Breakout Alert: AMD Head & Shoulders Points to $160+Overview

Name: Advanced Micro Devices, Inc.

Ticker Symbol: AMD

Exchange: NASDAQ

Founded: 1969

Headquarters: Santa Clara, California, USA

CEO: Lisa Su (as of 2025)Sector: Technology / Semiconductors

About

AMD is a leading semiconductor company known for its high-performance computing and graphics solutions. It competes with Intel and NVIDIA in the CPU, GPU, and data center markets. Its product line includes Ryzen (desktop/laptop CPUs), EPYC (server CPUs), and Radeon (GPUs), with strong expansion in AI and custom silicon for next-gen applications.

Fundamentals

Earnings: AMD reported strong Q1 2025 earnings with a beat on both revenue and EPS, supported by explosive demand in the AI and data center segments.Revenue: $6.52B, up 21% YoY

Outlook: The company raised guidance for the second half of 2025 as it expects to benefit from the AI chip boom and new product rollouts.

Technicals (4H Chart)

Inverted Head and Shoulders pattern confirmed with neckline breakout around ~$117

Breakout from Falling Channel aligning with bullish reversal structure

Price surged past resistance with strong volume, currently at $126.39 (+9.71%)

RSI at 65.88, approaching overbought but not signaling weakness

MACD bullish crossover, confirming momentum

Short-term target range: $145–$150, with extended projection up to $162.75

📌 Support Levels: $117, $111.50📈 Target Price (TP): $162.75 (based on pattern breakout height projection)

💡 My Take

AMD just pulled off a textbook bullish reversal — inverted head and shoulders breakout combined with a falling channel exit. With strong macro trends in AI hardware and data center expansion, this move feels well-supported fundamentally and technically.

The clean neckline breakout and explosive candle suggest continuation. I am expecting a potential consolidation around $130–$135ish before next leg to $150+. If momentum holds, $162+ is possible before August.

💼 Position

Type: AMD 145 Call

Expiry: July 03, 2025

Quantity: 15

Average Cost Basis: $.038

Date Purchased: June 12, 2025

Last Price: $0.47

Total % Gain/Loss: +23.4%

I entered after the neckline break and riding the wave. AMD’s setup is too clean to ignore — high conviction play.

#headshoulders

How to Spot Head & Shoulders Patterns in TradingViewDiscover how to identify and validate Head & Shoulders patterns using TradingView's built-in pattern recognition tools in this detailed tutorial from Optimus Futures. Chart patterns are essential tools for many futures traders, and the Head & Shoulders formation is among the most recognized reversal patterns in technical analysis.

What You'll Learn:

• Understanding the Head & Shoulders pattern: a key reversal formation in technical analysis

• How to access and use TradingView's pattern drawing tools and objects

• Step-by-step process for identifying potential Head & Shoulders formations on any timeframe

• Techniques for spotting the "head" by locating the highest high or lowest low pivot points

• How to identify matching "shoulders" on either side of the head formation

• Validating your pattern identification using TradingView's drawing tools

• Real-world example using crude oil futures on an hourly chart from October 2024

• Key characteristics that distinguish bearish Head & Shoulders reversal patterns

• Best practices for using pivot points and swing analysis in pattern recognition

This tutorial may benefit futures traders, swing traders, and technical analysts who want to improve their chart pattern recognition skills in TradingView. The techniques demonstrated could help you identify potential reversal opportunities and make more informed trading decisions when these classic formations appear on your charts.

Keywords: Head and Shoulders pattern, TradingView tutorial, chart patterns, technical analysis, reversal patterns, futures trading, pivot points, swing analysis, pattern recognition, trading education

Visit Optimus Futures to learn more about trading futures with TradingView:

optimusfutures.com

Disclaimer:

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only. Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools—not forecasting instruments. Market conditions are constantly evolving, and all trading decisions should be made independently, with careful consideration of individual risk tolerance and financial objectives.

Shoulders to the Sky: Amazon’s Breakout Journey BeginsOverview

Name: Amazon.com, Inc

Ticker Symbol: AMZN

Exchange: NASDAQ

Founded: 1994

Headquarters: Seattle, Washington, USA

CEO: Andy Jassy (as of 2025)

Sector: Consumer Discretionary / E-commerce & Cloud Computing

About

Amazon is a global e-commerce and cloud services powerhouse. It dominates online retail while also operating AWS (Amazon Web Services), one of the world’s leading cloud computing platforms. Other segments include advertising, logistics, streaming, AI hardware (Alexa), and physical retail.

Fundamentals

Earnings: Amazon has consistently beaten revenue expectations with strong growth in AWS and advertising segments.Revenue: Q1 2025 revenue topped $154.8B, up 13% YoY, with solid margins.Outlook: Management has raised guidance for Q2 citing AI integration in AWS and retail efficiency gains.

Technicals

Inverted Head and Shoulders Pattern confirmed on the daily chart — a strong bullish reversal signal.

Price has broken above the neckline (~$213–$215) with volume confirmation.

Golden Cross forming on short-term MAs — bullish signal.

RSI is around 64, suggesting momentum remains but is nearing overbought.

MACD is bullish with widening divergence — supports potential continuation.

📌 Support Zones: $202, $199

📈 Resistance / Target Zones: $217 (short-term), $235 (TP), $242 (extension)

💡 My Take

AMZN is showing bullish continuation out of a textbook inverted head and shoulders — typically a strong reversal setup after a downtrend. We’ve seen the neckline break with follow-through, and volume patterns support the move.

While the RSI shows slight overbought conditions, this could lead to a short consolidation before another leg up toward $235–$242. With macro tailwinds from cloud and advertising sectors, AMZN is positioned well for a strong Q3 rally.

Position

Type: AMZN 235 Call

Expiry: July 11, 2025

Quantity: 7

Average Cost Basis: $1.00

Last Price: $0.69

Purchase Date: June 12, 2025

Total % Gain/Loss: –30%

Despite current drawdown, I remain optimistic about AMZN's momentum. The technical setup is strong, and short-term weakness is likely just healthy consolidation. I'm holding through July with my eyes on the $235 target.

Shoulder on Shoulder - Need a dump this Week😥 The past week was complicated, and I don't want to bore you with all the political goings-on, which I hope you're already aware of. I'm a bit short on time right now, but I still wanted to share this perspective with you all.

💁♂️ It is Shoulder on Shoulder H&S everywhere!

💡 My concept of a plan:

🧗 Let's climb the Pinky way down

3289 - Actual Price

3271 - 🏁 S1

3232 - 🚪 Pink Neckline entry

3245 - 🤞 S2 & Head of White reverse H&S

3204 - 👀 Pink Start from Left Shoulder

3184 - 🎯 TP 1 - Fibo 1.272

3163 - 🎯 TP 2 - Fibo 1.414 or 3166

3134 - 🎯 TP 3 - Fibo 1.618 or 3154

3120 - 👀 Head of Yellow reverse H&S

3079 - 🎯 TP 4 - Fibo 2

🗣️ Important: FED Chair Powell speaking June 02 Mon at 1 PM EDT

What are your toughts about this? Please write it in the comments.

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

Possible Reverse Head and Shoulders?👁️🗨️ The strong uptrend yesterday, followed by the downtrend during the Asian session, has built a possible inverse head and shoulders pattern (30 min chart) 🤷🏼♂️.

⏫ If an uptrend follows today, the pattern will be complete.

The right shoulder began around $3287, which isn't far from the current price.

👀 Keep an eye on this, as it could drop lower while still keeping the structure intact.

⚡ What's very interesting is that the downward trendline (strong resistance) crosses the neckline support if the time window allows.

🙏 Possible target points:

TP 1: $3358

TP 2: $3382

What are your toughts about this? Please write it in the comments.

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

EURUSD | Head‑&‑Shoulders on the Brink – Bears Eye 1.1250📉 Trade Thesis

A textbook Head‑and‑Shoulders has completed on the 30‑min EURUSD chart. Price is now testing the rising neckline drawn from mid‑April swing lows. A clean close and retest beneath that trendline opens room toward the next demand shelf and the lower boundary of the broader ascending channel.

🎯 Execution Plan

Entry: wait for a decisive candle close below the neckline, then look to short on a minor pull‑back into that broken support.

Stop: just above the right‑shoulder high to keep risk tight.

Target: the measured‑move objective sits near the channel median/support cluster highlighted on the chart; scale out as price approaches that zone.

🧩 Confluence Factors

Momentum loss: RSI made a lower peak on the “head” versus the prior thrust, signalling fading upside energy.

Event risk: upcoming NFP/ISM releases may fuel USD volatility, providing the catalyst for a break.

Structure: the right shoulder’s supply shelf has capped every rally since late April, reinforcing bearish pressure.

⚠️ Risk Management

Macro data can produce whipsaws—size positions accordingly and stick to the plan. Move stops to breakeven once price pushes convincingly away from the neckline.

For educational purposes only. Trade your own strategy & manage risk.

Possible H&S Forming – It’s All About the News NowOANDA:XAUUSD

📉 Watching closely: Possible Head and Shoulders formation developing on the 4H and 1H charts

As of April 24, 2025, Gold (XAU/USD) is forming a potential Head and Shoulders pattern on the shorter timeframes (4H and 1H), which could indicate a reversal setup. While multiple scenarios are still in play, the price action around the $3368 level will be crucial.

If price fails to break above this resistance in the near term, it could suggest weak bullish momentum and open the door for a pullback toward and possibly below the neckline around $3250 .

🔔 Key Economic Events – April 24

08:30 EDT – Durable Goods Orders MoM

Forecast: +2.0%

Personal outlook: Numbers might come in weaker than forecasted.

Durable goods orders are a solid gauge of industrial demand. Weaker-than-expected numbers would likely weaken the USD and could offer some upside pressure on Gold.

10:00 EDT – Existing Home Sales

Forecast: Lower than previous.

As a key barometer of consumer confidence and economic stability, lower-than-expected figures could also put pressure on the USD, potentially providing Gold a short-term bullish impulse.

📊 Potential Scenarios

Scenario 1 – Bullish Breakout

Weak economic data → USD weakens → Gold spikes above $3400

If both data points disappoint, we could see a rally in Gold, possibly breaking the resistance and invalidating the H&S pattern.

Scenario 2 – Bearish Breakdown (Preferred H&S Scenario)

Strong data → USD strengthens → Gold falls below $3200

While less likely, if economic data comes in stronger than forecasted, Gold could see a significant drop, forming the right shoulder and breaking the neckline – confirming the Head & Shoulders reversal.

Scenario 3 – Sideways Movement

Neutral data + Tariff talks in focus

In the absence of impactful data or if figures come in as expected, Gold might consolidate sideways. Ongoing developments around US-China tariff negotiations could dominate sentiment, delaying or nullifying the H&S pattern entirely.

📉 Market Sentiment Snapshot

US stocks are rallying on optimism around tariff reductions

Trump administration signaling potential easing of China tariffs

➡️ Gold under pressure as risk-on sentiment rises

📍 Conclusion

Keep an eye on the $3368 level and $3250 neckline. Short-term moves will likely be dictated by today’s economic releases and the evolving trade narrative. A confirmed break below the neckline would validate the bearish H&S scenario with potential downside toward $3200 and below.

👉 Stay nimble and trade the reaction, not just the forecast.

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

Head and Shoulders Pattern: Advanced Analysis for Beginners█ Head and Shoulders Pattern: Advanced Analysis for Beginners

The Head and Shoulders pattern is one of the most widely recognized and reliable patterns in technical analysis. And today, I am going to teach you how to use it as efficiently as an experienced trader would.

Learning to spot and trade this pattern can be a great asset in your tool belt —whether you’re trading stocks, forex, or cryptocurrencies.

The Head and Shoulders is a well-known reversal pattern in technical analysis that signals a potential trend change.

⚪ It consists of three peaks:

The Left Shoulder: A peak followed by a decline.

The Head: A higher peak formed after the left shoulder, followed by a decline.

The Right Shoulder: A smaller peak resembling the left shoulder, followed by another decline.

When these peaks form in a specific order and the price breaks below the neckline (the line connecting the two troughs between the shoulders), it indicates a bearish reversal from an uptrend to a downtrend.

█ What about Bullish reversals? Don’t worry — there's good news!

Conversely, the Inverse Head and Shoulders pattern forms at the bottom of a downtrend and signals a potential reversal to the upside. By recognizing the pattern early, you can position yourself for a high-probability trade with a clear entry and exit strategy.

█ How to Identify a Head and Shoulders Pattern?

I truly believe the best way to learn any trading strategy is to keep it simple, away from the “technical” jargon unless absolutely necessary. We’ll do the same with this strategy.

Despite its varied usage, you can break it down into four simple steps:

1. Look for the Left Shoulder

The first part of the pattern forms when the price rises , creating a peak. Then, it declines back down to form the trough . This creates the Left Shoulder of the pattern.

Example: If the price of Bitcoin (BTC) rises from $85,000 to $90,000, and then declines to $87,500. This is your Left Shoulder.

2. Spot the Head

The second part of the pattern is the Head . After the Left Shoulder, the price rises again , but this time, it forms a higher peak than the Left Shoulder. The price then declines again, creating a second trough .

Example: Continuing with Bitcoin, after the price dropped to $87,500, it rises to a new high of $95,000 before dropping back to around $90,000. This $95,000 peak is the Head, which is higher than the Left Shoulder.

3. Find the Right Shoulder

After the decline from the Head, the price rises again, but this time, the peak should be smaller than the Head, forming the Right Shoulder . The price then starts declining again, and this is where the neckline is formed (connecting the two troughs).

Example: Bitcoin then rises from $90,000 to $92,000 (lower than the $95,000 peak). This forms the Right Shoulder, and the price starts to decline from there.

4. Draw the Neckline

The neckline is drawn by connecting the lows (troughs) between the Left Shoulder and the Head, and between the Head and the Right Shoulder. This is your key reference level.

█ How to Trade the Head and Shoulders Pattern

Once you've spotted the Head and Shoulders pattern on your chart, it’s time to trade it. And yes, it did need a separate section of its own. This is where most amateur traders mess up - the finish line.

1. Wait for the Neckline Breakout

The most crucial part of the Head and Shoulders pattern is the neckline breakout . This is when the price breaks below the neckline, signaling the start of the trend reversal.

Example: After the price rises to form the Right Shoulder at $92,000, Bitcoin then drops below the neckline (around $90,000). This is the confirmation that the pattern is complete. The price of BTCUSD is likely to continue downward past the 90k mark.

2. Enter the Trade

Once the price breaks below the neckline, enter a short position (for a bearish Head and Shoulders pattern). This is your signal that the market is reversing from an uptrend to a downtrend.

3. Set Your Stop Loss

Your stop loss should be placed just above the right shoulder for a bearish Head and Shoulders pattern . This makes sure you are protected in case the pattern fails and the price reverses back upward.

Example: Place your stop loss at around $93,000 (just above the Right Shoulder at $92,000) on BTCUSD.

You can also try one of these strategies I have used in the past:

⚪ Conservative Stop: Place the stop above the head (for bearish H&S) or below the head (for bullish iH&S) for maximum safety.

⚪ Aggressive Stop: Place the stop above the right shoulder (for bearish H&S) or below the right shoulder (for bullish iH&S) to reduce your stop size.

⚪ Neckline Reclaim Invalidation: Exit the trade if the price reclaims the neckline after breaking it. This could be an indication of a false positive/invalid pattern.

4. Set Your Profit Target

To calculate your profit target, measure the distance from the top of the Head to the neckline and project that distance downward from the breakout point.

Example: The distance from the Head at $95,000 to the neckline at $90,000 is $5,000. So, after the price breaks the neckline, project that $5,000 downward from the breakout point ($89,800), which gives you a target of $84,800.

5. Monitor the Trade

We’re in the home stretch now, people. This is the 9th inning.

There’s only one job left: keeping an eye on any retests or contrarian moves.

As the price moves in your favor, you can scale out or move your stop loss to break even to lock in profits.

█ What makes H&S strategy an all-time classic?

It’s simple. It works.

This pattern works because it reflects a shift in market sentiment:

In a Head and Shoulders pattern , the uptrend slows down as the market struggles to make new highs, and then the price ultimately breaks down, signaling that the bulls have lost control.

In an Inverse Head and Shoulders pattern , the downtrend weakens as the market fails to make new lows, and the price breaks upwards, signaling a bullish reversal.

⚪ Here are a few points to remember as a cheatsheet for Head and Shoulders patterns:

Wait for the neckline breakout to confirm the pattern.

Set a stop loss above the right shoulder for protection.

Project the price target using the height of the head for a realistic profit goal.

Always monitor the trade for any signs of reversal or false breakouts.

Mastering this pattern can be a game-changer for any trader, but like any tool, it’s only effective when combined with other indicators, strategies, and a solid risk management plan.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

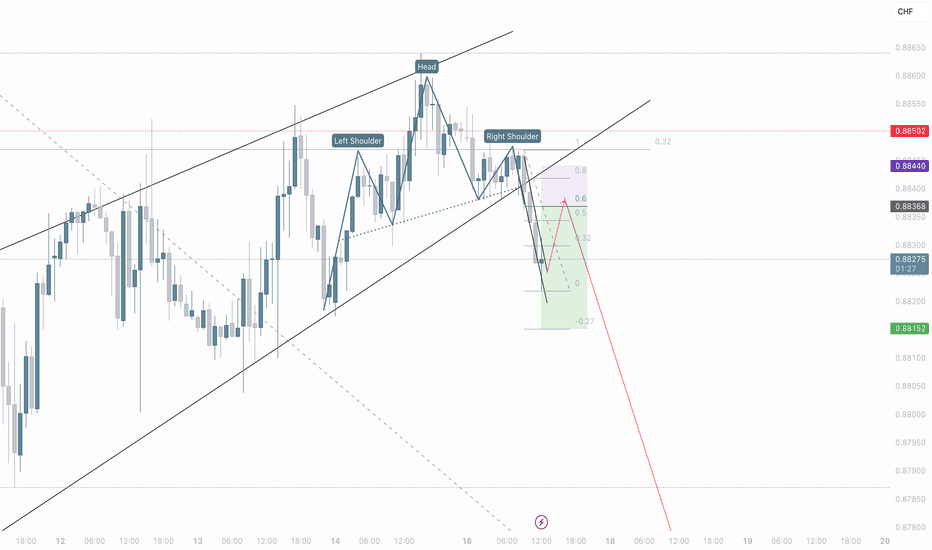

USD/CHF: Selling the Head & Shoulders BreakdownSpotted a clear H&S pattern on USD/CHF 15m chart!

Selling at 0.8826 with stop above 0.8844.

Target: First 0.8815, then possibly lower to the -0.27 Fib level.

The neckline break looks solid and we're still in the channel. Risk-reward looks good here.

What do you think? Are you bearish on USD/CHF too?

#USDCHF #Forex #TradingIdea

The Head and Shoulders Pattern: How to TradeHello, Traders!

Have you ever noticed price action forming three peaks, with the middle one standing taller than the others? If so, you’ve spotted the head and shoulders pattern, one of technical analysis's most well-known and reliable reversal patterns. Whether you’re trading stocks, forex, or crypto, the head and shoulders chart pattern can provide high-probability setups for both bullish and bearish trades. But is the pattern of the head and shoulders bullish or bearish? The answer depends on its structure.

Let’s dive into what a head and shoulders pattern is, how to identify it, and how to trade both the classic and inverse head and shoulders patterns effectively.

What Is a Head and Shoulders Pattern?

The head and shoulders trading pattern is a reversal formation that signals a shift in trend direction. It consists of three peaks:

Left Shoulder – A price rise, followed by a temporary decline.

Head – A higher peak, followed by another drop.

Right Shoulder – A lower peak that struggles to reach the height of the head, signaling weakness in the trend.

Neckline – A support level connecting the lows of the left shoulder and the right shoulder. The breakout below this level confirms the reversal.

The head and shoulders stock pattern typically appears at the top of an uptrend, indicating a potential trend reversal to the downside.

Is the Head and Shoulders Pattern Bullish or Bearish?

The classic head and shoulders pattern is bearish, which usually signals that buyers are losing strength and sellers are taking control. Traders use it to identify potential downtrends and short-selling opportunities.

However, the reverse head and shoulders pattern, also known as the inverted head and shoulders pattern, is bullish and might signal the start of an uptrend.

The head and shoulders candlestick pattern is considered to be most effective when combined with volume analysis—high selling volume at the neckline is thought to confirm the breakdown.

Head and Shoulders vs. Other Reversal Patterns

The head and shoulders chart pattern is one of the most reliable reversal formations, but how does it compare to others?

Head and Shoulders vs. Double Top – The head and shoulders pattern includes three peaks, while a double top has only two.

Head and Shoulders vs. Triangle – Triangles are continuation patterns, while the head and shoulders candle pattern signals reversal.

Final Thoughts: Why the Head and Shoulders Pattern Matters

The head and shoulders trading pattern is considered to be powerful for identifying trend reversals. Whether you’re trading a head and shoulders, a pattern bullish setup with an inverted head and shoulders pattern, or a bearish reversal with the classic formation, mastering this strategy can improve your trading accuracy.

So, traders, have you used the head and shoulders chart pattern in your strategy? What’s your success rate with it? Let’s discuss it!

Chart Patterns That Keep Showing Up (Are Traders Predictable?)In the grand theater of financial markets, traders often fancy themselves as rational actors, making decisions based on cold, hard data. Yet, time and again, their collective behavior etches familiar patterns onto price charts, as if choreographed by an unseen hand (the Invisible Hand?)

All across the world economy , markets trade in patterns. The trick is to spot those patterns before they unfold.

These recurring formations, known as chart patterns, are a testament to the predictability of human psychology in trading. Let's rediscover some of these enduring patterns, exploring why they persist and how you can leverage them.

🚿 The Head and Shoulders: More Than a Shampoo Brand

Imagine a market trend as a partygoer who's had one too many. Initially, they're lively (the left shoulder), then they reach peak status of euphoria (the head), but eventually, they slump with one last “let’s go party people” (the right shoulder). This sequence forms the Head and Shoulders pattern, signaling a trend reversal from bullish to bearish.

Traders spot this pattern by identifying three peaks: a central, higher peak flanked by two lower, similar-sized peaks on each side. The neckline, drawn by connecting the lows between these peaks, becomes the critical support level. A break below this line suggests the party's over, and it's time to exit or short the trading instrument.

Conversely, the Inverse Head and Shoulders indicates a reversal from bearish to bullish, resembling a person doing a headstand—a strong sign the market's ready to flip.

Ready to hunt down the charts for some Head and Shoulders? Try out the Head and Shoulders drawing tool .

⛰️ Double Tops and Bottoms: Déjà Vu in Trading

Ever experience déjà vu? The market does too, in the form of Double Tops and Bottoms. A Double Top resembles the letter "M," where the price hits a high, retreats, and then tests that high again before declining. It's the market's way of saying, "I've been here before, and I'm not going higher."

The Double Bottom, shaped like a "W," occurs when the price drops to a low, rebounds, and then retests that low before rising. It's akin to the market finding a sturdy trampoline at support levels, ready to bounce back.

These patterns reflect traders' reluctance to push prices beyond established highs or lows, leading to reversals.

⚠️ Triangles: The Market's Waiting Game

When traders are indecisive, prices often consolidate, forming Triangle patterns. These come in three flavors:

Ascending Triangle : Characterized by a flat upper resistance line and a rising lower support line. Buyers are gaining strength, repeatedly pushing prices up to a resistance level. A breakout above this resistance suggests bullish momentum.

Descending Triangle : Features a flat lower support line and a descending upper resistance line. Sellers are in control, and a break below support signals bearish continuation.

Symmetrical Triangle : Both support and resistance lines converge, indicating a standoff between buyers and sellers. The eventual breakout can go either way, and traders watch closely for directional cues.

Triangles epitomize the market's pause before a storm, as participants gather conviction for the next move.

Feel like looking for some triangles on charts? Jump straight to our easy-to-use Triangle Pattern drawing tool .

🏁 Flags and Pennants: The Market Takes a Breather

After a strong price movement, the market often needs a breather, leading to Flags and Pennants. These are short-term continuation patterns that indicate a brief consolidation before the trend resumes.

Flag : Resembles a parallelogram sloping against the prevailing trend. It's like the market catching its breath before sprinting again.

Pennant : Looks like a small symmetrical triangle that forms after a sharp move. Think of it as the market pitching a tent before continuing its journey.

Recognizing these patterns helps traders position themselves for the next leg of the trend.

🧠 The Psychology Behind Pattern Persistence

Why do these patterns keep appearing? The answer lies in human psychology. Traders, despite access to vast information, are influenced by emotions like fear and greed. This collective sentiment manifests in predictable ways, creating patterns on charts.

For instance, the Head and Shoulders pattern emerges because traders, after pushing prices to a peak, become cautious. Early sellers take profits, causing a dip. A second rally (the head) attracts more participants, but if it fails to sustain, confidence wanes, leading to a sell-off. The final attempt (right shoulder) lacks conviction, and once support breaks, the downtrend ensues.

Understanding the emotional drivers behind these patterns allows traders to anticipate moves and strategize accordingly.

🎯 Using Patterns to Your Advantage

While recognizing patterns is valuable, it's crucial to approach them with a discerning eye:

Confirmation is Key : Don't act on a pattern until it's confirmed. For example, in a Head and Shoulders, wait for a break below the neckline before taking a position.

Volume Matters : Volume often validates a pattern. A genuine breakout is usually accompanied by increased trading volume, indicating strong participation.

Contextual Awareness : Consider the broader market context. Patterns can yield false signals in volatile or news-driven environments.

Risk Management : Always set stop-loss orders to protect against unexpected moves. Patterns suggest probabilities, not certainties.

🧬 The Evolution of Patterns in Modern Markets

In today's algorithm-driven trading landscape, one might wonder if traditional chart patterns still hold relevance. Interestingly, even sophisticated trading algorithms (those used by hedge funds and investment managers) are programmed based on historical patterns and human behavior, perpetuating the cycle.

Moreover, as long as markets are driven by human participants, emotions will influence decisions, and patterns will emerge. The tools may evolve, but the underlying psychology remains constant.

🤗 Conclusion: Embrace the Predictability

In the volatile world of trading, chart patterns serve as a bridge between market psychology and price action. They offer insights into collective behavior, providing traders with a framework to anticipate movements.

By studying these recurring formations, traders can align their strategies with market sentiment, turning the predictability of human nature into a trading edge.

What’s your go-to technical analysis pattern? Are you and H&S trader or maybe you prefer to trade double tops? Share your approach in the comments!

GBPCHF - Head and Shoulders SetupHello traders,

On the daily timeframe GBPCHF has been consolidating in a range. Now it is at the resistance level of the range and so we should be looking for shorting opportunities.

On the lower timeframes, the 4H and 2H, it has formed a head and shoulders pattern which is a great reversal pattern.

Add to this the RSI divergence which in many occasions foreshadows the change in trend.

I will be entering when we get a close below the neckline on the 2H timeframe.

Be Careful Now!Crypto Trading Fam,

It's time for me to put out a note of caution. I have been bullish but a few days ago while doing my video, I spotted this pattern mid-session, hoping I would be wrong. Looks like I was not. The H&S pattern has now formed. This means we have an 85% probability that we'll drop to our next support of 75k. Yikes!

Now, 15% of the time a H&S pattern can fail. We can only hope this will be the case. But while hoping, prepare your SLs. Could get ugly for those alts!

✌️ Stew

EUR/USD's Déjà Vu: Ready to Ride the Next Wave?So, here’s the deal with EUR/USD – it’s throwing out a pretty juicy head-and-shoulders pattern. If you’re not familiar, just think of it like this: the market is literally shrugging its shoulders, and when it does that, it usually means it’s getting ready to slide downhill. And guess what? We’ve seen this exact move before... twice. 📉

Pattern Repeat: Déjà Vu, But Profitable

Flashback 1: Way back on the left side of the chart, there was a head-and-shoulders (that’s like the market’s favorite I’m-outta-here move). It shrugged its shoulders, and then – boom – dropped about 400 pips. Nice little payday if you were ready for it.

Flashback 2: Middle of the chart, same thing. It pulled another head-and-shoulders, neckline broke at around 1.0920, and down it went about 350 pips. It’s like clockwork – see a shoulder, expect the floor to drop soon after. 🕰️

Now, Let’s Talk About This Current Setup

We’re seeing another head-and-shoulders pattern forming on the right side. And here’s the fun part: if it follows the same pattern as the last two, we’re in for a similar ride.

Neckline Level: This one's got its neckline (the line where we know things could start falling fast) around 1.0740. And look – it’s already cracked below that. This means we’re potentially heading towards our next target.

Targets 🎯

Alright, so where’s this going if it drops? Here’s the roadmap:

First Stop: 1.0460 – This level’s like a speed bump. If price respects it, we might see a little bounce, but if it doesn’t, the road is wide open for more downside action. 🚗💨

Next Destination: 1.0175 – Think of this as the next major support level. Historically, every time EUR/USD has done its head-and-shoulders thing, it didn’t just stop at the first target. Nope. It kept on trucking, usually another few hundred pips. So if you’re looking for a bigger move, this level’s worth watching. 📉

Ultimate Bear Zone: 0.9650 – Now, if we’re talking about a full-blown trend continuation, then 0.9650 is the jackpot. That’s where things could get seriously interesting. But hey, let’s not get ahead of ourselves – let’s take this step by step. 🚀

How to Play This 🕹️

If you’re looking to trade this, here’s the game plan:

Entry Point: If the price slides down to 1.0460, that’s a prime spot to watch. If it hesitates here and starts bouncing, you might see some action going back up a bit – maybe a chance to reset or take some off the table if you’re short.

But if it breaks through 1.0460 like it’s not even there? Buckle up for 1.0175.

Stop-Loss: Look, head-and-shoulders has been reliable here, but we still need to protect ourselves. Set a stop above 1.0550. Worst case? You cut your loss if the market decides to play tricks.

Profit Goals: Go for 1.0460 first, and if things are looking spicy, aim for 1.0175. And if we’re really riding this bear wave – there’s that 0.9650 ultimate bear zone waiting at the end. 🐻💰

Quick Recap

EUR/USD is giving us a déjà vu setup with this head-and-shoulders action. This pattern has been on point the last couple of times – each breakdown led to big drops, so history’s on our side. If this one plays out similarly, 1.0460 is the first floor, 1.0175 is the basement, and 0.9650... well, that’s where we hit the goldmine if the bears take over completely.

Keep it simple. Watch for those levels, manage your risk, and let’s see if EUR/USD does what it’s done before. You know what they say – the trend is your friend... until it’s not. 😉

Put Your Speculators On!This head and shoulders pattern could be just pure speculation at this point. In fact, let me reword that.. this IS speculation based on the fact that I missed the lows and psychologically, I'm really hoping this comes back to shore so I can get back on the boat with everyone else.

I do however do my technical analysis in advance and set alerts at levels like you should do and if it plays out then great if not there's always the opposite idea too. We move onto the next one.

For now though what I'm looking at is BITGET:ADAUSDT.P has closed the daily candle back inside the value area high ( VAH ) of the range they just left. I am now in a waiting game to see what happens with the second candle close but we just had a 7.5% drop from that value area high (white dots) and the weekly level.

The purple line is the previous Monthly VWAP (volume weighted average price) which when you go down to a lower timeframe it's actually touched (Just doesn't look like that here).

The yellow line is the previous Weekly VWAP which we had confluence with at the weekly level and the value area high and also back tested a couple of hours ago.

The blue bars are to show the 21% from the top of the head down to the neck of the head and shoulders pattern and then a repeated 21% from the neck to complete the pattern right into a point of control ( POC ) from a very high timeframe, I'm talking years.

If we start to lose some levels here like $0.35ish and back test it, I'll probably just wait to lose the POC and then see if we get the drop down into that area of confluence below at around $0.26.

I'm far too broke to be gambling so I'd rather wait and reward myself with a little bit of patience, who knows, it could just happen quickly but “Uptober” isn’t starting off that well so far.

I won't be looking for any long trades unless we can reclaim that weekly level and value area high. Targets would be the weekly level above with confluence from the high timeframe value area high and anchored VWAP from the all-time high (Green line).

This is not financial advice. This is just an idea and some slight education to put out there for anybody that's feeling a little bit lost about what they're seeing on the charts.

The "Head and Shoulders": Real success rates.Inverted Head and Shoulders: WATCH volumes when the neckline breaks!!

Here is what we can say about the success rate of the inverted head and shoulders pattern in trading:

-The inverted head and shoulders pattern is considered one of the most reliable chart patterns to anticipate a bullish reversal.

-According to some sources, the success rate of this pattern would be very high, with around 98% of cases resulting in a bullish exit.

-More precisely, in 63% of cases, the price would reach the price target calculated from the pattern when the neckline is broken.

-A pull-back (return to the neckline after the break) would occur in 45% of cases.

-However, it should be noted that these very optimistic figures must be qualified. Other sources indicate more modest success rates, around 60%.

-The reliability of the pattern depends on several factors such as respect for proportions, neckline breakout, volumes, etc. A rigorous analysis is necessary.

-It is recommended to use this pattern in addition to other indicators and analyses, rather than relying on it blindly.

In conclusion, although the inverse head and shoulders pattern is considered a very reliable pattern, its actual success rate is probably closer to 60-70% than the 98% sometimes claimed. It remains a useful tool but must be used with caution and in addition to other analyses.

__________________________________________________________________

Head and Shoulders:

Here is what we can say about the success rate of the head and shoulders pattern in trading:

-The head and shoulders pattern is considered one of the most reliable chart patterns, but its exact success rate is debated among technical analysts. Here are the key takeaways:

- Some sources claim very high success rates, up to 93% or 96%. However, these figures are likely exaggerated and do not reflect the reality of trading.

- In reality, the success rate is likely more modest. One cited study indicates that the price target is reached in about 60% of cases for a classic head and shoulders pattern.

- It is important to note that the head and shoulders pattern is not an infallible pattern. Its presence alone is not enough to guarantee a trend reversal.

- The reliability of the pattern depends on several factors such as respect for proportions, the breakout of the neckline, volumes, etc. Rigorous analysis is necessary.

- Many experienced traders recommend using this pattern in addition to other indicators and analyses, rather than relying on it blindly.

In conclusion, while the head and shoulders pattern is considered a reliable pattern, its actual success rate is probably closer to 60% than the 90%+ sometimes claimed. It remains a useful tool but should be used with caution and in conjunction with other analyses.

_____________________________________________________________________________

NB: In comparison, the classic (bearish) head and shoulders pattern would have a slightly lower success rate, with around 60% of cases where the price target is reached.

NVIDIA: Bearish: Possible Head and Shoulders: Warning!NVIDIA: Bearish: Possible Head and Shoulders: Warning!

Hello everyone The Wolf of Zurich has detected a possible "head and shoulder" on Nvidia, which would bring the price down to around $42.

I have also drawn a trend line that you absolutely must watch!

The level to watch is around $98-98

Here, watch your Fibonacci levels as well as your exponential mobile means

Have a nice day everyone

Some information to know about Nvidia:

Nvidia, the world leader in graphics chips and AI, is enjoying a flourishing situation despite a recent drop in its stock price.

Here is a summary of its current situation:

-Dominant position in the AI market

Nvidia occupies a quasi-monopolistic position in the field of chips for artificial intelligence. Its GPUs, especially the H100 series, are essential for the development of cutting-edge AI systems and are selling at high prices around the world.

-Stock market performance

Despite a recent 9.53% drop in its share price, Nvidia has posted an impressive 120% increase since the beginning of the year and nearly 400% over 3 years. This one-off drop does not seem to worry analysts, who still see significant growth potential.

-Technological innovations

Nvidia recently presented its new Blackwell GPU architecture, with the B200 and GB200 processors. These chips promise performance multiplied by 5 compared to the previous generation in the field of AI. The company also reassured investors by announcing that it had resolved the production problems initially encountered.

-Future Outlook

With its dominance in AI training chips and its comprehensive software ecosystem, Nvidia appears well positioned for continued growth. The company continues to innovate and strengthen its position in the AI market, which suggests a positive outlook for the future.

Beginner Chart Patterns: Head & Shoulders, Double Tops and MoreWelcome to the world of chart patterns—the place where every price action tells a story. And if you read it right, you might just walk away with profits. In this Idea, we explore the immersive corner of technical analysis where chart patterns shape to potentially show you where the price is going. We’ll keep it tight and break down the most popular ones so you’d have more time to take your knowledge for a spin and look for some patterns (risk-free with a paper trading account ?). Let’s roll.

Chart patterns are the market’s version of geometry paired with hieroglyphics. They might look like random squiggles at first, but once you learn to decode them, they might reveal where the market is headed next. Here are the mainstay chart patterns everyone should start with: Head and Shoulders, Double Tops, and a few other gems.

1. Head and Shoulders: The King of Reversals

First up is the Head and Shoulders pattern—an iconic, evergreen, ever-fashionable formation that traders dream about. Why? Because it’s a reliable reversal pattern that often signals the end of a trend and the beginning of a new one.

Here’s the breakdown: Imagine a market that’s been climbing higher. It forms a peak (a shoulder), pulls back, then rallies even higher to form a bigger peak (the head), only to drop again. Finally, it gives one last weak attempt to rise (the second shoulder), but it can’t reach the same height as the head. The neckline, a horizontal line connecting the two lows between the peaks, is your trigger. Once the price breaks below it, it’s time to consider shorting or bailing on your long position.

And yes, there’s an inverted version of this pattern too. It looks like a man doing a handstand and signals a trend reversal from bearish to bullish. That’s Head and Shoulders—flipping trends since forever.

2. Double Tops and Double Bottoms: The Market’s Déjà Vu

Next up, we have the Double Top and Double Bottom patterns—the market’s way of saying, “Been there, done that.” These patterns occur when the price tries and fails—twice—to break through a key level.

Double Top : Picture this: The price surges to a high, only to hit a ceiling and fall back. Then, like a stubborn child, it tries again but fails to break through. That’s your Double Top—two peaks, one resistance level, and a potential trend reversal in the making. When the price drops below the support formed by the dip between the two peaks, it’s a signal that the bulls are out of steam.

Double Bottom : Flip it over, and you’ve got a Double Bottom—a W-shaped pattern that forms after the price tests a support level twice. If it can’t break lower and starts to rally, it’s a sign that the bears are losing control. A breakout above the peak between the two lows confirms the pattern, signaling a potential bullish reversal.

3. Triangles: The Calm Before the Storm

Triangles are the market’s way of coiling up before making a big move. They come in three flavors—ascending, descending, and symmetrical.

Ascending Triangle : Here’s how it works: The price forms higher lows but keeps bumping into the same resistance level. This shows that buyers are getting stronger, but sellers aren’t ready to give up. Eventually, pressure builds and the price breaks out to the upside. But since it’s trading, you can expect the price to break to the downside, too.

Descending Triangle : The opposite of the ascending triangle, this pattern shows lower highs leaning against a flat support level. Sellers are gaining the upper hand and when the price breaks below the support, it’s usually game over for the bulls. But not always—sometimes, bulls would have it their way.

Symmetrical Triangle : This is the market’s version of a coin toss. The price is squeezing into a tighter range with lower highs and higher lows. It’s anyone’s guess which way it’ll break, but when it does, expect a big move in that direction.

4. Flags and Pennants: The Market’s Pit Stop

If triangles are the calm before the storm, then flags and pennants are the pit stops during a race. These patterns are continuation signals, meaning that the trend is likely to keep going after a brief pause.

Flags : Flags are rectangular-shaped patterns that slope against the prevailing trend. If the market’s in an uptrend, the flag will slope downwards, and vice versa. Once the price breaks out of the flag in the direction of the original trend, it’s usually off to the races again.

Pennants : Pennants look like tiny symmetrical triangles. After a strong move, the price consolidates in a small, converging range before breaking out and continuing the trend. They’re short-lived but pack a punch.

Final Thoughts

To many technical analysts, chart patterns are the best thing the market can do. The secret code, or however you may want to call them, they can give you insight into the dealmaking between buyers and sellers and hint at what might happen next.

Whether it’s a Head and Shoulders flashing a trend reversal, a Double Top marking a key resistance level, or a Triangle gearing up for a breakout, these patterns are essential tools in your trading garden.

So next time you stare at a chart, keep in mind that you’re not just looking at random lines. You’re reading the market’s mind from a technical standpoint. And if you know what to look for, you’re one step closer to cracking the code.

GOLD: Bullish - FLAG detected + Breakout of the range.GOLD: Bullish - FLAG detected + Breakout of the range.

1- A "Head Shoulders" has been detected and we did a perfect Take profit ( TP1) at 2 395$.

2- When we break a range the Take profit should be the Height of the range.

Then the TP2 is expected around 2 518$.

3- Plus we can also consider that the range is like a flag and then the TP3 ( green arrow) is expevted around 3 030$

The red horizontals are retracements regarding ICHIMOKU levels .

However a retracement Fibonacci gives a target lower around 2 100$.

Be careful