Bullish Shark Within Bullish ChannelFrom this chart, can be found that Bullish Shark Within Bullish Channel.

This one of example for Bullish Retracement Patterns within Bullish Trend Channels shown in Harmonic Trading: Volume Two, Page 124 until Page 126 written by Scott M Carney.

Bullish Harmonic Pattern in Bullish Channel or Ascending Channel may indicate continuation pattern in Channel or rather as confirmation to show that price will go up.

To simplify, M pattern within Ascending Channel indicates that price will go up in continuation.

Noted that Shark is Harmonic Pattern that use Reciprocal AB=CD.

You may refer Link to Related Ideas for more information.

Thank you.

Shark

Shark patternHow to trade when you see the Shark pattern?

The ideal method used to trade a shark pattern is quite different from that used for other chart patterns. The take profit can be at 50 to 61.8 percent of BC .

The way to trade this pattern is to go in at the open of the next candlestick after the harmonic indicator has detected the pattern. As soon as the C-leg forms, enter the market with a protective stop-loss at the 2.618 extensions of AB swing-leg.

Drawing the pattern

Click on the indicator of the harmonic pattern which can be found on the right-hand side toolbar of the platform

Determine on the chart the starting point 0, which can be any swing high or low point on the chart

After locating the first swing high/low point, follow the market swing wave movements

Traders need to have 4 points or 4 swings high/low points that join together to form the harmonic crab pattern strategy. Each swing leg has to be validated and stick to the Fibonacci ratios of the shark pattern forex.

Trading the pattern

Buy at point D, which has to satisfy the requirement CD = 1.13 OX segment. The D to X can be found anywhere between 0.886 to 1.13, but it is best to take trades using an ideal 1.13 extension.

Stop-loss

The stop-loss can be placed below the 1.150 Fibonacci extensions of XA at point C. As the market begins to go towards the first take profit, move it after D leg. This is the best place to hide the stop-loss because any break below will automatically invalidate the Fibonacci requirements for a shark pattern.

Just as it is with any new pattern, you need to be cautious when trading this pattern. You should only trade the best price structure that fits into all the Fibonacci ratios with great precision. Be picky! The shark harmonic trading strategy works very well as a strong counter-trend strategy.

The NAS100 shark is surrounded by several indicatorsThis Idea is First Educational Idea

I am a novice Trader and not a Master. I hope that this Idea was Useful.

Nas100 Trend Formed Several Technical Subjects

1- Parallel channel

2- Rectangle pattern

3- Pullback and Breakout

4- Harmonic Pattern

5-supply/demand Zone

for this reason. I made this idea as Tutorial.

please leave a like and comment If it was useful

God Bless you and your Parents.

Harmonic shark strategyGuys, before getting started please dont forget to leave a like

& let me know your thoughts about this post in the comments below.

The shark pattern anatomy can be found online, I won't be going much into that. If you are interested in learning how to spot these patterns yourself, make sure to look for it.

With this post I will be looking at the issue of having the same kind of pattern giving two different signals. I have highlighted two bull shark patterns, two bullish signals where one produces a bullish move while the other causes a bearish move and a significant decline in price.

These two set-ups are identical, still far from apart. A quick view and study of the market will show just that.

So lets get into it:

How do you know if a bull shark is going to cause a reversal or a continuation?

Lets start with the (true) bull shark on the left. This is how it should have been traded:

Strong supply level at X. The shark completion point is 88.6% XC, with the stops just below the X point. Targets are the usual 50% and 88.6%

So what made this pattern a winner?

A quick view on the left side of the chart shows prices trending in a descending channel which simply means it is a downtrending market. The first sign of a reversal was when price broke the upper range of the channel and then traded above it. This caused a shift in momentum. If a bullish pattern then occurs you should expect a reversal based on the overall structure. If price starts to make lower lows, it just means the trend was stronger then usual and it could reverse at another level, for example the 1.13% XC for shark patterns. All though, a break below the structure does indicate that it is a strong trending market. We then look at the former leg and see a 150 pip decline, with the previous decline being 180 pips. This shows that the declines are getting smaller and smaller.

Now lets look at the second bull shark pattern on the right side of the chart. Here we have a kind of extended shark, since we see a test of the 113% XC level, price fails to close below this level which means that the shark is still valid:

Now, how come this shark pattern caused a decline?

Lets try to look at the structure again and the former leg again:

By using the parallel channel this time we can visually see an ascending channel, which simply means the current market is in an uptrend. Now in an uptrend there should be no sign of a bullish trend reversal set-up, and you would simply need to ask yourself: Should a bullish reversal occur in an uptrend?

No, if it reverses in an uptrend its going down. Besides, we already know that a harmonic shark pattern is an emerging harmonic 5-0 pattern, which means the bull shark is now a bear 5-0.. Simple does it!

As you can see in the chart a 5-0 pattern usually causes a strong move depending on the pattern in the market. 261.8% of XC (OB) is a good profit target for these set-ups..

Thank you for reading and make sure you leave a like for the post!

EURCAD SHARK HARMONIC EXPLANATION EURCAD Shark Harmonic Pattern explained.

- This is a explanation video on how to identify the Shark Pattern along with the target points and stop loss

- Targets range from 30-60 PIPS

As always if you found this idea helpful, please let me know by hitting that like button and/or leaving me a comment below.

Also feel free to share your opinion on this setup, or other setups that you have on your radar for the EURCAD. The more ideas we can generate the more informative these ideas become for newer traders.

~T$

ANTI ALT SHARK & BULLISH 5-0 PATTERNSThis is a high probablilty trade for me.

Shark and 5-0 patterns were developed by Scott Carney. Shark is 5-0 pattern without the last leg with additional constrains. The patterns are relatively new, but becoming more popular lately. The pattern stands out from the ranks of the other harmonic patterns because it is intended to start a new trend rather than identify retracement.

Technicals change on a day to day bases. Hell, even moment to moment. That's why I never fall in love with any trade. Shit is always subject to change and you should be ready for that at any given moment.

Terry's Guide to Drawing Perfect Harmonic Shark PatternsI will be using an example on EURAUD to share how to draw a perfect Shark Pattern.

This is a currency pair which i personally lost money on last week because I did not spot this big authentic Shark Pattern.

Scrolling through tradingview over the past few months, I realize 2 big mistakes that people are making while trading Shark Patterns.

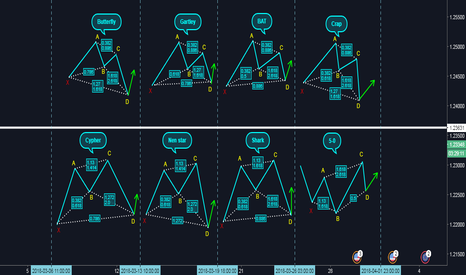

1. They think Cypher is a real harmonic pattern and Shark is just another name. Absolutely wrong! The ratios on Cypher are not harmonic at all, you might get one or two lucky wins, but Shark is definitely more reliable because the ratios are Harmonic.

2. The point B has no specific requirement, stop confusing it with the Cypher(Siphon your money) pattern.

There are also very clear rules of engagement which you will not find alot of information about it online.

I was personally mentored by Scott Carney back in 2016, so I definitely know the REAL way to draw this pattern.

I used to trade the Cypher until I got to know Scott.

To demonstrate my understanding, I collated what I learned from Scott and wrote a PDF to help other traders.

You can get it by visiting my website which I will share the URL in the comments session below.

Feel free to drop me any questions.

To see how I trade the Shark pattern, I have also included all the recent links where I successfully profited off a REAL shark pattern.

Inception of Shark pattern 5-0 pattern & bat patternAfter Shark pattern's target , there is a 5-0 pattern.

After 5-0 pattern's target, there could be a emerging bat pattern.

The fibonacci numbers is not exact true.

This image just showing the trade opportunities after shark pattern.

In essence the Shark is an emerging 5-0 pattern that you trade from C to target D. (target D is not shown in the diagram above - it's at the confluence of AB=CD and 50% Fibonacci on the BC leg).

Following that trade, you then have an interesting sequence of possibilities for further trades.

Apart from being a tradeable pattern in its own right, the Shark can also lead onto 3 other subsequent patterns, which you have the possibility to trade one after the other.

Firstly, The Shark leads onto the 5-0 pattern. Here is the 5-0 pattern. You can see how the Shark relates to it. (Note that not all 5-0 patterns are preceded by a Shark though).

The first target of the Shark is the D of a 5-0 pattern. And now with the 5-0 you have the possibility to enter a trade from the D in the opposite direction of your previous Shark trade.

Next, notice that the BCD of a 5-0 pattern often turns out to be the XAB of an emerging Bat or a Crab pattern (with B at 50% XA, it could turn out to be either a Bat or Crab).

So now we watch for the emerging Bat or Crab and if a C point is made - if so, then we have the possibility to enter a BAMM trade (trade from price at the B level to target the D of the emerging pattern). But we only enter the BAMM trade if it is in the direction of the prevailing overall trend. Do not trade a BAMM in the counter-trend direction.

Finally - whether or not the BAMM trade was taken, we now have the possibility to enter a new trade with the Bat or Crab pattern - if it has formed.

That's 4 possible trades all starting with the Shark. As i said - it's one of my favourite patterns.

Good Trading!

Harmonic Trading Tutorial - Bullish Shark - EURUSDBullish Shark Ratios

B (XA) = 0.618 Maximum

C (AB) = 1.13 ~ 1.618

D (BC) = 1.618 ~ 2.240

D (XC) = 0.886 ~ 1.13

StopLoss Below D

Targets : 0.382 & 0.618 CD of CD

Go Long when point D is completed according to above ratios and when it is confirmed with oscillator such as RSI Divergence

Advanced Patterns - SHARK1. Find the point X at the bottom and point A at the top of a strong bullish trend.

2. 1st Retracement is not higher than the 61.8% of point X.

3. Point C should be confirmed at the 113% to 161.8% retracement area of A.

4. Point D should be confirmed at the 161.8% to 224% retracement area of B.

4a. Point D should be confirmed at the 88.6% to 113% retracement area of X.

* The take profit for this order can be placed at the 38.2%, 50%, 61.8% ,88.6% or 100% retracement of point C , depending on the fundamental condition.

EJ SHORT + LESSON ON SHARK / CYPHERHow to determine the difference between a shark and a cypher as they are very similar. If I have time I'll try to catch the 5-0 trade on this one also. Extra addition: as you can see there were a lot of sellers in the 0.886 retracement too (as it is the first entry spot for a shark). You can determine if this is a false selling point by using the ABCD.

You sell at the 1.13 retracement from the XA leg, as Sharks tend to evolve into 5-0 patterns I trade this with only 1 profit target (near the 0.5 retracement of the CD leg) and then go long.