How to Avoid Falsa Breakouts and Breakdowns?Hello traders, today we will discuss how to Avoid Fails Breakouts and Fails Breakdowns.

Have you ever witnessed a significant resistance level being broken and opened a long trade just before the market made a sharp move to the downside?

Have you ever entered a short position after seeing the price break-through support only to watch the market rebound?

You are one of many false breakout victims, so don't feel bad. It might be challenging to learn how to recognise these things.

Continue reading as we talk about fakeouts and breakouts and introduce two potent indications from the @CRYPTOMOJO_TA team that can assist you in staying on the right side of the market and avoiding more suffering.

As shown above, the answer to this issue is actually quite straightforward. Waiting until the candle closes to determine the strength of the breakout is preferable to acting on trade as soon as the price breaks a crucial level. Therefore, it is not a good idea to position entry orders above or below support or resistance levels in order to automatically enter a breakout trade. Entry orders allow us to become "wicked" into breakout trades that never occur.

This indicates that the only way to successfully trade breakouts is to be seated in front of our trading terminals and prepared to take action as soon as the candle closes in the breakout zone. When the candle goes out, we can

How to avoid a false breakout

It can be almost impossible to tell a true breakout from a failed break if you don’t know what you’re doing. Here are four ways to avoid a failed break:

Take it slow

One of the simplest ways to avoid a false breakout is also one of the most challenging for many traders and investors – to simply wait. Instead of buying into the trend the moment your asset breaks through its support or resistance level, give it a few days (depending, of course, on your trading style and its timeline) and watch as, often, the failed breaks simply weed themselves out.

Watch your candles

A more advanced version of waiting it out, a candlestick chart can come in handy. When you suspect a breakout is happening, wait till the candle closes to confirm its strength. The stronger the breakout appears, the more likely it’s not a failed break.

While this can be an effective way to identify false breakouts, many traders and investors don’t have the time to sit and watch their chosen chart around the clock. That’s why, with us, you can set alerts to notify you of the specific market conditions you’re waiting for. In the case of a breakout, for example, you’d create an alert based on the candle’s close price, to notify you of any potential breakouts.

Use multiple timeframe analysis

Another efficient way to identify breakouts, and what of those are likely failed breaks, is multiple timeframe analysis. This entails watching your chosen market using a variety of different timeframes. When using this technique, you’d likely spot the potential for a breakout in the short term, then ‘zoom out’ to view that same market over a week, a month or even longer before opening a position.

This helps with identifying a false breakout because you’re paining perspective of your asset over both the longer and shorter term. Studying its patterns can show if what you think is a breakout is actually significant in the context of that market.

Know the ‘usual suspects

Some patterns in charts can indicate the likelihood of a false breakout. These include ascending triangles, the head and shoulders pattern and flag formations.

Learning how to identify these patterns can help you to tell the difference between a breakout and a false breakout, as these three formations are often associated with failed breaks. For example, ascending triangles are indicators of a temporary market correction, rather than a true breakout.

How to trade a false breakout

If you’re a trader, you may want to use a false breakout as an opportunity to go short, making a profit or loss from predicting that a market’s price is about to drop from its current high. Or, you could use it as an opportunity to hedge – going long in case it’s a true breakout and going short on the same market in case of a failed break.

To trade a false breakout you’d:

Create a live CFD trading account

Do technical analysis on your chosen market to identify false breakouts

Take steps to manage your risk, including stop orders and limit orders

Open and monitor your first trade

How to trade breakouts

Here’s how to trade breakouts with us:

Create a live account or practise first with a demo account

Learn the signs of a market about to break out – you can find out far more about breakouts by upskilling yourself on IG Academy

Open your first position

Plan your exit from the position carefully, including setting stop orders and limit orders

Take steps to manage your risk

Everything you need to know about trading breakout stocks

False breakouts summed up

A false breakout is a significant movement out of a market’s normal support or resistance levels that don’t last – hence it ‘fails’

These can cause costly mistakes for traders, thinking a market has hit a true breakout and to go long, only for it to lose momentum shortly afterwards

You can avoid false breakouts – or trade them intentionally – by studying your chosen market and knowing the chart patterns timeframes and other signs of a failed break

With us, you can trade on breakouts and failed breaks using CFDs.

This chart is just for information

Never stop learning

I would also love to know your charts and views in the comment section.

Thank you

Patterntrading

Easy-to-Spot Bullish Forex PatternsHi Traders, Investors and Speculators 📈📉

Ev here. Been trading crypto since 2017 and later got into stocks. I have 3 board exams on financial markets and studied economics from a top tier university for a year. Daytime job - Math Teacher. 👩🏫

For the biggest part, I prefer to trade reactive rather than predictive. Chart patterns really come in handy with this strategy. Here are my top easy to spot chart patterns, specifically focused on bullish chart patterns today. The green highlight dots are to help identify the margins of the pattern and the purple highlighted dot is where a long entry can be taken.

While you're here 👀 See this related idea on EURUSD from the monthly timeframe:

_______________________

📢Follow us here on TradingView for daily updates and trade ideas on crypto , stocks and commodities 💎Hit like & Follow 👍

We thank you for your support !

CryptoCheck

📉Bearish Reversal Patterns & Showcase📉What are Reversal Patterns?

In trading, candlestick patterns are used to analyze the behavior of the market and identify potential opportunities to enter or exit a trade. Reversal patterns and continuation patterns are two types of candlestick patterns that traders look for.

Reversal patterns are characterized by a change in the direction of the trend. These patterns indicate that the market is likely to reverse its direction and move in the opposite direction. In contrast, continuation patterns signal that the trend is likely to continue in the same direction after a temporary pause or consolidation.

Reversal patterns usually take longer to form than continuation patterns because it's easier for the market to continue moving in the same direction than to change course. For example, if sellers are pushing the market lower, it takes more effort for buyers to turn the market around and initiate an uptrend.

A reversal pattern may occur after a period of strong selling or buying pressure, as traders become exhausted or the market reaches a key support or resistance level. Once this happens, traders who missed the initial move may see an opportunity to enter a new trade in the opposite direction of the previous trend.

However, for a reversal pattern to be considered valid, there must have been a previous trend in place. A sideways market cannot be classified as a reversal because it doesn't reflect a change in trend direction. Traders typically look for confirmation of a reversal pattern, such as a breakout from a trendline or a significant price movement in the opposite direction of the previous trend.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

📊 Diverse Chart ApproachesHere is a diverse chart approach for trading that includes some tips:

📍 Use multiple timeframes:

Analyzing charts at different timeframes (e.g., daily, weekly, monthly) can provide a broader perspective on market trends and potential trading opportunities.

📍 Combine chart types:

Using different types of charts, such as line, bar, and candlestick charts, can provide different insights into price action and help identify support and resistance levels.

📍 Apply indicators:

Technical indicators, such as moving averages and oscillators, can be applied to charts to identify potential entry and exit points, as well as confirm price trends.

📍 Incorporate chart patterns:

Chart patterns, such as triangles, flags, and head and shoulders, can be used to identify potential price breakouts and reversals.

📍 Use trendlines:

Drawing trendlines on charts can help identify potential areas of support and resistance, as well as indicate trend direction.

📍 Keep it simple:

While it's important to use a diverse range of charting techniques, it's also important not to overload charts with too much information. Keeping charts clean and easy to read can help avoid confusion and lead to more effective trading decisions.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

📉 4 Common Bearish PatternsIn trading, a bearish pattern is a technical chart pattern that indicates a potential trend reversal from an uptrend to a downtrend. These patterns are characterized by a series of price movements that signal a bearish sentiment among traders.

📍Bear Flag

🔸 A small rectangular pattern that slopes against the preceding trend

🔸 Forms after a rapid price decline (flagpole)

🔸 The pattern is completed when the price breaks below the lower trend line of the flag

📍Descending Triangle

🔸 A bearish continuation pattern that forms with a horizontal support line and a descending trendline

🔸 Forms as the price reaches lower highs, while the lows remain at the same level

🔸 The pattern is completed when the price breaks below the horizontal support line

📍Rising Wedge

🔸 A bearish reversal pattern that forms with a series of higher highs and higher lows

🔸 The pattern forms as the price moves up in a narrowing range

🔸 The pattern is completed when the price breaks below the lower trendline

📍Triple Top

🔸 A bearish reversal pattern that forms with three peaks at the same price level

🔸 The pattern forms as the price reaches resistance at the same level multiple times

🔸 The pattern is completed when the price breaks below the support level, which connects the lows between the peaks

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

📊 Chart Pattern CheatsheetChart patterns are visual representations of a stock's price movement over time. These patterns can provide traders with information about the stock's trend, momentum, and potential future direction. Continuation and reversal patterns are two types of chart patterns that traders use to identify potential entry points. When considering entry points for both continuation and reversal patterns, traders often use a combination of technical indicators and price action analysis. They may use tools such as moving averages, oscillators, and trendlines to confirm a pattern's validity and identify potential entry points. Additionally, traders may set stop-loss orders to manage risk and limit potential losses.

🔹 Continuation patterns

Continuation patterns are chart patterns that suggest that the current trend will continue. They occur when the stock price consolidates in a certain range, showing a temporary pause in the trend. Some common continuation patterns include triangles, flags, and pennants. Traders may look to enter a long position when the stock price breaks out of the pattern, typically on higher than average trading volume.

🔹 Reversal patterns

Reversal patterns, on the other hand, suggest that the current trend is likely to reverse. These patterns occur when the stock price has reached a high or low point and is likely to move in the opposite direction. Some common reversal patterns include head and shoulders, double tops and bottoms, and the "V" pattern. Traders may look to enter a short position when the stock price breaks below a support level or the neckline of a pattern.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

What Trading Consolidation Looks Like?Should you trade consolidation? Well, the real question is are you a consolidation trader? If so, what does consolidation trading look like to you?

Not all traders will have the same answer because no trader knows when consolidation will form until it happens. What you will do when it happens is solely based on what you believe to be true based on your beliefs about trading and your trading strategy.

What is a market condition?

A market condition is a type of way the market moves. Much like the weather outside, you dress based upon the temperature outside and you choose your style of clothing.

You can't control the weather, but you can control what you do. Much like you can't control how price moves, but you can control how you trade it.

The way price moves determines the strategy you choose to trade it based on your trading style.

When consolidation begins forming you may notice a few things such as:

1. Its hard to gauge the price direction

2. Price moves sideways between an extreme high and low for an extended amount of time

3. You may be stopped out more often or have to wait longer before placing a trade if you are a trend or breakout trader

4. You may trade well within the ranges of crazy price movement in between the extreme high and low prices.

The bigger question to ask yourself when you notice consolation forming is do you do well in this type of market?

If so, what are the steps to trading this type of condition?

Do you look place horizontal trend lines?

Do you look for patterns such as wedges or flags.

If no, the current currency pair or asset will be best to ignore til it begins to trend again in your favor. What will that look like?

Is it a break out of the horizontal trend lines?

Is it a break out of your pattern?

Either way, as a trader, it's best you determine what consolidation looks like to you and decide to trade it or not to trade it. Construct steps around how you trade it and position your risk size according to this type of condition.

For me myself personally, I do not trade consolidation. I am a trend trader and my motto is, if I'm not in the trade before consolidation forms, I'm not trading at all.

I also don't create consolidation strategies. Thats just me personally. It helps with me mental capacity and keeps me focused on what works for me.

I'd like to know, do you trade consolidation and if so, whats your best strategy.

Lastly, thank you for reading my post. Be sure to like it. It lets me know you enjoy reading what I love talking about in my free time, trading. ❤️

📊 Chart Patterns Cheat SheetPatterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis.

A pattern is identified by a line connecting common price points, such as closing prices or highs or lows, during a specific period.

Technical analysts seek to identify patterns to anticipate the future direction of a security’s price.

These patterns can be as simple as trendlines and as complex as double head-and-shoulders formations.

🔹 Reversal patterns are those chart formations that signal that the ongoing trend is about to change course.

If a reversal chart pattern forms during an uptrend, it hints that the trend will reverse and that the price will head down soon.

Conversely, if a reversal chart pattern is seen during a downtrend, it suggests that the price will move up later on.

🔹 Continuation chart patterns are those chart formations that signal that the ongoing trend will resume.

Usually, these are also known as consolidation patterns because they show how buyers or sellers take a quick break before moving further in the same direction as the prior trend.

Trends don’t usually move in a straight line higher or lower. They pause and move sideways, “correct” lower or higher, and then regain momentum to continue the overall trend.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

🔠 The ABCD PatternThe ABCD is a basic harmonic pattern. All other patterns derive from it. The pattern consists of 3 price swings. The lines AB and CD are called “legs”, while the line BC is referred to as a correction or a retracement. AB and CD tend to have approximately the same size. A bullish ABCD pattern follows a downtrend and means that a reversal to the upside is likely. A bearish ABCD pattern is formed after an uptrend and signals a potential bearish reversal at a certain level. The rules for trading bullish and bearish ABCD patterns are the same, you will just need to take into account the direction of the pattern you trade and the movement of the market it predicts.

🔷Classic ABCD

The point C should be at 61.8%-78.6% of AB. The point D, in its turn, should be at the 127.2%-161.8% Fibonacci expansion of BC.

Notice that a 61.8% retracement at the point C tends to result in the 161.8% projection of BC, while a 78.6% retracement at the C point will lead to the 127% projection.

🔷AB = CD

Here CD has exactly the same length as AB. In addition, it takes the market the equal time to travel from A to B as from C to D. As a Result, AB and CD have the same angle. This type of ABCD pattern is seen quite often and is popular among traders.

🔷ABCD Extension

ABCD extension refers to when CD is the 127.2%-161.8% extension of AB. CD can be even 2 times (or more) bigger than AB. There actually are some signs that can hint that CD will be much longer than AB. They are a gap after point C or big candlesticks near point C.

📊Trading with ABCD pattern

The key thing you should remember is that you can enter the trade only after the price reached the point D.

Study the chart looking at the price’s highs and lows. It may be helpful to use ZigZag indicator (Insert – Indicators – Custom – ZigZag) that marks the chart’s swings.

Watch the price as it forms AB and BC. In a bullish ABCD, C must be lower than A and should be the intermediate high after the low at B. Point D must be a new low below B.

When the market arrives at a point, where D may be situated, don’t rush into a trade. Use some techniques to make sure that the price reversed up (or down if it’s a bearish ABCD).

The best scenario is a reversal candlestick pattern. A buy order may be set at or above the high of the candle at point D.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

📉📈 ZigZag IndicatorZigZag's primary goal is to focus on significant swings and trends by removing insignificant and misleading price changes.

ZigZag connects the price's highest and lowest points using straight lines while ignoring minor swings.

ZigZag just aims to make sense of the market's previous movements; it makes no attempt to predict the price of an item.

It is only based on hindsight and is not predictive in any way. It is based on the past prices of securities and cannot forecast the next swing highs and swing lows.

🟢Advantages

It eliminates market noise and displays the most significant price fluctuations.

It operates in several timeframes.

When utilized in cooperation with other technical indicators, it gives positive results.

🔴Disadvantages

It will mark the latest high or low of the price with a time lag.

The last stretch of the indicator (the one that involves the current price) may be redrawn.

Not predictive in any way, has to be used in combination of other strategies to be effective.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work , Please like, comment and follow

❌ False Breakout PatternsA breakout that failed to proceed past a level, leading to a "false" breakout of that level, is referred to as a "false breakout."

One of the most essential price action trading patterns to learn is the false double bottom and double top patterns,

as a false-break is frequently a very strong indicator that price may be changing direction or that a trend may soon resume.

False breakouts occur in all market scenarios, including trending, consolidating, and counter-trending.

Trading Tips To Respect:

✅False breakouts can happen in markets that are trending, range-bound, or going against the trend.

Watch for them in all market conditions since they frequently provide insightful hints about the direction the market will take.

✅Trading against a trend can be challenging, but one of the "best" approaches is to watch for a clear false breakout signal

from a significant support or resistance level, as in the last example above.

✅False breakouts provide us with a "window" into the "fight" between expert and amateur traders, allowing us to engage in trading alongside them.

Trading will appear to you in a different light if you can learn to recognize and trade false breakout patterns.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work , Please like, comment and follow ❤️

💎 Diamond Chart PatternAll financial markets, including the stock market, forex market, cryptocurrency market, and futures markets, feature diamond reversal patterns.

Compared to many other traditional chart designs, the diamond pattern is less frequent.

However, it's critical that you understand and recognize the pattern since, when it happens, it can present a great trading opportunity.

In general, a diamond top pattern that follows a rise in market prices offers a greater likelihood of a trade than a diamond bottom pattern that follows a decrease in market prices.

🟢 Bullish Scenario:

After a decline, a bullish diamond pattern known as a diamond bottom appears.

Typically, a diamond bottom is formed by a significant price decline followed by a consolidation phase that creates up and down swing points.

The appearance in this situation will resemble an upside-down head and shoulders design.

The structure's peaks and troughs will be connected in the same manner.

🔴 Bearish Scenario:

The diamond top typically occurs at the peak of significant uptrends.

It efficiently and accurately predicts imminent shortfalls and retracements.

By focusing on a head-and-shoulders structure and adding trendlines to the highs and lows, a diamond top can be found.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work , Please like, comment and follow ❤️

📊 Understanding the Cup and Handle PatternA cup and handle is a technical analysis pattern that appears on a chart as a U-shaped pattern, followed by a small downward drift, resembling a handle.

It is important to note that like all technical analysis patterns, the cup and handle pattern is not a guarantee of future price movements and should be used in conjunction with other analysis techniques.

📈Cup and Handle

It is considered a bullish pattern and is often used by traders to indicate the potential for an upcoming price increase.

The pattern is formed when the price of a security falls, reaches a bottom, and then rises back up to near its previous high before falling again. The downward drift that follows is the handle.

The pattern is considered complete when the price breaks through the resistance level (the top of the cup) and continues to rise. Technical traders using this indicator should place

a stop buy order slightly above the upper trendline of the handle part of the pattern.

📉Inverted Cup and Handle

After the cup forms and the beginning of a noticeable handle takes shape, begin to monitor trading volume closely.

One way to think of the inverted handle is a follow-up to an inverted cup. The inverted handle retraces the initial move, but not to the level of the original trend.

Once you see a retracement in the form of an inverted handle of the original inverted cup pattern, setting a stop loss while selling the trend could be a potential trade idea.

👤 @algobuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work , Please like, comment and follow ❤️

📈 4 Common Bullish Patterns🟢 RISING THREE

"Rising three methods" is a bullish continuation candlestick pattern that occurs in an uptrend and whose conclusion sees a resumption of that trend.

This can be contrasted with a falling three method. The first bar of the pattern is a bullish candlestick with a large real body within a well-defined uptrend.

🟢 FALLING WEDGE

The falling wedge pattern occurs when the asset’s price is moving in an overall bullish trend before the price action corrects lower.

Within this pull back, two converging trend lines are drawn. The consolidation part ends when the price action bursts through the upper trend line, or wedge’s resistance.

🟢 BULL PENNANT

A pennant is a type of continuation pattern formed when there is a large movement in a security, known as the flagpole, followed by a consolidation period with converging trend line.

Pennants, which are similar to flags in terms of structure, have converging trend lines during their consolidation period and last from one to three weeks.

🟢 ASCENDING TRIANGLE

An ascending triangle is a chart pattern used in technical analysis. It is created by price moves that allow for a horizontal line

to be drawn along the swing highs and a rising trendline to be drawn along the swing lows. The two lines form a triangle.

Traders often watch for breakouts from triangle patterns. The breakout can occur to the upside or downside

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work , Please like, comment and follow ❤️

HEAD AND SHOULDERS PATTERN - TRADING GUIDE Head and Shoulders pattern

This lesson will cover the following

What is a “Head and Shoulders” formation?

How can it be confirmed?

How can it be traded?

The Head and Shoulders pattern forms after an uptrend, and if confirmed, marks a trend reversal. The opposite pattern, the Inverse Head and Shoulders, therefore forms after a downtrend and marks the end of the downward price movement.

As you can guess by its name, the Head and Shoulders pattern consists of three peaks – a left shoulder, a head, and a right shoulder. The head should be the highest and the two shoulders should be at least relatively of equal height. As the price corrects from each peak, the lows retreat to form the so-called neckline, which is later used for confirming the pattern. Here is what an H&S pattern looks like.

Other key elements of this pattern and its trade process are the breakouts, protective stops, profit target, and volume, which is used as an additional tool to confirm the trend reversal. So here is how you identify the Head and Shoulders pattern and how its individual components are characterized.

Formation and confirmation

In order to have a trend reversal pattern, you definitely need a trending market. Let's talk about the first model of H&S, the Inverse or Reversal will have the same methodology but exactly in the opposite way.

While prices are trending up, our future patterns left shoulder forms as a peak, which marks the high of the current trend. For the shoulder to be formed, the price then needs to correct down, retreating to a low, which is usually above or at the trend line, thus, keeping the uptrend still in force. This low marks the first point used to determine where the neckline stands.

Afterward, a new higher peak begins to form, stemming from the left shoulder low, which is our pattern head. As the market makes a higher high (the head), it then corrects back and usually, this is the point where the upward trend is penetrated, thus signaling a shift in momentum and a possible Head and Shoulders pattern.

The second low that is touched after the retreat from the heads peak is the other point used to build the neckline, which is basically a line drawn through the two lows.

The subsequent rebound from the second low forms the third peak – the right shoulder. It should be lower than the head and overall match the height of the left shoulder (keep in mind that exact matches rarely occur). It is also preferable that the two shoulders have required relatively the same amount of time to form as this would make the pattern stronger.

In order for the Head and Shoulders pattern to be confirmed, the retreat from the third peak (the right shoulder) should penetrate the neckline and a candle should close below it.

The neckline itself should be horizontal in the perfect case scenario, but that rarely happens. Instead, most often it is sloping up or down and that is of significance as well – a downward-sloping neckline is more bearish than an upward-sloping one.

Volume

As mentioned above, volume plays a key role as a confirmation tool and can be measured via indicators or by just analyzing its levels. Presumably, volume during the left shoulder advance should be higher than during the subsequent one, because as the head hits a higher high on the base of declining volume, this serves as an early signal for a possible reverse. This, however, does not happen every time.

The next step of confirmation comes when volume increases during the decline from the head's peak and the last nail in the coffin are when volume gains further during the right shoulder's decline.

Trading the pattern, stops and profit targets

We said earlier that the Head and Shoulders pattern is deemed confirmed if the right shoulder's decline penetrates through the neckline and a candle closes below it. As soon as that happens and you are reassured that it is not a false breakout, you can enter into a short position. However, as you already know, no trading decisions should be made on the go, i.e. you need to have predetermined where your protective stop is going to stand and what your profit target is.

Protective stop

There are two common places where you can place your stop loss. The first one, which is more conservative, is right above the peak of the head, while a more standard position is right beyond the right shoulder. You can see those visualized in the following screenshot.

The second option makes more sense because if the breakout through the neckline actually fails and the price rebounds back with such momentum that it rises beyond the right shoulder, then the whole pattern is flawed and you definitely do not need to wait for it to exceed the head as well. Besides, such a loose stop significantly increases the risk and reduces the risk/reward ratio, thus, reducing this pattern's trading appeal.

Profit target

The most common and often advised profit target is the distance (number of pips) between the head's peak and the neckline. Having estimated that distance, you then need to subtract it from the neckline, just like in the screenshot below.

And how does that translate in terms of risk/reward ratio? If the breakout confirmation (the close beyond the neckline) appears very close to the neckline itself, and we enter into a short position there, we generally have a 1:1 risk-to-reward proportion, if we use a conservative protective stop. Why?

Since our profit target is the distance between the heads peak and the neckline, if we decide to use the conservative option for a protective stop, then we will have the same distance as a loss limit, thus, reducing our risk-to-reward ratio to 1:1.

This is why, in order to improve that ratio, most experienced traders place their protective stops more often above the right shoulders peak, given that they use the head-to-neckline profit target.

However, keep in mind that this price distance should serve as a rough target, because things are usually not that straightforward and other factors such as previous support levels, crossing mid-term and long-term moving averages, etc. must be taken into consideration as well.

Two ways to trade the Head and Shoulders Pattern

There are generally two ways to trade this pattern, depending on how it plays out. The first one we've already mentioned. As soon as a candle closes below the neckline as a sign of confirmation, you enter into a short position with the respective profit target and protective stop described above.

Now for the second way to trade the H&S formation. In this case, we have a pullback after the neckline penetration, which, once support, now acts as a resistance level. This time we need to go short once the price pulls back and tests the neckline as resistance. As soon as it rebounds from the neckline, we enter into a short position, using the same principle for placing the protective stop and aiming for the same profit as in the first scenario. Here is what this would look like.

Learn Cup & Handle Pattern | Profitable Trading Strategy For Beg

A Cup and Handle is a bullish continuation chart pattern that marks a consolidation period followed by a breakout.

Chart patterns form when the price of an asset moves in a way that resembles a common shape, like a rectangle, flag, pennant, head and shoulders, or, like in this example, a cup and handle.

There are two parts to this chart pattern:

The cup

The handle

The cup forms after a downtrend and is followed by an uptrend and looks like a bowl or rounding bottom.

As the cup is completed, the price trades sideways, and a trading range is established on the right-hand side and the handle is formed.

A breakout from the handle’s trading range signals a continuation of the previous uptrend.

The cup should resemble a bowl or rounding bottom.

The perfect pattern would have equal highs on both sides of the cup, but in the real world, just like when finding someone to marry, perfect doesn’t exist.

After the high forms on the right side of the cup, there is a pullback that forms the handle.

The handle is the consolidation before the breakout.

The handle needs to be smaller than the cup. The handle should not drop into the lower half of the cup, and ideally, it should stay in the upper third.

If the Cup and Handle pattern completes successfully, the price should break above the trend established by the “handle” and go on to reach new highs.

The buy point occurs when the asset breaks out or moves upward through the old point of resistance (right side of the cup).

Please, like this post and subscribe to our tradingview page!👍

Counter TradeHow to take counter trade ? in this video we try to make it easy to took a counter trade (Against the trend) and to make quick money from market

#nifty

#priceaction #priceactiontrading #optionanalysis #banknifty #bankniftyprediction

#nifty50 #niftytomorrow #niftyprediction #niftyanalysis #niftyfifty #niftytoday #niftybank #banknifty #bankniftytomorrow #bankniftyprediction #bnkniftytrading #charts #technicalanalysis #crypto #sensex #nse #nseindia #bse #optionsellingstrategy #optionstrading #optionsellingstrategy #optionstrategy #optiontrading #optionsellingstrategy

REVERSAL AND CONTINUATION PATTERNS ⚡️Chart patterns are visual representations of price action. Chart patterns can show trading ranges, swings, trends, and reversals in price action. The signal for buying and selling a chart pattern is usually a trend line breakout in one direction showing support or resistance is overcome at a key level. Stop losses are usually set on retracement back inside the previous range and profit targets are usually set based on the magnitude of the previous move leading into the pattern.

Many people think of chart patterns as bullish or bearish but there are really three main types of chart pattern groups: reversal chart patterns, continuation chart patterns, and bilateral chart patterns. Understanding the differences is important for traders to understand the path of least resistance on a specific chart based on the primary sentiment of the buyers and sellers price action.

Well in this article we will discuss the Reversal chart patterns and the Continuation chart patterns.

Reversal chart patterns

Reversal patterns happen when a chart has a strong break from its current trend and its momentum reverses course. These patterns show that a trend is coming to an end and the price action is moving in a new direction away from the previous range or direction. These patterns go from bullish to bearish or bearish to bullish. They can take longer to develop than other types of chart patterns.

Now I'll show you how the 3 Bullish and Bearish patterns shown in the picture in this Education post.

Double TOP and BOTTOM:

Well for this first pair of patterns, I have already made a very nice and detailed explanation here in Tradingview, follow the link :)

Click Below in the picture.

Head & Shoulder and Reversal H&S

A head and shoulders pattern used in technical analysis is a specific chart formation that predicts a bullish-to-bearish trend reversal. The pattern appears as a baseline with three peaks, where the outside two are close in height, and the middle is the highest.

The head and shoulders pattern forms when a stock's price rises to a peak and then declines back to the base of the prior up-move. Then, the price rises above the previous peak to form the "head" and then declines back to the original base. Finally, the stock price peaks again at about the level of the first peak of the formation before falling back down.

The head and shoulders pattern is considered one of the most reliable trend reversal patterns. It is one of several top patterns that signal, with varying degrees of accuracy, that an upward trend is nearing its end and vice versa.

and Viceversa the reversal will look like this

Reversal Rising Wedge and Falling Wedge

A wedge pattern can signal either bullish or bearish price reversals. In either case, this pattern holds three common characteristics: first, the converging trend lines; second, a pattern of declining volume as the price progresses through the pattern; third, a breakout from one of the trend lines. The two forms of the wedge pattern are a rising wedge (which signals a bearish reversal) and a falling wedge (which signals a bullish reversal).

Rising Wedge

This usually occurs when a security’s price has been rising over time, but it can also occur in the midst of a downward trend as well.

Falling Wedge

Continuation chart patterns

Continuation patterns signal that the current trend is still in place and it’s about to resume going in the same direction after a trading range has formed. These types of patterns usually form consolidations in price action to let buyers and sellers work through supply and demand before moving higher or lower like the previous trend leading into the range. These are the most popular classic bearish and bullish chart patterns.

Continuation Falling Wedge

The falling wedge pattern is a continuation pattern formed when the price bounces between two downward-sloping, converging trendlines. It will follow the impulse trend, so a Bullish trend will continue in the uptrend and Vice-versa for il downtrend.

And Vice versa the Rising Wedge

The Bullish and the Bearish Rectangle

A rectangle is a pattern that occurs on price charts. A rectangle is formed when the price reaches the same horizontal support and resistance levels multiple times. The price is confined to moving between the two horizontal levels, creating a rectangle.

Bullish Rectangle

Bearish Rectangle:

Bullish and Bearish Pennant

In technical analysis, a pennant is a type of continuation pattern formed when there is a large movement in a security, known as the flagpole, followed by a consolidation period with converging trend lines "the pennant" followed by a breakout movement in the same direction as the initial large movement, which represents the second half of the flagpole.

Some examples:

Hope this post will help you to understand the difference between some examples of the most common reversal and continuation patterns.

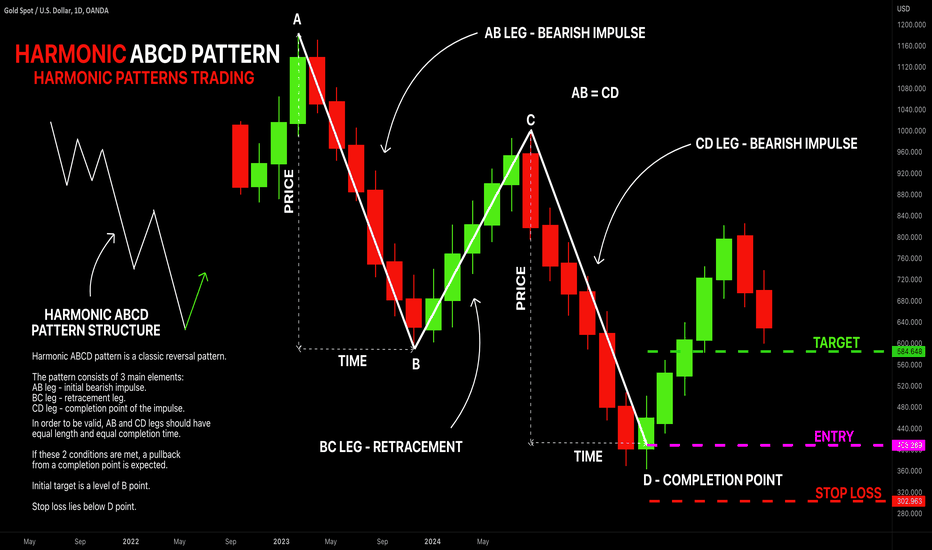

LEARN HARMONIC PATTERNS TRADING | ABCD PATTERN 🔰

Hey traders,

Harmonic ABCD pattern is a classic reversal pattern.

This pattern is composed of 3 main elements (based on wicks of the candles):

1️⃣ AB leg

2️⃣ BC leg

3️⃣ CD leg

The pattern is considered to be bullish if AB leg is bearish.

The pattern is considered to be bearish if AB leg is bullish.

AB leg must be a strong movement without corrections within.

A is its initial point and B is its completion point.

BC leg is a correctional movement from B point after a completion of AB leg. The price may fluctuate within that.

B is its initial point and C is its completion point.

CD leg must be a strong movement without corrections within.

C is its initial point and D is its completion point.

❗️ABCD movement is harmonic if the length and the time horizon of AB and CD legs are equal.

By the length, I mean a price change from A to B point and from C to D point.

By the time, I mean a time ranges of AB leg and CD leg.

If the time and length of AB and CD legs are equal, the pattern is considered to be harmonic, and a reversal will be expected from D point at least to B point.

🛑If the pattern is bullish, stop loss must be placed below D point.

🛑If the pattern is bearish, stop loss is placed above D point.

Initial target level is B point.

Usually, after reaching a B point the market returns to a global trend.

What pattern do you want to learn in the next post?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

What is Rising Wedge pattern and how to trade with that?The Rising Wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two rising trend lines. It is considered a bearish chart formation which can indicate both reversal and continuation patterns – depending on location and trend bias. Regardless of where the rising wedge appears, traders should always maintain the guideline that this pattern is inherently bearish in nature (see image).

HOW TO IDENTIFY A RISING WEDGE PATTERN ON CHARTS

The rising wedge pattern is interpreted as both a bearish continuation and bearish reversal pattern which gives rise to some confusion in the identification of the pattern. Both scenarios contain a different set of observation dynamics which must be taken into consideration.

Reversal Pattern:

Established uptrend

Rising wedge consolidation formation

Linking higher highs and higher lows using a trend line assembling towards a narrowing point

Look for break below support for short entry

Continuation Pattern:

Established downtrend

Rising wedge consolidation formation

Linking higher highs and higher lows using a trend line assembling towards a narrowing point

Look for break below support for short entry

How to trade with this:

*Entry Point: Right after the candlestick breakout of the support.

*Stop-Loss: At the highest resistance level of the Wedge pattern.

*Take-Profit: From the entry point, the distance is equal to the maximum width ( H ) of the rising wedge pattern.

This is the academic shape of this pattern, in the future we will publish Falling Wedge pattern 📚 . Please follow our page to be informed as soon as the materials are published.

Thank you all for supporting our activity with Likes 👍 and Comments ❤️

What is Head and shoulders pattern and how to trade with that?*The Head and Shoulders ( Bearish ) pattern is one of the most popular and best known price patterns in trading.

This is a very accurate trading signal if you know how to use it properly and flexibly.

*What is Head and Shoulders? How to identify and characterize

Head and Shoulders is the name of a special type of price pattern that usually appears at the end of uptrends. This is a signal of future downtrends.

It is called Head and Shoulders because the shape of this pattern on the price chart is similar to that of the human body including Left Shoulder, Head, and Right Shoulder.

The line connecting the two troughs of the shoulders is often called the neckline. In fact, this pattern is perfect when the Neckline is horizontal (the prices of the two lows are approximately the same).

How to trade with this:

ENTRY POINT : Right after the candlestick breaks out of the neckline (or at the Retesting the neckline )

STOP-LOSS : At the peak of the right shoulder.

TARGET : Usually, Head and Shoulders is a pattern for starting a downtrend. Therefore, adjust the first target to the height of the neckline to the top (H) of the pattern and adjust the next targets according to the past price and chart.

This is the academic shape of this pattern, in the future we will publish other types of head and shoulder patterns 📚 . Please follow our page to be informed as soon as the materials are published.

Thank you all for supporting our activity with Likes 👍 and Comments ❤️

How to Spot & Trade Falling Wedge Pattern | Price Action 🤓

Hey traders,

In this video, I will teach you how to trade a falling wedge pattern.

I will share with you my rules on how to identify the pattern,

how to read it correctly, how to select the target & entry levels

and how to set a safe stop loss.

We will discuss a theory and real market examples.

❤️Please, support this video with like and comment!❤️