#silver#commodities

XAGUSD - Hunting for Bullish Entries on Smaller TFThe Silver/USD 4-hour chart displays a significant retracement from recent highs around $3,420, with price currently rebounding near the $3,300 level. This correction has brought price to test both the ascending trendline and the horizontal support at $3,275 (marked by the red line), creating a potential buying opportunity. Given the overall uptrend structure and the recent bounce from this dual support zone, we need to prepare for finding buy setups on smaller timeframes. Traders should shift to lower timeframe charts (15-minute, 30-minute, or 1-hour) to identify precise entry signals. The price action suggests a potential retest of the upper blue reaction zone after completing the current zigzag correction, as indicated by the directional arrow on the chart. Monitoring these smaller timeframes will help capture optimal entry points with tighter stop-losses while maintaining the broader bullish bias shown on this 4-hour chart.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAG/USD: Dual Paths to Bullish ResolutionSilver's 4-hour chart presents two potential scenarios for price action in the near term. In the first scenario, price could break above the current consolidation around $3,254 and move directly toward the red resistance line at approximately $3,278, as indicated. Alternatively, the second scenario suggests we may first see a deeper retracement toward the lower blue box support zone (around $3,160-$3,180) before finding buyers and resuming the upward movement, as illustrated by the zigzag pattern and second arrow. Both scenarios ultimately project bullish outcomes, with price expected to challenge the upper resistance after completing either path. The recent recovery from the late February lows around $3,080 provides the foundation for this bullish bias, though traders should monitor which scenario unfolds to adjust their entry strategies accordingly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver Price Setup = Major Move Ahead?Silver (XAG/USD) Analysis – Breakout Incoming?

Silver (XAG/USD) is currently testing a key resistance zone after a strong upward move, supported by a rising trendline. The price has respected this trendline multiple times, confirming its role as a strong support level. If bulls push beyond the resistance zone, a breakout could trigger further upside momentum.

Key Insights:

🔹 Trendline Support – The ascending trendline has acted as a strong base for price action, providing steady higher lows.

🔹 Key Resistance Zone – Price has faced multiple rejections here in the past, making it a crucial breakout level.

🔹 Potential Breakout Setup – If Silver breaks and holds above resistance, we could see a rally towards $31.50–$32.50+

SILVER, very bullish outlookHello everyone,

I like to provide you a detailed elliot wave analysis on silver. In my opinion we are in the middle of a higher degree fifth wave. The elliot wave rules I use:

Standard:

- Wave 3 has to be the longest

- Wave 4 can not overlap with wave 1

Advanced:

- Target levels are 1,5 to 1,618 (wave 3) and 2.272 to 2.618 (wave 5)

- Wave 3 needs to show a change of character to wave 1 (usually steeper)

SILVER Massive Run Coming (Timeframe 1-7 years)

I think TVC:SILVER might be preparing for a Massive Breakout from a 45 YEAR consolidation period. This will happen gradually over the next few years. I think current prices are great for getting in to this. I have been buying up silver weekly for the last 2 months on Revolut as an auto-purchase, and will continue to do so. GOLD has had its breakout already. Silver will follow.

Here's the macro to my theory:

Industrial Demand Boom: With the rapid expansion of green technologies, especially solar panels and electric vehicles, the demand for silver over the next years is set to skyrocket. Silver’s unique properties make it indispensable in these growing industries.

Economic Uncertainty: Amidst global economic volatility and geopolitical tensions, silver remains a reliable safe-haven asset. As investors seek refuge from market turbulence, silver will shine as a go-to investment.

Inflation Hedge: With inflationary pressures mounting globally, silver offers an excellent hedge. Its intrinsic value and historical performance during inflationary periods make it a must-have in any portfolio.

Supply Constraints: Mining and production challenges are limiting silver supply, creating a perfect supply-demand imbalance. This constraint will drive prices higher as demand outpaces supply.

Technological Advances: Innovations in medical technology and electronics continue to find new uses for silver, further increasing its demand.

📈 Technical Analysis: Chart patterns are indicating a very bullish trend. Text book 45 year cup and handle formation, Ascending Triangle with strong support levels and upward momentum. Silver is breaking out of long-term resistance zones, setting the stage for an explosive upward move.

💡 Investor Sentiment: Sentiment is turning overwhelmingly positive. Market analysts and experts are predicting a significant price surge, with some forecasting silver reaching unprecedented highs. ($100-200)

Silver breaking out of its consolidationSilver is breaking out its long term consolidation and triggering a bullish reversed Head & Shoulder pattern with a target in the $42.50 area.

Next resistances at the all time high near $50 then the line linking the top of the channel near $53.

A break below $23.50 would invalidate this view.

________________

With gold and copper making all time highs, the governments and central banks printing money like crazy, it's hard to believe that Silver won't catch up and eventually make new all time highs.

Sanity Check: Channeling Silver's Recent (+ not so recent) MovesChannels are an incredible tool for technical analysis. Today we're going to put them to the test with the recent moves up in silver, as it looks like the precious metal is currently sitting at a decision point that can (still) go either way.

MEASURING IMPLICATIONS OF CHANNELS

The real power of channeling is greater than just working with a supportive/resistive trend line; there are measuring implications that are often remarkably accurate in forecasting. Once a (valid) channel is broken, tested, and confirmed to have broken, the subsequent move is usually between .5-1.0 the width of the broken channel. You can think of that .5 level as a micro channel within a channel.

Depending on this week's close outside of the bullish channel, we can safely say the weight of evidence lies in favor of bullish continuation. If that does indeed materialize, silver could have an incredible run just around the corner, especially as markets continue to price out cuts.

**Two partial retraces are circled to illustrate their significance in indicating a faltering channel. Important to note that the first circle (the bearish partial retrace) is only useful in hindsight, as the uppermost channel was not valid at the time.

XAGUSD Breakout and Potential RetraceHey Traders, In the current trading session, our focus lies on monitoring XAGUSD for a potential buying opportunity within the 24.15 zone. Silver, having previously exhibited a downtrend, has effectively surpassed this trend, prompting our attention. Presently, we are awaiting a corrective phase to assess the likelihood of a retracement in the direction of higher levels in the market trend.

Trade safe, Joe.

TradePlus-Fx|GOLD: wait for support💬 Description: The metal is trading below 1948.160 , where the price was after testing the previous price area (balance), thereby confirming our assumptions about the strength of the seller. All the current downward movement is taking place as part of a correction, which is likely to continue in the first half of this week.

The nearest support is located at the level of 1919.235 , where we actually expect the price. The area around this level may serve as a reversal of the correction, and on a global scale, we will continue to grow. Here, we can once again test the level of 2000 . But we need to look at all this after the fact. At the moment, we expect a fall to 1919.235 .

🔔 FX CALENDAR TODAY 🔔

🇪🇺EU Economic Forecasts

🛢OPEC Monthly Report

🛢Crude Oil Inventories

🇺🇸Federal Budget Balance

➖➖➖➖➖➖➖

🚀Thank for your BOOSTS 🚀

👇Share your views and FOLLOW US 👇

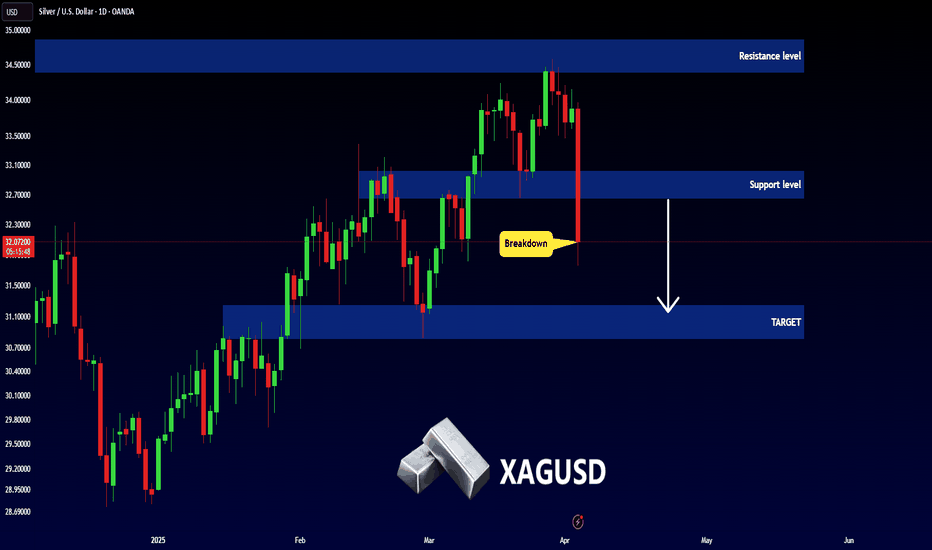

XAGUSDXAGUSD is repeating the same pattern.

In late September silver created the same pattern , formed strong support level and once loss that support , there were some red days for silver bulls.

Now silver again forming support zone in same area of value, if it again loss this level, then are we expecting red days for silver again ?

Gold in a bottoming areaAs you can see, gold in severly oversold. It has an very low RSI turning up, and finally a green candle forming after many red downward candles. Looks likely it will bottom around this area and probably head back up to the previous support level which is around 1913.

Of course, it could go up only a little and make another lower dip, but I doubt it.