro area it's 85,9% (as of Dec 2019).

//

I would very much appreciate if you support my work by hitting like .)

Feel free to share your opinion/position via comment and follow me to stay updated.

Gold Butterfly Pattern Oct 2019Gold Butterfly Pattern Oct 2019

Point C is near 1487.30. If Point C not yet completed, it may go to the lowest limit at 1465.60. If point C go lower than 1465.60 the Butterfly pattern is questionable and probably not valid.

Trade idea : Go long with proper risk reward ratio.

Target : At Point D.

Educational: How you can swing in bear marketHello Traders,

If you follow my Bitcoin analysis, you probably know that I gave early warning about potential Bitcoin dip this morning. $6500 is definitely a becoming a major resistance and Bitcoin needs to go above this level in order to have trend reversal.

However, this does not mean that you can't make money. Bearish breakout is as volatile as bull market, and we can take advantage of this volatility as out advantage.

So how do we trade in bear breakout (this needs some practice so please do at your own risk). I will be predicting how ICON moves in this scenario. (this is purely a prediction and many things can wrong so please make sure you set very tight stop losses/limits)

Step 1) When you see abnormally high selling volume --> Sell your share

Step 2) Buy back at minor support --> 965 Satoshi

Step 3) Sell at 38.2% fibonacci level --> 980 Satoshi

Step 4) Buy back at same level as step 2 (or a little bit below) --> 965 Satoshi (this is because we need to see trend reversal by having RSI bullish divergence)

Step 5) Sell again at 980 Satoshi --> Because this is the minor resistance, bears will most likely defend this point

Step 6) Buy back between 965 Satoshi (I usually go a little bit higher for safety purposes)

Step 7) End the trade --> this should lead to short term inverse head and shoulder pattern

This way, not only you dont lose money in bear breakout, but you can earn profit in this situation. However, there is always an exception and I would highly recommend you to just practice first instead of using real money.

Here is one good example:

Step 1: Huge selling volume --> Sell

Step 2: Buy back at 970 Satoshi

Step 3: sell at 38.2% Fib level --> 1005

Step 4: Buy same or a little bit lower than 970

Step 5: Sell at 1005

Step 6: Buy back at 970

Happy trading!

How to chose X point in harmonic patternFor harmonic pattern, the most important and confused thing is how to chose the X point.

In this chart, due to Canadian rate decision, there are two candles with very long tails. The X I selected is based on it is the actual start point for the down trend. From there, we can find the potential butterfly pattern is in forming.

Please share your idea and comments. I am still new in forex trading.

GBPUSD: A good lesson on harmonics pattern invalidationGBPUSD: A good lesson on harmonics pattern invalidation.

GBPUSD formed very good bullish BAT + bullish Butterfly pattern on 26 Sep 2016.

26 Sep daily candle closed above the critical price levels. A long should enter after that.

this pair did move up afterwards.

However, there was extreme price action on 3 Oct 2016. it was a gap down below the whole PRZ and closed as a very bearish candle even below point X. Stop loss should have been triggered and we should call for a invalidation for the patterns and cease longing this pair until further patterns form.

Harmonic Patterns ratio and examplesHi,

Above, some harmonic patterns that i often look for (bullish ones)

These patterns, when identified, have a good risk/reward ratio. They allow traders to enter into the market with minimal risk. Obviously, you need some other confirmations before taking the trade on the pattern completion.

If the point D occurs with some divergence on classic oscillators (RSI / Macd, Sto), on a bottom (or top, if pattern is bearish) of a trendline / channel, previous support/resistance levels, supply/demand zone...then there are good probabilities to see price react on the completion of the pattern.

There are plenty of patterns, but this selection, from my side, is a good start for those who want to learn harmonic pattern.

Below some examples that have worked nicely (this don't work each time, this would be too easy ;)

The Butterfly Pattern // Educational ®By LARRY PESAVENTO & LESLIE JOUFLAS

HISTORY OF THE BUTTERFLY PATTERN:

Bryce Gilmore

Bryce has spent a lifetime studying the works of the great masters—R.N. Elliott , W.D. Gann, and many others.

He developed the Wave Trader Program in 1988; it was the first computer program to use all the numbers of sacred geometry, including the Fibonacci summation series. This pioneering led to the discovery of the Butterfly pattern .

Almost two decades and thousands of Butterfly patterns later, it can be said that it is one of the most profitable trading patterns with the proper use of stop-loss orders.

Safe Trades;

My Butterfly pattern rules GBPUSDHere on the GBPUSD im getting closer to my short orders being filled and the butterfly pattern completing. stops for me go just above the 1.414 ext and target is the .382 retrace of the A to D-leg.

Butterfly rules:

1= Atleast a .786 retrace of the X to A- leg but cannot break X.

2= Atleast a .382 retrace of the A to B-leg and can go past .382 just cannot break A.

3=Pattern completion for the butterfly pattern is a .127 ext of the A to B-leg. Thats were i place my orders.

If you have any questions about this pattern or if you would like me to post more educational content about advanced patterns just leave me a comment in the comment section and i will help you with it any way that i can. Thanks for checking out my idea and Good luck on all your trades!!

Advanced Patterns - ButterlflyThe Harmonic Pattern Butterfly is closely related to the Gartley 222 pattern with the main difference being that the Butterfly pattern’s CD extends beyond the XA leg. The Gartley Butterfly pattern is also identified by the classic ‘M’ and ‘W’ patterns.

The Butterfly pattern was one of the many harmonic patterns developed by H.M Gartley which were then fine tunes with the introduction of the Fib rations by Scott Carney and Larry Pesavento. Visually, the Butterfly pattern looks similar to the Gartley 222 pattern, especially the Fib ratios between the pivot points.

The Butterfly pattern can be found near key market reversal points, usually at intermediate highs and lows. The appearance of the butterfly pattern indicates reversals when it is validated. The chart below gives an illustration of the Bullish and Bearish butterfly patterns.

* The butterfly pattern therefore is an easy to trade harmonic pattern which offers a highly reliable trade probability. The risk/rewards may of course vary depending on how far the CD leg extends and therefore traders should be looking to trade only those butterfly patterns that offers a lower risk and higher reward trades.