BITCOIN NEXTKind of a Messy coorective Structure, this is What I can see right now with the movemments it has done

YIf you lower the time frame you should see the complete map also levels are Highlighted

It should go as follows

Buy from now @ 107.600 to 108.500

Sell from @ 108.500 to 105.000

buy from @ 105.000 to 111.000

Sell from @ 111.000 to 96.000

Buy from @ 96.000/ 94.000 to 120.000 and 130.000

GG

1-BTCUSD

Buying Reploy AI (RAI) Today Is Like Buying Bitcoin at $345Buying Reploy AI (RAI) Today Is Like Buying Bitcoin at $345—Or Even $3.45

Imagine going back in time to 2016 and buying Bitcoin at $345. Most people didn’t believe in it. They thought it was too risky, too early, or just plain irrelevant. Today, Bitcoin is trading in the six figures. The opportunity was historic.

Now, there’s another chance brewing—and it’s quietly sitting in front of us.

That opportunity is Reploy AI ($RAI).

🚀 What is Reploy AI?

Reploy AI is a micro-cap artificial intelligence (AI) project focused on decentralizing the compute layer that powers AI training and inference. It’s building a distributed AI network that connects GPU resources with developers and businesses in need of scalable AI infrastructure. Think of it as the decentralized AWS + OpenAI — built from the ground up for speed, accessibility, and equity.

It’s early. But the fundamentals, vision, and market positioning are explosive.

💰 Let’s Talk Numbers: The Bitcoin Comparison

Right now, Reploy AI ($RAI) trades at a tiny market cap—roughly $3 million at the time of writing.

If $RAI hits a $1 billion market cap, that’s a 31,000% return.

Yes, 31,000% — not a typo. That’s a 310x gain.

That would be like buying Bitcoin at $345, before it ran to over $100,000.

If $RAI grows into a $10 billion AI ecosystem, it would be like snagging Bitcoin at just $3.45.

Let that sink in.

🌐 Why This Could Actually Happen

AI Is the Next Internet

The world is undergoing an AI revolution. But centralized giants (like OpenAI and Google) dominate access. Reploy offers a decentralized, censorship-resistant alternative — and the market desperately needs it.

Micro Cap = Maximum Asymmetry

Unlike hyped-up billion-dollar AI tokens, Reploy is still undiscovered. Small caps like this can explode with just one partnership, listing, or viral catalyst.

Strong Tokenomics & Ecosystem Design

RAI has a deflationary supply structure, utility-driven demand, and real infrastructure use cases tied to decentralized compute, developer tooling, and enterprise deployment.

It’s Not Just Hype. It’s Being Built.

Reploy isn’t vaporware. The team is shipping code. The platform is live. And the network of compute contributors is growing.

⚠️ Of Course, This Is Risky

Yes, it’s still early. Yes, micro-cap tokens carry real risk. But so did Bitcoin when it was $345. So did Ethereum when it was $7.

The difference is this: most people only see opportunity when it’s already gone.

This isn’t financial advice. But if you’ve ever wished for a second shot at catching a generational trend early—this might be it.

🧠 Final Thought

In crypto, the biggest returns come from spotting the future before it’s obvious.

Buying $RAI at today’s price could be your version of buying CRYPTOCAP:BTC at $345—or even $3.45. The only question is: will you see it in time?

📈 DYOR. Stay sharp. Think long-term. And don’t miss what might be the next breakout in AI + crypto.

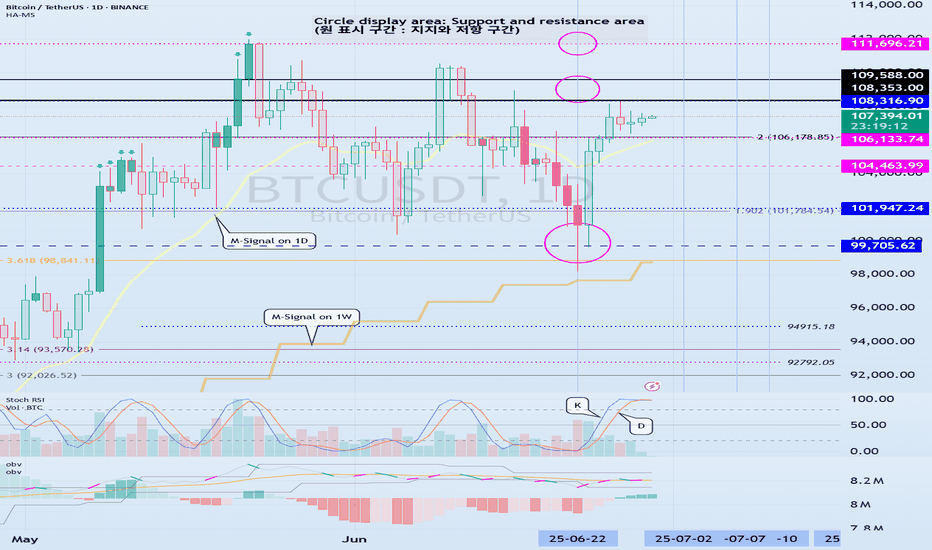

StochRSI indicator and support and resistance levels

Hello, traders.

If you "follow" me, you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

The StochRSI indicator on the left chart is slightly different from the StochRSI indicator on the right.

The StochRSI indicator on the left chart is the StochRSI indicator provided by default in TradingView, and the StochRSI indicator on the right chart is an indicator with a modified formula.

The StochRSI indicator is a leading indicator that is reflected almost in real time.

Therefore, it reacts sensitively to price changes.

Although it is advantageous because it reacts sensitively, it also increases the possibility of being caught in a fake, so I thought that a slight delay(?) was necessary, and so I created the StochRSI indicator on the left chart.

If you look at the relationship between the K and D of the StochRSI indicators on the two charts, you can see that there is a big difference.

In the end, you can predict the movement by checking whether the movement of the K line has escaped the overbought or oversold section.

However, I think that you will receive information that can determine the sustainability of the trend depending on the positional relationship between K and D.

Therefore, it is important to distinguish the inflection points that occur in the StochRSI indicator.

This is because these inflection points provide important information for drawing trend lines.

Therefore, the StochRSI indicator on the left chart, which better expresses the inflection point, is being used to draw the trend line.

(Unfortunately, this indicator was not registered on TradingView because I did not explain it well.)

-

As a new candle was created, the StochRSI indicator on the left chart is showing an inflection point on the K line.

The StochRSI indicator on the right chart is showing a transition to a state where K < D.

We will have to check whether the inflection point was created only when today's candle closes, but I think that the fact that it is showing this pattern means that there is a high possibility of a change in the future trend.

Since the next volatility period is expected to start around July 2nd (July 1st-3rd), I think it has started to show meaningful movements.

-

It is true that you want to buy at the lowest price possible and sell at the highest price.

However, because of this greed, one mistake can lead to a loss that can overturn nine victories, so you should always be careful.

Therefore, if possible, it is better to check for support and respond.

In that sense, I think it is worth referring to the relationship between K and D of the StochRSI indicator on the left chart.

This is because the actual downtrend is likely to start when K < D.

-

In order to check for support, you definitely need support and resistance points drawn on the 1M, 1W, and 1D charts.

Ignoring this and checking for support at the drawn support and resistance points can result in not being able to apply the chart you drew to actual trading.

Therefore, you should draw support and resistance points first before starting a trade.

Otherwise, if you draw support and resistance points after starting a trade, you are more likely to set support and resistance points that reflect your subjective thoughts, so as I mentioned earlier, you are more likely to lose faith in the chart you drew.

If this phenomenon continues, it will eventually lead to leaving the investment market.

-

It is important to determine whether there is support by checking the correlation between the StochRSI indicator and other indicators at the support and resistance points drawn on the 1M, 1W, and 1D charts.

Even if the inflection point of the StochRSI indicator or other indicators occurs at a point other than the support and resistance points you drew, you should consider it as something that occurred beyond your ability to handle.

In other words, you should observe the price movement but not actually trade.

As I mentioned earlier, if you start to violate this, you will become less and less able to trust the chart you drew.

-

Accordingly, the basic trading strategy I suggest is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, since the HA-Low and HA-High indicators are expressed as average values, they may move in the opposite direction to the basic trading strategy.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downward trend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise upward trend.

Therefore, the basic trading strategy mentioned above can be considered a trading strategy in the box section.

In the case of deviating from this box section, it is highly likely to occur before and after the volatility period indicated by the relationship between the trend line using the StochRSI indicator mentioned above and the support and resistance points drawn on the 1M, 1W, and 1D charts.

Therefore, special care is required when conducting new transactions during the volatility period.

This is because there is a high possibility of being caught in a fake when trading during the volatility period.

-

The DOM(60) and DOM(-60) indicators are good indicators to look at together with the HA-Low and HA-High indicators.

The DOM indicator is an indicator that comprehensively evaluates the DMI, OBV, and MOMENTUM indicators.

Therefore, the DOM(60) indicator is likely to be at the end of the high point range, and the DOM(060) indicator is likely to be at the end of the low point range.

In the explanation of the HA-Low and HA-High indicators,

- I said that if the HA-Low indicator receives resistance and falls, there is a possibility that a stepwise downtrend will begin,

- and if the HA-High indicator receives support and rises, there is a possibility that a stepwise uptrend will begin.

In order for an actual stepwise downtrend to begin, the price must fall below DOM(-60), and in order for a stepwise uptrend to begin, it must rise above DOM(60).

In other words, the DOM(-60) ~ HA-Low section and the HA-High ~ DOM(60) section can be seen as support and resistance sections.

-

If these correlations start to appear, I think you will be able to create a trading strategy that fits your investment style without being swayed by price volatility and proceed with trading.

The reason for analyzing charts is to trade.

Therefore, the shorter the time for chart analysis, the better, and you should increase the start of creating a trading strategy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

BTCUSD Trade Setup - 28/Jun/2025Hi Traders,

I expect this pair to go Down after finishing the correction.

1) Need to wait for market to show changing of the direction.

2) The first reaction zone foe me will be at 95000 level followed by 89000 level.

3) Need to observe the characteristic of the move coming down in order to understand if market is planning to go up without coming to those levels.

Current expectation for investing is to see market dropping to 89000 level and then start to look for entry.

I only invest in BTC so no shorts for me but market shows potential to give a reversal soon and give a decent down move.

BTC/USD INDEXEach cycle typically spans 4 years. Historically, the cycle peak occurs near the end of year 3, followed by a year-long market downturn in year 4, with the cycle bottom forming closer to the end of that final year.

Based on previous cycles, a reasonable peak for Bitcoin in this cycle would be around $120K–130K, followed by a correction down to the $45K–50K range.

BTC/USD 1DHello everyone, let's look at the 1D BTC chart to USD, in this situation we can see how the 3rd peak formed us and we are currently fighting to maintain the price or a potential output up if we do not see a try to break out, you can expect a stronger relief.

However, let's start by defining goals for the near future the price must face:

T1 = 108376 $

T2 = 110473 $

Т3 = 112061 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 105444 $

SL2 = 103637 $

SL3 = 100644 $

SL4 = 98285

Looking at the RSI indicator, we see

As we entered the upper part of the indicator again, however, there is still a place to try to grow.

ETH could be about to rip into a short-term rallyWhile the stock market has seen surprising upside in the past weeks (presumably due to pricing in rate cuts / a more positive liquidity picture / high expectations for Q2), crypto has lagged behind. I don't believe anything significantly above current prices - no matter in which market - is sustainable for now, but we can certainly milk it for whatever it's worth.

Notably, BTC has shown way more resilience and dominance in the current cycle so far. This makes sense in a high interest environment. However, within the bias of the markets pricing in expectations for rate cuts and as such more liquidity, we could also assume that demand for assets other than "safe havens" would now increase as well, leading us to the biased conclusion that we could see altcoins wildly outperforming BTC over the next weeks.

Indeed, if we look at the BTC chart, technicals such as VWAP stddevs show significantly less potential for upside if compared to ETH in the current moment in time. We therefore would focus on ETH at this point (as money flow seems to cycle BTC->ETH->Others).

PLEASE NOTE: SL and TP are not accurate. This is not a precise trading idea. Please use your own judgement in accordance with your trading style.

BTC's Mid 2025 OutlookBitcoin is currently trading around $107,000 on the 4-hour 4H timeframe, navigating a consolidation phase following a sharp rally that culminated in a new all-time high of $111,900 in May 2025. Despite recent price corrections, BTC remains up 3% on the week, reflecting underlying bullish momentum. This sustained strength hints at continued confidence in the market, particularly among larger players.

A notable development supporting this view is the increase in the number of Bitcoin wallets holding at least 10 BTC, which has surged to a three-month high of 152,280. This metric is widely regarded as a proxy for whale activity and may indicate renewed institutional interest, especially amid accelerating inflows into spot Bitcoin ETFs.

On the 4H chart, Bitcoin appears to be consolidating within a tight range, hovering just beneath a key supply zone at $107,000, which could act as short-term resistance.

Several potential outcomes are currently in play:

Bullish scenario:

A breakout above the $107,000–$108,000 range could clear the path toward the critical resistance at $115,000. A successful move above this threshold would likely signal resumption of the broader uptrend, with some technical analysts eyeing a potential cup and handle formation that could project long-term targets up to \$180,000

Bearish scenario:

If BTC fails to hold above the current level, it may correct toward the first major support at $102,800, with further downside risk to $98,500. In a more pessimistic setup, price could extend losses toward $96,000, especially if macroeconomic or geopolitical pressures intensify

Key levels to watch:

Resistance: $107,000 - $115,000

Support: $102,800 - $98,500 - $96,000

Market Sentiment and External Drivers:

Bitcoin's price is being shaped not only by technical dynamics but also by powerful external forces

Spot Bitcoin ETFs:

The US regulatory greenlight for spot ETFs has dramatically altered market dynamics. With projections of $190 billion in assets under management AUM for these products by the end of 2025, institutional access to BTC has become more streamlined, providing strong tailwinds for long-term accumulation

Geopolitical risk and macro conditions:

Global uncertainty, particularly due to escalating tensions in the Middle East and potential US military involvement, has introduced volatility. At the same time, rising inflation and economic instability in developed markets is a double-edged sword, either undermining risk assets or conversely boosting Bitcoin’s narrative as digital gold and a hedge against fiat devaluation

Forward-Looking Outlook:

Bitcoin is at a critical juncture. The ability to sustain above $107,000 and reclaim the $115,000 resistance will be pivotal. A confirmed breakout could open the door to price discovery and possibly a surge toward $130,000 to $150,000, with $180,000 as an extended target in more bullish scenarios

However, a failure to hold key support levels could shift momentum toward the bears, prompting a deeper correction toward the $96,000 zone. Traders should monitor:

- Price reaction around $107,000 and $115,000

- ETF inflow data and AUM growth

- Macro news especially inflation reports and central bank commentary

- Developments in global conflict zones impacting risk appetite

Conclusion:

Bitcoin’s medium-term direction hinges on a delicate interplay of technical consolidation institutional flow and macro geopolitical signals. While the bullish structure remains intact for now a decisive move in either direction above $115,000 or below $98,000 could set the tone for the next major trend.

BTCUSD Trading Opportunity! SELL!

My dear subscribers,

This is my opinion on the BTCUSD next move:

The instrument tests an important psychological level 10686

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 10417

My Stop Loss - 10836

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

HelenP. I Bitcoin can drop from resistance levelHi folks today I'm prepared for you Bitcoin analytics. If we examine the chart, we can see that the price has approached a significant resistance zone between 108200 and 108800. This area previously acted as a ceiling for the price, and now coincides with the retest of the broken trend line from above. After a strong bullish push from the support zone near 103000, the price is currently consolidating just below resistance, which often signals hesitation and potential reversal pressure. Earlier, we observed a period of consolidation around the support zone, followed by a breakout that broke above the trend line. However, the current structure suggests that the breakout may have been temporary. With multiple signs of slowing momentum and price failing to break convincingly through the resistance, a bearish move from this level becomes increasingly likely. Given the context, I expect BTCUSD to reject this resistance and move downward toward the 103000 support level again. That is my current goal, as I anticipate the price to complete a corrective wave in line with the overall structure. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

BTCUSD - Weekly Bullish Momentum Targeting $115K, Eyeing $137KI'm currently observing a strong bullish structure on the weekly timeframe for Bitcoin, trading at $107,305 at the time of writing. The current weekly candle shows aggressive buying pressure, and if this momentum sustains through the close, we could see a continuation toward the $115,200 level.

There’s visible liquidity and unfilled price action around $109,500, which I expect to be taken out as price moves upward. Once cleared, Bitcoin could either:

1. Continue straight to \$115K+, or

2. Briefly retrace before resuming the uptrend.

From a Fibonacci retracement perspective, BTC previously pulled back to the 38.2% level ~$76,000 before launching into the current leg up, a classic continuation signal within an uptrend.

Given the current price action and historical behavior, I’m targeting the following levels:

Short-term target: $115,200

Long-term target (multi-month): $137,200-$137,300

Stop loss and entry would depend on the timeframe of execution, but from a weekly structure, invalidation would occur if BTC breaks below the last major higher low around $98,000-$96,000.

Let’s see how this weekly candle closes. If the momentum holds, the next leg could already be unfolding.

BTCUSD TRADE SETUP 📈 **Bitcoin (BTC/USD) 1H Chart Analysis — June 28, 2025**

🔍 **Pattern Identified: Bullish Flag Breakout**

🧠 **1. Market Context**

* This is the **1-hour chart** of **BTC/USD** on Binance.

* Price recently formed a **bullish flag pattern**, which is a **continuation pattern** signaling a potential breakout in the **direction of the previous trend (upward)**.

🔧 **2. Technical Breakdown**

🔹 **Trend Before the Flag**

* Price had a strong **impulsive move up** from \~105,000 to \~107,800.

* That was followed by a **consolidation phase** forming a downward sloping **channel** (blue parallel lines), creating the **flag**.

🔹 **Flag Channel**

* Price oscillated inside this flag for nearly 2 days (June 26–28).

* The **channel** is clearly defined, and price **respected both upper and lower bounds** during the consolidation.

🚀 **3. Breakout Confirmation**

* Price has now **broken out of the upper boundary** of the flag.

* A clean **break and candle close** above the trendline suggests **bullish momentum** is returning.

* This breakout is occurring around the **107,400–107,800** zone, which is also a **key structure level** acting as local resistance.

---

🎯 **4. Trade Setup**

✅ **Entry:**

* Around **107,400–107,800**, post-confirmation of the breakout.

❌ **Stop-Loss (SL):**

* Placed just below the **flag support / demand zone**, around **106,800**.

* This protects against a fake breakout or pullback into the flag.

🎯 **Target (TP):**

* Projected at **110,000**, which is aligned with the height of the initial flagpole projected from the breakout point.

* This also represents a psychological round number and a previous resistance level.

---

📊 **Risk-Reward Ratio (RRR)**

* **RRR = \~3:1**

* For every \$1 risked, the potential reward is \$3 — **excellent reward structure**.

---

📌 **Key Insights for the Traders**

* This is a **classic bullish flag breakout** play—very reliable in trending markets.

* **Volume confirmation** (not shown in chart but should be checked live) is important — higher volume during breakout gives stronger conviction.

* Watch for a possible **retest of the breakout level** (around 107,800) before the next move up.

Solana coin Long setupIn this video I go through the current price action and talk about how the 126$ target level was recently reached for a clean long entry and on the daily timeframe we printed a higher low .

I expand on my thoughts for a continuation to the upside and to retest some higher levels of resistance 180$s and time will tell if we print a higher high at the 180$s before retesting the $200 zone .

Bitcoin Dominance Is at the Edge and Fundamentals Are PushingCRYPTOCAP:BTC.D Bitcoin dominance (BTC.D) is pressing right into a massive multi-year trendline that has capped it since 2018. We have seen higher lows building since 2022, tightening this squeeze even more. Now it is decision time.

The fundamentals might just tip the scales.

David Sacks says July could be a huge month for crypto. Bakkt is lining up a 1 billion dollar shelf offering that could directly buy BTC. Meanwhile US regulators are pushing hard to finalize crypto market structure rules by September. On top of that, ETFs and big institutional players keep funneling money primarily into Bitcoin, not altcoins.

All this is fueling the case for a breakout in BTC dominance. If it happens, Bitcoin will likely outperform the rest of the market for a while, pulling more of the crypto share back into its hands.

If the chart rejects, we might see altcoins catch some wind and take the spotlight for a bit. But right now with this macro pressure building, the odds seem to favor Bitcoin leading the next leg.

Keep an eye on this chart. A clean breakout above the trendline could set the stage for a very Bitcoin-heavy next few months.

Bitcoin’s not done dropping. Selling pressure’s still on!Welcome aboard ✌️

In order for Bitcoin to climb higher, we first need a deeper correction.

Right now, price is stuck inside a channel — and it’ll take stronger momentum to break out.

🔻 So for now, I’m expecting further downside. Stick with me and don’t miss this bearish wave!

BINANCE:BTCUSD OANDA:BTCUSD

BTC/USD: Breakout Watch - short setup BTC/USD 15-min: Watching for a potential long opportunity. Price is pressing against a key descending trendline, with recent internal 'bos' and 'ChoCh' indicating a shift in momentum.

Plan:

* Entry: Targeting a retest around 107,509 after a confirmed trendline breakout.

* Target: 108,971

* Stop Loss: 106,885

Risk management is key! What are your thoughts?

BTC BTC/USDT LONG_TERMChannels are drawn, long-term targets are clear. The upper extreme visible so far is around $200K for Bitcoin — possible within this cycle.

More realistic targets for this cycle are around $135K.

In the short term, a correction to the lower red channel zone ($88K–94K) is possible.

Watching closely.

Bitcoin -> The bullrun is not over!📣Bitcoin ( CRYPTO:BTCUSD ) is still totally bullish:

🔎Analysis summary:

A couple of months ago Bitcoin broke above the previous all time high. This was basically just the expected creation of new highs, perfectly following the underlying cycles. With respect to the long term rising channel formation, this bullrun on Bitcoin is just starting.

📝Levels to watch:

$100.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Bitcoin Structurally Momentum Bullish – On-Chain Confirmed.⊢

⟁ BTC/USD – BINANCE – (CHART: 4H) – (June 27, 2025).

⟐ Analysis Price: $106,840.15.

⊢

⨀ I. Temporal Axis – Strategic Interval – (4H):

▦ EMA(9) – ($107,126.95):

∴ Current price is slightly below the EMA(9), indicating the beginning of intraday buyer fatigue;

∴ EMA(9) still curves upward, sustaining the recent bullish momentum, but showing signs of deceleration.

✴️ Conclusion: Short-term strength is weakening; potential micro-shift in sentiment underway.

⊢

▦ EMA(21) – ($106,574.03):

∴ EMA(21) acts as immediate dynamic support, now closely tested;

∴ Still sloping upward, suggesting buyers are attempting to defend the structure.

✴️ Conclusion: Tactical support remains intact - this is the battlefield line.

⊢

▦ EMA(50) – ($105,651.25):

∴ Mid-range structure confirms trend stability as price remains well above the EMA(50);

∴ EMA(50) direction remains mildly bullish, reinforcing medium-term control by buyers.

✴️ Conclusion: Medium trend unshaken; pullbacks remain controlled within bullish context.

⊢

▦ EMA(200) – ($104,890.51):

∴ Long-term baseline remains untouched, with price notably above;

∴ The slope of EMA(200) is stable and slightly positive.

✴️ Conclusion: Structural bullish foundation remains intact. No long-term threat detected.

⊢

▦ Ichimoku Cloud (9/26/52/26):

∴ Price remains above the Kumo cloud; Tenkan and Kijun are aligned in bullish formation, though beginning to flatten;

∴ Chikou Span remains free and clear above historical price — no conflict.

✴️ Conclusion: Structure is still bullish, but compression in the cloud signals potential pause in directional conviction.

⊢

▦ Volume (BTC) + MA(21):

∴ Volume sits below its 21-period moving average, indicating waning buyer participation;

∴ No breakout or capitulation candle - sentiment is reserved.

✴️ Conclusion: Lack of conviction - volume confirms indecision and pause in impulse.

⊢

▦ RSI + EMA9 – (RSI: 54.78 / EMA9: 59.70):

∴ RSI curves downward from the upper-neutral zone - momentum is retreating;

∴ RSI has crossed below its EMA(9), which typically signals fading bullish strength.

✴️ Conclusion: Momentum has weakened - buyers are hesitating.

⊢

▦ Stoch RSI – (K: 9.72 / D: 10.22):

∴ Oscillator is deep in the oversold region, preparing a bullish cross;

∴ No confirmation of reversal yet - early signal.

✴️ Conclusion: Setup for potential rebound exists, but signal remains unconfirmed.

⊢

▦ MACD – (MACD: 725.17 / Signal: 883.72 / Histogram: –158.55):

∴ MACD histogram turns increasingly negative, suggesting decay in momentum;

∴ Though MACD line remains above signal, curvature favors a bearish crossover soon.

✴️ Conclusion: Momentum fading; risk of technical crossover if weakness persists.

⊢

▦ OBV – (71.13M):

∴ OBV is flat and shows no divergence, suggesting balanced pressure;

∴ Movement remains parallel to EMA21, confirming neutrality.

✴️ Conclusion: Volume flow is not supporting a continuation; neutral.

⊢

🜎 Strategic Insight – Technical Oracle:

∴The structure remains bullish at the macro and medium levels;

∴ As evidenced by EMA alignment and Ichimoku posture. However, momentum signals are fading, and the current 4H candle lacks conviction;

∴ A breakout requires stronger volume and RSI reacceleration - until then, the tactical stance is suspended.

⊢

∫ II. On-Chain Intelligence – (CryptoQuant):

▦ 1. Exchange Netflow Total – (All Exchanges):

∴ Current readings show net outflows dominating, indicating coins moving out of exchanges - typically interpreted as holding behavior and bullish bias;

∴ No recent spike in inflows that would suggest imminent selling pressure or dump risk.

✴️ Conclusion: Exchange behavior is structurally bullish - environment favors accumulation.

⊢

▦ 2. Exchange Stablecoins Ratio – (All Exchanges):

∴ The ratio remains low and stable, meaning high stablecoin reserves vs. Bitcoin on exchanges - suggesting potential buying power in standby;

∴ No spike in the ratio - no immediate conversion from stablecoins into Bitcoin.

✴️ Conclusion: Stablecoins on standby confirm latent demand - supportive for bullish continuity if triggered.

⊢

▦ 3. Funding Rates – (All Exchanges):

∴ Funding is positive but mild, indicating long interest, yet not overheated;

∴ No excessive leverage detected - absence of speculative imbalance.

✴️ Conclusion: Derivatives market supports a healthy uptrend with no signs of crowd euphoria.

⊢

▦ 4. Estimated Leverage Ratio – (All Exchanges):

∴ Leverage ratio remains within neutral bounds, not expanding aggressively;

∴ Suggests market is currently not dominated by overleveraged positions.

✴️ Conclusion: The structure is stable - no systemic risk from forced liquidations.

⊢

▦ 5. Taker Buy/Sell Ratio – (All Exchanges):

∴ The ratio is slightly above 1.0 - meaning more aggressive buying than selling, but without dominance;

∴ Reinforces sentiment of cautious buying, not yet euphoric.

✴️ Conclusion: Taker flow confirms moderate bullish sentiment, no reversal pressure.

⊢

🜎 Strategic Insight – On-Chain Oracle:

∴ On-chain metrics align with structural bullishness;

∴ Netflows, leverage, and taker activity all support continuation;

∴ Importantly, stablecoin ratios signal dry powder remains available, meaning the market holds the potential energy for further upside - if volume and technical confirmation align.

⊢

⧈ Codicillus Silentii Strategic Note:

∴ In the discipline of silence, one waits as price tests its dynamic zone. The wise act after structure, not inside uncertainty;

∴ The chain speaks in whispers. Smart liquidity waits. The structure is armed - but momentum requires ignition. Not fear, not hope - signal.

⊢

𓂀 Stoic-Structural Interpretation:

∴ Structurally Bullish - (Tactically Suspended);

∴ The core architecture remains intact, but the absence of volume and declining oscillators justify a suspended stance for entry;

∴ On-chain and chart-based structures are aligned in bullish posture, but technical indicators remain in a suspended tactical phase. Awaiting breakout or deeper pullback for positioning.

⊢

▦ Tactical Range Caution:

∴ Watch $106,574 (EMA21) and $105,651 (EMA50) for reactive buying;

∴ Below $104,890 (EMA200) - structure weakens;

∴ Upside breakout requires volume reclaim above $107,330;

∴ Resistance: $107,330 / $108,200.

⊢

⧉

⚜️ Magister Arcanvm (𝟙⟠) – Vox Primordialis!

𓂀 Wisdom begins in silence. Precision unfolds in strategy.

⧉

⊢