Mastering Liquidity Dynamics: Understand the Dynamic True ValueDear Reader,

Thank you for reading—your time is valuable.

Use the chart's zoom-in/out (-/+) function for better visibility. This chart captures a large sample for your evaluation.

Below is the manual detailing the Smart Farmer System —a Dynamic True Value framework derived from real-time data to anticipate market intent and liquidity behavior .

If this resonates with you, drop a comment below— constructive insights are always welcome .

The Dynamic True Value - a Smart Farmer System: Terminology and Mechanics

: For now, I have firmed up POC - Price of Control, VAP - Value Average Pricing, SULB - Sell Upper Limit Bound, BLLB - Buy Lower Limit Bound.

Mechanic:

POC - Where fair value price dynamic is read.

VAP - Trading above indicates bullish sentiment of the cycle, and the opposite for bearish sentiment.

A crossed over of:

Grey POC above Green VAP - Signaling distribution, accumulation, consolidation, build-ups, correction, retracement .

Green VAP above Grey POC - Bullish strength and momentum consistency .

Pink VAP above Black POC - Bearish strength and momentum consistency .

Flip of Pink VAP to Green VAP - Sentiment flips from bear to bull, and the same goes for green flip to pink showing bull to bear.

Validation of entry signals requires:

Signal's candle must close past the opposite side of POC – flip sentiment .

The confirmation candle (is the closed next candle immediately after entry signal candle) must continue closed past the POC – maintain sentiment .

The progress candle (is the next candle closed right after the Confirmation Candle) shows traction, momentum build-up, and volume consistency .

Hint of invalidation:

Signal's candle is considered void if the next candle prints a new entry signal in the opposite direction. This often signals accumulation, sideways movement, build-up, uncertainty, or swings in range .

The immediate next candle closed past POC to the opposite side.

What to understand about Liquidity Trap, SULB, and BLLB:

Liquidity traps

Often occur at the recent/previous flatlines of Dynamic True Value (POC, VAP, SULB, BLLB) .

It is worth paying attention to the market’s intent and institutional positioning.

Signs of exhaustion, absorption, inducement, offloading, and accumulation are visible in the M1 (one-minute) TF, with significant confluence near the previous/recent flatlines of Dynamic True Value in the higher/macro-TFs.

An Anchored VWAP tool can be helpful for filtering noise in the market. This tool can be found in the drawing tab in the TradingView platform.

SULB

Details the dynamic of upper resistance where Bears remain in control below the dynamic level.

Below this limit bound (LB) , bears show strength – bear sentiment .

A converging price toward this LB indicates bulls are present.

Moving past this LB (a candle closed above) and successfully RETESTING newly formed support indicates a confirmed directional shift . Followed by printing a new BLLB in the next following candles with price continuing to rise above this failed SULB.

A rejection below LB (a rejection/exhausted candle closed below LB) and successful RETEST reaffirms the resistance holds , indicating downside continuation .

BLLB

Details the dynamic of lower support where Bulls remain in control above the dynamic level.

Above this LB, bulls show strength – bull sentiment .

A converging price toward this LB signifies bears are present.

Moving past this LB (a candle closed below) and successfully RETESTING newly formed resistance indicates a confirmed directional shift . Followed by printing a new SULB in the next following candles with price continuing to push lower below this failed BLLB.

A rejection above LB (a rejection/exhausted candle closed above LB) and successful RETEST reaffirms the support holds , indicating upward continuation .

Important Notes:

Select preferred Entry’s Signal TF (ex. M3 TF, M5 TF for scalping strategy, M15 for intraday/daily strategy, 4H TF for day-to-weekly strategy, etc.).

Always refer to the selected Entry’s TF for trading progress. Anticipate TP and SL by watching the range in this TF.

Non-entry TFs are not for entry purposes. These multi-TFs are used for measuring strength, momentum, liquidity, positioning, structure – The market intends . The Non-entry TF is used to anticipate institutional executions and liquidity pools.

These criteria MUST BE MET. A failed criterion suggests vague execution. Be patient and wait for clear validations.

Institutions excel in creating illusions.

SFS is designed to stand ready, calm, and execute with Clarity.

SFS cuts through noise, distraction, and stays independent of NEWS, GEOPOLITIC, RUMORS, and herd mentality because all these are designed to mislead retail traders into institutional traps.

When we see such ambiguity against the criteria, we know not to fall into the TRAP and become the liquidity FUEL.

Stay sharp, only respond when signals are firmed. SFS is designed to counter Smart Money capitalism. It is about time to level the playing field.

Liquiditygrab

Understanding Liquidity: Where Big Players Hunt Stops

Understanding Liquidity: Where Big Players Hunt Stops

Ever wondered why price suddenly spikes through your stop-loss and reverses moments later? That’s not a coincidence—it’s liquidity at play. This article will teach you how liquidity zones work, why stop hunts happen, and how to avoid getting trapped like the crowd.

🔵 What Is Liquidity in Trading?

Liquidity refers to how easily an asset can be bought or sold without drastically affecting its price. But in practical trading, liquidity is more than just volume—it’s where traders *place* their money.

Large players—institutions, market makers, or big accounts—need liquidity to fill orders.

They target areas where many retail stop-losses or pending orders are stacked.

These areas are often just above resistance or below support—classic stop-loss zones.

To move large positions without slippage, smart money uses stop hunts to trigger retail orders and create the liquidity they need.

🔵 Where Do Liquidity Zones Form?

Liquidity often builds up in predictable areas:

Above resistance: Where shorts place stop-losses.

Below support: Where longs place stop-losses.

Swing highs/lows: Obvious turning points everyone sees.

Round numbers: e.g., 1000, 10,000, 50,000.

Breakout zones: Where breakout traders place entries or stops.

These zones act like magnets. When price approaches them, it accelerates—seeking the liquidity pool behind the level.

🔵 What Is a Stop Hunt?

A stop hunt happens when price moves just far enough to trigger stop-losses before reversing. This isn’t market noise—it’s an intentional move by big players to:

Trigger a flood of stop orders (buy or sell).

Fill their own large positions using that liquidity.

Reverse price back to fair value or the prior trend.

Example: Price breaks above resistance → stops get hit → institutions sell into that liquidity → price drops sharply.

🔵 Signs You’re in a Liquidity Grab

Look for these clues:

Fast spike beyond key levels followed by rejection.

Wick-heavy candles near highs/lows.

Price touches a level, then sharply reverses.

High volume on failed breakouts or fakeouts.

These are signs of a liquidity event—not a real breakout.

🔵 How to Trade Around Liquidity Zones

You can use liquidity traps to your advantage instead of becoming their victim.

Avoid obvious stops: Don’t place stops directly below support or above resistance. Instead, use ATR-based or structure-based stops.

Wait for confirmation: Don’t chase breakouts. Let price break, reject, then re-enter inside the range.

Watch for wick rejections: If price quickly returns after a level is breached, it's often a trap.

Use higher timeframe confluence: Liquidity grabs are more powerful when they align with HTF reversals or zones.

🔵 Real Example: Liquidity Sweep Before Reversal

In this chart, we see a textbook liquidity grab:

Price breaks below support.

Longs get stopped out.

Candle prints a long wick.

Market reverses into an uptrend.

This is where smart traders enter— after the trap is set, not during.

🔵 Final Thoughts

Liquidity is the invisible hand of the market. Stop hunts aren’t personal—they’re structural. Big players simply go where the orders are. As retail traders, the best thing we can do is:

Understand where traps are set.

Avoid being part of the crowd.

Trade the reaction, not the initial breakout.

By thinking like the smart money, you can stop getting hunted—and start hunting for better trades.

Liquidity Hunt PatternLiquidity Hunt Pattern

Uncover Hidden Opportunities in the Market

Introduction:

The Liquidity Hunt Pattern is a powerful technical analysis tool that helps traders identify potential turning points in the market. By understanding how this pattern forms and its implications, traders can gain an edge in uncovering hidden opportunities and making informed trading decisions.

What is the Liquidity Hunt Pattern?

The Liquidity Hunt Pattern is characterized by a series of price movements that create a distinct "W" or "M" shape on the chart. This pattern forms when large institutional players, known as "liquidity providers" enter the market to buy or sell large quantities of assets. Their actions create temporary imbalances in supply and demand, leading to price swings that can be exploited by astute traders.

Identifying the Pattern:

The Liquidity Hunt Pattern consists of three key elements:

The "W" or "M" shape: This is the most recognizable feature of the pattern and is formed by a series of price swings that create the distinctive letter shape.

Volume spikes: The pattern is often accompanied by significant volume spikes, indicating the presence of large institutional activity.

Breakout or breakdown: The pattern typically resolves with a breakout or breakdown, signaling a potential change in the market direction.

Trading the Liquidity Hunt Pattern:

Traders can use the Liquidity Hunt Pattern to identify potential entry and exit points for their trades. By understanding the dynamics of the pattern, traders can:

Anticipate potential turning points: The pattern can signal potential reversals or continuations in the market trend.

Identify high-probability trading setups: The pattern can be used to identify areas where the risk-reward ratio is favorable.

Manage risk effectively: The pattern can help traders set stop-loss and take-profit levels to manage their risk exposure.

Conclusion:

The Liquidity Hunt Pattern is a valuable tool for traders of all levels. By understanding its formation and implications, traders can gain an edge in the market and uncover hidden opportunities for profitable trades.

Liquidity - How to easily spot it!Here's how you can easily use liquidity to create wealth 🤑

Knowing how to identify liquidity is an important aspect of trading that shouldn't be overlooked, BUT contrary to popular belief, it's not the greatest thing since sliced bread...

It does have its significance and it's place, but understanding WHY "liquidity" is formed is more important than the WHERE ...

Once you know why, you can slay hard every single day!

Follow me for more educational posts and market analysis:)

Anyway, that's all for now,

Hope this post helps and as usual...

Happy Hunting Predators

🦁🐯🦈

How to find Key Price Action zones for Daytrading successPrepping a market for daytrading is an important part of my process and understanding and identifying the KEY LEVELS is the major part of that process.

We have to build a Price Action picture of what may happen and what levels may be targeted so we will be ready for a trade. Understanding who (buyers or sellers) is getting caught off side and levels the market is targeting, will set us up for the higher probability trades.

I discuss a few key concepts for Intraday trading and how I identify the important zones. I show some trade examples and high probability trade zones.

** If you like the content then take a look at the profile to get more daily ideas and learning material **

** Comments and likes are greatly appreciated **

Mastering Liquidity in Trading: Unraveling the Power of SMC 🔥Liquidity is what moves the market. Liquidity and liquidity pools are created and targeted by the markets and a lack of understanding on this topic is the main reason why the trading mind fails even if the analyst mind is correct. Traders who have been victim to their stop losses being taken by a wick before price running in their favour are the perfect example of having the correct analytical mind but a weak trading one.

Liquidity is unlike an order block or price inefficiency or anything else that can be physically identified on a chart. It is invisible, however, it is still possible to identify without the need of indicators or anything other than price action alone.

Simply put, liquidity is money in the market. Typically, this money comes in the form of retail orders and stop losses. Knowing this allows us to understand that if the market targets liquidity, and liquidity comes in the form of retail stop losses, the market must be hunting and going against retail strategies.

🟢The first and most prominent of these retail strategies is the idea of support and resistance. On the chart we can see an example of what retail traders would refer to as a level of resistance. In doing this they would short price from this level expecting a move down. This creates a liquidity pool just above this ‘resistance level’ where the average retail trader would place their stop losses. This liquidity pool is now a target for the market. So instead of trading this move down, we wait for the liquidity grab and use the rest of this strategy to capitalise on the bearish move that we can expect.

On the Chart is a demonstration of the market hunting liquidity before making its next move. Again this is where traders would be correct in terms of bias but incorrect in terms of trading.

This is an example of what an informed chart looks like. Instead of highlighting support and resistance levels, we highlight equal lows and equal highs respectively. Equals are usually in the form of otherwise referred to double tops or double bottoms but can also be more than that. The key difference, however, is that we would anticipate the market hunting the liquidity above the equal highs and below the equal lows. Due to this, we avoid being a victim to the market stopping us out by a wick and falling in our direction.

The second most prominent retail strategy or idea is the trend-line. Every time a trend-line formation is present within the market, we can now understand the amount of stop losses and, therefore, liquidity that would be sitting under this ‘trend-line’.

Above is an example of the importance of recognising trend-line liquidity. Once the liquidity above the equal highs has been hunted, we need to establish the next liquidity pool in the market. Seeing a break above the ‘resistance level’ would be seen as a ‘bullish breakout’ by the average trader. However, we can identify that as a liquidity purge and higher high, in which case we can expect a higher low to be made - which would mean a bearish retracement.

On top of this, we can see a build up of trend-line liquidity just above the discount end of the parent price range. This gives us an added confluence and confidence in the fact that we can expect lower prices with the liquidity underneath the trend-line as our first target.

Above is an example of liquidity being grabbed on the bullish side (above the equal highs) sending the uninformed trader long based off of a ‘bullish breakout’, then hunting the liquidity on the bearish side (below the trend-line) and sending the uninformed trader short based off of the break of the trend-line. This is typical of the market - it shakes out impatient and uninformed traders on both sides of the market before making the actual move.

Here is another examples of how trendline liquidity gets purged by the market. On the chart we can see a trend-line where many traders would be longing the market, unaware that they will be victims of a liquidity purge.

Below we can see that liquidity purge below the trend-line which would send the average trader short. Using the rest of the strategy, we are able to understand that price will react from specific levels to go long

Below we can see the completion of this market cycle with our levels being respected and the real bullish leg being made.

🔥🟠🔥🔥🟠🔥 BONUS CHEATSHEETS👇👇👇👇

LESSON 1: TRADE THE LIQUIDITY OR BE THE LIQUIDITYWhat is Liquidity in Forex Trading?

Liquidity is the presence of orders at specific prices in the market, ensuring that transactions can take place without disruptions. When traders talk about liquidity, they are usually referring to the resting orders in the market. These orders can be absorbed or targeted by banks and financial institutions (BFIs) to influence the patterns of price movement. Liquidity can be found throughout the market, although certain areas may have higher levels than others. The good news is that it is indeed possible to learn how to identify and recognize liquidity patterns.

Liquidity comprises a variety of orders that gather in the market, including limit orders, stop loss orders, and stop limit orders. These orders come into play when prices reach specific levels of supply or demand in the market. Understanding liquidity is essential in comprehending how prices move.

Why do you need to understand Liquidity?

Liquidity is crucial for predicting price movements. Analyzing liquidity, along with market structure, supply and demand, and order flow, provides insights into potential price directions. It's important to consider liquidity alongside trend analysis and supply and demand to understand market conditions effectively. Highly liquid markets can be manipulated by large banks or institutions, leading to liquidity shortages, price slippage, and poor trade execution. Recognizing liquidity pools during slow sideways price movements is key.

What are the main types of Liquidity in Forex trading?

1. Buy-side liquidity (see chart for example)

Buy-side liquidity refers to the accumulation of orders above a range or high, including buy-stop limits and stop losses placed by sellers and breakout traders. Banks and financial institutions (BFIs) may target these orders to fuel temporary or sustained bullish price movements.

2. Sell-side liquidity (see chart for example)

Sell-side liquidity refers to the collection of orders situated below a range or low, including sell-stop limits and stop losses placed by buyers and breakout traders. Banks and financial institutions (BFIs) can target these orders to generate temporary or sustained bearish price movements. Similar to buy-side liquidity, sell-side liquidity serves a crucial role in the market dynamics.

Do you have any questions? feel free to ask.

Cheers,

David

📊Liquidity GrabSmall and big players tend to acquire larger positions in the market than they can afford, in an attempt to benefit from the leverage. This is where the concept of liquidity grab comes into play. Large trades and institutional investors need to locate liquidity areas in the market to complete their trades. Stops and stop-loss orders are critical for survival in a leveraged market. Stop hunting is a common practice in Forex trading, where traders are forced to leave their positions by triggering their stop-loss orders. This can create unique opportunities for some investors, which is called a liquidity grab. Stop hunting is a trading action where the price and volume action threatens to trigger stops on either side of support and resistance. When a large number of stops are triggered, the price experiences higher volatility on more orders hitting the market. Such volatility in price generates opportunities for participants to enter a trade in a favourable environment or protect their position. The fact that too many stop losses triggered at once result in sharp moves in the price action is the reason behind the practice of liquidity grab.

📍 What is liquidity sweep?

In trading, a liquidity sweep is the process of filling an order by taking advantage of all available liquidity at multiple price levels. Traders use this method to ensure their orders are filled at the best possible price by breaking up their order into smaller sub-orders and spreading them across multiple price levels. Institutional traders and high-frequency trading firms commonly use liquidity sweeps for efficient and quick execution of large trade volumes.

📍 Liquidity Zones

Big players in trading aim for the best prices but face challenges finding sufficient counter-forces to fill their large orders. Entering the market at low liquidity areas creates more volatile markets, negatively impacting the average price. Conversely, entering at high liquidity areas results in less volatile markets, ensuring a better average price for the position. These liquidity zones are where stop-loss orders are placed, and the concept of "liquidity grab" comes from the need for big players to enter the market in these zones to take large positions. Traders use swing lows and swing highs to create these liquidity zones and place stops as reference points, resulting in either a reversal to the mean or a breakout of the level.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

CONSOLIDATION RANGE AND WHAT IT MEANSThere is a trick that market makers use and that is to create consolidations in order to induce retail entries. In text book practice, retail traders will always view a resistance or support level that has been tested more than once as a strong area to do entries because they feel it will hold price. As a result they put stop losses above or below the entry and these stop losses increase as market makers consolidate and incubate more retail traders entries. Remember market makers need these stop loss pools in order for them to open their huge positions so afterwards, they will run these stop losses, enter their orders and inject liquidity to move price very quickly. So beware not to buy at the current NZDUSD equal lows. You'll be trapped!

LIQUIDITY RUNSLiquidity runs occurs when price gives a false break out below a support or above a resistance and the purpose is usually to take out the stops or liquidity lying around those areas. This liquidity is then used by market makers to open their large positions in the opposite directions. When a false break out occurs below a support, stop losses belonging to retail traders are wiped out and retail break out sellers get trapped. The opposite happens at a resistance level. Liquidity run is my favorite strategy when I'm anticipating market reversals or at times retracements like what happened with dollar pairs yesterday (5th Dec 2022).

You Should Know Importance of Asian Range! Asian Range is very important when we want to talk about liquidity concepts in general.. Most importantly, Liquidity Grab ..

First have a daily bias .. then use Asian Range's high and low to determine sellside/buyside liquidity.. Wait for London Open Killzone and search for a FVG ..

Let me know your thoughts in comments 🤠

Asian Range | Liquidity Trap | FVG & London OpenHey folks I hope you're all good and making some good untraditional profits 😉

Here is a model that you will find few days every trading week!

{Terms used in this Idea}

Asian Range:

a time span from 19:00 to 00:00 NY Time that forms every day except for Mondays.. Usually price taking of Asian Range's high or low means liquidity is taken and price "could" reverse short-term if that agrees with our daily bias..

London Open:

Time span from 02:00 to 05:00 NY Time when the market is very acrive. Price usually forms high or low of day during London Open..

FVG:

Fair value gab is a gab that forms between two candles separated by a third candle forming the gab (blue-shaded boxes on chart)

If you found that useful give it a ♥️LIKE♥️

💙Thank You💙

Glad to hear from you in comments✍️

London Open Killzone Liquidity Build and FVG Hello Traders! What I shared with you happens on most days of the week and is a super easy way to get trdaes that are highly probable..

London Open Killzone time is: from 3:00 AM to 5:00 AM New York Time.. (though it could extend a bit further)..

What we should be looking for is this scenario:

We have a clear liquidity area..(single or double lows/relative equal lows) and time is London Open Killzone and we have reached liquidity area.. on this case we expect price to reverse and we look for a confirmation (in this case a "Fair Valie Gab")..

Note that:

I recommend using 15-min chart to spot liquidity area and for looking at how price is performing..

And once we get into a liquid area, we should go lower (5-min_1-min) charts to look for FVG..

Hope you find this helpful 😃

Let me know your thoughts in comments I would be happy..

Be Well All!

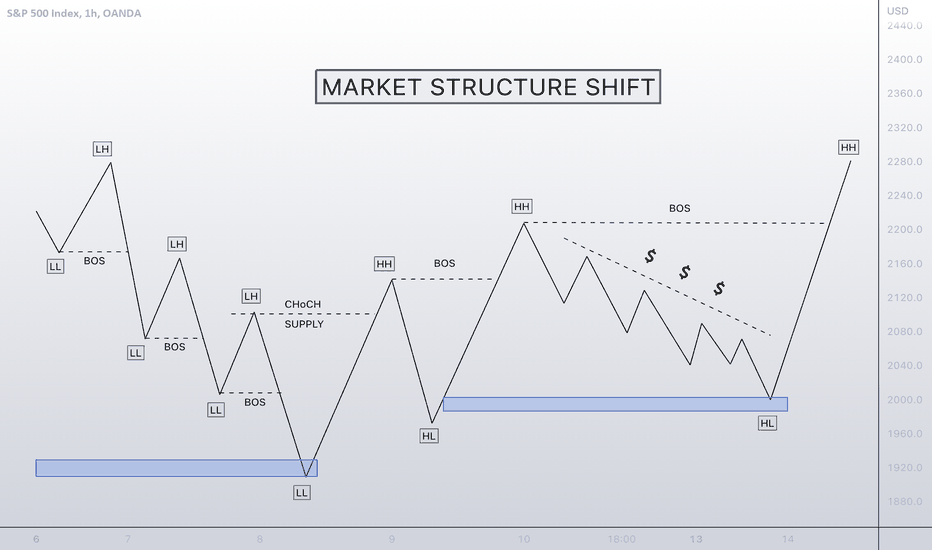

🤓 🤓 MARKET STRUCTURE SHIFT! SMCMarket structure in Forex trading or price action is how many people take advantage of the markets. No indicators, and no volume. Because the market does not have a centralised exchange. Forex traders often swing trade the market based on the structure to take advantage of the opportunity.

Structural market change is broadly defined as a shift or change in the way in which a market or economy functions or operates.

I have tried my best to show you in the easiest possible way to look out for. Save this to your notes for future reference.

🤓 🤓 DON'T TRADE FROM THIS ZONE!I have tried to make this example as simple as possible to understand for anyone that are not too familiar with liquidity hunts.

Always look for were the most liquidity is accumulating then place your trade above or below were there has been a liquidity swoop, as long as it lines up correctly with what strategy you are using.

If you add this to your trading tool belt this will improve your overall results.

Only Strategy You Ever Need! .. Liquidity Build&SweepHello everyone!

Liquidity is the main force that moves all markets, understand it well, and everything becomes clearer...

Liquidity, simply, is "where orders are resting". Sometimes it is clear, other times not. So you have to look really well into where we have relative equal highs (sell-side) or lows (buy-side).Does that mean to jump into buying below relative equal lows/selling above relative equal highs right away? Of course no. As explained above, most of the time we have an indication as to whether the Market is responding as it shouldmd or not. Like a rejection or multiple rejections or a candle pattern or whatever.. you should see and indiction in price action, not indicators. Also pay attention to time frames. Equal highs/lows should not be treated the same way in small and big time frames... At least 15-min timeframe is recommended...

Your comments are highly appreciated...

Please don't forget to ▶️ FOLLOW & ▶️LIKE if you found my tutorial a help to you... Great content is to come yet.. hopefully..

Thanks Guys!

The Liquidity GrabI'm going to do my best here at explaining the basics around a liquidity grab (some times called a stop hunt), why it happens and how it works (ignore the chart I'm using, I'm not saying this is a manipulated move just showing you an example of how it works)

I often refer to this in my playbook as an STL "Sweep The Legs" coupled with a picture of Johnny Lawrence from the karate kid lol

First you need to understand that Big money plays a different game to retail.

When you want to place a buy order at a specific price point, lets say your buying a thousands dollars worth of BTC @ $30,000, you can put an order in and boom it gets hit your filled and your ready to go to the moon.

Now imagine some bigger traders who play with a lot more money than you, lets say there order is more like a billion dollars.

Well in order for them to fill there position, there needs to be a large amount of selling at that level other wise they may only get a small piece filled...... theeeeeen of course the price moves away and your priced out of the market (imagine putting your $1000 order in, only getting $10 of it filled and then having the price moon....yeah it would suck)

They do not want to chase candles or buy up the order book, thats just not good business, and if you have to do that in order to get your orders filled thats a good indication that there is already liquidity issues within this market and you may have a similar problem trying to cover of your position later on.

So these players some times need to hunt down and find or even artificially create liquidity pools for them to take a big bite at like pigs at the trough.

One of the easiest ways to do that is to look for the most obvious levels of support with in a trend of sideways channel and look at the buying thats happening on that level.

If we dont get an instant recovery or bounce at that level it can normally indicate price being trapped or held down in order to encourage more retail to "buy the dip" or buy on support as these are some of the most basic tools and strategies taught to retail traders.

Now one thing to remember when all of these traders/investors are in there positions from this level, there will be a large number of these traders protecting capital with stop losses, normally under the level they where buying at.

This now created a liquidity pool...... You see every stop loss on a BUY order, becomes a SELL order, and with so many BUY orders created and entered at a specific level that means the stop loss orders are stacking more and more on top.

Think about it like this, if we hit 30k and someone buys $1m worth, that means there is possibly a SELL order (via a stop loss) of roughly 1m under that level.... now we hit that 30k level again, and someone buys some more, maybe another $1m worth... well now there is roughly $2m worth of SELL orders in that stop loss zone. Hit that 30k super sweet safe support level 5 or 6 times and all the sudden you could have 8-10m worth of SELL orders at a single price point below support.

Now if I wanted to enter this market long and I had 10m order to fill, it would make sense for me to run the price down to clip these stop losses creating a large amount of selling straight into my pig of a buy order.

Once my orders filled I can stop holding the price down and let the price begin to organically rise again, this often creates fomo for all the retailers who just got knocked out of there trades from "tight stop losses" to chase the market back in only adding to the momentum and mark up of my position.

The same thing can happen in vice versa when they are covering or exiting a position as well, and its often followed by a square up to reduce or remove the risk taken on to manipulate the price during there accumulation or distribution of there order, more specially into a short position as they take on more exposure to the underlying asset to manipulate the price, in a long there exposure is fiat and there isnt any need to cover. (ill explain square up in detail next time)

This is often what is referred to as a liquidity grab and its how big players enter the market, they do not chuck a limit order in on Binance and hope for the best...

I hope that made sense and added some value, but if you have any questions please chuck them below