USD_CHF LOCAL SHORT|

✅USD_CHF price went up sharply

But a strong resistance level was hit at 0.8152

Thus, as a pullback is already happening

And a move down towards the

Target of 0.8113 shall follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

#usdchf#forex

USD_CHF SHORT FROM RESISTANCE|

✅USD_CHF has been growing recently

And the pair seems locally overbought

So as the pair is approaching

A horizontal resistance of 0.8064

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

6S1! Futures Divergence Signals USD/CHF Long OpportunityI'm anticipating a bullish USD/CHF move. We're seeing a retest of a key daily demand zone, which is reinforced by a weekly supply area from the futures market (6S1! contract). Futures data suggests significant retail investor bullishness, contrasting with bearish positioning from commercial and hedge funds. This divergence suggests a potential long opportunity. I've also highlighted the next key demand area on the CFD USD/CHF chart.

✅ Please share your thoughts about 6S1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

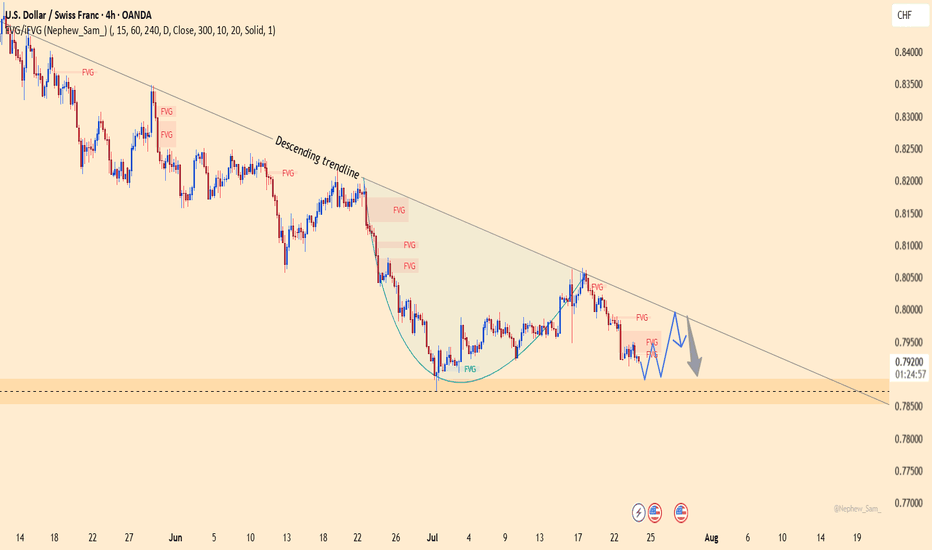

USDCHF – The Wind Still Blows South!USDCHF remains trapped below the descending trendline since June. Every bullish attempt has been sharply rejected – showing sellers are still in control.

Fresh U.S. data just released:

Jobless claims dropped → strong labor market → Fed likely to keep rates high → USD gains strength.

Manufacturing PMI beat expectations → resilient economy → more reason for a hawkish Fed.

But don’t forget: CHF is attracting safe-haven flows, adding downward pressure on USD!

If price fails to break above 0.7990 and gets rejected at the trendline, a drop toward 0.7890 is likely.

Strategy: Look to SELL around the trendline – follow the trend, not your emotions!

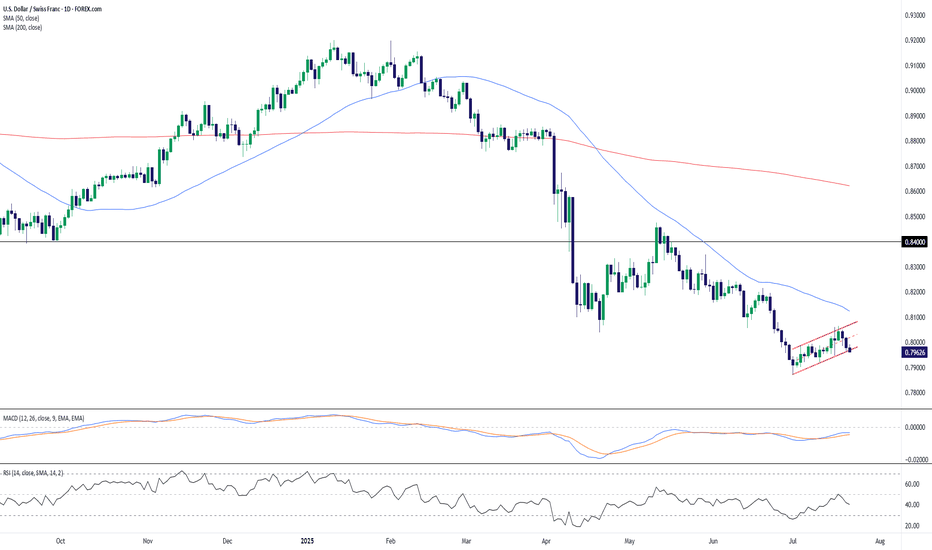

USD/CHF – Bearish Flag Forms Below Resistance, Trend Still DownUSD/CHF remains under pressure after a sustained downtrend and is currently consolidating within a potential bearish flag pattern. Price action has carved out a rising channel after the sharp June selloff, but the structure appears corrective rather than impulsive—suggesting the dominant bearish trend may soon resume.

The pair is struggling to hold the 0.7950–0.8000 zone and trades below both the 50-day (0.8124) and 200-day (0.8621) SMAs, confirming a bearish market structure. Momentum indicators also lean bearish: the MACD is below zero and has begun to curl lower again, while RSI hovers near 40, not yet oversold but lacking bullish momentum.

A breakdown below the flag’s lower boundary would confirm the continuation pattern, exposing 0.7900 initially, with scope toward fresh multi-month lows. On the upside, a close above 0.8100 would challenge the flag’s validity and place the 50-day SMA in focus as resistance.

Bias: Bearish continuation favored unless price breaks and holds above 0.8100. Flag breakdown would reconfirm downside momentum.

Time frame: Short-term (days)

-MW

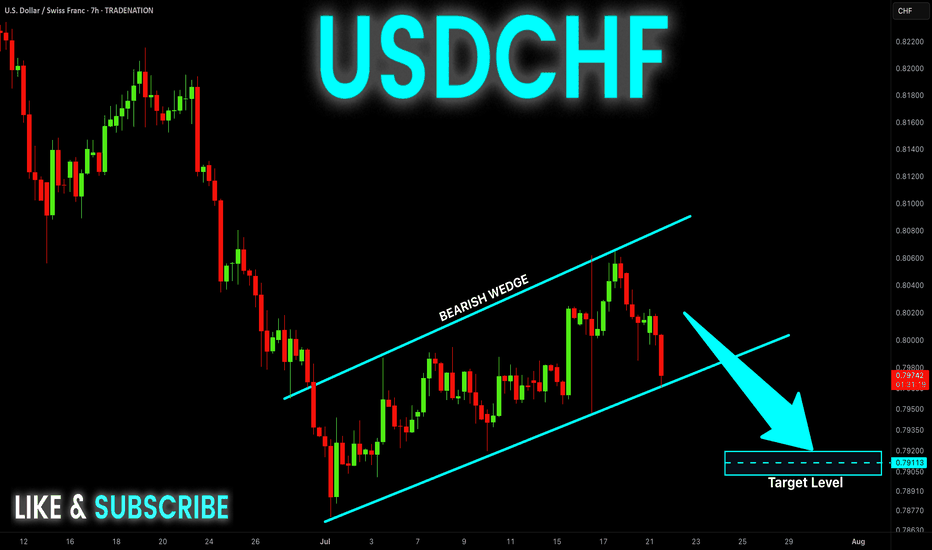

USD-CHF Bearish Wedge! Sell!

Hello,Traders!

USD-CHF is trading in a

Downtrend and has formed

A bearish wedge pattern

So IF we see a breakout

Then we a further bearish

Continuation will be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Bearish Flag! Sell!

Hello,Traders!

USD-CHF is trading in a

Downtrend and the pair broke

Out of the bearish flag so

We are bearish biased

And we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Will Fall! Sell!

Hello,Traders!

USD-CHF keeps falling down

And the pair broke the key

Horizontal level of 0.8090

Decisively so we are bearish

Biased and we will be expecting

A further move down next week

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CHF BEARISH BREAKOUT|SHORT|

✅USD_CHF broke the key structure level of 0.8050

While trading in a strong downtrend

Which makes me bearish

And I think that after the retest of the broken level is complete

A bearish continuation will follow

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF Channel Down reached its top. Sell signal.The USDCHF pair has been trading within a Channel Down pattern since the May 12 High and today the price hit its top again. Trading above its 4H MA50 (blue trend-line) but still below the 1D MA50 (red trend-line), that maintains the medium-term bearish trend.

This is a strong bearish signal as it technically indicates that the new Bearish Leg is about to start. Support 1 at 0.80565 is a low risk Target. The previous 2 Bearish Legs have both gone for -3.40% declines, so technically the downside can be extended beyond Support 1.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USD_CHF SHORT SIGNAL|

✅USD_CHF made a nice

Rebound from the support

Below just as we predicted in

Our previous analysis but is now

About to retest the horizontal

Resistance of 0.8200 from where

We can go short with the TP

Of 0.8124 and the SL of 0.8207

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Head And Shoulders Breakout! Sell!

Hello,Traders!

USD-CHF formed a H&S

Pattern and then made a

Bearish breakout which is

Confirmed so we are bearish

Biased and we will be expecting

A further bearish move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Growth Ahead! Buy!

Hello,Traders!

USD-CHF is approaching a

Key horizontal support area

Around 0.8189 which is a

Strong level so after the retest

A local bullish correction

And a move up are to be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF - Predictive Analysis & Forecasting USDCHF

Scales

- S: 0.8485 pending

- M: 0.8460 activated, triggers 0.8138 pivot

- L: 0.8457 activated, triggers 0.8258 pivot

Forecast & Targets

- ST: Limited upside to 0.8485 min, 0.8584 max

- MT: bearish; eyeing reversal conditions

#USDCHF #Forex #CROW2.0

4xForecaster

------

Originally published on BlueSky

USD_CHF WILL GROW|LONG|

✅USD_CHF is falling down

And will soon retest

A horizontal demand level of 0.8190

So I think that we will see a rebound

And a move up from the level

Towards the target above at 0.8253

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Free Signal! Buy!

Hello,Traders!

USD-CHF is once again

Retesting a horizontal support

Level around 0.8189 and the

Pair seems to have formed

A H&S pattern, so we are bearish

Biased, however, a local bullish

Rebound from the support

Is possible so while risky

A long trade still makes sense

With the Take Profit of 0.8238

And the Stop Loss of 0.8184

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CHF CORRECTION AHEAD|SHORT|

✅USD_CHF is going up now

But a strong resistance level is ahead at 0.8328

Thus I am expecting a pullback

And a move down towards the target of 0.8260

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Risky Long! Buy!

Hello,Traders!

USD-CHF made a retest

Of the horizontal support

Of 0.8213 and we are already

Seeing a local rebound so

We are locally bullish biased

And we will be expecting a

Further bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF Will the Downtrend Break or Bounce? Full Trade Plan TodayUSDCHF – Will the Downtrend Break or Bounce? | Full Trade Plan Today 🔥

🌍 Macro Overview

USDCHF remains in a short-term bearish correction, reflecting current macroeconomic uncertainties surrounding US interest rate expectations and safe-haven demand for CHF.

USD is under pressure after softer-than-expected CPI and PPI data last week, increasing speculation that the Fed may cut rates in Q3.

CHF continues to benefit from its safe-haven status amid ongoing geopolitical uncertainty and fragile European growth.

However, the key support around 0.8318 has acted as a major demand zone. If bulls react strongly here, we could see a technical rebound in the short term.

📉 Technical Analysis (H1–H2)

USDCHF is trading within a descending channel, showing lower highs and lower lows.

Price is now testing the lower boundary of the channel around 0.8318, which also aligns with a key liquidity area.

EMAs (13 and 34) still slope downward, but momentum is slowing — a possible signal that sellers are losing strength.

🔑 Key Levels to Watch

🔺 Resistance Zones:

0.8395 → Recent swing high & supply zone

0.8459 → Medium-term structural resistance

🔻 Support Zones:

0.8318 → Major confluence zone (channel bottom + demand block)

0.8230 → Final support level before deeper drop

🎯 Trade Setups

✅ Scenario A – Bullish Reversal from Support (Preferred):

Entry (Buy): 0.8318 – 0.8322 (after bullish rejection confirmation)

Stop Loss: 0.8288

Take Profits: 0.8395 → 0.8430 → 0.8459

✅ Scenario B – Bearish Breakdown Below Support:

Entry (Sell): 0.8300 – 0.8310 (only if price closes below 0.8310 on H2)

Stop Loss: 0.8340

Take Profits: 0.8260 → 0.8230 → 0.8200

⚠️ What to Watch Today:

Market may see higher volatility during the US session, especially with housing data (Existing Home Sales) and Fed speakers lined up.

Watch for clean price action around 0.8318 — no need to rush entries until confirmation appears.

This is a reactive market, not a predictive one. Let price speak first.

📌 Follow for real-time market updates and actionable strategies during US trading hours.

USD-CHF Will Grow! Buy!

Hello,Traders!

USD-CHF made a retest of

The horizontal support level

Of 0.8318 from where we

Are already seeing a bullish

Rebound so we are locally

Bullish biased and we will

Be expecting a further

Bullish move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD-CHF Growth Ahead! Buy!

Hello,Traders!

USD-CHF made a bullish

Rebound from the horizontal

Support level around 0.8318

So we are locally bullish

Biased and we will be

Expecting further growth

On Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD_CHF LOCAL BULLISH BIAS|LONG|

✅USD_CHF is making a local

Bearish correction and will

Soon retest a horizontal

Support of 0.8320 from where

We will be expecting a

Local bullish rebound

And a move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.