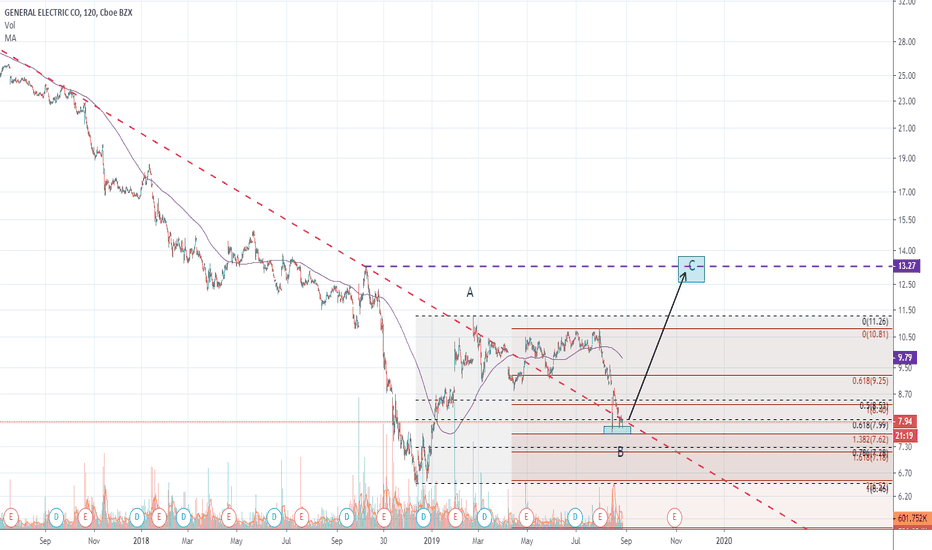

General Electric - contrarian buy?NYSE:GE is not the stock you probably want to own given all the heat experienced by the company recently.

But from contrarian perspective, nice levels right now to attempt speculative buy. Price retraced by 61.8% of previous bounce and is holding the line of previous resistance. Today may be the third daily candle when 7.8 is held, indicating that good support zone might be formed at around current levels.

Trade: stop at 6.39 (previous low), target at ~13$

#generalelectric

GENERAL ELECTRIC (GE): Close To Supply Zone

General Electric is very close to a decent area of supply.

looking left at structure we can see how the underlined area was significant for the market participants in the past.

+ rsi has reached the overbought condition and we haven't seen a bearish reaction on this stock since summer 2019.

good luck!

General Electric: New Bull Cycle starting.GE is on Higher Highs on the 1W chart for the first time since August 2016. That was the last peak before a strong 2 year bear cycle hit the company. As you see on the chart General Electric's trend is a parabolic Channel starting with the All Time Highs in 2000. This long term curve has entered its asymptotic phase and may initiate the recovery back to the ATH.

At this stage however we choose to focus on the next Bull Cycle which based on the following parameters is about to start:

* As mentioned Higher Highs on 1W.

* RSI on a Channel Up.

* Long term support at 5.50 holding.

A Golden Cross will simply confirm the new Bull Cycle. We are still in the early stages, GE is an excellent long term investment for your portfolio.

Our Target Zone is 28.00 - 32.00.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

GE (General Electric), Look at this Mirror Level!..In this chart, you can see a nice example of how Mirror Levels works.

If you see such a situation you can open your position with a nice risk/reward ratio!

Push like if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Write your comments and questions here!

Thanks for your support!

GE at key W resistance | Opp. for shortGeneral Electric has reached a key daily and weekly resistance.

It has already re-tested this resistance and I would like to use it as an opportunity. Now, if the price will have really weakness it should drop and filled a market gap at $9.70 which would be also our target.

If there will be no strength in our resistance I will immediately cut this trade, because overall this stock looks very strong in the short term. Take this idea as some relief to take more longs at $9-10 levels.

GE Short Setup - 1:4 Risk to Reward / RISKYGE daily chart shows weakness. I am expecting a pullback to $10.50. I can buy some puts for this. However there's no reversal signal yet. If I wait for a confirmation, the risk to reward will be less. I have decided to buy the risk.

GE SHORT TRADE SETUP

Entry: 11.39

Stop-Loss: 11.60 (0.21)

Take-Profit: 10.56 (0.83)

Risk to reward: 1:3.95

Winning probability: Less than 40%

NOTE: I am not very comfortable with the stop-loss. During the trade, i can move it up to 1:2 Risk to reward. That's why I'm not going to risk more than 1% of my account.

Disclaimer: This is not an investment or financial advice. Please do not copy my trades.

Remember to follow me.

Trade safe,

Atilla Yurtseven

Lifetime opportunity, soon Bankruptcy, short with PUT options!!It's time to talk about the story of a decade!

It is now clear, that General Electric has been cooking it's books for years now!

Says Harry Markopolos, a legendary whislteblower, who runs a finical fraud detection company, famous with him exposing Bernie Madoff and his Wall Street firm Bernard L. Madoff Investment Securities LLC, a hedge fund that turned out to be a giant Ponzi Scheme!

The company is allegedly lacking 39 billion in cash, that being a conservative estimation, covering up it's losses with sophisticated accounting and it's organizational structure!

I am long PUT options on the 2.00-1.5 level with 4-6 moths expiration, and will be adding to the portfolio each month!

When the company announces it's bankruptcy the stock price will go below the mentioned levels, ideally to a couple of cents per share!

A MASSIVE opportunity with 1:100/ 1:300 returns, as the put options on these levels are currently worth almost nothing!

even if the odds of it going bankrupt is 1:2, the risk return ratio is just mind blowing!

It is important to note, that I am taking 4-6 months as an average for the previous cases of such fraud detection, like Enron and WorldCom, which both went bankrupt within 4 moths after the exposure!

S NYSE:GE o I am just being on the safe side here, being up put options with further expiration each month!

It does not matter how the stock's price behaves during these 4 months.If it goes up, take it as the opportunity to double down on your PUTS position.

General Electric - Expect volatilityGE, America's sweetheart has been accused of fraud allegations before. This time though, it's by the same person who did it on the Madoff Scheme (Harry Markopolos)

Markopolos’ main points of contention are:

1) GE’s insurance obligations are woefully under-reserved and it has been lying to the Kansas Insurance Department

2) GE shouldn’t have consolidated BHGE’s financial statements, which are a source of confusion

3) GE’s evolving presentation makes it very difficult to evaluate GE’s operating performance.

-------

In response to the whole ordeal, General Electric's CEO bought $2million in shares.

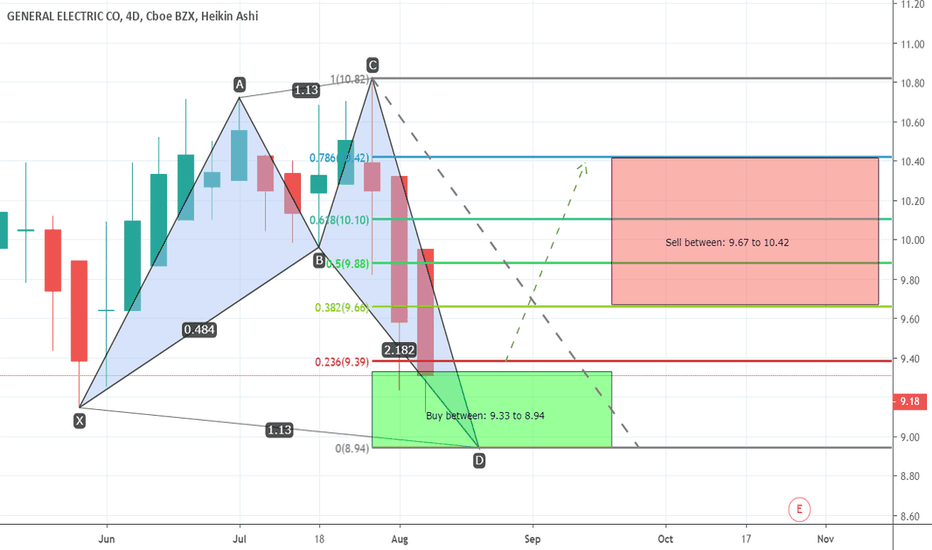

GE formed bullish shark a good long opportunityPriceline of GENERAL ELECTRIC CO (GE) Stocks has completed a bullish shark pattern and entered in potential reversal zone.

From here price aciton will take bullish divergence soon insha Allah.

I have defined targets using Fibonacci sequence as below:

Buy between: 9.33 to 8.94

Sell between: 9.67 to 10.42

Regards,

Atif Akbar (moon333)

Possible 3rd Quarter Break Out for GEI was looking at this trying to determine a downward trend for GE but based upon the RSI and MA I am more optimistic that there may be an upward tick coming. I would suggest watching this for the next few weeks as it test the support / resistance barriers. Earning were nothing special but RSI suggest there may be a slight undervaluation here.

pin bar daily candle @ 200 day EMA pretty simple set up ill be looking for a break above 10.57 to go long, if the scenario ends up a bearish one ill look for a break of that pivot level to take us down to S1 or that red support for a 3rd test 9.50-9.60 area, would be a great spot to get bullish again if we test and hold that 9.50-9.60 area

GE - Daily 7-7-19Upside:

- Ascending triangle forming over the past month

- The bottom of the ascending triangle is closely in-line with the 20-day SMA, providing additional support

- Inverse head and shoulders set-up forming since early February

Downside:

- Stock price has failed to break above $10.71-$10.72 on three separate days, potentially leading to a double-top set-up

- Volume has slowly been trending down

Notable Prices:

- Top of ascending triangle (also potential double top level) is $10.72

- Bottom of triangle and 2-day SMA is $10.35

I am watching to see which way out of this narrow range the stock price breaks and the volume that is associated with it.