Two Roads to Profit. A Comparison of ICT/SMC and Advanced VSAHello traders and investors!

When we start engaging in trading and investing, we get acquainted with various methods of forecasting price movements. Gradually, if we have enough persistence, strength, and patience, we choose our own path to profitable trades. Among the most popular approaches, we can highlight the use of various oscillators and channels, Dow Theory, Elliott Waves, Fibonacci levels, supply and demand, Volume Spread Analysis (VSA), market auction theory, and the Inner Circle Trader/Smart Money Concept (ICT/SMC). Many traders combine elements from different approaches into their trading system.

I personally prefer a concept I call Advanced VSA. It’s a comprehensive set of tools that combines ideas from VSA, Dow Theory, and Supply and Demand analysis. The name "Advanced VSA" perfectly captures the essence of the method, as it is fundamentally based on analyzing volume and price spread.

Recently, the ICT/SMC concept has been gaining more and more popularity. Today, I want to explore the similarities and differences between ICT/SMC and Advanced VSA. If there are any inaccuracies in my explanation of ICT/SMC basics, feel free to correct me in the comments. Perhaps after reading this article, you’ll be able to decide which approach resonates more with you and which one you believe will help you in your trading. I hope this will be helpful. Let’s dive in!

Basic Differences

Before diving into the technical details, let's first clarify the key differences between these concepts.

Who Controls Price Movements

The ICT/SMC concept assumes that price movements are controlled by large players, such as market makers, who direct prices in the desired direction. This is similar to a model where one "center of power" determines the market's direction.

In contrast, Advanced VSA is based on the idea that two forces influence price — the Buyer and the Seller. All analysis revolves around the interaction between these two sides, creating a more balanced model where both forces are equally important.

Traded Volume

The ICT/SMC concept does not use traded volume as a part of its analysis.

In Advanced VSA, volume is an important factor. It is considered an integral part of the data that helps to understand market processes and the actions of participants.

Now let’s move on to a detailed comparison of the elements of these concepts.

What They Have in Common

Both concepts teach traders to identify price ranges on the chart where a large player (Market Maker in ICT/SMC) or a Buyer (in Advanced VSA) shows interest in buying, and ranges where the Market Maker or Seller is interested in selling. When the price returns to these ranges, traders can execute buys or sells. We can call these price ranges contextual areas for buying and selling.

Neither concept relies on technical indicators. Instead, they focus on the following key terms for identifying the trade direction and the trade entry point:

Trend

Trend break/half-trend

Trend confirmation

Accumulation/Distribution/Sideways movement/Flat

Contextual areas for buying and selling

The first four terms help determine the direction of the trade, while the fifth helps identify the entry point and the likely target of the trade.

Both methods suggest using higher timeframes to find contextual areas and lower timeframes to find entry points within those areas.

What Are the Differences

The differences between the concepts lie in the interpretation of key terms. For the first four terms (trend, trend break, trend confirmation, accumulation/distribution/Sideways movement), the distinctions are minor and relate mostly to specific interpretations. However, the main differences arise in the rules for identifying contextual areas of interest (buyer, seller, or market maker). Let's look at these differences in more detail.

Difference 1: Use of Volume

In ICT/SMC, contextual areas of interest are determined solely based on price action and candlestick patterns, without taking traded volume into account.

In contrast, Advanced VSA sees volume as an integral part of the analysis. contextual areas of interest are identified by both traded volume and price behavior (candlestick patterns). If there was interest from a buyer, seller in a specific price range, leading to a price change, it's logical to assume that the volume traded in that range should be higher than in previous periods over a similar timeframe.

To illustrate the importance of using all available data for analysis, consider an analogy with choosing the best time for a seaside vacation. If the decision is based only on water and air temperature, while ignoring factors like wind or rainfall, the choice may be misguided. For example, choosing April for its comfortable temperature might result in encountering constant rain and high waves.

Thus, in Advanced VSA, volume plays a crucial role, whereas it is absent in ICT/SMC.

Difference 2: Types of Contextual Areas of Interest

In ICT/SMC, the following types of contextual areas of interest are used: order block, breaker, mitigation block, and rejection block. All of these areas are formed by a specific arrangement of candles on the chart.

In contrast, Advanced VSA operates with a different set of contextual areas of interest: effort, zone, and range (sideways movement). Effort refers to a single candle or bar that indicates significant market activity. Zone is formed by a sequence of candles or bars, taking into account their traded volumes. Range (sideways movement) is defined by a series of consecutive candles/bars where price fluctuates within a limited range, interacting alternately with the upper and lower boundaries of the range. It's only possible to identify which party (buyer, seller, or market maker) controls the range after the price breaks out and confirms the move.

If the volumes align with Advanced VSA's criteria, order blocks and mitigation blocks in ICT/SMC can be considered as zones in Advanced VSA. So, not all order blocks and mitigation blocks will be considered zones in Advanced VSA. The breaker will be discussed separately, and there is no equivalent to the rejection block in Advanced VSA.

Difference 3. Price Attraction Points

In ICT/SMC, concepts such as fair value gap, liquidity void, and liquidity are used to describe price attraction points.

In Advanced VSA, the terms fair value gap and liquidity void are not utilized. Most of the time, these ICT/SMC elements correspond to price interest points in Advanced VSA, such as effort. The term liquidity has the same meaning.

Difference 4. Importance of Levels

In Advanced VSA, levels play an important role in identifying trade opportunities. To understand the significance of levels, let’s first recall the concepts of trend and range (sideways movement). In both ICT/SMC and Advanced VSA, a trend is broken down into components, often referred to as impulses or expansion moves. A range, on the other hand, is characterized by its boundaries and the vectors of price movement between those boundaries.

In Advanced VSA, important trading signals include the defense of a broken level or a price retracement to a level followed by its defense.

In Advanced VSA, the defense of a broken level or the cancellation of a breakout (where the price returns back behind the broken level) followed by a defense of that level is considered a signal for identifying trades. This method helps traders spot potential entry points where either buyers or sellers to protect a key price level, giving more confidence in the direction of the market. The most important levels include the base of the last impulse, the boundaries of a range, and the test level of a zone.

In ICT/SMC, there are no direct equivalents of these elements when it comes to searching for trades. However, breakers and sometimes mitigation blocks serve similar purposes to the levels in Advanced VSA, but the approaches differ. In ICT/SMC, trades are typically executed within the breaker or mitigation block, whereas in Advanced VSA, trades are found when a level is defended: buy trades above the level (supported by buyers), and sell trades below the level (supported by sellers).

Additionally, Advanced VSA allows for trading within ranges, moving from one boundary to the other, as long as the boundaries are defended.

Summary

Despite the shared terms and similar approaches, there are significant differences between the two concepts:

Number of forces influencing price movement: In ICT/SMC, it is believed that price is controlled by a single force, the Market Maker (MM). In contrast, Advanced VSA considers the interaction of two forces—buyers and sellers—as driving price movements.

Use of volume in analysis: ICT/SMC does not take traded volume into account during analysis, while in Advanced VSA, volume is a crucial element for identifying market forces and areas of interest.

Use of levels for trade entries: In ICT/SMC, levels do not play an important role, whereas in Advanced VSA, levels one of the possible places for identifying potential trade setups.

Good luck with your trading and investing!

Smcconcepts

BULLISH STRUCTURE SMC How to identify a bullish market structure according to SMC

In a bullish structure, identify the top, the high after the bos is only confirmed as a top when the price scans idm (RECENT PULLBACK)

When there are 2 confirmed highs, the lowest level between the 2 highs will be the bottom (the bottom does not need to be confirmed with an uptrend)

Thanks

EURUSD Trade study short/longTrade study using Asian range.

Trade went below opening candle in London session indicating bullish but wasn't noticed. Price also took the Asian lows before moving up. Price then consolidated before taking the Asian high, then took the recent swing low at lower timeframe indicating out POI. Price then eventually achieved our target Price Asian range low then took Thursdays (Asian high +4) before taking our initial Target (Asian range -1). Trading in Friday is complicated but with proper risk management we was able to take a 1:1.2rr trade

Using proper risk management is always necessary which I didn't do for some reason

NOTE : PRICE ALWAYS MOVES FOR A REASON

Unlocking the Secrets of Price Inefficiency: Dive Deep into FVG👑Price inefficiencies are also known as imbalances, gaps or voids. Healthy price action moves in a zigzag fashion, making highs and lows in line with the directional bias at any given moment. When price isn’t trending we find it consolidates, in which case highs lows are still being made. However, we may also see price move in straight lines with huge volume and momentum. When this happens, price finds itself unable to deliver price in an efficient manner. For example, in a bullish environment, price may continue to make higher highs without providing higher lows at a discount price. When price moves with this much momentum, it leaves behind imbalances.

🟠An imbalance can be identified by open space in price action, where the wicks on either side of a candle do not match each other. On the left is an example of price inefficiency, since the wick high of candle 1 does not meet the wick low of candle 3, leading to an imbalance on candle 2.

🟠This is an example of healthy price action with no imbalances. This is because all candles have wicks on either side of them. Since wicks were bodies during live price action and are bodies on lower time frames, this shows that price was delivered efficiently to buyers and sellers in this area. Whereas the example above shows an imbalance on a bullish candle, which shows that price was only available to buyers in that imbalance and therefore is not efficient.

👉For price to be efficient, it needs to be delivered to buyers and sellers. This helps us understand that in our original bullish imbalance, price has to come back and fill that imbalance using bearish price action in order to make that price available to sellers. This re-balancing could take hours, days, weeks or years, but it is our job to understand that it must happen at some point. Inline with the rest of the strategy, we can use this knowledge to pick out the specific imbalances that will be filled and how we can capitalise on this.

🟠This is an example of the correctly identified imbalance and where we expect price to react from

🟠This is an example when is our level being met, it is at this point that we use the rest of the strategy and knowledge to capitalise on the move that is about to unfold with high risk:reward entries.

🟠This is the completion of this particular market cycle, with our level being respected and price giving us a nice bullish leg.

🔴Bearish Order Flow:

🟢Bullish Order Flow:

Backtesting SMC Continuation StrategyTV wouldn't let me write "ICT" in the title lol

Anyhow, here's a great example of a clean SMC/ICT continuation trade on the 15min timeframe.

I generally like to watch the Euro on the 4H, but since I don't have a setup at the moment, I thought I'd flip to the lower timeframes and play around with Replay.

1. The first thing that caught my attention was the break of structure on the 15min TF. This BOS to the upside was the first hint that price wanted to move up.

2. This BOS was caused by a tiny order block, and the same explosive move created a fair value gap (imbalance). Since we know price loves to fill imbalances, you'd want to see price pull back into the order block where a tight entry and SL could be filled (as it did in the, in the picture).

3. Before price hit the order block, it first purged the liquidity within the present area, which is another sign I look for before pulling the trigger.

4. With TP placed at the most recent high, this trade was able to offer 7R (thanks of course to the very tight spread between entry and SL).

1 of 2 patterns I rinse and repeat these days. Hope it helps

A Comprehensive Guide to Order BlocksOrder Blocks Explained

Now we'll look at one of the important concepts we utilize to find our precise entry points:

order blocks.

So, what exactly is an order block? An orderblock is a visible spot on the chart where a

large order is being placed on the market. You'll notice the order being placed, followed

by a quick move from that region, leaving behind imbalances and a structures would be

broken

The candle before that impulsive move is what we call an "order block," but I want you to

remember that order blocks are essentially areas of supply and demand in the markets,

and we'll go over that later in an other idea.

Essentially, an order block is the fingerprint that market makers and

institutions leave behind on the charts that informs us of their activity and intent

which we can capitalise on. Unlike retail traders, the capital available to market

makers and institutions is enough to move the market and affect price. For this

reason, there are differences in the ways that market makers and retail traders go

about trading in the financial markets.

The first difference to understand is that market makers and institutions

cannot simply place a buy or a sell trade. Due to the high amounts of volume

behind each trade they place (millions of lots), a single buy or sell from institutions

would crash the market. For this reason, they have to hedge each position. In other

words, each time they place a buy, they have to place a sell at the same price, and

vice versa. For example, if a buy is placed at 1.34610, and price moves up 100

pips, the buy trade will be 100 pips in profit, whereas the sell trade from the same

price will be 230 pips in loss. Essentially there is an equal floating profit and loss.

The second difference between retail traders and market makers is that

market makers and institutions do not trade with a stop loss, therefore, the floating

loss in the sell trade from the example above won’t close itself. Therefore, once the

market is at a desirable high, market makers will close the buy positions in profit,

let the price trickle back to their entry point, and close the sell trade at breakeven.

Bullish Orderblock (Demand)

Looking at this textbook example, we can see that the red block was the last bearish candle before the impulsive move, the candle would normally consist mostly body with very minimal wicks, This is what we call our bullish order block. To mark out our OB we draw a zone from the top of the candle to the bottom, but you may also include the wicks.

Bearish Orderblock (Supply)

Looking at this textbook example, we can see that the red block was the last bearish candle before the impulsive move, the candle would normally consist mostly body with very minimal wicks, This is what we call our bullish order block. To mark out our OB we draw a zone from the top of the candle to the bottom, but you may also include the wicks. Looking at this textbook example, we can see that the grey block was the last Bullish candle before the impulsive move, the candle would normally consist mostly body with very minimal wicks, This is what we call our Bearish order block. To mark out our OB we draw a zone from the top of the candle to the bottom, but you may also include the wicks.

HOW TO TRADE USING ORDERBLOCKS

First stage is identifying your higher time frame directional bias. Whether you are looking for intraday or Swing entries you still need to understand which way the market is moving for the pair that you are focusing on. Essentially you want to identify Order blocks from weekly down to the hourly and work off there. However, the more experience you gain, you may find that you can trade intraday moves by having a short term directional bias from lower time frames and finding entries on an even lower time frames. Either way, the concept is exactly the same.

From above we can see a clear break of structure, this is the first thing we look for before looking for OBs. Reason for this, we want to find the candle that created this move, this candle is our OB. The OB is generally the last opposing candle before the move. So if its a bearish break, the OB is a Bullish candle. However, we need to understand what kind of BOS we look for and how to refine our OBs.

HOW TO REFINE ORDER BLOCKS

There are a few ways to refine the OB. The easiest would be moving left from the OB until you find the candle before the impulse which is still within the OB candles range.

Example:

As we can see above, the green candle following the OB hasn't overly moved or broken the range of the OB. This is now our refined OB. You can do this on all time frames. Alternatively, you can locate your OB, and you can refine down the time frames and find a clear open OB within the OB.

So here on the picture, that little candle with big wicks is our OB, however within that candle on a lower time frame, there is a clear OB and this is now our refined OB. You can go down by as many time frames as you like.

TIP: If you are happy with the RR from a particular time frame OB, then Simply use that one. Don't get greedy and don't use lower time frames if it makes you anxious.

UNDERSTANDING BREAK OF STRUCTURE (BOS)

There are two types of BOS, we prefer a full body break.

This is very simple to understand as shown below:

HOW TO TRADE USING ORDERBLOCKS

Safer entry

Identify your Point of interest on the higher time frame. In this example it was the hourly, however as mentioned, this concept can be applied to any time frame. The higher time frames such as 4 hourly or daily are more more swing entries with hourly and lower being intraday.

So here we can see our higher POI. Now from here, you can look deeper into that OB so you have an idea as to where price could potentially go before reversing. Once you find your OB, you can set an alert at the Open of your OB. This frees up your time, meaning you dont need to sit and stare at the screen. The reason we trade is to for our free time, so why waste time staring and waiting.

Once price taps your higher time frame OB, go to a lower time frame. This is up to you and what you are comfortable with, some prefer 1 min some prefer 15 min its up to you. But what we look for is a BOS and an OB on the lower time frame. Once we find our OB we set a limit order at either THE OPEN of the OB or 50% of the OB. This again is up to you.

Once we set the order and set our target to our higher time frame High in this example.

The benefit of using a safer entry over a risk entry:

- More confirmation for the trade

- May get a better RR for the trade

Cons:

- More time consuming

- Sometimes it may not form a BOS on the lower time frame and price may just shoot from the higher time frame OB. So you may miss trades.

Risky entry

This method is very simple. Once you locate your Higher time frame OB, you simply go down the time frames till you find an OB within the higher time frame OB which is clear. Once you find your OB, mark it out. Use an OB which gives you and RR you are comfortable with. Same as before you can set a limit order at the OPEN or the 50% mark of the OB with your stop loss below the low of the OB or the overall low and target the recent high or low depending on if you are buying or selling.

With this style of entry, it is of course riskier. This method is ideal when there is high momentum in the direction you are aiming for. If its more within a consolidation period, it is not worth trying a risk entry.

Either way you go about, you get similar results and its all dependent on your risk appetite and how you are comfortable trading. Trading is personal to you, you dont need to follow what everyone else is doing. You need to what you are comfortable with doing and how you are happy about going about it.

PSYCHOLOGY

This way of trading is all about precision and finding the market at the perfect time of reversal. However, don't get too greedy with the RR, there is nothing wrong with sacrificing a few PIPS and rr for a safer trade.

having a pip stop loss, is not the goal, having a safe trade and saving capital is the main goal. Our percentages are always gonna be crazy even with a 10 pip stop, so dont always look for a smaller stop if there isn't one available.

Focus on yourself and what you are comfortable with. Don't trade time frames that you are not happy trading. the goal is not to be replicas of Vertex traders. The goal is to be you and be yourself as a trader. Be selfish and think about yourself and your own growth.

FAQ

When do we delete orders? When TP is hit or if there is a new BOS leaving another OB

Best timeframes? Any that makes you comfortable . if lower time frames make you anxious, don't use it. You want to be calm and relaxed when trading, not on edge.

Best pairs? Main indexes or pairs.

Fair Value Gap Strategy (FVG): GBPUSD 7.32x Reward TradeCheck out this 7.32RR trade I took today on GBPUSD.

OANDA:GBPUSD

Trade Process:

Daily is bullish with FVG serving as draw on liquidity.

1HR: Took out Sellside liquidity left with BuySide liquidity to take out.

15M: London Session open took out 15M sellside liquidity with high probability of taking out Buyside liquidity.

Entry: I used my fib to locate OTE at the FVG which is where i placed my buy limit.

Price retraced to pick my order and fly high to take out the buyide liquidity and the daily FVG.

Why candle closes are importantThis is an example of why candle closes are important when marking out a BOS which changed direction. Like here the low just got swept and went on to make another higher high. There is no real way to know if it is a BOS or a trap so it's best just wait and see if we get a candle close or in this case break the high. You could get a reaction on the lower timeframe but it could just be a reaction and not lead to anything.

Smart Money Concept - TerminologyToday i would like to share full list of basic terminology Smart Money Concept

To all newbies this list will be useful

HH (Higher High) - high maximum

HL (Higher Low) - high low

LH (Lower High) - low high

LL (Lower Low) - low minimum

Fib (Fibonacci)

PDH is the high of the previous day.

PDL is the low of the previous day.

PWH is the high of the previous week.

PWL is the low of the previous week.

DO - opening of the day.

WO - opening of the week.

MO is the opening of the month.

YO - discovery of the year.

TF (TF) – timeframe

MN (Monthly) - monthly

W (Weekly) - weekly

D (Daily) - daily

H4 (4 hours) - 4 hours

H1 (1 hour)

M15 (15 minute) - 15 minutes

M1 (1 minute)

MS (Market Structure) - market structure

BOS (Break of Structure)

MOM (Momentum) - momentum. Time difference between impulse and corrective wave

HTF (Higher Time Frame)

LTF (Lower Time Frame) – lower timeframe

RSP (Real Structure Point) - key structural point

PRZ (Price Reversal Zone) – price reversal zone

CPB (Complex Pullback)

RR (Risk:Reward) – risk/reward

TGT (Target)

SL (Stop-loss) - stop order

BE (Breakeven) - breakeven

PA (Price Action) - price movement

Liq (Liquidity) – liquidity

EQH (Equal Highs) - equal highs

EQL (Equal Lows) - equal lows

SMC (Smart Money Concept) - the concept of smart money

DD (Drawdown) - drawdown

Be (Bearish) – bearish trend

Bu (Bullish) – bullish trend

HNS (Head and Shoulders) - head and shoulders

IT (Institutional Traders) - institutional traders

CO (Composite Operators) - composite operators

WHB (Weak Handed Buyers) - Weak Buyers

WHS (Weak Handed Sellers) - Weak Sellers

DP or POI (Decision Point) or (Point of Interest) - decision point or point of interest

IMB (Imbalance) - imbalance

SHC (Stop Hunt Candle)

OB (Order Block) - block of orders

OBIM (Order Block with Imbalance) - a block of orders with an imbalance

OBOB (Lower timeframe Order Block with a higher timeframe Order Block) – LTF order block in the HTF order block zone

WKF (Wyckoff)

PS (Preliminary Support) - preliminary support

PSY (Preliminary Supply) - preliminary offer

SC (Selling Climax) - Selling Climax

AR (Automatic Rally) - automatic rally

ST(Secondary Test) - secondary test

SPR (Spring) - the final position by a major player, followed by the liquidation of the last players in the market

Test (Test)

SOS (Sign of Strength) - a sign of strength

SOW (Sign of Weakness) - a sign of weakness

LPS (Last Point of Support/Supply)

LPSY (Last Point of Supply) - the last point of the offer

BU (Back-up) - price return to the range to cover the imbalance

JAC (Jump across the creek) is another name for SOS

UT (Upthrust) - the primary move out of the range to capture liquidity

TR (Trading Range) – trading range

WAS (Wyckoff Accumulation Schematic)

WDS (Wyckoff Distribution Schematic)

WICK - a candle with a long shadow, which removes liquidity, stops.

A squeeze is a rapid rise or fall in prices.

Range - sideways price movement in a certain period without updating highs and lows.

Deviation (deviation) - a false exit, beyond the boundaries of the range.

EQ - (equlibrium) - the middle of the range.

TBX is the entry point.

Take Profit - take profit.

STB - sweep (manipulation) of liquidity, the sale of an asset before growth.

BTS - sweep (manipulation) of liquidity, the purchase of an asset before the fall.

AMD (accumulation manipulation distribution) - accumulation, manipulation, distribution ( distribution)

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

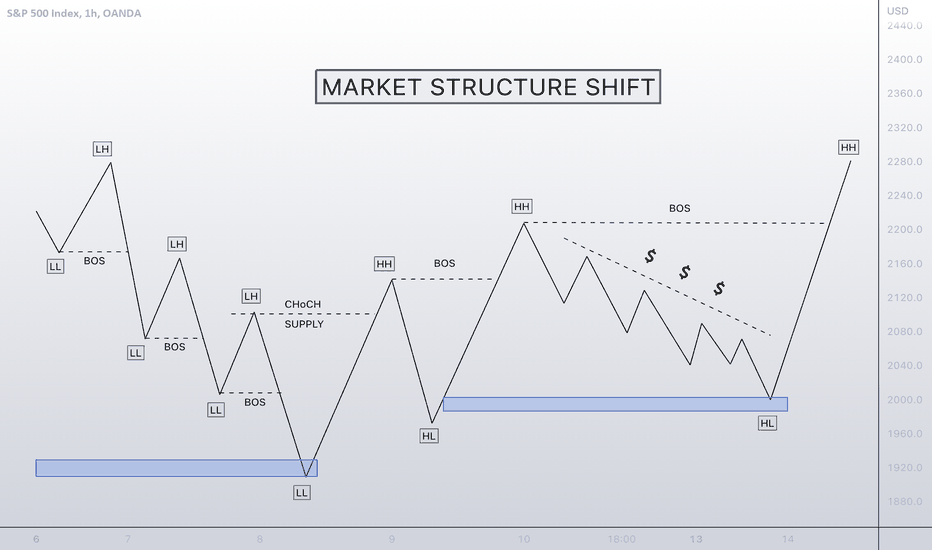

🤓 🤓 MARKET STRUCTURE SHIFT! SMCMarket structure in Forex trading or price action is how many people take advantage of the markets. No indicators, and no volume. Because the market does not have a centralised exchange. Forex traders often swing trade the market based on the structure to take advantage of the opportunity.

Structural market change is broadly defined as a shift or change in the way in which a market or economy functions or operates.

I have tried my best to show you in the easiest possible way to look out for. Save this to your notes for future reference.

🤓 🤓 DON'T TRADE FROM THIS ZONE!I have tried to make this example as simple as possible to understand for anyone that are not too familiar with liquidity hunts.

Always look for were the most liquidity is accumulating then place your trade above or below were there has been a liquidity swoop, as long as it lines up correctly with what strategy you are using.

If you add this to your trading tool belt this will improve your overall results.