NAS100 live trade execution 10k profit and breakdown Seven fundamentals for the week: Iran-Israel war, Fed to fire up tariff-troubled markets

Premium

When will the Fed cut interest rates? That question competes with the Israel-Iran war and the fate of the tariffs America slaps on its peers. US retail sales and interest rate decisions in Japan and the UK keep things lively as well.

100

CORE Rectangle BreakoutBITGET:COREUSDT appears to be breaking out of a 2 1/2 months long rectangle, and is currently challenging the 100-day EMA.

Confirmation: Daily close above $0.58

Invalidation: Break back below the rectangle resistance

Target: Previous support at $0.77 (resistance reinforced by 200-day EMA)

Navigating the Nasdaq's Turbulence: A Peek into the Week AheadAs we head into the trading week, let’s zero in on some critical levels on the CME_MINI:NQ1! Nasdaq that are making the rounds in savvy financial circles. With a bit of a bearish vibe from the get-go, understanding these might just set the stage for some strategic plays.

Top Tier: 19,300 to 19,400

Keep your eyes peeled on this upper bracket. It's where the ceiling might just come crashing down with selling pressure. A lot hinges on how prices react here—will they retreat or break through unexpectedly?

Middle Ground: Around 19,200

Here lies the Fair Value Gap, a zone that often acts as a decision-making hub for the bulls and bears alike. If prices struggle to push past this, it might just reinforce the gloomy outlook for the week.

Entry Alert: Near 19,100

Thinking of going short? This could be your spot. The Optimal Trade Entry point around 19,100 is where the action could heat up, signaling a strong entry if bearish momentum continues.

Watch Your Step: Around 18,730

This level has history. It's served as a balance point before and could either prop up prices for a rebound or give way under bearish pressure, leading to further declines.

Base Camp: 18,300 to 18,550

Down here, if the floor gives way, expect the bears to rush in even stronger. It's a critical zone to gauge just how far the current sentiment could drag the market down.

___________________

Abbreviations

D FVG - Daily Fair Value Gap

D OTE - Daily Optimal Trade Entry

Eq 4h - Equilibrium 4 hours

OTE 4h - Optimal Trade Entry 4 hours

NDOG - New Day/Week Opening Gap

BITCOIN in Coming Days.Hi.

COINEX:BTCUSDT

✅Today, I want to analyze BTC for you in a 4H time frame so that we can have a Short-term view of BTC regarding the technical analysis. (Please ✌️ respectfully ✌️share if you have a different opinion from me or other analysts).

💰 BTCUSDT is sitting at the local support confluence of EMA 50 + 51250$ Support Zone👀

Last chance to bounce off of here☝️ Otherwise down we go📉

Stay awesome my friends.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

The Euro Dollar**Welcome, first I want to personally thank you for taking you time to read what I am about to share with you. These ideas I am publishing come from my view of the market as any other trade influencer out there. It's important to understand that as humans, we possess the possibility of sharing information, and are known to adapt to correct feedbacks of information and disregard what we perceive as being false/wrong information. I want to begin with this fact. The market is designed for neither of you or me to be right or wrong. The market is designed to move money from one source to another. That's all. There is nothing more to that fact. Understand this fact at it is vital for this publication.**

The Euro Dollar has been on a downtrend, 4H chart, since July 13. Although many attempts have been seen throughout the last couple of weeks of bullish pressure entering the market in an attempt to rebound prices. They, unfortunately, have failed. This is obvious. Without looking at indicators, take a shot at the 4H chart on the EUR USD. What do you see? The correct answer is what I just have mentioned. Now, this is nothing I have made up or predicted, however, everyone in the whole wide world who has access to a 4H chart can clear as day see this downtrend (As suppose you are right now). But this downtrend is subject to reversal! I know some of you may be thinking just that, however, and hear me out. How certain are you that the price will reverse just because an indicator is advising you it will? Are you sure you are using the indicator in a correctness. Well, for starts, an indicator can only provide you information on what others are doing, and not where the market is actually going.

Yeah I know, it sucks. Well its the truth. I'm not saying use or don't use them, I'm just advising you of the fact, just like you can see the downtrend on the 4H. And the fact is that INDICATORS CAN NOT show you where the market is going. If they did, well... they'd all work. Period.

What I can tell you is, is that the market itself is telling you what its doing. The market is going down, bottom, low, whatever you want to call it but its doing this ( \ ) not ( / ). Those are suppose to be trend lines, I know terrible. Anyhow, the MARKET is telling you what to do. Its telling you hey bud I'm going down, whether you like it or not, its going DOWN! Now it may choose to go up tomorrow, or in the next couple of weeks, and that's cool and all because good traders would at that point cut their losses and follow the trend upwards, assuming they haven't opened a YOLO 100X margin trade on a $300 account.

See. Its really that simple. Market tells you its going down, you go with it, obviously protecting yourself from when it decides to go back up and vice versa. I hope you found this simple idea with meaning, because honestly, the markets are that simple. You can only BUY or SELL, don't over complicate that fact as a retail trader.

Good Luck

HAPPY HUNTING

TSLA ludicrous mode bounceThis is not good or bad but we are coming back to the down trendline. What does this mean? It has been beat up for the whole month of December, and this short term support will face its biggest test of the new year.

Bullish case the oscillators have to reset, how could that happen? With the momentum it did time to locate the support angle assuming last week was the base of the pivot. After this consolidation look for Tesla to test the moving average it rejected after breaking post November 2022

Bearish case don't fight the trend, go with the current. The rejection at the level it is at now is inevitable, this will test the line and fall. Looking for this to get a bounce around 105, thats ok. It will help to break under $100.

NASDAQ potential for bearish drop to overlap supportLooking at the H4 chart, my overall bias for NASDAQ is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market.

Looking for a sell entry at 12456.1, where the overlap resistance and 38.2% Fibonacci line is. Stop loss will be at 12781.1, where the recent high is. Take profit will be at 11898.1, where the overlap support is and slightly above where the 50% Fibonacci line is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NASDAQ Potential For Bullish ContinuationLooking at the H4 chart, my overall bias for NASDAQ is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market.

Looking for a buy entry at 11921.1, where the overlap support is. Stop loss will be at 11546.9, where the 38.2% Fibonacci line and minor low is. Take profit will be at 12807.5, where the overlap resistance is.'

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

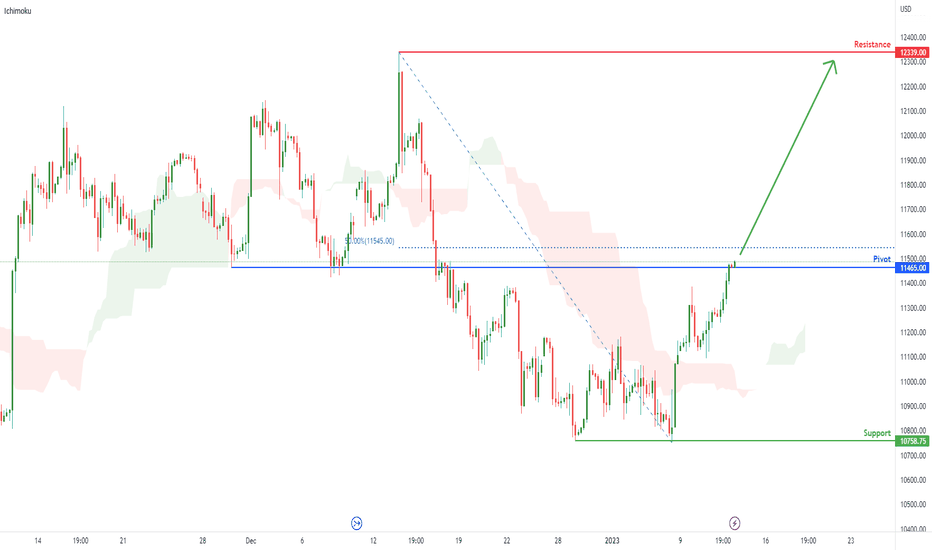

Nasdaq 100 Futures ( NQ1! ), H4 Potential for Bullish RiseTitle: Nasdaq 100 Futures ( NQ1! ), H4 Potential for Bullish Rise

Type: Bullish Rise

Resistance: 12339.00

Pivot: 11465.00

Support: 10758.75

Preferred case: Looking at the H4 chart, my overall bias for CL1! is bullish due to the current price crossing above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to continue heading towards the resistance at 12339.00, where the previous swing high is.

Alternative scenario: Price may break the pivot at 11465.00, where the 50% Fibonacci line is, before heading towards the support 10758.75, where the previous swing low is.

Fundamentals: There are no major news.

Nasdaq going to 11111 .... I think 🤔 good to buy Triangle patterns show the direction

Hope I it reach target 11111

Good luck everyone

Risk is your own

Life is simple 😌

My Price Analysis of LINKBTC on December 10, 2022Hello friends. Today, according to the LINKBTC chart, I noticed that the chart is generally going down and I have drawn the short-term channel in the 1-hour time frame. The formation of EMAs of 50, 100 and 200 assures that the market is bearish. On the other hand, this arrangement is being formed in the 2-hour time frame. On the other hand, the MACD indicator gives a buy signal. My analysis of this signal is that it can either be a fake signal or a short-term signal that will return to its downward channel after encountering the upcoming resistance. and continue its downward trend.

NDX Potential for Bearish Momentum | 13th October 2022On the H4 chart, the overall bias for NDX is bearish. To add confluence to this, the price is below the Ichimoku cloud, indicating a bearish market.

Looking for a retracement sell entry at 11439.38 where the 23.6% Fibonacci line and -27.2% Fibonacci expansion line is located. Stop loss will be set at 12062.52, slightly above the 38.2% Fibonacci line. Take profit will be at 10408.41 where the 78.6% Fibonacci projection line and 127.2% Fibonacci extension line are located.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

WTC/USDT 100% gain incoming!?Expecting a quick 100% gain in short term. Make sure to cash out when it happens. Goodluck all

US 100 chart is going for bearish reversal.It looks like that ABCD harmonic is complete and now reversal has began.

Us 100Us 100 breaking out of channel pattern on the verge to give strong closing might give breakout with gapup keep an eye