Why does it always go against you? You might be new to trading, you may have several years of experience. But, where a lot of people still seem to go wrong is in not realising the relationships.

I have posted hundreds of educational posts here on Tradingview from cartoons, trying to simplify techniques through to market relationships between technical systems such as Elliott Wave and Wyckoff.

Many new traders fall foul of social media posts covering "SMC - Smart Money Concepts" and are not seasoned enough to appreciate what or why these can work for some and not for others.

You have Elliott Wave traders, there is a saying along the lines of "if you put 10 Elliott traders in a room searching for a wave count you will come out with 11 different answers"

This isn't to say Elliott doesn't work, nor Smart Money.

The market seeks liquidity, it forms seemingly complex patterns that humans try to make sense of. We are great at that, seeing patterns even if they are not there. - Look, there's an upside-down butterfly 1.618 extension!

First, you need to appreciate Elliott Wave counts on smaller timeframe are pointless, especially in the age of algo's and bots. However, sentiment on the larger timeframes can't really be spoofed.

In this first image; you can see a market wave that is straight out of a textbook.

Let's also add some Wyckoff; if you were to visualise this - Wyckoff schematics would be visible on smaller timeframes, the Green boxes represent accumulation and the Red show distribution.

Let's overlay and Elliott Wave count -

Take that to the next level, this count is only part of a higher fractal count.

How does this fit into smart money concepts? well, it's more like - How does Smart Money fit into this?

Elliott waves and Wyckoff have been around for over 100 years. Many of the techniques shown on YT video's today can be traced back to these older concepts.

Now, if you can see how a 1-2 EW count pushes up for a 3. You can zoom in again and start to see what to expect when trading using SMC.

In this image you can see a drop, then a gap as price pushes back up (I haven't bothered drawing wicks for simplicity assume their inside the box)

Many traders would now anticipate a move that looks something like this.

Only to see price do this

Yeah - you're not the only one!

The next issue is where and how Supply and Demand is drawn.

Ok, the gap didn't hold, it must be the demand level there. GO AGAIN!!!

How did that play out? Trade 1, Trade 2 =

What about now?

Price holds the support

This time you are afraid to go in. Then one of two things happens.

1)

Or

2)

In the first image, we can see a sweep of prior liquidity and that creates momentum for a move up. In the second image, price simply melts away.

This is an easy fix. It all comes down to understanding what the charts are trying to tell you.

People love to talk about how "Smart Money" is the banks and institutional players - how they are playing against you on every click of the button.

The truth is, most people don't understand the market.

When larger players enter the market, the can leave a pretty obvious footprint. In addition to that - they leave behind orders they had but were unable to fill. These orders they will be defended with even more buying or selling (if they need to), and this is the premise for a rally and pullback or a drop to pullback.

Now, visualise a 1-2 Elliott Wave move. Why do you think 2 often comes back so deep?

What would you expect the move from 2-3 to do?

Powerful push, yes?

In this image, the move that created demand is simply the opposing colour candle before the power play. The significant move pushed up (showing institutional involvement). Hence, a location they will likely defend.

In addition to the push up, they pushed with so much money - it created a natural gap.

This type of example doesn't always have to be a power play 1-5 up, it could be visualised on pullback moves too.

Here's a great example recently on Euro.

The demand candle 'buy before the sell" is clearly targeted on the way up. Price fails to close above it, drops, goes back to retest - sweeps and drops. If you were to zoom in you will see on smaller timeframes evidence of a Wyckoff schematic with a UTAD.

Add a volume profile there.

As the price breaks above, after it's pullback you can see an acceleration in price and of course the area has the PoC.

Back to where people go wrong.

They will see this GAP created and assume price will come back here to reject and go. However, look closer and the demand that started the move is very near that gap.

Where is the juicy liquidity? PoC is another little clue.

Let's take this to another level.

In this image I have a range, using the prior high just to give the example in this post.

We are in an uptrend = we just broke the high, we expect a Pullback. Where would that likely target?

Zoom in again. This time I have added a fixed range volume tool.

What do you know?!

Anyways, once you get a handle on the bigger picture and understand the relationships, you can zoom into any timeframe you like - the game is always the same.

Have a great week all!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Es1

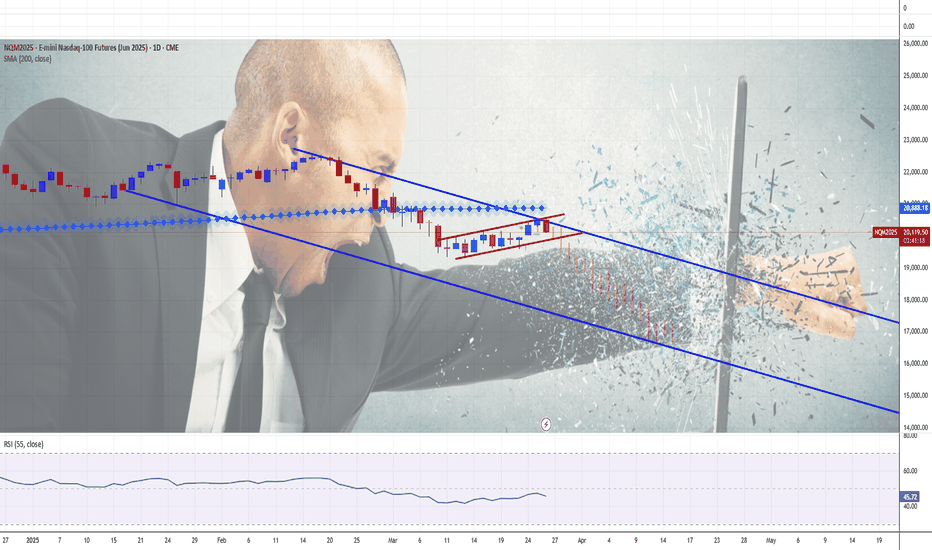

US Cash Market Goes 'Flippant'. Understanding Revenge in TradingFirst of all, revenge trading is a destructive pattern of behavior in trading where individuals make impulsive and emotionally-driven decisions in an attempt to recoup previous losses. This practice is not limited to novice traders; even experienced traders can fall prey to it. The primary emotions driving revenge trading include anger, frustration, greed, fear, and shame, which cloud judgment and lead to irrational decision-making.

Causes of Revenge Trading

Emotional Response: Traders often react emotionally to significant losses, feeling compelled to immediately recover their losses without adequate analysis or strategy.

Lack of Discipline: Deviating from established trading plans and risk management principles is common in revenge trading.

Psychological Triggers: Feelings of injustice, anger, or a desire for vengeance against the market can trigger revenge trading.

Consequences of Revenge Trading

Financial Losses: Revenge trading often results in larger losses due to riskier trades and poor timing.

Emotional Burnout: The stress and frustration from repeated losses can lead to emotional exhaustion and decreased trading performance.

Career Impact: Persistent revenge trading can erode confidence and lead to a trader questioning their abilities.

Real-Life Examples of Revenge Trading

Increasing Position Size: A trader experiences a significant loss and decides to double or triple their position size in the next trade, hoping to quickly recover their losses. This action disregards risk management principles and often leads to even greater losses.

Ignoring Stop-Loss Orders: After a loss, a trader might hold onto a losing position longer than planned, hoping it will turn around. This behavior ignores established stop-loss orders and can result in further financial damage.

Chasing Trades: A trader feels compelled to enter trades without proper analysis, driven by the urge to recoup losses quickly. This impulsive behavior can lead to a series of poor trading decisions.

Market Reversal Scenario: A trader suffers a loss due to a sudden market reversal. In an attempt to recover, they enter a trade in the opposite direction without thorough analysis, which can exacerbate their losses.

Wish more examples? Watch recent one below 👇👇

How to Avoid Revenge Trading

To avoid revenge trading, traders should focus on maintaining discipline and adhering to their trading strategies. This includes:

Taking Breaks: After a loss, taking time to reassess the market and calm emotions can help prevent impulsive decisions.

Sticking to Plans: Adhering to established trading plans and risk management principles is crucial.

Emotional Awareness: Recognizing emotional triggers and taking steps to manage them can help prevent revenge trading.

In conclusion, revenge trading is a HARMFUL AND DANGEROUS practice that can lead to significant financial and emotional consequences. Understanding its causes and recognizing its signs are essential steps in avoiding this behavior and maintaining a successful trading career.

--

Best wishes,

@PandorraResearch Team 😎

QUICK LOOK AT A FEW INDICATORS AND INTEREST IN A SERIES?Quick overview testing out the upload from a browser on a ethernet connection computer vs wifi with the desktop downloaded app. Do you find value in this and want to make a regular series? Contact me if so and follow. Esp if your a developer and want to add some videos to your products, free, locked or paid. Im game. Platforms, customization and breaking down analytics is the life. Its what i enjoy and maybe you will too!

Thank you All,

DrawDownKing CME_MINI:ES1!

Unlocking Trend Reversals: Mastering Bollinger Bands and VWAPsIn this comprehensive video tutorial, we will delve into the powerful techniques of utilizing Bollinger Bands and VWAPs (Volume Weighted Average Prices) to identify and master trend reversals in the futures market. ES1!

You will learn how to leverage these volatility-based indicators to detect potential turning points in price trends. By understanding Bollinger Bands' ability to highlight periods of market consolidation and expansion, you will gain an edge in predicting trend shifts and take advantage of profitable opportunities.

Additionally, we will explore the significance of VWAPs, an essential tool for analyzing price and volume dynamics. By combining volume-weighted prices with Bollinger Bands, you will be equipped with a comprehensive approach to assess market liquidity, support, and resistance levels.

Throughout this tutorial, I provide step-by-step guidance to effectively interpret the signals generated by Bollinger Bands and VWAPs, empowering you to make informed trading decisions. We will also address common misconceptions that can often lead to misinterpretations and false signals.

Whether you are a seasoned trader seeking to refine your strategy or a beginner eager to grasp these technical indicators, this video is designed to provide valuable insights and practical knowledge that can elevate your trading outcomes.

Tech stock Vs Energy stocks. The Competition for Decades This is an education-style publication where the main graph is a comparison (ratio) between two ETFs (funds) managed by State Street Global Advisors Corporation, the creator of the world’s first ETF (well-known in nowadays as AMEX:SPY ) and an indexing pioneer.

The first one ETF is The Technology Select Sector SPDR Fund, AMEX:XLK .

👉 AMEX:XLK seeks to provide investment results that provide an effective representation of the Technology sector of the S&P 500 Index SP:SPX .

👉 AMEX:XLK seeks to provide precise exposure to companies from Technology hardware, storage, and peripherals; software; communications equipment; semiconductors and semiconductor equipment; IT services; and electronic equipment, instruments and components.

👉 AMEX:XLK is a place where securities of American World-known Technology companies like Apple Inc. NASDAQ:AAPL and Microsoft Corp. NASDAQ:MSFT , like Nvidia Corp. NASDAQ:NVDA and American Micro Devices NASDAQ:AMD , like Cisco Systems Inc. NASDAQ:CSCO and Adobe Inc. NASDAQ:ADBE meet together.

👉 In contrast with other Technology-related ETFs like NASDAQ:QQQ (Invesco Nasdaq 100 Index ETF) or NASDAQ:ONEQ (Fidelity Nasdaq Composite Index ETF), stocks allocation in AMEX:XLK depends not only on their market capitalization, but also hugely on Technology industry allocation (like software, technology hardware, storage & peripherals, semiconductors & semiconductor equipment, IT services, communications equipment, electronic equipment instruments & components).

That is why allocation of Top 3 holdings in AMEX:XLK ( Microsoft Corp. NASDAQ:MSFT , Apple Inc. NASDAQ:AAPL and Broadcom Inc. NASDAQ:AVGO ) prevails 50 percent of Funds assets under management.

👉 Typically AMEX:XLK holdings are Growth investing stocks.

The second one ETF is The Energy Select Sector SPDR Fund, AMEX:XLE .

👉 AMEX:XLE seeks to provide investment results that provide an effective representation of the energy sector of the S&P 500 Index SP:SPX .

👉 AMEX:XLE seeks to provide precise exposure to companies in the oil, gas and consumable fuel, energy equipment and services industries.

👉 AMEX:XLE allows investors to take strategic or tactical positions at a more targeted level than traditional style based investing.

👉 AMEX:XLE is a place where stocks of American World-known Oil companies like Exxon Mobil Corp. NYSE:XOM and Chevron Corp. NYSE:CVX , like EOG Resources Corp. NYSE:EOG and ConocoPhillips NYSE:COP , like Valero Energy Corp. NYSE:VLO and Phillips 66 NYSE:PSX meet each other.

👉 Weight of Top 3 holdings in AMEX:XLE (Exxon Mobil Corp. NYSE:XOM , Chevron Corp. NYSE:CVX and EOG Resources Corp. NYSE:EOG ) prevails 45 percent of Funds assets under management.

👉 Typically AMEX:XLE holdings are Value investing stocks.

The main graph represents different stock market stages of work

🔁 Early 2000s, or post Dot-com Bubble stage, that can be characterized as Energy Superiority Era. There were no solid Quantitative Easing and Money printing. U.S. Treasury Bond Interest rates TVC:TNX , TVC:TYX as well as U.S. Federal Funds Rate ECONOMICS:USINTR were huge like nowadays. Crude oil prices TVC:UKOIL , TVC:USOIL jumped as much as $150 per barrel.

The ratio between AMEX:XLK and AMEX:XLE funds collapsed more than in 10 times over this stage.

🔁 Late 2000s to early 2010s, or post Housing Bubble stage, that can be characterized as a Beginning of Quantitative Easing and Money printing. U.S. Treasury Bond Interest rates TVC:TNX , TVC:TYX as well as U.S. Federal Funds Rate ECONOMICS:USINTR turned lower. Bitcoin born.

The ratio between AMEX:XLK and AMEX:XLE funds hit the bottom.

🔁 Late 2010s to early 2020s, or post Brexit stage, that can be characterized as a Continuation of Quantitative Easing and Money printing. U.S. Treasury Bond Interest rates TVC:TNX , TVC:TYX as well as U.S. Federal Funds Rate ECONOMICS:USINTR turned to Zero or so. Crude oil turned to Negative prices in April 2020 while Bitcoin hit almost $70,000 per coin in 2021.

Ben Bernanke (14th Chairman of the Federal Reserve In office since Feb 1, 2006 until Jan 31, 2014) was awarded the 2022 Nobel Memorial Prize in Economic Sciences, jointly with Douglas Diamond and Philip H. Dybvig, "for research on banks and financial crises", "for bank failure research" and more specifically for his analysis of the Great Depression.

The ratio between AMEX:XLK and AMEX:XLE funds becomes great and respectively with monetary stimulus hit the all time high.

🔁 Early 2020s, or post Covid-19 Bubble stage, that specifically repeats early 2000s Energy Superiority Era. There is no again Quantitative Easing and Money printing. U.S. Treasury Bond Interest rates TVC:TNX , TVC:TYX as well as U.S. Federal Funds Rate ECONOMICS:USINTR are huge nowadays like many years ago. Commodities prices like Wheat CBOT:ZW1! , Cocoa ICEUS:CC1! , Coffee ICEUS:KC1! , Crude oil prices TVC:UKOIL , TVC:USOIL jump again to historical highs.

The ratio between AMEX:XLK and AMEX:XLE funds is fading to moderate levels that can be seen as 200-Month simple moving average.

💡 In a conclusion.. I wonder, how the history repeats itself.

This is all because markets are cyclical, and lessons of history always still remain unlearned.

💡 Author thanks PineCoders TradingView Community, especially to @disster PineCoder for its excellent and simple script Quantitative Easing Dates .

Based on this script, Easing Dates are highlighted at the graph.

Advanced Bull Flag ConceptsHave you ever wondered why price action sometimes forms a bull flag pattern?

Have you ever wondered if there is a way to predict whether a bull flag will break out before it actually does so?

In this post, I will try to address these questions by presenting a couple of theories about the nature of bull flags.

Bull Flag Theories

(1) The flag structure of a bull flag tends to form along Fibonacci levels, with the ideal flag proportion being an approximated golden ratio to the flagpole; and

(2) Fibonacci and regression analyses can provide useful insight into whether price will successfully break out of its bull flag pattern, sometimes long before price even attempts to do so.

I will try my best to clearly explain both theories in detail below.

Note: Although this analysis is also generally true for bull pennants, bear flags, and bear pennants, to keep things simple I will focus solely on bull flags. Additionally, this analysis is generally true across timeframes.

Part I - The Basics of a Bull Flag

First, let's begin with the basics. As shown in the image below, bull flags form when an asset is in a strong uptrend. The uptrend forms the flagpole of the bull flag structure.

The flag structure forms when price consolidates, usually in a falling trend. This consolidation phase is often characterized by price oscillators rotating back down while the price retraces only a small part of its prior upward move.

From a market psychology perspective, bull flags often form when most market participants who bought the asset continue to hold it expecting the uptrend to resume, while only a minority of market participants sell (or short the asset) as its price corrects downward. The bull flag pattern is a continuation pattern because it reflects the market's general expectation that price will eventually resume its upward move.

Once the price definitively breaks above the upper channel of the flag (often with strong momentum and high volume), the bull flag pattern is validated. Upon breakout, the expected move up is equal to the vertical height of the flagpole.

Part II - The flag structure of a bull flag tends to form along Fibonacci levels, with the ideal flag proportion being an approximated golden ratio to the flagpole

Here's where things begin to get interesting. Below is the golden ratio.

Two quantities, a and b (where a > b ), form the golden ratio if their ratio is the same as the ratio of their sum to the larger of the two quantities. (See the equation below)

The equation above shows the Greek letter phi which denotes the golden ratio. Phi is equivalent to a/b when such ratio is also equivalent to (a + b)/a.

Although bull flags can take various forms, it is my hypothesis, based on chart analysis and research, that the most perfectly structured bull flags (ones that also have the highest probability of successful breakouts) occur when the flag forms a golden ratio to the flagpole.

Mathematically, this means that the vertical height of the flagpole is equivalent to (a + b) and the vertical height (i.e. the width) of the flag is equivalent to b. This is also to say that price retraces down to the 0.382 Fibonacci level as measured by applying Fibonacci retracement levels along the flagpole (or to the 0.618 point on the vertical height of the flagpole if one measures from the bottom to top).

I realize that this can be quite confusing, so let’s walk through some visualizations.

Let's first visualize this hypothesis using the golden rectangle. Below is an image of the golden rectangle. A golden rectangle is composed of a square (with sides equal to a) and a smaller golden rectangle (with width equal to b and length equal to a).

Now let's rotate the golden rectangle to better visualize the hypothesized flag pattern.

The bull flag is hypothetically an approximation of the golden rectangle, whereby the width of the flag is in a golden ratio approximation to the length of the flagpole.

In the illustration below, there are multiple bull flags contained within a Fibonacci spiral. The spiral is made up of golden rectangles, with each larger golden rectangle containing a smaller golden rectangle inside it. The smaller golden rectangle is the flag structure, and the length of the larger golden rectangle is the flagpole.

One can think of the Fibonacci spiral and the golden rectangles as a series of bull flags that build on top of each other in a repeating pattern. In this diagram, price is represented by the increasing length of the sides of each golden rectangle. In other words, the price on a chart can be seen as spiraling higher after each bull flag breakout.

Of course, not all bull flags form a structure that approximates the golden ratio, but it is my belief that in forming a bull flag, price action is aspiring to achieve as close of a golden ratio approximation as it can. I believe that the bull flags that best approximate the golden ratio structure also present the highest probability for a successful break out.

To learn more about Fibonacci spirals, including the golden spiral that Fibonacci spirals approximate, you can check out this Wikipedia article: en.wikipedia.org

Part III - Fibonacci and regression analyses can provide useful insight into whether price will successfully break out of its bull flag pattern, sometimes long before price even attempts to do so.

To see how Fibonacci levels and regression analysis can give insight into whether a bull flag will break out or break down before it does so, let's consider an example.

Let’s consider the massive bull flag that the iShares Russell 2000 ETF (IWM) formed in 2021.

In 2021, the monthly chart of IWM formed what appeared to be a bull flag, as shown below.

Now let's see why Fibonacci analysis and regression analysis were warning that this bull flag was not likely to break out successfully.

First, IWM's price did not retrace to a Fibonacci level before attempting a breakout (when using the pole as the Fibonacci retracement reference point). In the chart below, we see that price tried to break out, without even so much as retracing down to the highest Fibonacci retracement level: $196.71. By not undergoing Fibonacci retracement, price did not give its oscillators the opportunity to rotate back down fully. Instead, price remained overextended at the time it attempted to break out.

Now let's look at regression analysis. Below is a log-linear regression channel that contains IWM's entire price history. As noted in my prior posts, a regression channel simply indicates how far above or below the mean (or average) price an asset's current price is trading. In the regression channel above, the red line is the mean price, the upper channel line is 2 standard deviations above the mean, and the lower channel line is 2 standard deviations below the mean.

A successful breakout of the bull flag would have taken IWM's price way above its regression channel, to a level that is too many standard deviations above its mean price for us not to question the probability of the breakout’s success. Achieving the full measured move up would have been extremely unlikely, assuming that the regression channel is valid and that price tends to revert back to its mean over time. What was more likely than a breakout was a breakdown, and a reversion back to the mean, which is what ended up happening with IWM.

Another interesting note about IWM’s bull flag is that it presented a false breakout in November 2021. This false breakout was presenting multiple warnings signs including being a UTAD test of a Wyckoff Distribution. As shown below, however, another important clue that the November 2021 breakout would likely fail was that the breakout was not confirmed when comparing IWM to the money supply (M2SL). See the chart below.

One can interpret this chart to mean that in late 2021, IWM’s price was rising because the central bank was increasing the money supply, but not due to improving strength of the underlying companies that comprise the ETF. Using the money supply as a ratio to an asset elucidates the true inherent strength of the asset's value. To understand more about why the money supply can be used in this manner, you can check out my post below.

Part IV - Additional Comments

I have a few additional comments. I usually use Fibonacci levels on a log-scale chart to identify Fibonacci spirals because Fibonacci spirals are logarithmic spirals. However, when using Fibonacci levels based on log scale, the ratios, percentages and numbers, can seem quite confusing because they are logarithmically adjusted. If you choose to replicate my process, please be mindful of this. While using log-scale charts is critical for higher timeframes (e.g. the monthly chart or higher), I have not identified much benefit to using it on shorter timeframes.

In a prior post, I noted that Plug Power (PLUG) is currently forming one of the best-looking log-scale, golden ratio bull flags I have ever seen. If my above hypotheses are true, I would expect to see PLUG move dramatically higher in the years to come. For more information about PLUG, you can read my post linked below. (This is not a solicitation to buy PLUG. Please do your own research and carefully consider all risks.)

At the risk of making this post too long and too dense, I just want to briefly note that it is also my hypothesis, based on observation and research, that the golden ratio is where many S-curve dilemmas are solved. If you don't know what an S-curve dilemma is and you'd like to read about this you can see my post below about Jumping S-Curves .

In short, an S-curve dilemma is another way of conceptualizing the question of whether a bull flag will break out or break down.

I hope that someone finds value in this post. I spent a lot of time studying, researching, analyzing, and cogitating the mathematical nature of price action to reach many of the conclusions here. Thank you for your valuable time in reading my post.

Boost Your Trading Game With Bollinger BandsIf you understand the market environment, you'll be a better trader. I've been using Bollinger Bands to identify the market environment for over 20 years. In today's video, I'll explain how to use them to identify a two-way tape, when a market will keep trending, and when it will revert back to the trend.

ES Morning Shorts From Last Nights IdeaGood Afternoon everyone,

I will show in depth order entries in this post, read the updates to see.

This idea was formed last night around 10PM NY Time. I originally was hoping to trade up into the most recent Order Block (green path arrow) during the London session and end at the Terminus -4 around 8:00AM NY time. I then would've liked to see accumulations followed by a Turtle Soup or sweep of that low at the Terminus -4 during market open. I wanted to take countertrend longs in that area into the Order Block resting above the Liquidity Void, this move is denoted by the orange path arrow.

However we ended up going straight to Terminus -4 during London and we rallied above Asia accumulation into the Bearish Order Block sitting right above (green path arrow). We took shorts from this area and we were looking to target the Sellside Liquidity below to complete our MMSM (Market Maker Sell Model) on the 15M chart. We were able able to bank 2.1% off the move just by taking profits at the short term low 4507.5 and holding a few more contracts to a slightly lower price once we noticed price wasn't wanting to break the low at the Terminus -4 just yet. The Sellside Liquidity is still a viable target, we have just been choppy since right after open so taking profits is worth the time spent waiting for price.

Hopefully this was more insightful on how to form an idea for the next trading day. I will commit to making more informational posts like this. Please read the updates for a 5M look at the entries and a reference to the MMSM.

Understanding Trends In Markets: Why They DevelopThe prime example of a Trend on the S&P will help you understand and be ready for any future move..

Especially when you are looking at it the right way.

In this video we go from the very start to where we are now to understand how the market develops based on market news and sentiment and what to look for in the future.

Trade Small and Trade Safe.

Swing Trading using Island ReversalsIsland Reversal are powerful reversal signals so as a swing trader I'm always searching these out and/or watching them form.

The most powerful Island Reversals generally occur around some sort of news event (or sometimes prior to a news event if Wall Street is in the "know") and typically leads to fairly violent initial move to the upside or downside.

What is important about the "strongest" of these reversals is that the "white space" will remain for some time and/or never clears!

Below is the chart of SPX prior to the Covid vaccine approval announcement:

Who can forget the Mother of all Islands!

JPM-

TSLA-

What are some of your favorite Island Reversals?

The ART of profit booking I am posting a chart for educational purpose using S&p 500 index with heikinAshi candle and elliott waves

trading is an art of buying at low and selling at high, looks easy to do? if so why more people loosing and big players minting money?

trading is a money making process when the crowd has extreme interest in one direction(buy /sell).

when everyone in the street is buying, it is the RIGHT time to sell.

The ART of profit booking without harming buyers(they don't know what's happening) is described in the chart.

Because if they knew in advance then to whom the seller has to sell?

Actually speaking the BULLS AT THE BEGINING OF THE TREND NOW BECOME BEARS!

SELVAM BE, MBA

option trader

Asset Classes - Part 3 - For beginnersToday we prepared for you 3rd part of our paper on asset classes for beginners. Purpose of this paper is to concisely detail futures contracts, forwards, swaps and options.

Asset Classes - Part 1 and 2 - For beginners

Feel welcome to read part 1 and part 2 if you have not yet.

Derivative

Derivative is a type of financial asset which derives its value from an underlying asset or group of assets, or benchmark. Underlying assets for derivative contracts can be, for example, stocks, commodities, currencies, bonds, etc. Derivatives are traded on a stock market exchange or over-the-counter (OTC). They can be used as investment vehicles, speculative vehicles and even as hedge against the risk. Additionally, derivatives often allow for use of leverage. Most common derivatives are futures contracts, options, forwards and swaps.

Illustration 1.01

Illustration 1.01 shows the daily graph of gold in USD.

Futures contracts

Futures contract is a standardized derivative that is publicly traded on a stock market exchange. It binds two parties together which are obligated to exchange an asset at a predetermined future date and price (without regard to current value). Expiration date is used to differentiate between particular futures contracts. For example, there may be a corn futures contract with expiration in April and then another corn futures contract with expiration in May. On a day of expiry, also called delivery, the exchange of an asset between the two parties is enforced. Underlying assets for futures contracts can be stocks, commodities, indexes, etc.

Forwards

Forward contract is a derivative contract between two parties to buy or sell an asset at a specified price on a future date. Unlike futures contracts, forward contracts are not standardized. They are customizable and traded over-the-counter rather than at a stock market exchange.

Illustration 1.02

Illustration above depicts the daily graph of continuous futures for gold. It is clearly visible that the gold chart in USD and gold continuous futures chart are resemblant.

Swaps

Swap is another form of derivative contract that binds two parties to exchange cash flows. There are currency swaps and interest rate swaps. Currency swap is defined as the exchange of an amount in one currency for the same amount in another currency. Interest rate swaps are defined by exchange of interest rate payments.

Illustration 1.03

Picture above shows daily graph of S&P500 continuous futures.

Options

Option is a type of financial asset that gives a buyer the right to buy or sell an underlying asset at a predetermined price and date. Options differ from futures contracts in that they do not oblige parties to exchange an underlying asset. There are European-style options and American-style options. European-style options can be exercised only on a date of expiry while American-style options can be exercised at any time before this date. Options that give a buyer the right to buy an underlying asset are called call options. Contrary to that, the put options give a buyer the right to sell the underlying asset. Options are very complex as they involve option risk metrics, so called greeks.

DISCLAIMER: This content serves solely educational purposes.

Understanding Sessions - US Index FuturesMarket Sessions are not commonly understood. Let's use ES Futures as an example (concept applies for all assets in every market).

What you see is an automated tool that I call ' The Session Maker '. It's all about providing in the moment context when trading, but it the principles and concepts are valuable when used on any timeframe. Below I briefly explain Sessions, why we often haven't learned what they are or how to use them, and what we can do about it.

Most of the time we hear about the importance of the "Close" of the day's session and that level is what most see or reference on their charts, or CNBC, or social media, etc.

The reality is, the OPEN of a Session carries more weight than the Close. And before you say "but the Close of one session and Open of the next are often identical" - think again. Plus it's not just the level, it's the way we perceive it, and perception is everything in this game.

By definition if we look at the Close of the previous session, we're focusing on what has already happened and basing our analysis on increasingly older data.

Using the OPEN as our guide for the current session, we're bringing our attention as close as possible to the "here and now". We're actually assessing the "type" of market participants involved right in this moment. Plus by doing so, we're able to recognize there are many concurrent sessions happening each moment.

Timeframes like Today's Session, the Weekly Session, the MONTH, the QUARTER, the YEAR.

To smaller timeframes like 2 hour, 15 minute, 5 minute, etc.

I encourage you to take a moment, look at the Opens on any timeframe you prefer, and notice HOW the candle or bar is formed. How is the wick created and when? Put it in context of the current trend on a larger timeframe.

For example, in an auction move higher, do they consistently sell the open of each 15 minute session, but not break below the previous 15 minute session Opens? Consistently giving small pullback backs but auctioning higher? WHERE did the move slow and/or stop? Was it an "untouched" or "unvisited" Open from a previous Day or Week or much larger timeframe, such as the Quarter?

When we start to put it all together, we get more context for which Sessions carry more weight, which one's we want to be participating in, and most of all refine our entries and exits not based on Moving Averages or other squiggly lines... just price and orderflow.

Happy to discuss any questions or thoughts in the comments and plan to provide future posts with examples of how this automated tool can help provide quality data for better decision making.

**For anyone who can answer the below question correctly - I'll shoot you over a custom link with this tool that you can copy into TradingView**

What is the actual Daily Open for US Index Futures we should all be aware of?

Is it: (all times Eastern)

6pm? 8:30am? 9:30am? 9:28am?

Volume Profiles on TradingViewIf you are new to @TradingView

Or a new trader, there is a pretty useful feature called volume profiles - available with paid membership of Tradingview. This is a quick introduction to and not a full lesson on how to use, strategies or techniques (will post one if there is interest for that).

TradingView's own definition of Volume profile

Volume Profile is an advanced charting study that displays trading activity over a specified time period at specified price levels. The study (accounting for user defined parameters such as number of rows and time period) plots a histogram on the chart meant to reveal dominant and/or significant price levels based on volume. Essentially, Volume Profile takes the total volume traded at a specific price level during the specified time period and divides the total volume into either buy volume or sell volume and then makes that information easily visible to the trader.

Source - www.tradingview.com

Types of volume profiles available

First there is session volume

As it says on the tin - session volume calculates the volume of transactions during the session, boxed off individually on a session by session basis.

Inside the session volume;-

Second type of volume profile is "Visible range" - again not much of an explanation needed, however - this one is a little more tricky as a lot of novice traders spend a lot of time flipping between charts, time frames and so on. So you need to be careful as it will compute, whatever you have in view on the chart.

Here we can see the value area, just like the session - but for the visible range.

I have also highlighted the region outside of the value zone - grey area in orange boxes. (for this example) and of course the point of control.

By zooming out to another swing high you can see how this changed the profile.

This is due to the fact we are now viewing on the chart a different range - A bigger swing with more info inside the calculation.

The third type of volume profile on TradingView is the fixed range;

In simple terms - this kind of works between the two; you can highlight what you want, but it is then anchored much like the session volume.

In this example above, I have shown the fixed range to match a visible range - larger left and the profile larger on the right. As well as a smaller fixed range showing the original smaller range form the visible range image 1.

Mix and match - or different use cases;

There are several different ways to apply volume, the use case, the logic & the strategy will depend on what one or what combo works best for you. As I mentioned above, I will do a lesson on strategies for volume if requested.

In this example below; I have shown a fixed range and a session profile.

And finally - just to reiterate, there are several techniques when trading volume, at a glance here you will see a cluset of "PoC's" consolidating at a high before the price moves on down over several sessions.

This is just one application.

As always, I hope this helps some newer traders out there get into volume profile, It can be a powerful tool when you know how to use it.

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

How to Spot Blow-off Tops - ES1!Here are 3 blow-off tops and 1 failed attempt which all occurred in the last 7 months. Successful completions are marked in solid black. The failed attempt is shown in dotted black.

On all 4 attempts, the price accelerated upwards to different degrees. Each target can be roughly measured based on the price move.

Notice how the failed blow-off begins closer to a price bottom than the successful ones did.

Volume was either steadily increasing or declining during successful blow-offs, compared to the unsuccessful attempt when volume was not clearly trending.

ROC (momentum) was increasing with all 4 attempts. The blow-offs were successful when momentum was at 0 or positive at the start of each blow-off.

Disclaimer: This is my opinion. This is not advice. Trading involves risk.

Focus On What Matters The Most... Trend Trading!Sometimes as traders we tend to focus on every little move and get overwhelmed with price action.

I personally believe making your charts simple is the key to success!

1. Trend Trading

2. Risk Management

The 2 things that matter the most by far when it comes to trading. You as a trader need to step away from focusing on every price action move in the markets, and focus on trend. Trying to be overly aggressive on trying to capture exact bottoms and exact tops will only lead to more stress. With trend trading we can filter out a lot of the noise and focus on what matters the most!

Here we look to buy or sell when all 3 charts line up the same color to identify bigger moves in the markets. This is good for both swing trading and daytrading. The reason a lot of traders FAIL as daytraders is because they get lost in all of the noise on the lower timeframes and also try to play every breakout. If you just focus on trend you will have a better chance at becoming a better trader.

We than manage our risk whenever we do get a trend chop and learn how to get out of a trade and not let them run against us.

Trend + Risk Management = Happy Trader 😁

Winning Daytraders Understand Trend Trading.Hey guys, most people that get into the markets want to learn how to daytrade. They want to learn how to play the market on a day to day basis and eliminate a lot of the stress.

Smart day traders understand trend trading. At the end of the day if you are trading something like a 15 minute time frame you're aware of how much noise their is in the markets. You need to eliminate the noise and focus on trend. Stop trying to scalp every little move getting in and out and racking up your fees.

What we do is identify some of the largest trends that we can find... the more noise you filter out, the better your odds are at winning. Then we just follow up with good risk management.

Take a look at the ema dots indicator. This takes out the complicated noise that most traders battle back and forth all day long either selling too early or buying too late. You need to stop focusing on trying to capture the exact bottom and the exact top. Just focus on capturing the overall trend transitions.

Every 15 minutes for example on this chart of the ES futures CONTRACTS we will get a set of dots to close a certain color. We take our position when they align and set a take profit, or hold till next transition. Easy. You risk a little to win big, meaning you play good risk management knowing that the next major move is right around the corner. Technically you don't really need to understand support and Resistance but it does help. I personally believe trading the trend is the way to the gold mine.

Investors, do not panic, relax, and hang in thereThis might be it.

I've seen a video recently "A Guided Meditation for When the Stock Market Is Dropping"

Loved it. A video to help reassure and relax bagholders.

"The market always goes up over time" I keep hearing this over and over and over.

It is so absurd, so stupid, but every one keeps repeating it.

Complacency much?

All these investors need a harsh lesson.

"Last time they said" "Bears are wrong".

"Just do nothing" "Market drops it is perfectly natural".

Except the stock market has spent more than a century in a range at once in the past, and it is only 500 years old.

Going to be great to see the paradigm of "blindly invest 100 bucks a month since you are young and you will be a millionaire with no effort by 50" crash its face on the ground.

"Zoom out" "Always go up". Hehehe let's see where those people are when the SnP goes 3 digits.

I have had this idea for a while, and was thinking the dow would top 27000 to 33000 then the big crash would happen.

Price to Earnings, Price to GDP, Revenues, What revenues should be, inflation, rational measurements.

They all say it is way time to go down.

Emotional and dreaming people think "price go up forever dis just noise", especially boomers. They have only known a bull market maybe?

Well bubbles have to pop and nothing "goes up magically forever with 0 effort 0 risk not even having the patience to wait for cheap prices"

Does this really make sense? Getting rewarded for absolutely nothing...

Would have been nice if friday the 13 would have had a huge crash but probably recovers for now awww.

People especially in europe terrified of covid-19 coronavirus when it's been declining and almost no new cases now in asia, and this clown of a french president said yesterday "it has just begun" and "it is accelerating at an alarming rate so we are shuting down the country no school work from home non urgent patients are cancelled and so on".

The irrationals will lose money, the rationals will make money.

US democrats hate Trump so much they will do everything they can to help this market go down, they LOVE the price falling like this.

So the woke US irrationals are the ones to want the world stocks to go down down down down, pretty neat.

And boomers are going to be so desperate after losing their retirement, they'll be tempted to vote for free stuff dems in 2024.

Which will mean more bear YEEEEEESSSSS!

I wonder who will be the 2024 dem nominee? Tulsi Gabard is being ignored, probably because she is moderate and won't bow down and pro freedom at least partially.

They want a wahman do'nt they so this would be nice... Or an 80+ yo bernie? xd Or some other complete nutcase... Or salamander IQ AOC?

They are scary, if a complete nut gets the power to ruin the country the bear will extend a bit too much.

All is setting up for a mighty mighty bear cycle, and these "infinite free money no effort just buy and hold" are going to learn the most brutal lesson.

I love it!

Keep moneyz to buy cheapy stonks when they drop 80%

FED probably going to print more and more magical money because this works so well, if they keep doing that there will be a revolution of the poor eventually and the result will simply be even worse.

Bear Power!

Bond yields rising, divergence shows a slight 2020 SPX pullbackThe S&P 500 has been on a tear in 2019, rising nearly 30%, from low of the year to high it has surpassed the 30% growth mark. However, there has been a prevalent divergence between bond yields in the US and the SPX, which are correlated to move the same way. This means there could be a convergence in the near future to get back to the "regular" pattern.

Over the past few months bond yields have been climbing slightly, but year to date there has been a 23% drop in the 30 year and 31% drop in the 10 year. About the same amount as the S&P has risen. Those bond yields have risen about 15% since September while the S&P 500 has risen exponentially. This means we are expecting a pullback in the S&P 500 since the bond yields have started to do their part and slowly rise. We are not expecting a 30% gain in bond yields, not a 30% drop in the S&P 500 but a moderate move to regularity. Based on the monthly, the S&P 500 could pullback 9.5% to the 2926 level where the impulse for the move higher happened. The volume is extremely weak on all time highs which is another indicator. From there the upside potential is 3500+ based on a Fib extension.

If the S&P 500 pulls back we do expect another rise of 15+% ideally in bond yields. This can be contributed to eased tensions between China and the US and a hold on rate cuts from the US Fed.

How the Russell 2000 indicates a correction in the S&P 500The Russell 2000 small cap index has been a prevalent lagger throughout the whole US equity rally into all-time highs. This is of concern for the health of the economy and the health of the S&P 500 index. The small-cap sector reacts the most to economic conditions and monetary policy, being the most affected if they cannot make new highs and are over 8.5% away from all-time highs we can infer that a stronger correction of 8-10% may occur in the S&P 500.

The S&P 500 is full of companies that have been artificially inflated by stock buy-backs and also monetary policy allowing for cheaper borrowing. There is a healthy retrace coming out to catch down to small caps since they have not relished in the strong economic conditions. Which presents another concern, is the economy that strong to begin with? If there is a correction, there could be more buyers in both the S&P 500 and Russell 2000 companies to help markets reach all-time highs yet again.