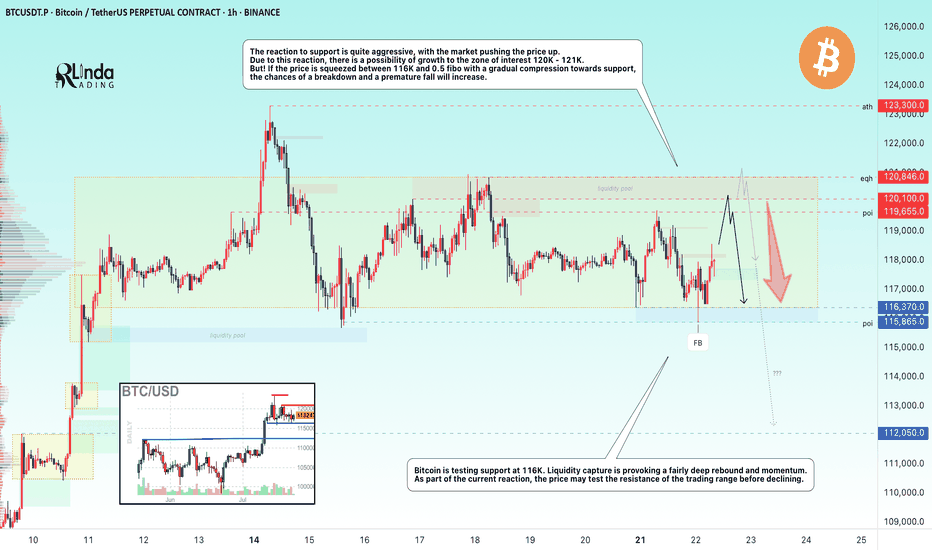

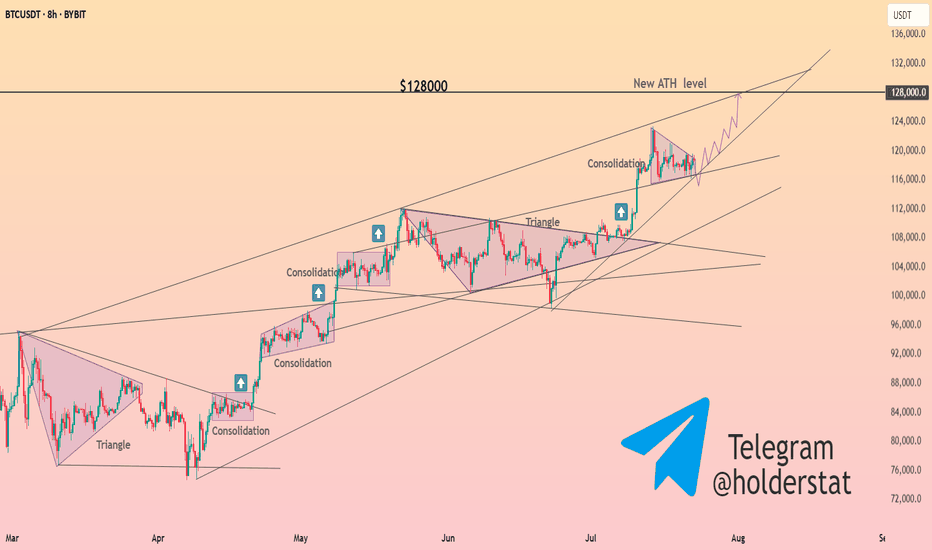

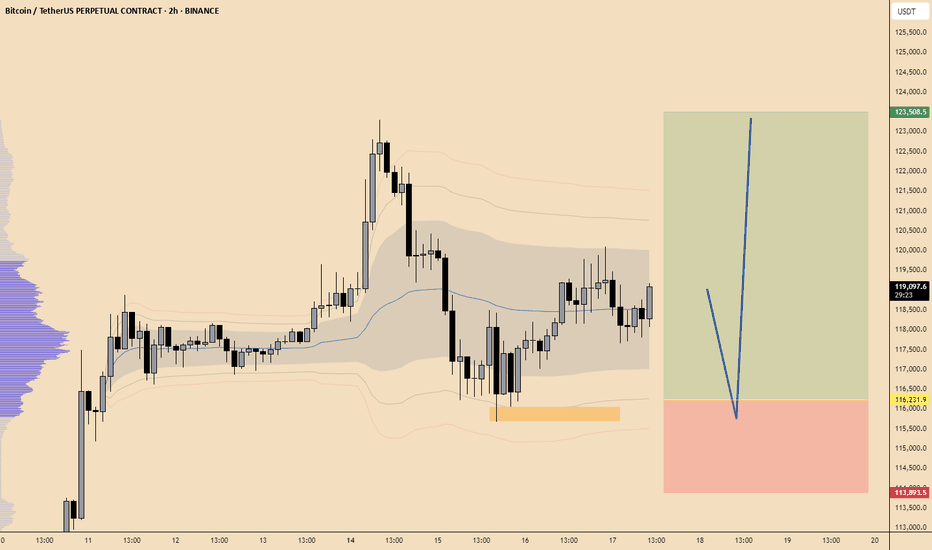

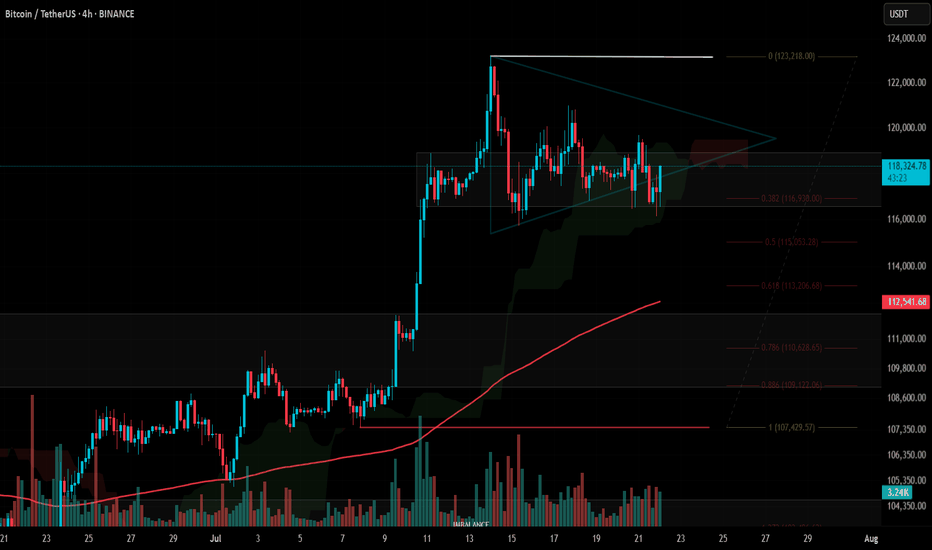

BITCOIN → Consolidation and compression to 116K. Correction?BINANCE:BTCUSDT.P continues to consolidate, with the price testing support at 116K, leaving behind the zone of interest at 120K-121K. Are there any chances for further growth?

(Alternative scenario (if growth to 120K does not occur))

Fundamentally, there is nothing particularly new, and the hype surrounding Bitcoin is stagnating. Technically, on D1, consolidation is underway with pressure from bears against the backdrop of an outflow of funds into altcoins. However, the dominance index is starting to rise, which could trigger some correction in the market. The price on the working timeframe, without updating local highs, is testing lows, and the latest retest of the liquidity zone is provoking a fairly aggressive reaction that could bring the price to retest the zone of interest at 120K-121K.

But! If the price is squeezed between 116K and 0.5 Fib with a gradual squeeze towards support, the chances of a breakdown and a premature fall will increase.

Support levels: 116370, 115860

Resistance levels: 119650, 120100

Technically, the market needs a breather or correction, which is generally a sign of health. The nuance with Bitcoin is that below 115860 there is no support until 112K, and if the market breaks the current consolidation boundary, the further correction could be quite deep. In the current situation, I do not yet see any drivers or reasons for another rally.

Best regards, R. Linda!

1-BTC

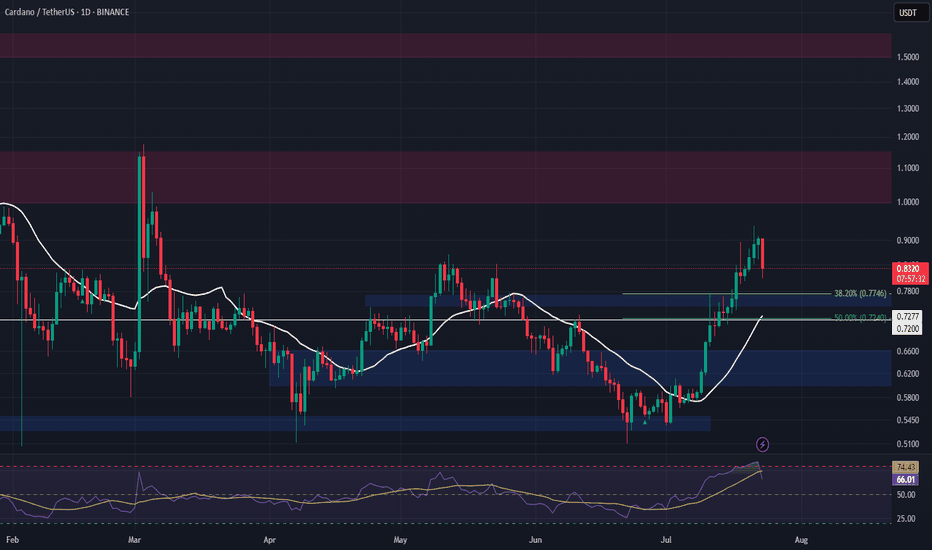

ADA Spot Entry – Pullback Opportunity AheadADA has reached a major resistance zone, and with the broader market appearing overbought, a healthy pullback looks likely. We’re watching for a dip into the next key support area to accumulate for spot holdings.

📌 Trade Setup:

• Entry Zone: $0.75 – $0.77

• Take Profit Targets:

o 🥇 $1.00 – $1.15

o 🥈 $1.50 – $1.60

• Stop Loss: Just below $0.72

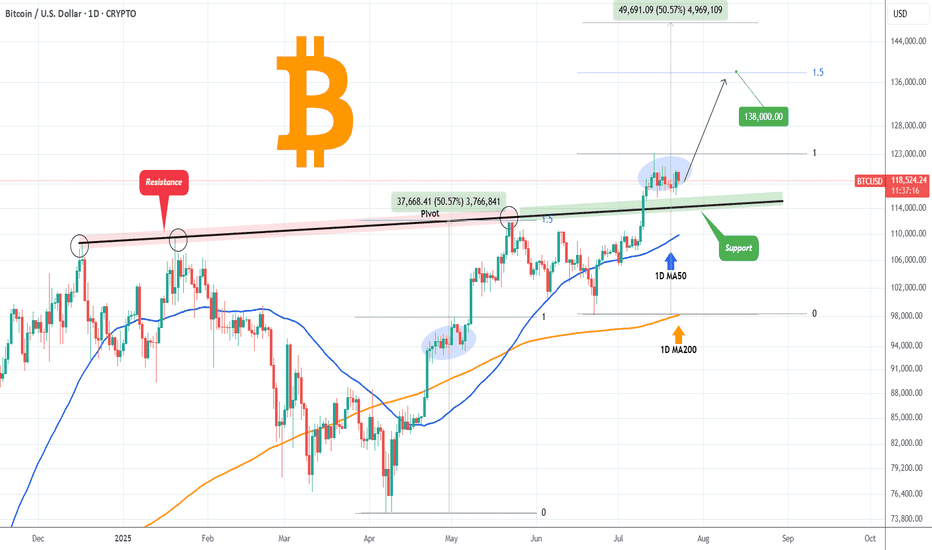

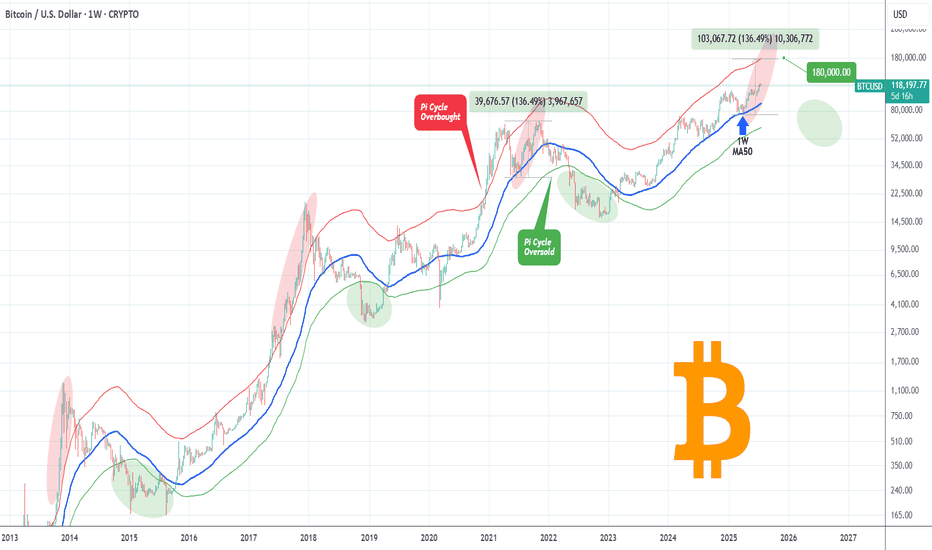

BITCOIN Former Resistance turned Support!Bitcoin (BTCUSD) is consolidating right above the December 17 2024 Pivot trend-line, a level that started off as a massive Resistance delivering two strong rejections but has now been turned into Support, holding this consolidation.

The 1D MA50 (blue trend-line) will soon cross this Pivot trend-line and will confirm it as a Support with the price technically looking for a new Bullish Leg towards the 1.5 Fibonacci extension at least ($138000), similar to the April - May uptrend, which also consisted of an Accumulation Phase much like the current.

Can the Pivot trend-line provide the necessary support for such a rebound? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

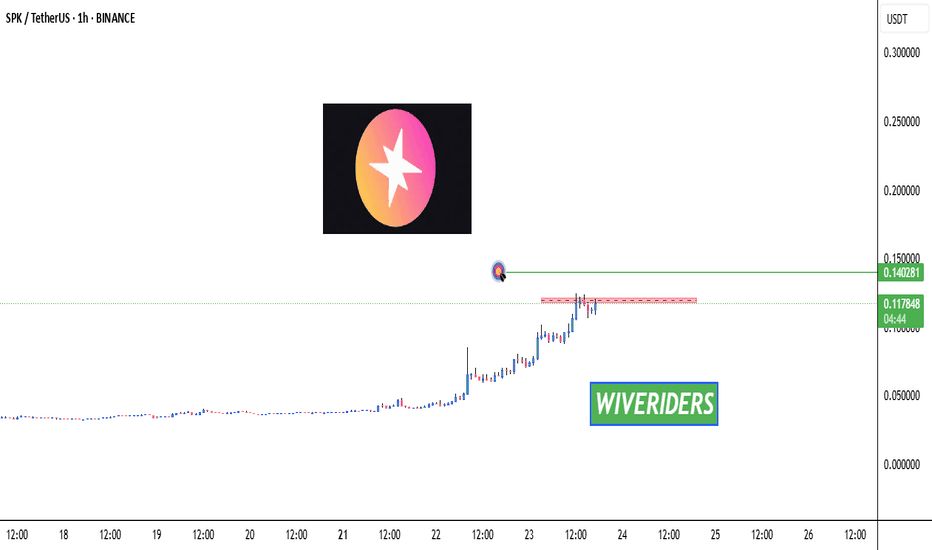

SPK Testing Red Resistance Zone 🚨 INDEX:SPK Testing Red Resistance Zone 🔴📈

INDEX:SPK is now testing the red resistance zone.

📊 Watch for breakout confirmation — if successful:

🎯 First Target → Green line level

This could signal the beginning of a new move up if buyers push through the resistance.

Let’s track it closely for a potential entry! 💼📈

Cup & Handle Formation 🚨 XETR:HOT Testing Red Resistance – Cup & Handle Formation 📈

XETR:HOT is currently testing the red resistance zone and has formed a bullish Cup & Handle pattern on the chart — a classic continuation setup.

If breakout is confirmed, potential upside:

✅ First Target: Green line level

✅ Second Target: Green line level

🕵️♂️ Wait for clear breakout confirmation before entering long.

This pattern often signals strong momentum if buyers step in.

Trade smart. Let’s monitor for the perfect entry! 💹💼

ADA/USDT Trade Idea – 15m (Following V–Trend Setup)Bias: LONG

🔍 Trade Breakdown:

V-Structure Identified:

Market formed a clear V-reversal structure, shifting from a bearish downtrend into a bullish uptrend. This is a key part of my setup — I look for these V-shaped reversals as confirmation of potential long entries.

Trendline Break + Structure Shift:

The red descending trendline was broken with strong bullish candles. Price also broke above a key structure level, confirming the bullish trend shift.

Risk Management Zone (RM):

Price pulled back into my Risk Management Zone (RM) — a demand zone marked by previous consolidation and imbalance. I do not enter on impulse, instead I wait for price to return to this zone for a safer entry.

NO FOMO Zone:

Highlighted in red — I avoid entering if price doesn't respect this zone. It helps me stay disciplined and avoid emotional trades.

Entry & Target:

Entry: Within RM zone (~0.8780–0.8845)

Stop Loss: Below RM zone (~0.8739)

Target: 0.9266

This gives a solid risk-to-reward setup in alignment with the trend.

✅ Strategy Checklist:

V-shaped recovery ✅

Structure break ✅

Pullback into RM ✅

No FOMO entry ✅

RR > 1:3 ✅

📌 Let the market come to you. Stay disciplined, trust the setup.

#ADAUSDT #CryptoTrading #VTrend #SmartMoney #PriceAction #NoFOMO #15mSetup #TradingView

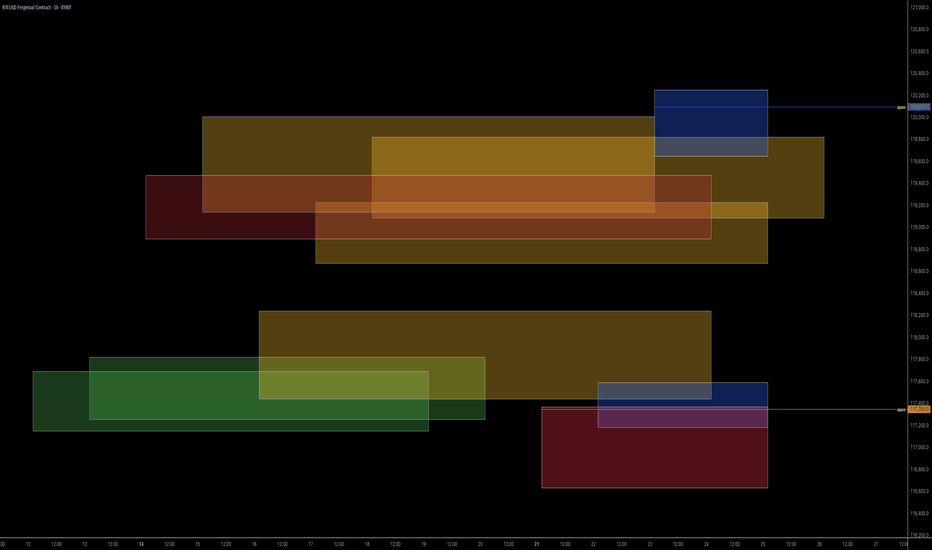

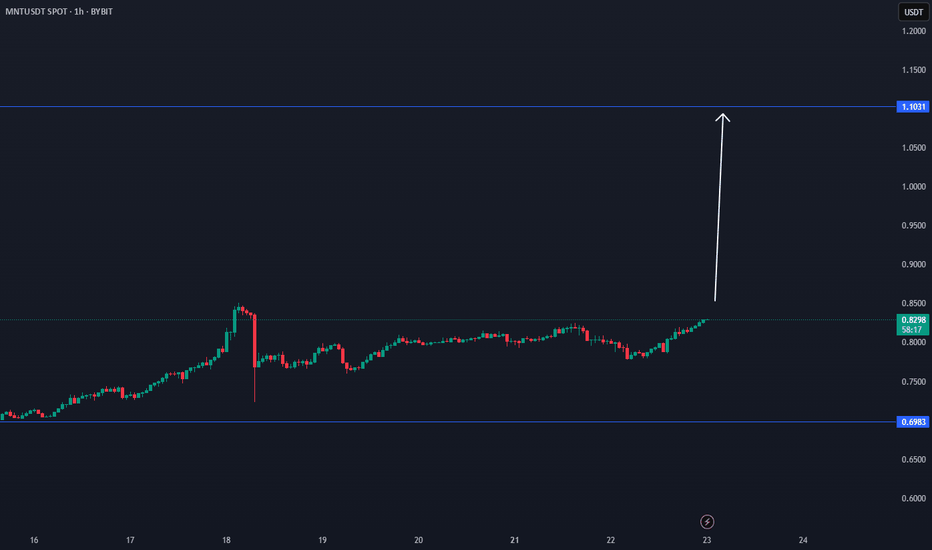

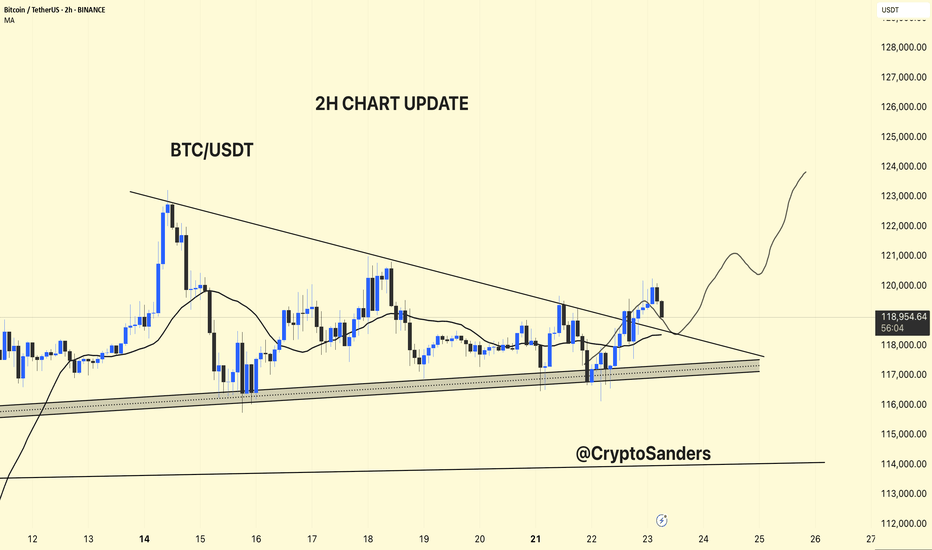

BTC/USDT – 2H Chart Update!!BTC/USDT – 2H Chart Update

Breakout Confirmed:

BTC has broken above the descending trendline but is currently facing resistance at around $ 119,500.

Support Zone:

Strong ascending support between $ 117,000 and $ 118,000 remains intact.

Moving Average:

Price is currently testing the 2H MA (~$118.3). Holding above this could confirm bullish continuation.

Outlook:

If BTC holds above $ 118,000, a move toward $ 123,000–$ 125,000 is likely.

Failure to hold may retest $117K support.

Bias: Short-term bullish unless price breaks below ascending trendline.

Thanks for your support!

DYOR. NFA

HIGH POWERED SHORT ZONE 2.0HIGH POWERED SHORT ZONE ⚡️

Usually, a 3% move doesn’t make anyone blink—but this one? It sent BTC into all-time high territory. I almost popped the champagne… until I remembered I’m in a short.

Not because I don’t believe in upside—but because my add zone in the HIGH POWERED SHORT ZONE hasn’t been tagged. Yet.

Here’s the breakdown 🧵👇

________________________________________

Before anyone goes bUCK wilD and cracks open that dusty bottle of Veuve, double-check something:

📅 The July 10th daily candle needs to close above the monthly swing high (orange line).

If BTC bulls lock that in, then a move deeper into the HIGH POWERED SHORT ZONE becomes real...

play-the-game real…

________________________________________

Where’s this HIGH POWERED SHORT ZONE coming from?

🔻 Solid red line – a trendline from Dec 2024 that has held strong through three separate tests — marking it as a key line on the sand.

🔻 Dashed red line – goes all the way back to Dec 2017. A seasoned veteran of resistance.

I also drew in a white ascending channel—not just for looks. If BTC breaks out, this channel will help us ask:

“How high is too high?”

________________________________________

Now enters Fibonacci — where nature maps out key alignments on the chart. 🌱

🟡 Gold lines = Fib golden ratios

🔵 Teal lines = Fib Degen Ratios

It’s wild how they just line up:

• 2.618? Right on the top of the channel.

• 1.618? Sitting on the 2017 trendline.

• 0.618? Near current support + bottom of the channel.

Also had to draw that horizontal support white line to keep an eye on.

A Bounce or bust? Ask the bUCKmOON!

AVAX Long Swing Setup – Waiting for Support RetestAVAX has been rallying for two straight weeks, showing strong momentum. We’re watching for a healthy pullback into the $22.50–$24.00 support zone to position for continuation. If this zone holds, the risk/reward setup favors bulls with clear upside targets.

📌 Trade Setup:

• Entry Zone: $22.50 – $24.00

• Take Profit Targets:

o 🥇 $27 – $29

o 🥈 $33 – $35

o 🥉 $40 – $44

• Stop Loss: Daily close below $20.50

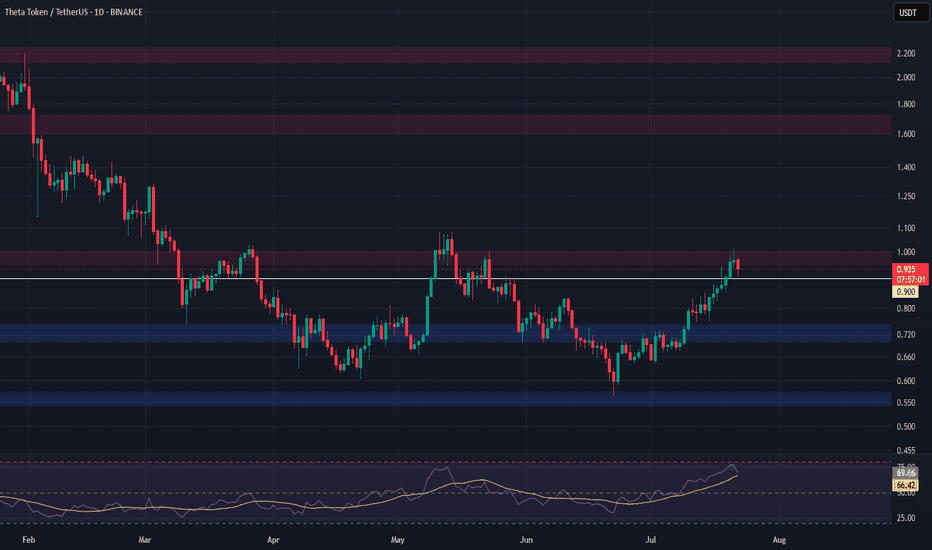

THETA Long Swing Setup – Accumulation Phase Near BreakoutTHETA is still consolidating in a range, but momentum is quietly building. A break above $1.07 followed by a higher low would confirm structural reversal. We’re eyeing the $0.95–$1.00 zone for a clean entry on retest, offering solid risk-reward if support holds.

📌 Trade Setup:

• Entry Zone: $0.95 – $1.00

• Take Profit Targets:

o 🥇 $1.60 – $1.70

o 🥈 $2.10 – $2.20

• Stop Loss: Daily close below $0.90

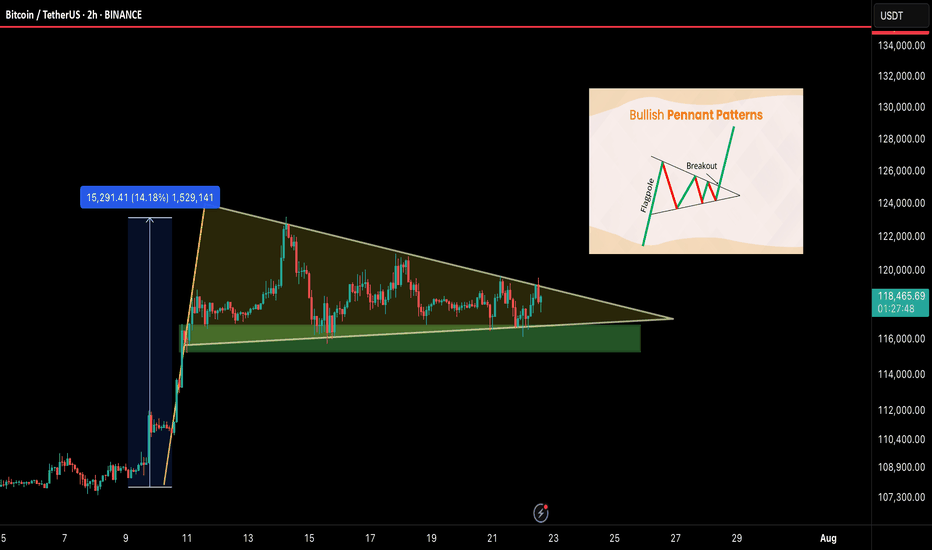

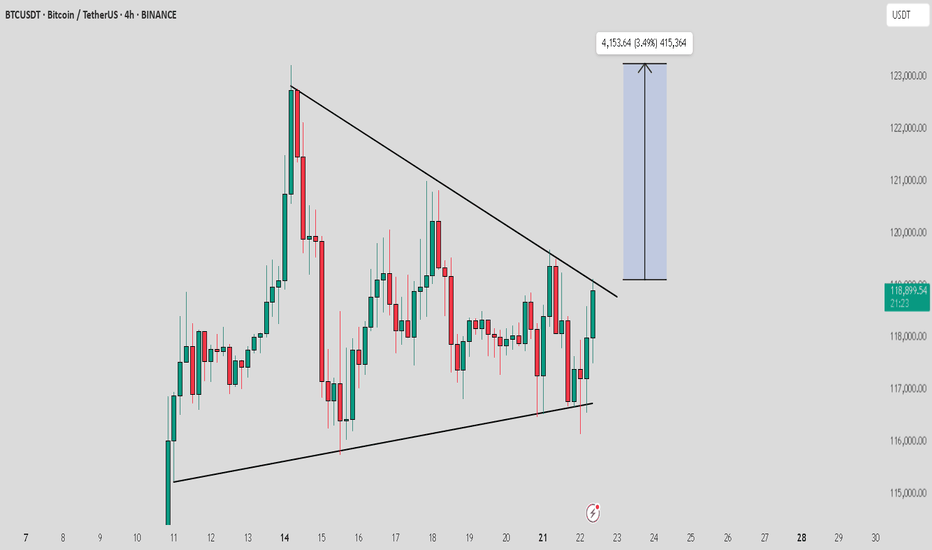

BTC/USDT – Bullish Pennant Setting Up for the Next Leg!Bitcoin is currently forming a bullish pennant — a classic continuation pattern — right after a strong 14% impulse move. This type of structure often leads to a breakout followed by another powerful rally. And it’s coiling up nicely.

🧠 Technical Breakdown:

🟢 Bullish pennant formation in progress

🔽 Support zone: $115.5K – $116.5K

📏 Flagpole projection targets $135K+ on breakout

⚠️ Currently consolidating with lower volatility — breakout could be near

🔍 What to Watch For:

Clean breakout above pennant = breakout confirmation

Daily close below $115K = invalidation zone

Volume spike will likely signal the next move

📢 Final Take:

BTC is showing healthy consolidation after a strong move, and this pennant could launch us toward $135K and beyond. Keep your eyes on the breakout and manage risk wisely.

💬 Share your thoughts below & smash that ❤️ if you’re watching this move!

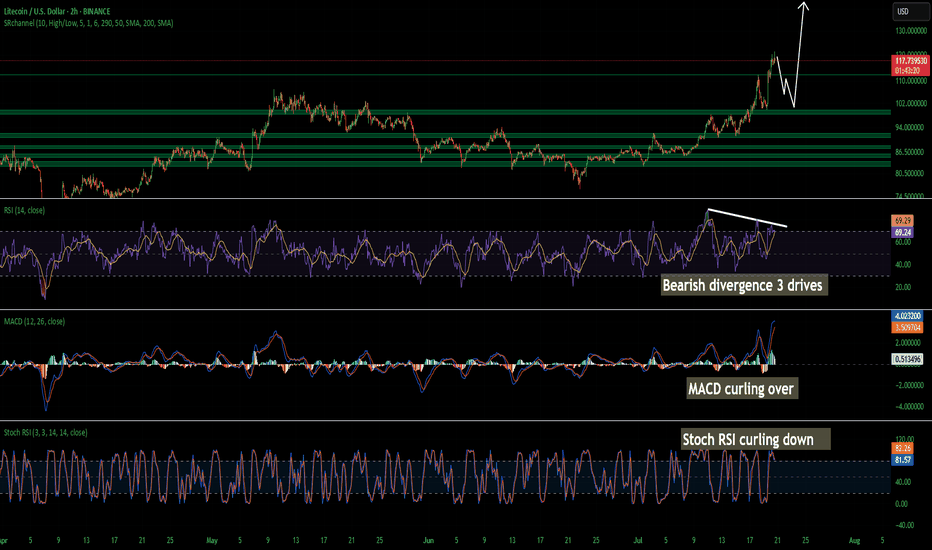

LTC Litecoin Short Term Pull Back Quick and SharpI believe Litecoin Is topping out on the 2 hour. Looks like we may come back down and tap support at around 104 but I wouldn't be surprised a wick hits 100. I have buy orders around 103-106. I am not super confident on a deeper pullback so thats why my buys are there is so i don't miss the dip. Id rather make a little less money than miss a buy in trying to nail the bottom. Litecoin is starting its breakout from a 7 year consolidation and accumulation phase. This should be pretty massive. Litecoin is going to benefit considerably from these new bills that are being signed and many of the favorites in the top 100 will soon disappear!

The time for Litecoin to shine as I have been talking about for years is now. I am almost certain that this is that time. My predictions all still hold if you would like to go read them. I was just off on timing. Timing is the hardest thing to predict especially with how wild this planet has been lately. None of this is financial advice its just my opinion.

Total to 5T & BTC to...?Morning fellas,

No way BTC is stopping here. People are gonna get reckt shorting, and are not gonna believe where this price action is gonna stop.

TOTAL must reach anywhere between 4.5T & 5T, this spread across all Alts.

It has been a long time coming, and the party hasnt even started yet.

Hold your horses and trade thirsty, my friends!

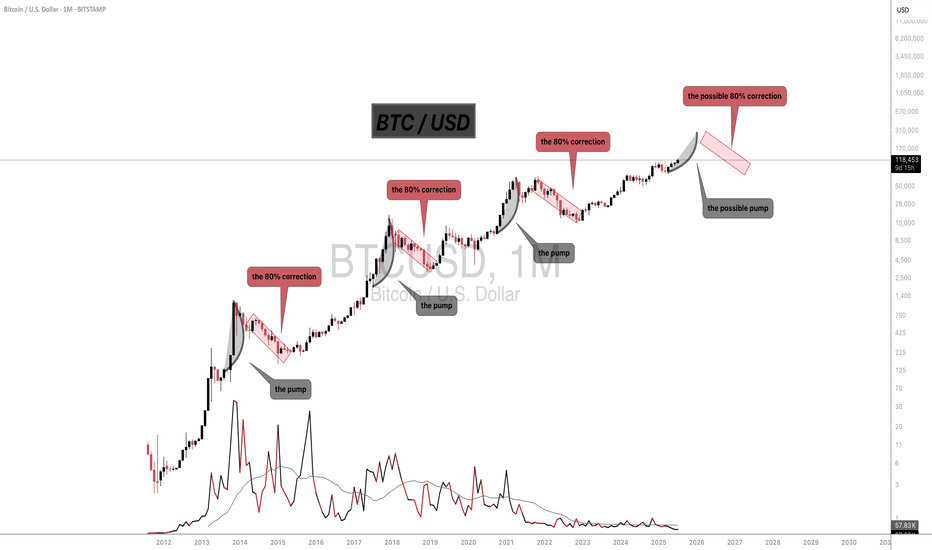

BITCOIN Isn't even overbought yet!Bitcoin (BTCUSD) has been rising strongly within a structured Channel Up pattern but even this consistent and steady uptrend since the April 07 2025 rebound on the 1W MA50 (blue trend-line) hasn't been enough to touch the Pi Cycle's overbought trend-line (red).

Throughout BTC's historic Cycles, all Tops have been priced after the overbought level was breached, which currently sits around $180000 (and rising). Given that the 4-year Cycle Theory won't change, even a repeat of the 'weaker' +136.49% last rally of the previous Cycle (Jun-Nov 2021), would take us to $180k exactly but still will be below the overbought trend-line. This just shows the immense upside potential of the market even at the current stages.

So do you think we will get that kind of rally? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

#BTC Update #9 – July 22, 2025#BTC Update #9 – July 22, 2025

As previously noted, Bitcoin is currently trading within both a horizontal range (box) and a tightening triangle formation. Although there was a drop last night, price didn’t pierce the lower boundary of the box and is now showing an upward reaction.

As long as BTC holds above this box, there’s no major risk. Bitcoin has already completed the 0.382 Fibonacci retracement from its previous impulsive move. If that correction is sufficient, the next upside target is $127,900.

However, one key point to watch: Bitcoin failed to break its previous high in its last three attempts — a clear sign of price compression and market indecision.

📌 No need to rush into Long or Short positions. It’s best to wait for a confirmed breakout before acting, as premature entries could carry elevated risk.

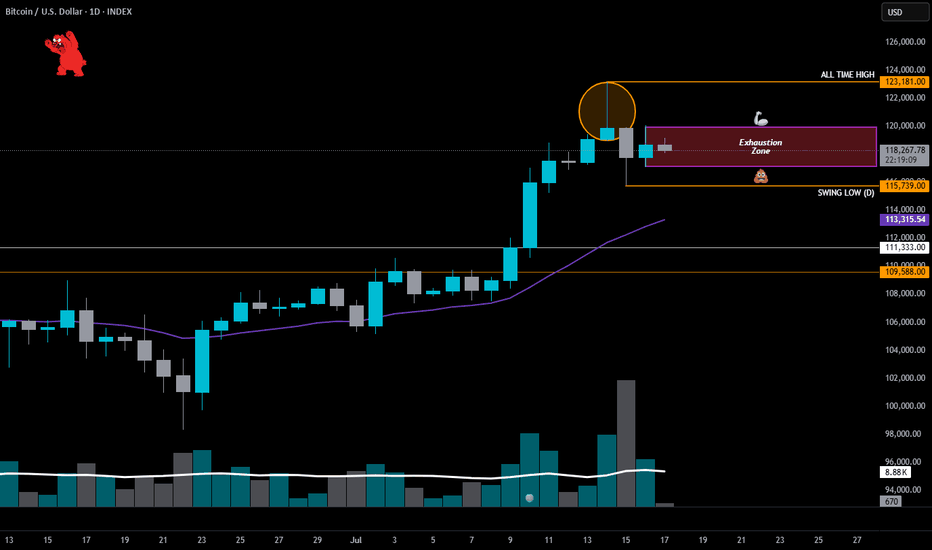

BTC Exhaustion Zone Upper Wick Rejection Candle 🔶 (Orange Circle)

🔍 Candle Breakdown | July 14, 2025

• Opened near the lows

• Rallied intraday to $123K (ATH)

• Closed well off the highs, just above $119K

• Long upper wick = rejection of higher prices

• Elevated volume = signal is valid, not noise

🧠 Translation: Bulls charged into resistance. Sellers didn’t flinch — absorbed the move and slammed price back down. The result? “Exhaustion Candle.”

📦 Exhaustion Zone (Purple Box)

This is the real battlefield. If BTC fails to close above 119.5K by Friday, we likely get Manipulation over the weAkend:

🔄 Chop & Range Behavior

• Consolidation between ~115K support and ~120K resistance

• Classic pause before either expansion or collapse

🔻 Retrace Scenarios

• 21 EMA at $113K

• Breakout retest near $111K

💡 If we close the weAk closer to $111K than $125K… gravity’s working in favor of the HIGH powered short Zone again!

MMM still sTRONg — but without a decisive breakout above $125K, I might just be dancing with the market makers for once.

🧘♂️ Breathe in. Kill the ego. sTAY sHARP. Execute.

100% not financial advice, for edutainment purposes only!

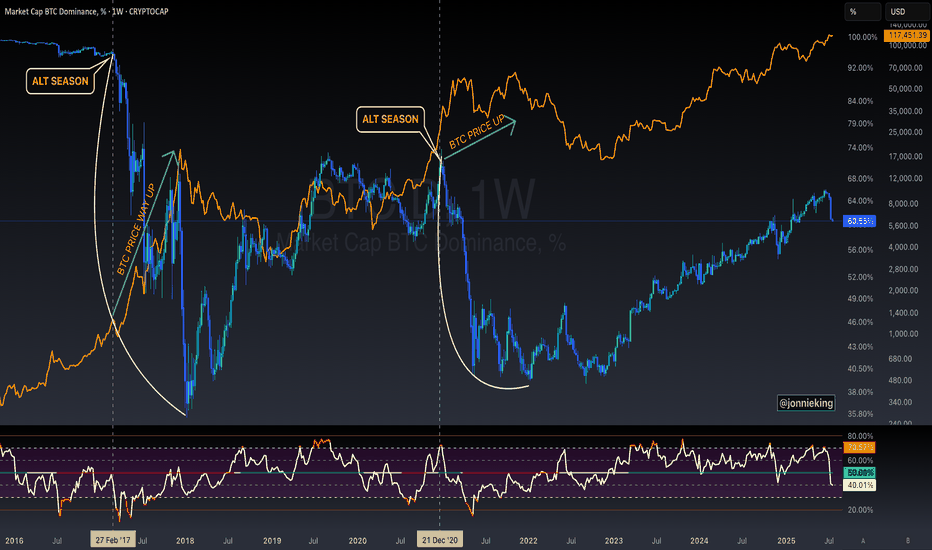

$BTC Will Go Up Alongside Alt SeasonSomeone posted on one of my tweets the following:

" Jonnie my bro, the only problem for me right now is that btc didnt top yet. You also talked how btc shoud top around 200k range. Alt season can only come when btc reach top"

MYTH DEBUNKED ✅

CRYPTOCAP:BTC does NOT need to top in order for Alt Season to commence.

Both can and will occur in tandem 🤝