aFew Trendline basics ♧"A overview in the definition and importance of using trendlines , consolidation and breakouts in trading"

-Understand the basics of drawing trendlines, identifying consolidation and support and resistance levels. Get familiar with connecting highs and lows and forming a trendline or reconize consolidation.

-Run with the runners by understanding market momentum.

Identify runners and follow their trend and use other tools for identifying presure on the runners (such as RSI4) and manage the risk while trading in profit.

-Trading the reversal of the breakout as a cycle and understand the breakout and its significant counter value. Identify the breakout and entry points. Recognize the signs of a reversal and exit the position to trade the reversal to the breakout.

In this lecture, i hope to cover the basics of drawing trendlines, how to identify runners and trade with them, and how to trade the reversal of the breakout as a cycle.

By the end of the lecture, you should have a solid understanding of how to use trendlines to your advantage in your trading strategy.

" Trendlines are lines drawn on a chart that connect two or more price points, used to identify trends and potential trading opportunities. Knowing these basics of drawing trendlines, identifying runners, and trading the reversal of the breakout can be a powerful tool when traders look to identify trends and determine entrys & exits points and potential trading opportunities."

There are three types of trendlines: uptrend, downtrend, and horizontal (or sideways) trendlines.

- Uptrend lines connect 2 a 3 higher bulls (uprising bars),

- Downtrend lines connect 2 or 3 lower bears (downsetting bars)

- High & Lows trendlines connect high with hights and Low with lows

- Horizontal trendlines occur when the price remains relatively flat.

• Drawing the trendline and understand the basic is by identifying at least two points on a chart and draw a line that connects them. The line should be drawn along the slope of the trend, either up or down.

• Highs and lows trendlines are realized by connecting highs with highs and lows with lows. You should draw a line that runs along the top of the highs. When connecting lows, you should draw a line that runs along the bottom of the lows.

• Support levels are price points where demand for an asset (EURUSD) is strong enough to prevent the price from falling further, while Resistance levels are price points where supply is strong enough to prevent the price from rising further.

Run with the runners and understand the market momentum.

Market momentum is the strength of the current trend in a market and the momentum can be positive (upward trend) or negative (downward trend).

Runners are assets with strong positive or negative momentum trends. Traders can identify runners by looking for assets with strong upward price movement, high trading volume, and positive news or market hype.

Tools for identifying runners are the use of technical analysis tools such as moving averages, relative strength index (RSI4), and trendlines.

Managing risk while trading with runners is the way traders gain profit. Stop-loss orders should be set and avoid trading with too much leverage is necesary to manage risk while trading with runners.

Trade the reversal of the breakout as cylce. Understand the breakout and its significance when they occure as an asset's price moves beyond a key support or resistance level, indicating a potential trend reversal and identify potential breakouts and entry points by the use of trendlines and technical analysis indicators to take entrys and exits.

Recognizing the signs of a reversal as they occur when an asset's price movement changes direction, signaling a change in trend. Signs of a reversal may include a change in momentum, a break in a trendline, or negative news or market sentiment. Exit the trend for trading the reversal of the breakout should be accomlplished throught soul desire, set profit targets and or the use of a trailing stop-loss orders to manage the risk or take profit while trading the reversal of a breakout.

"Support and Resistance & Consolidation"

A consolidation occurs when the price of an asset moves within a range, between a defined level of support and resistance. Consolidations can provide traders with opportunities to identify potential breakouts and to trade with runners as they move the price towards the breakout level.

Support levels are price points where demand for an asset is strong enough to prevent the price from falling further, while Resistance levels are price points where supply is strong enough to prevent the price from rising further.

"Trendlines can be drawn to connect the highs and lows of the price movement during the consolidation period.

These will form the upper and lower boundaries of the consolidation range."

"Technical analysis tools such as Bollinger Bands, RSI, and Moving Averages can be used to confirm the consolidation and identify potential breakout levels."

During consolidations, runners can be identified by looking for assets with a consistent pattern of higher lows or higher highs.

Traders can buy when the price is moving towards the resistance level and sell when the price is moving towards the support level. You should set stop-loss orders and avoid trading with too much leverage to manage risk while trading in consodilations ranges.

Potential breakout levels can be identified by looking for price movements that break through the upper or lower boundaries of the consolidation range.

Traders can enter a long or short position once the price breaks out of the consolidation range.

Stop-loss orders can be placed below the support level for a long position or

above the resistance level for a short position.

Managing risk while trading the breakout is through a set profit targets and or use of trailing stop-loss orders to manage risk when trading the breakout as breakouts are reasons why traders intent to spot and run with runners , without jumping the gun.

"Recap the lecture by knowing the basics of drawing trendlines, identifying runners, and trading the reversal of the breakout."

The basics of identifying consolidations, trading with runners during,

the 3 trends, consolidations and trading the breakout

..all may provide traders with opportunities to identify potential profitable Forex trades and trade with runners as they move the price more than often.

"Traders use it as a powerful tool to identify trends and potential trendline breakout trading opportunities!"

• HappyForexTradingJournal

J

USDZAR

Q. Why when the FED raises interest rates does the rand weaken?A. Whenever you think about a country raising interest rates, we need to consider what happens to investors and where they are more likely to deposit their money.

So, as we are expecting an increase in interest rates this month from the FED, there are a few reasons why we can expect the rand to weaken further:

Here are three to consider…

Reason #1: Investors flock to the US Dollar

When the US Federal Reserve raises interest rates, it becomes more attractive for investors to hold or buy US-dollar denominated assets.

That’s because they know they’ll receive a higher rate when they invest in it.

This will also lead to a rise in the US dollar and a drop in smaller currencies (like the rand).

Reason #2: US Dollar is still the fat cat of reserve currencies

A rise in US interest rates may lead to higher borrowing costs globally.

This is because the US dollar is still the world's primary reserve currency.

When we think of gold, Bitcoin and other precious metals, we think of how it’s priced in US dollars.

The problem with this, is that emerging market countries, like South Africa, will

face higher debt-servicing costs as the US interest rates continue to move up.

And this could continue to put pressure on their economies which will lead to a depreciation in the rand.

Reason #3: South Africa is still a big exporter

Also, South Africa remains one of the major exporters of commodities.

And the value of the rand is linked to fluctuations in commodity prices.

So, when US interest rates rise, this leads to a stronger US dollar. And can

cause commodity prices to drop (as they are generally priced in US dollars).

As South Africa is a major commodity exporter, the lower commodity prices would have a negative impact in SA’s export revenue – which can in turn weaken the rand further.

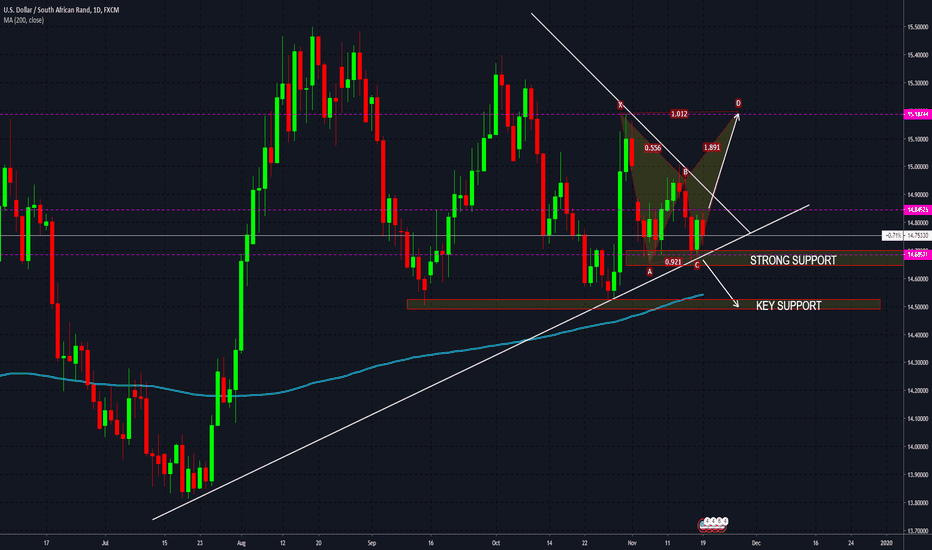

USD/ZAR Critical Zone - Possible 2,500 pip Drop I have not labeled this a short, pending study of price action within this critical zone. So, for now this is for study and educational purposes only. Study, study, study price action in this critical zone and price action. Price action within this zone is very key to whether we will see selling or a continued buy.

USD/ZAR Bullish Pennant? Lets Suppose..HummmPurely for Demonstration and Education Purposes, Hence it is a Tutorial to get our wheels turning about possible outcomes.

If market structure plays out...hummmm I wouldn't dare to say this will happen, but if it did, it would be a textbook play. Given the sentiment of the market with economic outlook of South Africa and Coronovirus fears, it's not far fetched. My USD/ZAR Subscription Zone caught over 600 pips this week just on USD/ZAR movement, join us here as we study this zone by zone for $19 a month. Check out my testimonials on my Instagram (link below)

Link is www.celestefrederick.com

USD/ZAR Are the Bulls Warming Up for a Run? This tutorial is for demonstration and education purposes. For full study as we go along please join my $19 subscription channel where we day trade based on price action at www.celestefrederick.com

Price action trading is like reading a book. As price plays out we take note of what is occurring and can draw conclusions along the way based on price action at key zones in the market.

A few points to note in favor of bull run:

1. The past few weeks have seen more bullish momentum with pullbacks.

2. Price has breached the 200 MA on the daily timeframe. Price could very well attempt to maintain a footing above the 200 MA.

3. We see price is at a key level in the market. See how price likes the zone where we currently are by looking left.

4. Bearish momentum over the past day could very well be a re-test after a break of this key level as demonstrated with my notes. Price could then continue up after the re-test.

5. Keeping fundamentals in mind, with the economic outlook of South Africa and the impact of the Coronavirus in China, the outlook could negatively impact the South African economy. China is a key investor of the South African economy. Economic consequences of the virus spill over to South Africa.

We still can't count the bears totally out.

However, price action tells the story..Will price breach the current zone where it is sitting and pullback? Price action will tell.

My study group is catching pips on this pair daily based on price actions in the market daily. Would love to have you join us!

Please visit my website at www.celestefrederick.com to see my subscription packages and also other free resources. Please also refer to other trade ideas on USD/ZAR which help support this study. Links to a few are below.

Happy Studying and Trading!

USD/ZAR Price Action Study - Read Contents - Do Not PresumeThis study is for demonstration and educational purposes, and study of this will start with the related idea which is linked below. As you recall, I suggested to long term buyers to beware. A few points I would like to make:

1. We are still in a bearish trend, until price breaches the trendline as noted in this tutorial. The bullish price action we have seen thus far could be very well corrective, and not a reversal of the trend.

2. Price is currently sitting at a key level in the market, at the 61.8% fib level from the latest swing points.

3. Price action will tell us if we will see more action to the upside or downside. Watch price action at the key zones as noted, and use other confluences for your entry.

Given this, do not presume on the market but we must study price action as it relates to the zones as noted. For more in depth study on this and how to determine zones and key levels I invite you to join my new subscription service.

I am now offering a subscription service for concentrated study of this and other pairs. Please visit www.celestefrederick.com to subscribe to this service for less than $10 per week.

My subscription service will include access to:

Group Chat, where we will discuss charts, education, and fundamentals

Exclusive Webinars

Trade Ideas with Entry and Exit Suggestions

I am also having a free charting webinar on this Saturday, January 18, 2020 at 11:00 am. Visit www.celestefrederick.com to register.

You can also follow me on Instagram and Facebook.

USDZAR Key Zone Study - With Video Analysis - Read WithinWe had a great time this past Friday studying USD/ZAR and key zones/levels pertaining to this pair.. To Watch the replay of ForexNChill visit the YouTube video at www.youtube.com

This idea is being posted as an educational post, following the study from the ForexNChill, where I share how I study this pair. A few things to note as we study:

1. Note price has rejected key levels in the market with a few failed attempts to rally to higher prices.

2. Price has fallen beneath the 200 MA on the daily timeframe; given so, we are open for further movement to the downside as a possibility.

3. The short term 9 EMA and 50 EMAs have crossed to the downside. This could mean that we will see lower prices.

5. The 50 EMA has crossed beneath the 200 MA which could signal a death cross, with further movement to the downside.

Given this, my inclination is that we have a bit more room to the downside to go; we could see a pullback or a retracement before seeing a continuation of price further down. HOWEVER, It is also not out of the question that we will see a strong bounce around key levels as noted and movement towards the upside. Watching price action at the key zones as noted is key to analysis. There are a few possible scenarios that could happen. Hence the various directions noted. However, again, my overall inclination is that unless we see a notable reversal or strong bullish momentum building, I think we have more room to the downside to go.

For now, study, watch and observe price action around these key levels. As price approaches these levels study candlestick analysis. Time will tell and the market will tell us in time what it wants to do. Never presume on the market, but allow price action to show you along the way.

To see the study on this pair and how to use market structure and price action to study this pair visit www.youtube.com

To receive personal mentorship or join the educational platform to which I belong visit www.celestefrederick.com

Visit the Contact Me page on my website and type in FREE RESOURCES to get free resources to help you learn how to study price action.

Always use proper risk management and use your confluences before entering.

USD/ZAR - Anticipation of a Breakout But Which Direction?USD/ZAR is experiencing what I would call a choppy market at the present time. In times of choppy markets my suggestion is always to look at other opportunities in the market. Why? In choppy markets, we see a lot of indecision. Its actually likely that you will LOSE money or try to chase the market to no avail. What we want to trade is a trending market..A trending market is where we can see clear buy and sell opportunities and we see CLEAR continuous higher highs (buy opportunity) or lower lows (sell opportunity)

As a backdrop in terms of fundamentals there is a lot of uncertainty in the markets as it relates to emerging market currencies. The China trade war is playing heavily into this uncertainty. In light of the fundamentals, we know that we keep the fundamentals in mind as we trade the technicals. The technicals are what make up make up the market structure. It gives a picture of the forex pair over the course of time, which includes the fundamentals (news). This is why I always say to keep the fundamentals in mind. However, we should give a lot of credence to the technicals more than the fundamentals. Given this lets look at the technicals and what do we see?

- We see price is sitting on a very strong level of support, and is currently trading within a range On a lower timeframe you will see the choppiness to which I refer..

- We see price is still sitting above the 200 MA and the 200 MA which tells us that for now price is holding ground above the very next key level of support.

- We see price is trading and consolidating on a higher timeframe within a pennant (note trendlines)

- We know that the longer the consolidation within a pennant on a higher timeframe especially, we can expect there to be a massive breakout. In which direction though? Only time will tell.

- As we continue to study this pair, we could possibly have two scenarios:

1. If price breaks out to the upside, given the previous consolidation, I would expect a massive breakout to the upside to higher highs as noted (remember the massive breakout a couple of weeks ago? Perhaps just like that..not definite but perhaps).

2. If price pushes beyond support to the downside, given the previous consolidation, I would expect a breakout to the downside towards the next key support as noted.

For now I say, watch, study and be ready to take advantage of the breakout when it happens, as it breaks out of the pennant or for conservative, you can watch for the break and re-test.

Please refer to my previous studies on price action, key zones, and how to study the markets using price action study.

I now offer one-on-one mentoring sessions where we will together study the markets and you will learn how to trade price action and understand market structure. If interested please inbox me for information. Spaces are limited; For individual sessions, I have space just for a few more students, as I like to take the on-on-one time to spend with each individual. Group sessions are also available, if you would like to get a small group of students (3 to 5), and you can take advantage of lesser group rate. I really enjoy studying the market and sharing with others. As we study I will share certain e-books and educational material that I have as we learn this market together.

Thanks for studying along! Always use proper risk management, use your confluences, and wait for confirmation before entering any trade. Conserving capital is very key.

USDZAR Educational PostHappy Wednesday! As we continue our study of this pair USD/ZAR we see price is at a very key point in the market. The market opened on Sunday with a gap. Price continued it's descent and pulled back to the 38% key fib level, which is also right at the market open gap point. Will price trade above Sunday market open, which will lead us to higher price, or will price continue down after the pullback (rhetorical question). For now it's a good watch or perhaps a scalp. This is a study for demonstration and educational purposes only. Thanks for studying. We should visit back and play forward to see how price reacted, which helps us to build knowledge for future trade ideas. Sometimes the best trade to make is no trade at all, while we study price action. Please note, the arrows are not pointing towards a particular take profit area, but I am showing that price COULD reach these points. How do we know for sure? WE DON'T. We must continue to study price action along the way to gain better insight. Price action and market structure is EVERYTHING when studying for trade ideas. Price doesn't have to reach particular points. We see what the market is doing and REACT accordingly. Protection of capital is key. Please study progression of my previous ideas below to aid in your study. Study is most important versus taking signals. You build knowledge to call your own trades, independent of others traders ideas which are all speculation as well. We can only speculate, not dictate the markets. Feel free to offer your comments as well as we study the markets.

USDZAR Truly For Study Purposes ONLY - READ CONTENTSNow before I share this idea, let me tell you THIS IS FOR STUDY PURPOSES. This is what we do as traders STUDY. This idea is a tutorialL for now because I want you to read the contents and understand my profile. Let me preface before I begin a few points:

1. My trade ideas are for STUDY and EDUCATIONAL PURPOSES.

2. My goal in sharing with YOU is NOT to be RIGHT. The market doesn't give a hoot if I or you are right or wrong for that matter. Heck, I don't give a hoot if my analysis is wrong. Price action and Market movement is dynamic. It's subject to change at any notice. Just one news event can change a perfectly good set up. So know being wrong is not my biggest fear, which is why I can share freely. What is important is how we REACT to price action. A WRONG IDEA IS ONLY WRONG IF YOU ENTER UNWISELY AND LOSE YOUR CAPITAL. If I share an idea and it is not right..there is no shame in that..as that is not my goal to be right, but to help you to STUDY.

3. I DO NOT give signals..let me repeat. I DO NOT GIVE SIGNALS

4. When I share trade ideas, they are not for SIGNAL TAKERS. I repeat. MY IDEAS ARE NOT FOR SIGNAL TAKERS.

5. My ideas are for STUDENTS OF THE MARKET. I repeat. If you are a signals taker, this may not sit well with you.

6. The purpose of my profile is to EDUCATE. Meaning we STUDY the markets, watch price action and confluences to consider an entry. IF YOU DO NOT KNOW HOW TO STUDY, JOIN MY TEAM WHERE YOU WILL LEARN. INBOX ME.

7. I WILL VERY VERY RARELY TELL YOU WHEN TO EXECUTE. WHY? Again, my ideas are to EDUCATE YOU and not to tell you when to get in the market. YOU are responsible for your own entries. MY IDEAS ARE FOR STUDY PURPOSES. We should all want to be students of the market and depend on our own analysis. Take the time to learn this skill.

8. I DO NOT GIVE SIGNALS

9. If you take this idea and run with it, without exercising proper study and risk management, it is your own responsibility and fault, not mine, if your trade fails and you lose capital.

Now that we got that out of the way, THIS IS FOR STUDY PURPOSES. How do we improve our winnings in the market? We do this by way of study, sharing ideas (NOT SIGNALS). If you want signals, join my team for my precise entries.

For the study

On a lower time frame we have the possible makings of an inverse head and shoulders. What does this mean for the future? we could possibly see the creation of a right shoulder . Is it definite? No. It's possible. We know we also see on a lower timeframe what may be the makings of a reversal for another bullish run up. Is it definite? No. It's possible. How do you determine which way price will go? Answer is WE REALLY DON'T KNOW. However, we can STUDY PRICE ACTION, CONFLUENCES, STUDY AGAIN, EXERCISE PROPER RISK MANAGEMENT and enter trades based upon our study and wise judgement.

Please refer to the linked idea below, which will show you what I believe based on where we are now, what is the direction of the market. Keep in mind, the market does not move in a straight line, and it WILL have a series of bull runs and pullbacks, even sell opportunities until we make it there. My ideas are overall market outlook only

What I am doing is studying price action and will see how price responds to certain areas in the market. This will determine if I enter the trade. This should determine if you enter the trade. You enter at your own risk and are responsible for your own trades and outcomes. I would love to help you learn to study; please inbox me to join my team. If not, there are a plethora of resources to help you learn the skill of trading.

Thanks for following.. Feel free to leave comments if you like, follow me on Instagram and Facebook. I am here to educate and share!

USD/ZAR Purely for Educational Purposes - Price Action StudyPlease note, this idea is for educational and demonstration purposes and does not constitute a trade idea or a signal. The entire idea is much too far out to predict. As such, this is a study. Trade at your own risk. To demonstrate please note the following:

1. This pair has seen an extended bull run. Given this we can expect the market to adjust itself by way of experiencing at least a 50% to 61.8% retracement of the entire previous swing before continuation back up to higher prices.

2. You may ask.....Continuation back up? If we keep fundamentals in mind (remember we do not trade based on fundamentals, but technicals, but we keep the fundamentals in mind), is the rand yet ready to strengthen to prices under 14.5?

3. We see an inverse head and shoulders possibly forming. The continuation up could possibly put us on track to previous highs and beyond, given the fundamental sentiment of the market.

4. We also see that price is being contained with an ascending channel. Price could reach 14.2 before year end, especially if we see strengthening of the rand. This would result in a double top formation.

This is strictly for educational purposes. Study, study, study price action along the way! Trade at your own risk. Follow me on Instagram and Facebook (see links below) for more updates along the way!

USD/ZAR Never Presume on the Market Study (Part 2)As a follow up to my previous post (see below), we see that what we have seen in the way of sell activity was a deep pullback to the trendline. When we are not sure what the market is doing, it's best to wait than to presume. Let us also look left, we see retesting of key zone (wick). Will price continue up to 15.5 and above? Continue to study price action and see where it takes us!

USD/ZAR Never Presume on the Market - TutorialUSD/ZAR is by far my favorite pair to trade. This is simply a tutorial to remind us to always keep an open mind when we perform analysis. We can never presume which way the market will go. We must study zone to zone, swing by swing, price action, all along the way. Some may say we will see a drop , some may say we will see a rise, but what does the market say? What we want to study is market structure and patterns within the market structure, as well as price action along the way.

Before we study the charts the first thing we should do is forget everything we think we know about where we think price will go. We need to approach the market with an open mind and ask ourselves: What is the market saying to me?

Now for what we do see. Starting on a higher timeframe, technically speaking we could have a bullish flag forming. Afterwhich we could expect another push to the upside. Depending on price action in the markets in the near future, we could see price break the trendline as noted for further movement down; Even still In either sense we may see price reverse. We can't assume that price will reach a certain high or low, but what does the market say? The analysis can change from one day to another based on what price action is doing. I also remind us all to not trade the news, but to keep the news in mind. We should always be aware of what's going on fundamentally. However, the market structure of the chart over time incorporates news events and such over time. Technicals tell the whole story.

Lets discuss! What do you see? Follow me on Facebook or Instagram (links below). Be sure to comment and like as well. Students of the market we must always remain! To join my team of forex traders and learn how to trade the markets, inbox me for more information or click my link in my bio.