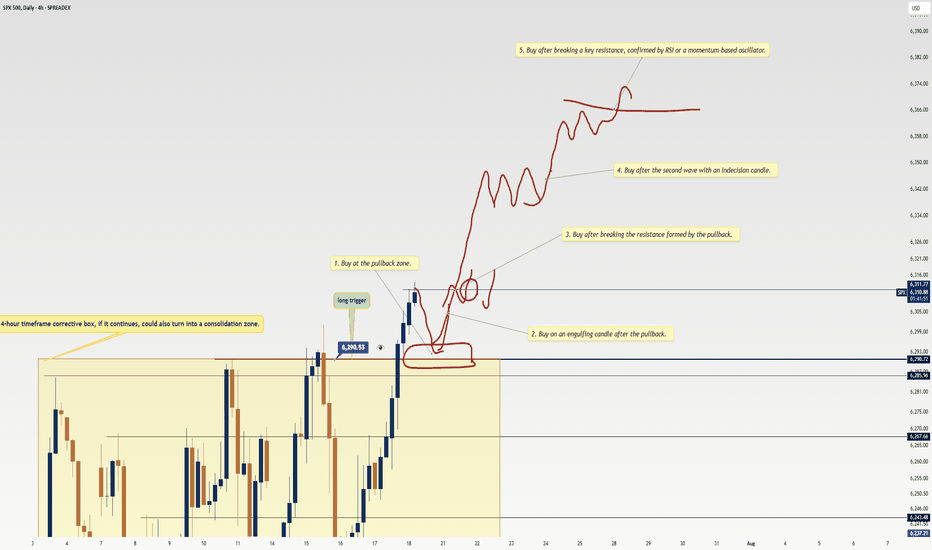

5 Proven Tricks to Trade Without FOMO After Missing Your TriggerYo traders! In this video, I’m breaking down what to do if you miss a trading trigger , so you can stay calm , avoid FOMO , and still catch the next move. We’re diving into five solid strategies to re-enter the market without losing your cool:

Buy on the pullback zone.

Buy with an engulfing candle after a pullback.

Buy after breaking the resistance formed by the pullback.

Buy after the second wave with an indecision candle.

Buy after breaking a major resistance post-second wave, confirmed by RSI or momentum oscillators.

These tips are all about keeping your trades smart and your head in the game. For more on indecision candles, check out this lesson . Wanna master breakout trading? Here’s the breakout trading guide . Drop your thoughts in the comments, boost if you vibe with it, and let’s grow together! 😎

Trading Plan

How to Read Market Depth in TradingViewThis tutorial video covers what Depth of Market (Market Depth) is, how to read it, and how traders might use it.

Learn more about trading futures with Optimus Futures using the TradingView platform here: optimusfutures.com/Platforms/TradingView.php

Disclaimer: There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

Order flow and DOM data reflect market participant activity but do not guarantee future price movement or execution certainty. These tools are best used as part of a broader trading strategy that includes risk management and market understanding.

How to Use Stop Losses in TradingViewThis video covers stop loss orders, explaining what they are, why traders use them, and how to set them up in TradingView.

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

The placement of contingent orders by you or broker, or trading advisor, such as a "stop-loss" or "stop-limit" order, will not necessarily limit your losses to the intended amounts, since market conditions may make it impossible to execute such orders.

Set Up & Data Collection | Day 1 of 21 | Back Test With Me21-Day Backtesting Plan

A Step-by-Step Challenge to Master One Pair and Develop an Unshakable Trading Edge

Backtesting is the foundation of trading mastery. This 21-day plan is designed to help you deeply understand GBPUSD, refine your strategy, and build the confidence needed to trade with precision. Each day introduces a specific focus, challenge, and takeaway, progressively strengthening your ability to read market movements.

Week 1: Laying the Foundation – Market Structure & Patterns

📅 Day 1: Set Up & Data Collection

Task: Gather at least 6 months of historical GBPUSD data on your charting platform.

Challenge: Define your testing parameters (e.g., timeframe, session focus, lot size).

Takeaway: Clarity in what you’re testing prevents randomness in your results.

Are you up for our 21 Day Backtesting Challenge?

Drop Your Thoughts in the Comment Section, boost the post, share with your friends and follow me on Trading View if you had an aha moment.

-TL

SOLUSD: How to Draw Quarter's Theory LevelsApplying Quarter’s Theory to SOL/USD helps traders identify key psychological price levels where institutional players might step in. With Solana’s volatility, these quarter levels (25%, 50%, 75%, and full dollar increments) act as crucial areas for potential reversals or breakouts.

Current Market Outlook

SOL/USD is currently trading around a major quarter level, signaling a potential shift in momentum. If buyers push above $150, the next logical upside target is $175, while a breakdown could send prices back to $125—both key quarter points.

How to Trade It

Aggressive traders can enter at quarter levels with tight stops, aiming for quick price movements.

Conservative traders should wait for a breakout confirmation and a retest before executing trades.

Renko charts can help filter noise and confirm trend strength, making it easier to spot clean setups.

Is SOL/USD Gearing Up for a Big Move?

With SOL/USD sitting at a crucial level, the next move could be significant. Will we see a drop toward $125, or is a deeper pullback coming? What’s your take? Drop a comment below!

PROFIT & LEARN: NEWS TRADING (MY VIEWS) Introduction:

“Hello, traders! Welcome back to ‘Profit and Learn.’ Today, we’re diving into a fascinating topic: how markets can move contrary to news. It’s a common misconception that positive news always leads to positive market movements. Let’s explore why this isn’t always the case.”

Main Content:

“Markets often price in expected news ahead of time. This means that by the time the news is released, the market has already reacted. Media and PR play a significant role in shaping sentiment, often creating a disconnect between actual news and market reactions. For instance, positive news can sometimes lead to a market drop due to profit-taking or because the news was already expected.”

Case Study:

“Let’s look at a recent example with USD/JPY. Despite all news items coming out positive, USD/JPY made a strong move downward. This can happen when markets have already priced in the positive news, or when traders take profits, causing a reversal.”

Key Takeaways:

“Always understand market psychology. Don’t rely solely on news headlines. Consider the bigger picture and broader market context before making trading decisions.”

Conclusion:

“Thanks for tuning in! Remember, successful trading requires a holistic approach. Stay informed, stay cautious, and happy trading!”

What's Flowing: Trump’s Tariffs – Institutional InsightOn this episode of “What’s Flowing”, I dive into a document shared with me by an institutional trader analyzing the impact of Trump’s tariffs on the markets. With global trade in focus, we’ll explore how these policies are affecting currencies, commodities, and equities, and what institutional traders are watching closely.

Are tariffs a strategic move for economic leverage, or are they setting the stage for market volatility? I’ll break down what I can from the report, reading between the lines to extract key takeaways for traders and investors.

Stay tuned as we analyze the potential winners and losers in this shifting economic landscape, and what it all means for your portfolio.

What is Bitcoin ‘Pairs Trading’? (Example: ETH/BTC)This is for anybody who wants to sell some Bitcoin but is still bullish crypto. 🚀

It’s also if you’re neutral on crypto but think Bitcoin is overvalued vs other tokens.

It’s also just if you’re just interested to see a way to apply a pairs trading strategy .

In case you’ve been hiding under a rock, Bitcoin just broke over $100k - No more waiting for the HODLRS!!

Naturally after hitting this massive milestone, some traders are going to be thinking about taking profits. And if they’re thinking it, some of them are going to be doing it.

But let’s forget about selling for a moment, are you really buying more BTC when it just hit $100k and it's up ~150% this year?

So even if there is not more active selling interest, there’s probably less buying interest.

I think you’d be mad (or very brave) to bet against Bitcoin. BUT

Are these scenarios possible?

Bitcoin trades sideways for a while after hitting $100k

Alt season kicks in and other cryptos play catchup

If you think yes to at least one of these, my team and me have been looking at a pairs trade

What is pairs trading?

Pairs trading in crypto is a market-neutral trading strategy that involves taking a long position in one cryptocurrency and a short position in another, based on the assumption that their historical price relationship will revert to the mean.

The point is to profit from the relative price movement between the two assets, i.e. not the absolute ups or downs of one asset like Bitcoin.

ETH/BTC

I put this crypto pair this way around - I’m not sure if you’re meant to - it just kind of reminds me of EUR/USD in forex trading.

So as a reminder, ETH/BTC is Ethereum’s token Ether priced in Bitcoin. When Ether outperforms Bitcoin it goes up and when Ether underperforms Bitcoin, it goes down.

So it doesn’t actually matter if Bitcoin goes up, down or sideways, if you’re trading ETH/BTC - what matters is what one does relative to the other.

Well this thing has been going down a lot! Until recently.

Going back to the idea of pairs trading - the thesis here is that the Ethererum/Bitcoin price ratio has dropped to bargain levels and could be about to recover.

I’m not going to lie to you - there are a lot of sore hands out there from trying to catch this falling knife!

But this rebound off the 61.8% Fibonacci retracement of the 2020-21 rally has caught our attention.

Dropping to the daily chart, can you see how 0.4000 has acted like a magnet to the price both from above and below?

0.4 is our line in the sand for long positions.

Equally, our risk is well defined in this setup. A drop back under the 61.8% Fib level around 0.32 means the idea isn’t working and it's time to get out and let Bitcoin do its thing!

How to trade it

Specific entries and exits depend on your personal risk tolerance, but broadly there are THREE methods here:

1. Crypto-to-Crypto Spot Trading

Trade ETH directly for BTC (or vice versa) on a cryptocurrency exchange. This is straightforward and involves holding the actual assets.

2. CFD Trading (Contracts for Difference)

Speculate on ETH/BTC price movements using CFDs without owning the underlying cryptocurrencies. This allows for leverage and the ability to short-sell.

3. Spread Trading

Buy ETH and simultaneously short BTC (or vice versa) with equal dollar value to profit from their relative price movement while minimizing exposure to overall market trends.

But that’s just how we are seeing things?

Do you think this is bananas, or could we be onto something?

Please let us know in the comments

Cheers!

Jasper. Chief Market Analyst, Trading Writers

Why Day Traders Act Like Drake but Need Kendrick’s DisciplineDay traders are a lot like Drake: flashy, quick to make moves, and often living for the moment. They’re chasing the thrill of the next trade, celebrating their wins like hit singles, and always looking for the next big opportunity. But here’s the reality: while Drake’s charm works for the music charts, traders need something more if they want to succeed long-term. They need Kendrick Lamar’s discipline.

Kendrick’s artistry is meticulous, thoughtful, and built for longevity. He’s not dropping tracks every week to chase clout—he’s crafting albums that stand the test of time. Traders can learn a lot from that approach. Trading isn’t about scoring a single big win; it’s about building consistency, managing risk, and sticking to a plan.

Here’s how you channel your inner Kendrick:

Stay Humble, Stay Grounded – Don’t let one winning trade inflate your ego. Remember, the market is always the real star.

Think Long-Term – Focus on strategies that build your portfolio steadily over time, rather than trying to hit a jackpot every day.

Master the Basics – Like Kendrick perfects his craft, you need to master your entries, exits, and risk management to create lasting success.

Final Thought:

Are you trading like Drake—seeking the spotlight—or like Kendrick, crafting a legacy? Let’s discuss how you can shift your mindset and elevate your trading game. Drop your thoughts below!

Education: How to Dominate the 2025 Markets with a Solid PlanAs the world hurtles toward 2025, the financial landscape is poised for both opportunities and challenges. For traders, investors, and business owners alike, the key to success is not simply reacting to market movements, but proactively creating a solid plan that allows you to dominate whatever the markets throw your way.

Today, we’ll break down the core elements of a strategy that will not only help you survive but thrive in the coming year. It’s time to stop guessing and start planning.

1. Understand the Big Picture

The first step to dominating the 2025 markets is understanding the macroeconomic forces shaping them. In 2025, we’ll still see the effects of post-pandemic recovery, shifts in global trade, and technological innovations that will change how we interact with financial markets. But there are other things on the horizon too—potential interest rate hikes, geopolitical tensions, and emerging market dynamics that can influence everything from commodities to currencies.

If you want to play the markets effectively, you need to get ahead of these trends, rather than reacting to them. You can’t predict every move, but by staying informed on what’s going on globally, you’ll be better prepared to make moves when the market presents opportunities.

Practical Tip:

Set aside time each week to catch up on world events, economic reports, and financial news. This gives you the context you need to make decisions beyond just looking at your charts.

2. Master Your Trading Psychology

A successful trading plan in 2025 won’t just be about technical setups or market conditions—it will depend largely on your mindset. As traders, we all face the emotional rollercoaster of drawdowns, missed opportunities, and the temptation to break our own rules. This is where a solid psychological foundation can make or break your success.

Having the right mindset means understanding that losses are part of the process and not an indicator of failure. You must embrace discipline, patience, and emotional control. The real key to dominating the market is sticking to your plan when things aren’t going well, not abandoning it at the first sign of trouble.

Practical Tip:

Use tools like TradingView’s alert system to stay detached from the screen and avoid emotional overtrading. This can help you focus on your long-term strategy and prevent impulsive decisions during high-pressure moments.

3. Leverage the Power of Backtesting and Data Analysis

By 2025, data is more powerful than ever. Whether you’re trading stocks, forex, or crypto, having access to historical data allows you to backtest your strategies and refine them based on actual performance rather than guesswork. Backtesting helps you determine if your strategy has been profitable under various market conditions—taking the guesswork out of your trading decisions.

Think of backtesting as practice before the real game. It’s like running drills before a big match, and it’s absolutely essential if you’re serious about dominating the market. When you know that a strategy works in various conditions, you can confidently execute it when the time comes.

Practical Tip:

Use platforms like TradingView or MetaTrader to backtest your strategies using historical data. Look for patterns, analyze risk-to-reward ratios, and refine your entry and exit criteria.

4. Refine Your Risk Management

A solid risk management plan will separate you from the pack in 2025. Market conditions will be volatile, and having a solid framework for controlling risk is critical to surviving and thriving. The best traders are not the ones who make the most money on each trade—they are the ones who manage their losses effectively.

This means setting stop-loss orders, only risking a small percentage of your capital on each trade, and having clear guidelines on position sizing. A well-structured risk management strategy ensures that you can weather periods of drawdown without blowing your account.

Practical Tip:

Decide upfront how much you’re willing to risk on each trade (usually no more than 1-2% of your capital), and set your stop-loss orders accordingly. Even if a trade goes against you, your account will survive and thrive in the long run.

5. Adapt to Emerging Market Trends

The market in 2025 will be shaped by more than just traditional assets like stocks, bonds, and forex. The rise of cryptocurrencies, advancements in AI and machine learning, and innovations in fintech will play an increasingly important role in the way we invest and trade.

While you don’t need to be an expert in every new trend, it’s important to stay agile and keep your finger on the pulse of emerging opportunities. The traders who adapt first to new markets, whether it’s cryptocurrencies, NFTs, or AI-driven investment strategies, are the ones who stand to gain the most.

Practical Tip:

Start exploring new markets now, even if you're not ready to trade them yet. Get familiar with the technologies, projects, and coins that are emerging. This gives you a head start in identifying potential profitable opportunities in 2025.

6. Create a Daily Routine and Stick to It

Success in trading and investing isn’t about working 12-hour days—it’s about consistency. The traders who consistently succeed are the ones who develop a daily routine and stick to it. Your routine should include time for market analysis, backtesting, reviewing your trades, and staying updated on economic news.

A daily routine keeps you grounded and ensures you are constantly improving your skills while managing your trades with a calm and clear mind. The moment you start skipping steps, rushing through your plan, or making impulsive decisions, you're more likely to miss important opportunities or make unnecessary mistakes.

Practical Tip:

Create a trading checklist that you follow every day. This could include checking the economic calendar, reviewing your previous trades, performing technical analysis, and setting alerts for key levels. By following this routine, you ensure that you're always prepared and never caught off guard.

Final Thought: Your Plan, Your Success

The key to dominating the markets in 2025 is not about hoping for luck or predicting the future—it’s about having a solid plan, mastering your mindset, and executing consistently. If you follow the steps outlined here, you’ll be well-positioned to navigate whatever challenges the market throws your way and come out on top.

But here’s the thing: plans are nothing without action. It’s time to stop reading about success and start implementing these strategies. You know the risks. You know the challenges. Now, are you ready to dominate the 2025 markets? Let me know what strategies you're planning to implement, and how you’re preparing for the coming year! Your thoughts could make all the difference.

Why Nailing the Perfect Entry Won't Make You a Winning TraderWhen I first started trading, I spent an absurd amount of time obsessing over the “perfect entry.” I believed if I could just pinpoint the exact right moment to enter, my trades would take off like clockwork. I’d spot my pattern, line up my indicators, and wait for that split-second trigger. But as my journey evolved, I found that success in trading hinges far more on how you exit than on the entry itself.

Aggressive Entries: Simple and Straightforward

Let’s be clear—there is no “perfect entry,” no mythical timing trick that’ll guarantee success. Aggressive entries, for example, are straightforward: you spot the trigger candle, recognize the pattern, and take action at the close. That’s it. No endless analysis or hesitation, just decisive entry. This type of entry is powerful because it’s intentional, capturing the setup in real time rather than waiting for confirmation that could lead to a delayed entry.

While aggressive entries get you in at an ideal price, focusing on entry alone doesn’t cover the full picture of trade management. Without a plan for managing the trade after entry, you’re just hoping the market follows through—and hope is not a strategy.

Exits Matter More Than the Entry

Successful traders don’t just focus on getting in; they put more thought into getting out. If the goal is to grow and protect capital, then exits are the difference between locking in profit or watching it evaporate. After countless hours in the market, I learned that getting the exit right, or at least having a disciplined exit plan, is what shapes your profit curve.

For example, some traders aim for a certain percentage of profit or wait for the price to hit a key level. Others may use stop-loss strategies to protect gains by trailing the stop along the way. The exit strategy you choose is personal, but having one at all is non-negotiable. Think of it this way: without a solid exit plan, even a perfect entry is likely to unravel at some point.

Practical Tips for Developing a Strong Exit Strategy

Define Your Exit Before You Enter: Every trade should begin with a clearly defined exit plan. Before you even click “buy,” know exactly where you’ll exit for both a win and a loss. Setting realistic profit targets and stop losses not only protects you from over-trading but also keeps you focused on executing your plan.

Set Alerts and Automate: Using tools like TradingView’s alert feature is a lifesaver. Alerts allow you to step away from the charts without stressing over every price movement. Let’s be real—the market can be a hypnotic place, and constantly watching it can lead to impulsive decisions. Set your alerts and detach; you don’t need to be glued to your screen for every tick.

Use Incremental Exits: Instead of going all in or all out, consider taking partial profits at different stages of the move. For instance, you might exit half your position at a certain level and let the rest ride to maximize your gains. This approach allows you to capture profit while giving the remaining position room to potentially yield a larger win.

Review and Refine Your Exits: One of the best ways to improve your exit strategy is to backtest it. Use TradingView’s replay feature to “replay” past market conditions and test out various exit strategies. This is invaluable as it gives you a chance to fine-tune your approach based on actual data, not just theoretical setups.

Create Realistic Expectations: The reality of trading is that the market doesn’t always move according to plan. Stay flexible. Some trades might require a quick exit, while others might reward you for holding on. Don’t be afraid to adapt based on the conditions and price action unfolding in front of you.

Why Traders Fail Without an Exit Plan

For many traders, focusing solely on entries becomes a crutch. They mistakenly believe that if they just find the right entry, the trade will manage itself. But the market is unpredictable. Even the best entry can’t secure a win if the trader doesn’t know how to get out.

The hard truth is, obsessing over entries often masks a lack of strategy or confidence in the bigger picture. I’ve seen traders who hit excellent entries repeatedly, but without disciplined exits, they end up handing their profits back to the market. Don’t let your gains evaporate because you didn’t think about your way out.

Trading Success Is Built on Execution, Not Perfection

In the end, what separates successful traders from the rest isn’t a “perfect entry.” It’s a systematic approach to execution. The best traders don’t need flawless timing—they need consistency, discipline, and a clear plan that includes both entries and exits.

So, next time you’re studying a chart, ask yourself not just “Where would I enter?” but also, “Where and how would I exit?” It’s the exit, not the entry, that ultimately decides how much you keep—or give back—to the market.

So, how do you handle exits? Are you still chasing perfect entries, or have you found a balance? Share your strategy below—your insights might be just what another trader needs.

The Rookie Mistake of Timeframe Mismanagement: Avoid This!As a full time forex trader, I’ve seen my fair share of both triumphs and missteps. One of the most common pitfalls that can plague even the most seasoned investors is the rookie mistake of managing trades across different timeframes. It may seem innocuous at first, but failing to align your analysis can lead to confusion, frustration, and ultimately, poor trading decisions.

Understanding the Timeframe Disconnect

In the world of trading, charts come in all shapes and sizes. Whether you’re examining a daily chart to gauge the overall trend or an hourly chart to refine your entry and exit points, the timeframes you choose can significantly influence your trading strategy. The mistake often arises when traders analyze a longer timeframe, such as the daily chart, to identify a potential trade setup, only to switch to a shorter timeframe like the hourly chart to manage their positions. This inconsistency can lead to conflicting signals and erratic decision-making.

The Daily Chart: A Macro Perspective

The daily chart serves as a vital tool for understanding the broader market context. It reveals trends, support and resistance levels, and overall momentum. By focusing on the daily chart, you can identify high-probability setups and determine the prevailing sentiment. For example, if you notice a bullish trend on the daily chart, you might decide to enter a long position based on a breakout or a pullback.

The Hourly Chart: A Micro Perspective

On the other hand, the hourly chart provides a more granular view of price action. It helps traders refine their entry and exit points, offering insights into shorter-term fluctuations and volatility. While the hourly chart can help you capitalize on intraday movements, it can also introduce noise and lead to a focus on minor price changes that may not matter in the broader context.

The Mistake: Conflicting Signals

The rookie mistake occurs when traders attempt to manage their daily chart positions by referencing hourly charts without considering the potential for conflicting signals. For instance, imagine you spot a bullish setup on the daily chart, indicating a solid entry point. However, as you switch to the hourly chart, you notice some bearish price action—a couple of lower highs and lower lows—which may prompt you to second-guess your original thesis.

This disconnect can lead to unnecessary anxiety and erratic trading decisions. You might find yourself prematurely exiting a position or missing out on an opportunity because the hourly chart paints a picture that doesn’t align with your higher-timeframe analysis.

The Impact on Performance

In my early days as a trader, I fell victim to this very mistake. I would analyze a promising setup on the daily chart, only to find myself second-guessing my decision based on hourly price fluctuations. This led to whipsaw trades and emotional exits, ultimately impacting my profitability.

The emotional toll of constantly reacting to the noise of shorter timeframes can be detrimental. Instead of executing a well-thought-out plan, you may find yourself making impulsive decisions driven by fear or frustration.

Solutions: Aligning Timeframes

To avoid falling into the trap of conflicting signals, it’s essential to align your timeframes and establish a coherent trading strategy. Here are a few key strategies to consider:

Top-Down Analysis: Always start with a higher timeframe to set the context. Use the daily chart to determine the trend and potential trade setups, then drill down to the hourly chart for precise entry and exit points.

Avoid Overreacting to Noise: Understand that shorter timeframes can introduce volatility that may not reflect the overall trend. Stick to your original analysis unless there’s a compelling reason to change your viewpoint.

Set Clear Rules: Establish rules for managing trades based on the timeframe you used for your initial analysis. For example, if you entered a trade based on a daily chart setup, consider using the daily chart for exit signals as well.

Stay Disciplined: Remain patient and trust your analysis. If your daily chart setup is valid, give it time to unfold without being swayed by short-term fluctuations.

Conclusion

I’ve learned that managing trades across different timeframes requires discipline and a clear understanding of the market context. Avoiding the rookie mistake of conflicting signals can enhance your trading performance and help you navigate the complexities of the market with confidence.

By maintaining a consistent approach to your analysis and execution, you’ll be better positioned to capitalize on high-probability setups while minimizing the emotional turmoil that often accompanies reactive trading. Remember, the key to success lies in your ability to stay true to your trading plan, regardless of the noise surrounding you. Happy trading!

Strategic Gold Plays: Maverick-Rabbit Precision in Key PatternsBased on your archetype, a combination of the Bold Maverick and the Analytical Rabbit, you have a natural tendency to take calculated risks while also ensuring that those risks are backed by thorough analysis. This hybrid nature likely drives you to engage in trades that have high potential rewards, but only when they meet specific analytical criteria.

Chart Analysis and Coaching on Your Positions

Overview:

Context: This is a 15-minute chart of XAUUSD (Gold vs. USD).

Structure: The chart shows a clear bullish trend with higher highs and higher lows. There are multiple channel formations, liquidity zones (LQZ), and key levels identified (including a 4H Over Ride/LQZ level).

1. Position Analysis:

First Entry - Inside the Ascending Channel:

Entry Reasoning: You likely identified the ascending channel as a bullish continuation pattern and entered within it.

Archetype Reflection: As a Bold Maverick, you're comfortable entering before a full breakout, assuming the trend continuation. However, as an Analytical Rabbit, you probably also considered the channel support before entry.

Coaching: This entry aligns with your dual archetype. You took the position inside the channel, expecting price to continue its upward momentum. However, consider tightening your stop loss in case of a fake breakout to protect your position.

Second Entry - Near the LQZ:

Entry Reasoning: You likely saw price approaching the Liquidity Zone (LQZ), expecting a bounce or reaction at this level.

Archetype Reflection: Analytical Rabbits love analyzing levels like LQZ, while Bold Mavericks might anticipate a reaction before confirmation.

Coaching: Good job recognizing the importance of the LQZ. You probably set a trailing stop to capture profit while letting the trade run. Just be cautious with overconfidence—always have a plan if the price moves against you.

Third Entry - At the 4H Over Ride / LQZ level:

Entry Reasoning: This level is crucial as it represents a 4H Liquidity Zone (LQZ), a significant potential reversal point.

Archetype Reflection: This is a classic Bold Maverick move—anticipating a strong reaction at a higher timeframe LQZ. The Analytical Rabbit side of you likely analyzed the 4H timeframe and identified this as a high-probability zone.

Coaching: This is an aggressive yet well-informed entry. Ensure your stop loss is adjusted to below the LQZ to minimize risk in case the market turns against your position.

2. Trailing Stop Loss (SL) Usage:

Position: You’ve used trailing stop losses, which is a smart move, especially given the bold yet analytical approach.

Coaching: Trailing stops can help lock in profits as the price moves in your favor. Ensure that the trailing distance is neither too tight (to avoid premature exit) nor too wide (to protect against significant pullbacks). This aligns with the Analytical Rabbit’s cautious nature.

3. Key Levels and Patterns:

Ascending Channel: The price is respecting the channel boundaries, which validates your initial entries.

LQZ & 4H Override: Price has shown reactions at these levels, indicating they are well-chosen.

4. Risk Management:

Balance Between Risk and Reward: Your trading strategy seems to balance the Bold Maverick’s appetite for risk with the Analytical Rabbit’s focus on minimizing unnecessary exposure.

Coaching: Given your dual archetype, keep refining your entry and exit points. Use the rule of three (waiting for confirmation after three touches on key levels) to align with your analytical side.

Conclusion:

Your trading approach is a robust mix of intuition and analysis. You're combining bold entries with a solid understanding of market structure. Continue to refine your strategy, especially in the context of multi-timeframe analysis and liquidity zones, to maximize your trading effectiveness. Make sure to always have an exit strategy and avoid letting the Maverick side take over without sufficient backing from the Rabbit’s analysis.

Determining Which Equity Index Futures to Trade: ES, NQ, YM, RTYWhen it comes to trading equity index futures, traders have a variety of options, each with its own unique characteristics. The four major players in this space—E-mini S&P 500 (ES), E-mini Nasdaq-100 (NQ), E-mini Dow Jones (YM), and E-mini Russell 2000 (RTY)—offer different advantages depending on your trading goals and risk tolerance. In this article, we’ll dive deep into the contract specifications of each index, explore their volatility using the Average True Range (ATR) on a daily timeframe, and discuss how these factors influence trading strategies.

1. Contract Specifications: Understanding the Basics

Each equity index future has specific contract specifications that are crucial for traders to understand. These details affect not only how the contracts are traded but also the potential risks and rewards involved.

E-mini S&P 500 (ES):

Contract Size: $50 times the S&P 500 Index.

Tick Size: 0.25 index points, equivalent to $12.50 per contract.

Trading Hours: Nearly 24 hours with key sessions during the U.S. trading hours.

Margin Requirements: Change through time given volatility conditions and perceived risk. Currently recommended as $13,800 per contract.

E-mini Nasdaq-100 (NQ):

Contract Size: $20 times the Nasdaq-100 Index.

Tick Size: 0.25 index points, worth $5 per contract.

Trading Hours: Similar to ES, with continuous trading almost 24 hours a day.

Margin Requirements: Higher due to its volatility and the tech-heavy nature of the index. Currently recommended as $21,000 per contract.

E-mini Dow Jones (YM):

Contract Size: $5 times the Dow Jones Industrial Average Index.

Tick Size: 1 index point, equating to $5 per contract.

Trading Hours: Nearly 24-hour trading, with peak activity during U.S. market hours.

Margin Requirements: Relatively lower, making it suitable for conservative traders. Currently recommended as $9,800 per contract.

E-mini Russell 2000 (RTY):

Contract Size: $50 times the Russell 2000 Index.

Tick Size: 0.1 index points, valued at $5 per contract.

Trading Hours: Continuous trading available, with key movements during U.S. hours.

Margin Requirements: Moderate, with significant price movements due to its focus on small-cap stocks. Currently recommended as $7,200 per contract.

Understanding these specifications helps traders align their trading strategies with the right market, considering factors such as account size, risk tolerance, and market exposure.

2. Applying ATR to Assess Volatility: A Key to Risk Management

Volatility is a critical factor in futures trading as it directly impacts the potential risk and reward of any trade. The Average True Range (ATR) is a popular technical indicator that measures market volatility by calculating the average range of price movements over a specified period.

In this analysis, we apply the ATR on a daily timeframe for each of the four indices—ES, NQ, YM, and RTY—to compare their volatility levels:

E-mini S&P 500 (ES): Typically exhibits moderate volatility, offering a balanced approach between risk and reward. Ideal for traders who prefer steady market movements.

E-mini Nasdaq-100 (NQ): Known for higher volatility, driven by the tech sector's dynamic nature. Offers larger price swings, which can lead to greater profit potential but also increased risk.

E-mini Dow Jones (YM): Generally shows lower volatility, reflecting the stability of the large-cap stocks in the Dow Jones Industrial Average. Suitable for traders seeking less risky and more predictable price movements.

E-mini Russell 2000 (RTY): Exhibits considerable volatility, as it focuses on small-cap stocks. This makes it attractive for traders looking to capitalize on significant price movements within shorter time frames.

By comparing the changing ATR values, traders can gain insights into which index futures offer the best fit for their trading style—whether they seek aggressive trading opportunities in high-volatility markets like NQ and RTY or more stable conditions in ES and YM.

3. Volatility and Trading Strategy: Matching Markets to Trader Preferences

The relationship between volatility and trading strategy cannot be overstated. High volatility markets like NQ and RTY can provide traders with larger potential profits, but they also require more robust risk management techniques. Conversely, markets like ES and YM may offer lower volatility and, therefore, smaller profit margins but with reduced risk.

Here’s how traders might consider using these indices based on their ATR readings:

Aggressive Traders: Those who thrive on high-risk, high-reward scenarios might prefer NQ or RTY due to their larger price fluctuations. These traders are typically well-versed in managing rapid market movements and can exploit the volatility to achieve significant gains.

Conservative Traders: If stability and consistent returns are more important, ES and YM are likely better suited. These indices provide a more predictable trading environment, allowing for smoother trade execution and potentially fewer surprises in market behavior.

Regardless of your trading style, the key takeaway is to align your strategy with the market conditions. Understanding how each index's volatility affects your potential risk and reward is essential for long-term success in futures trading.

4. Conclusion: Making Informed Trading Decisions

Choosing the right equity index futures to trade goes beyond personal preference. It requires a thorough understanding of contract specifications, an assessment of market volatility, and how these factors align with your trading objectives. Whether you opt for the balanced approach of ES, the tech-driven dynamics of NQ, the stability of YM, or the volatility of RTY, each market presents unique opportunities and challenges.

By leveraging tools like ATR and staying informed about the specific characteristics of each index, traders can make more strategic decisions and optimize their risk-to-reward ratio.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Taking On Discipline In StagesOnce you have decided that you need discipline in your trading, knowing where to start can be difficult and overwhelming. There are many pieces to a trading plan, and it's easy to feel overwhelmed.

You can break the task into manageable sections and master one discipline at a time, or focus on the the discipline you need. This approach makes the process more manageable and ensures that each aspect of your trading strategy is given the attention it deserves.

Trading Plan Components: Each of these sections should have objective rules so there isn't any escape room.

Method Rules

Entry Rules

Stop Rules

trailing Stop Rules

Exit Rules

Journaling

Trade Plan for TME, COIN

Shane

TradingView Masterclass: The power of Bar Replay🚀 Unlocking Your Trading Potential with Bar Replay on TradingView

In the whirlwind of trading, having ace tools up your sleeve can dramatically shape your strategy and success. The spotlight shines bright on TradingView’s Bar Replay feature, a gem that offers a rewind on market movements, setting the stage for strategic mastery. Let's dive into what makes Bar Replay a must-use for traders eager to refine their game.

🕒 Understanding Bar Replay on TradingView

Bar Replay is one of TradingView's standout features, allowing traders to select any point in history on their chart and watch the market's movements replay from that moment. It's a game-changer for visualizing price actions and volume changes without the stakes of live trading. Whether you're aiming for an in-depth analysis or a quick market recap, the adjustable speed of Bar Replay caters to all your needs with unmatched flexibility.

🤿 Why Dive into Bar Replay ?

The magic of Bar Replay lies in its exceptional ability to simulate market scenarios, offering a practice ground for strategy testing and gaining insights from historical market behavior. Newcomers find a safe space to learn and experiment, while the pros get a robust tool for refining strategies. Our tutorial video steps it up by walking you through practical uses on a top company's chart—marking crucial levels, applying indicators, and making trade decisions, all within the Bar Replay environment.

✨ Conclusion: ReplayYour Path to Trading Excellence

Bar Replay isn't just another tool; it's your companion in the quest for trading excellence, turning theory into actionable insight. Whether you're just starting or fine-tuning your strategy, it bridges the gap to more informed and decisive trading.

Ready to explore Bar Replay 's power and make each session a step closer to your trading goals? Let's embark on this journey together.

❓ Ever tried Bar Replay in your trading adventures?

We're all ears! 📢 Whether it's been a strategy game-changer or you're navigating its integration, drop your stories below. Let’s navigate the market's waves together.

💖 TradingView Team

PS: Check out our other Masterclasses in the Related Ideas below 👇🏽👇🏽👇🏽 and give us a 🚀 and a follow if you don't want to miss any of our future releases!

How to: Dynamic DCA with Risk Metric [Live Backtest]Hi Everyone,

This tutorial is a live backtest demonstration of a basic Dynamic DCA strategy using my Bitcoin Risk Metric and how it performed in the 2018-2021 BTC market cycle.

The risk metric quantifies the risk of buying BTC at any given time, highlighting periods of overvaluation and undervaluation. A Dynamic DCA strategy allows the user to:

Accumulate BTC during periods of undervaluation.

Lock in profit during periods of overvaluation.

Grow a cash position (undeployed capital) to take advantage of periods of extreme undervaluation.

I hope this tutorial is informative and gives a clear picture of how the @panpanXBT Bitcoin Risk Metric indicators can be utilised to guide decision making.

Please refer to the ideas linked below for information on how to gain access to these private indicators and strategies.

Price Channel TradingPrice Channel + RSI trading

Price channel trading involves identifying a range of prices in which is trading and buying when the price hits the lower end of the range and selling when it hits the upper end of the strategy to trade within the range and that the price will eventually revert the mean.

RSI trading involves using the Relative Index (RSI) identify overbought and oversold in a stock. When the RSI is above 70, is considered overbought, and when the RSI is 30, the stock is considered overs Traders may buy when the stock is oversold and it is overbought, assuming the price will eventually revert of these strategies can be used to make money trading stocks, but careful analysis and to be successful. It's important to do your own research and consult with a financial advisor before making investment decisions.

Know when you have trading edge, and know when to clean housebull trades when over sold,

bear trades when overbought,

and tidy up the house when in the middles.

when you know you dont have edge, trade small and clean up. wait for you setup scenario.

dont be in a rush to lose money

the market will always take your money, dont rush it. wait for you sweet spot for better reward to risk.

audio book link if you want: www.youtube.com

This Pivot Point Supertrend Strategy has up to 90% Success!Traders,

I'll review the Pivot Point Supertrend Trading Strategy in this video. This strategy has up to a 90% success rate with an avg. of 80-100% profits weekly. I think it's well worth our time to review and potentially implement or even automate going forward. Enjoy.

Stew

How to create simple web-hook to send alerts to TelegramHello Traders,

In this video, I have demonstrated how to create a simple web-hook which can send your Tradingview alerts to Telegram channel or group for zero cost.

⬜ Tools Used

▶ Telegram Messenger

▶ Replit - Cloud platform for hosting small programs

▶ Postman - To test web-hooks before going live (Optional)

▶ Cronjob - To set health-check and keep bot alive

⬜ Steps

▶ Create Telegram Bot

Find BotFather and issue command /newbot

Provide bot name

Provide bot username - which should be unique and end with _bot

Once bot is created, you will get a message with token access key in it. Store the token access key.

▶ Prepare Telegram Channel

Create new telegram channel

Add the bot @username_to_id_bot to it as admin and issue /start to find chat id

Store the chat id and dismiss @username_to_id_bot from channel

Find the bot created in previous step using bot username and add it to channel as admin

▶ Setup replit

Create a free Replit account if you do not have it already.

Fork the repl - Tradingview-Telegram-Bot to your space and give a name of your choice.

Set environment variables - TOKEN and CHANNEL which are acquired from previous steps.

Run the REPL

▶ Test with postman

Use the URL on repl and create web-hook post request URL by adding /webhook to it.

Create post request on postman and send it.

You can see that messages sent via postman appearing in your telegram channel.

append ?jsonRequest=true if you are using json output from alerts.

Json request example:

▶ Set alerts from tradingview to web-hook

Use web-hook option and enter the webhook tested from postman in the web-hook URL

And that's all, the webhook for Telegram Alerts is ready!!

Thanks for watching. Hope you enjoyed the video and learned from it :)

PS: I have made use of extracts from the open github repo: github.com