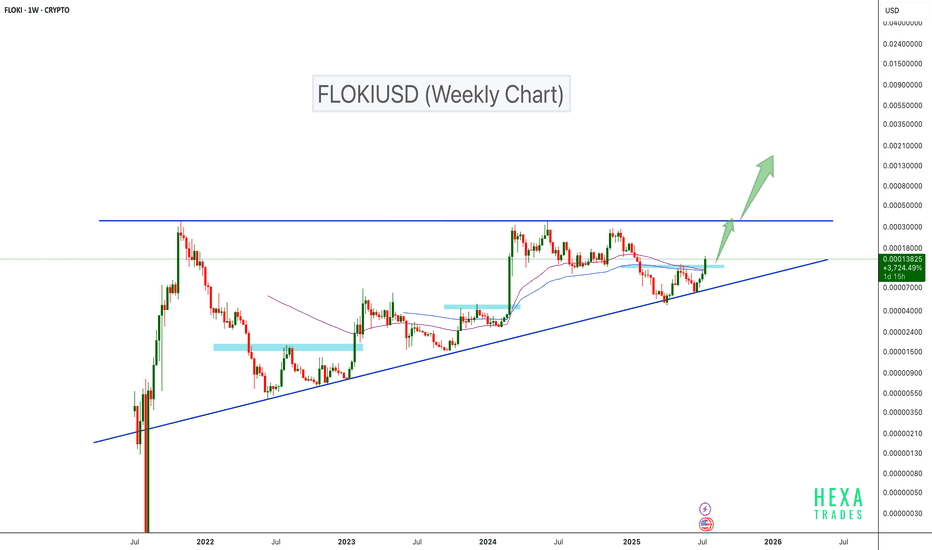

FLOKIUSDT Breaks Key Resistance – Bullish Continuation Ahead?BINANCE:FLOKIUSDT is trading inside its longest ascending triangle. The price has respected the triangle's support and bounced back. It has now broken a key resistance zone. As seen in the chart, every time the price breaks a major resistance, a bullish move follows, and we can expect a similar scenario this time.

SEED_DONKEYDAN_MARKET_CAP:FLOKI CRYPTO:FLOKIUSD

Cheers

Hexa🧘♀️

1000FLOKIUSDT

FLOKI at Key Support – Is a Bounce Coming?The price of FLOKI has dropped back to an important level where it used to face resistance before going up. Now, this same level is acting as support, which could lead to a bounce.

We also see a bullish divergence on the RSI, It often signals that selling is slowing down and a reversal might be coming.

If the price holds above this support zone, we might see a bounce toward the $0.09 to $0.11 area.

If the price breaks below the support, the idea may not work, so it’s important to manage risk.

Floki Is Ready For New ATHFloki/USDT is currently trading within a defined range, forming a box setup on the chart. This indicates a consolidation phase, where the price is accumulating strength for the next significant move.

Box setup details:

- Support (bottom of the box): This level acts as the accumulation zone, where buyers typically step in. Ideal for entries during pullbacks.

- Resistance (top of the box): This is the breakout level. The price needs to close above this area on higher timeframes to confirm a bullish continuation.

Trading strategy:

1. Entry strategy:

- For spot trades: Enter near the support level within the box. Hold patiently for potential upside.

- For leverage trades: Use lower leverage and wait for the price to either bounce off the support zone or confirm a breakout above the resistance with volume.

2. Targets:

- First target: 20-30% (if the price moves to the midpoint of the box).

- Second target: 50% (if the price nears resistance).

- Final target: 100% or more after a confirmed breakout.

3. Stop-loss:

Place your stop-loss slightly below the support zone to protect against downside risk in case of a breakdown.

4. Breakout confirmation:

A breakout above the top of the box, confirmed with increased volume and a strong candle close, can lead to a powerful rally.

Remember, patience is key with box setups. Always manage your risk and trade responsibly.

FLOKI is in the middle of correctionFrom the place where we placed the red arrow on the chart, it seems that FLOKI's correction has started.

This correction looks like a big diametric as we are now in wave D of this diametric.

From the red range, we expect a downward price rejection.

Closing a daily candle above the invalidation level will violate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You