1000PEPE/USDT – CUP & HANDLE BREAKOUT!Hey Traders!

If you’re finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver!

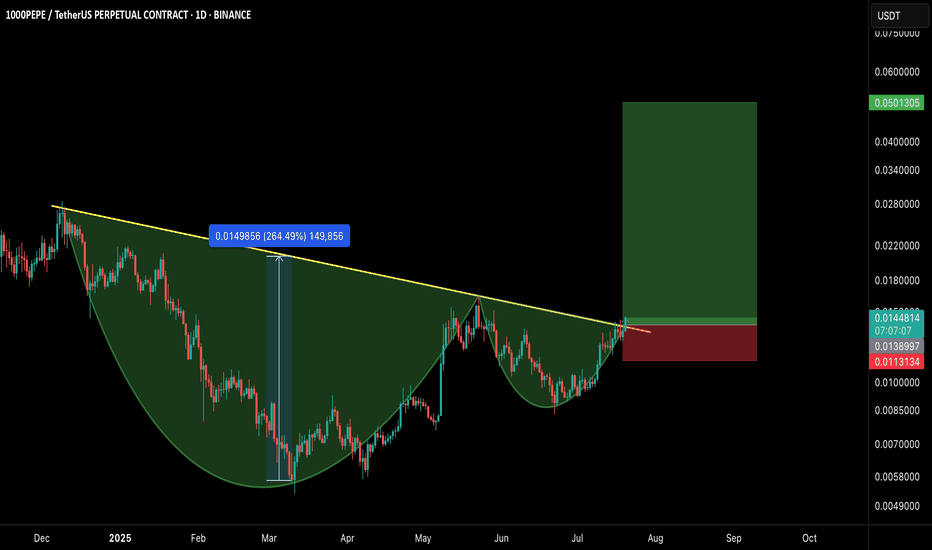

A classic Cup and Handle formation just broke out with strong bullish confirmation, signaling the potential start of a massive trend reversal on the higher timeframe.

📊 Pattern Breakdown

✅ Cup & Handle pattern forming over 7+ months

📐 Breakout above neckline with volume confirmation

📈 Measured move target points towards $0.0501+

🛒 Long Entry:

CMP or on retest near $0.0128–$0.0138

🎯 Targets:

TP1: $0.022

TP2: $0.028

TP3: $0.035

TP4: $0.050

🛑 Stop-loss:

Below handle low — around $0.0113

📌 Risk-to-Reward:

Insane potential here with a 3.5R+ setup even with conservative targets.

📢 Final Thoughts:

This is a textbook reversal pattern breaking out after long accumulation. If BTC remains stable or bullish, meme momentum could supercharge this move.

DYOR + SL is a must!

1000pepeusdt

1000PEPE looks good from here?I did my analysis on different times frames, On higher time frame we are bearish, Short time frame up or down is unpredictable. On as you guy can see price didn’t respect trend and breakdown’ It’s does means that 100% is goin down because we also have Fib Support may that change the market direction from bearish to bullish. We also have FVG which didn’t respect it also and As you guys can see the situation of market mostly up and down by news. So I don’t expect anything good news for the market right now but we should prepare for everything. Those analysts on daily time frame.

$ETH Breakout Holding Support, Targeting $4KBITSTAMP:ETHUSD has broken out of its long-term downtrend and is now holding above key support at $2,440–$2,500.

Once strong resistance, this zone has flipped to support after a clean breakout and retest.

#Ethereum could rally toward $4,000 if this level holds a potential 66% upside.

Bullish structure, but always manage your risk.

DYRO, NFA

$1000PEPE | Smart Money Retracement Levels - Watch FVG + Fib ConAfter a strong breakout and Change of Character (ChoCH), $1000PEPE is now pulling back into a potential premium-to-discount retracement. I'm watching the following key areas:

FVGs + Fib Gold Zones (50% & 61.8%) = high-probability bounce regions

Bu-MB & Bu-B zones = smart money interest area

Daily MSB confirms shift in structure

Key retracement levels:

🔸 Fib 61.8% at 0.0105671

🔸 Fib 78.6% at 0.0091527

🔸 Fib 100% at 0.0052434

Targets: Reclaiming PDH / PWH could suggest continuation.

Invalidation: Break below 0.0052 weak low area (LL) cancels bullish bias.

PEPEUSDT Eyes the Sky!BINANCE:PEPEUSDT has shown a strong bounce from a key support level, signaling potential for a continued bullish move. The overall market sentiment is positive, which could act as a catalyst for further upside. With the price structure leaning bullish and momentum picking up, there’s a good chance we’ll see higher highs in the coming sessions. Traders should keep an eye on the next resistance zone as a possible target while maintaining disciplined risk management. Always trade with a clear plan—and most importantly, don’t forget your stop loss!

$1000PEPEUSDT Currently trading at $0.00735

Buy level : Above $0.0071

Stop loss : Below $0.0056

Target : $0.0145

Max leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#1000PEPEUSDT expecting further decline!📉 SHORT BYBIT:1000PEPEUSDT.P from $0.009650

🛡 Stop Loss: $0.009875

⏱ 1H Timeframe

📍 Overview :

➡️ BYBIT:1000PEPEUSDT.P remains under selling pressure after failing to sustain an upward move. The price is trading below the key POC $0.010072 , which previously served as a high-liquidity zone.

➡️ The recent breakdown of $0.009815 , followed by a retest as resistance, confirms the bearish scenario.

➡️ If the asset holds below $0.009650 , this could trigger a move toward $0.009242, where buying interest was previously observed.

➡️ Current price action shows weakness in buyers as volume does not support an upward breakout.

⚡ Plan :

➡️ Enter short once a firm breakdown below $0.009650 is confirmed.

➡️ Risk management through Stop-Loss at $0.009875 , positioned above the nearest resistance zone.

➡️ The main downside target is $0.009242 , where profit-taking and a possible bounce could occur.

🎯 TP Targets:

💎 TP 1: $0.009242

📢 BYBIT:1000PEPEUSDT.P is showing signs of further downside, with no strong buying reaction at the moment.

📢 The $0.009242 level should be closely monitored as a potential support zone. If weakness persists, breaking this level could accelerate downward pressure.

📢 For those holding long positions, caution is advised when facing repeated resistance retests.

🚀 BYBIT:1000PEPEUSDT.P continues to show weakness — expecting further decline!

PEPE/USDT Ascending Channel Breakout WatchThe price is currently moving within an ascending channel pattern, indicating a potential bullish continuation. A breakout to the upside is expected, but confirmation is key. We'll look to accumulate PEPE near the lower trendline support around 0.0001995 for a long position. The breakout target is set at 0.0002412, offering a promising risk-to-reward opportunity. Ensure proper risk management by placing stop-losses below the lower trendline. Keep an eye on volume during the breakout attempt for stronger validation.

SHORT PEPE NOW! becauseAs in the chart attached to this article, the price of PEPE/USDT or 1000PEPE/USDT.P (for those trading the perpetual symbol, PEPE is currently on a downward movement on the daily, which is a clear sign of a downtrend. In this analysis, a perfect retracement of 79% on the FIB is at the place of interest, which has very high level of confluence which i can't go over in this article. But if you'd like to know how i got the accurate entry to this trade and more exactly like this, follow, and i'll interact with you. For now, enjoy this trade, and lets ride the wave together.

P.S: Don't forget to set your limit orders!

@realalvaritarfa

PEPEUSDT Long Tp 93% Sl - 18%PEPE Long Setup

Reason:

Breakout from trend line in HTF as well in LTF.

Took all possible Liquidity from down side.

Fundamentally created good hype, Technically and fundamentally looks super bullish.

All technical indicator suggesting a strong bullish wave up to at least 400% in spot.

Best Regards,

Crypto Panda

BINANCE:PEPEUSDT

BINANCE:1000PEPEUSDT.P

MEXC:PEPEUSDT.P

PEPEUSDT Forming Bullish Flag$1000PEPEUSDT Technical Analysis update

BINANCE:PEPEUSDT 's price has increased by over 230% from its bottom. It is now consolidating and forming a bullish flag pattern in the middle of the trend. The price could touch the flag pattern support at $0.018 before moving higher, where the 200 EMA will act as support. A bullish continuation can be confirmed once the price breaks the flag's resistance line.

CRYPTOCAP:PEPE CRYPTO:PEPEUSD

$PEPEUSDT Set to Soar After Strong Retest!BINANCE:1000PEPEUSDT.P is demonstrating solid strength following a trend breakout and subsequent retracement. With positive momentum building, it looks poised for a significant move, likely following in the footsteps of DOGE. Traders should keep an eye on key levels as BINANCE:PEPEUSDT prepares for potential big upswings, similar to what we've seen with $DOGEUSDT.

As always, remember to use a stop loss and invest only a small portion of your capital to manage risk effectively.

$1000PEPEUSDT Currently trading at $0.0096

Buy level: Above $0.0093

Stop loss: Below $0.0077

TP1: $0.01

TP2: $0.012

TP3: $0.013

TP4: $0.017

Max Leverage 3x

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#PEPE Bearish Head and Shoulders 📊#PEPE Bearish Head and Shoulders 📉

🧠From a structural point of view, we have constructed a bearish head and shoulders structure near the resistance zone, so we need to be alert to the risk of a correction. Although the general trend direction is a bullish trend, only a healthy correction can make us rise higher. For new long transactions, you can focus on the green buy zone and the neckline support zone.

Let’s see 👀

🤜If you like my analysis, please like 💖 and share 💬

💕 Follow me so you don't miss out on any signals and analyze 💯

PEPE/USDT: SWING LONG POSITION!!Hey everyone!

If you're enjoying this analysis, a thumbs up and follow would be greatly appreciated!

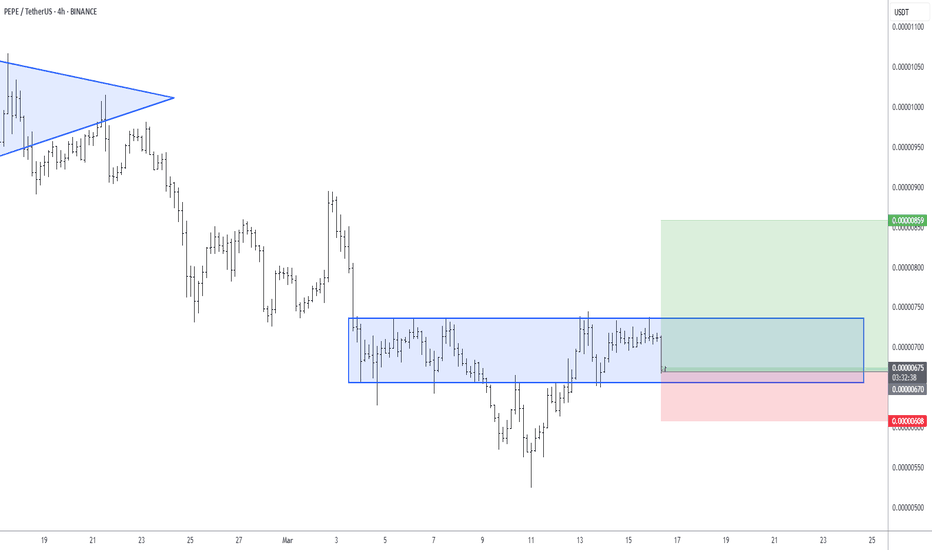

PEPE looks good here. It is breaking out from the symmetrical triangle in 4hr time frame. Long some here and add more in the dip.

Entry range:- $0.0086-$0.009

Target:- $0.0102/$0.0109/$0.0118/$0.0128

SL:- $0.008

Lev:- Use low leverage (Max5x)

What are your thoughts on PEPE's current price action? Do you see a bullish pattern? Share your analysis in the comments below!

1000PEPEUSDT.P Short Position | 15m15m: Took buy-side inducement and cleared the entire day's buy-side liquidity.

15m NY Killzone: Took buy-side liquidity, and with no significant buy-side liquidity available, the market is likely to turn bearish.

Additionally, the market took the 15m inducement and today's entire buy-side liquidity.

Entered a short position after the NY Killzone gave a bearish candle confirmation.

1000PEPEUSDTBINGX:1000PEPEUSDC.P

Well, in updating this analysis, I have to add a point that the red range drawn in the 4-hour period caused the price to fall in the previous downward trend, but pay attention to the fact that it formed a higher floor, so most likely, after crossing the red range to On the upper side, we will enter into the purchase transaction in the first pullback and earn a profit of 1:6 risk to reward.

As simple as this delicious.

1000PEPEUSDTBINGX:1000PEPEUSDC.P

The red line is the 4-hour trend, the gray range is the price compression in 30 minutes, if the trend line is broken and the price closes below the green range, you can enter a sell order in pullback, keep in mind that the big red range that It is at the top of the price, it was the 4-hour range, and the price has retraced its money in that time frame, so eventually we will have a decline, according to the previously mentioned conditions.

This is a simple method of chart analysis.

Phemex Analysis #5: 1000PEPE_ Resistance, Support & Trade Ideas.Since October, PHEMEX:1000PEPEUSDT.P has been a standout performer in the bull market, showcasing an impressive gain of 2,300% (from $0.000747 on October 23rd, 2023, to $0.0172 on May 27th, 2024). However, recent market signals indicate a potential deceleration. The formation of a lower high on June 26th and a significant decline in the Relative Strength Index (RSI) suggest weakening price strength, culminating in a notable drop to $0.0076 last week.

This development necessitates a comprehensive reassessment of the technical landscape, with a specific focus on critical support and resistance levels that are pivotal for informed trading decisions.

Resistance Levels:

Understanding resistance levels is essential for anticipating zones where selling pressure may intensify, potentially halting or reversing the current uptrend. Here are the identified resistance levels for PHEMEX:1000PEPEUSDT.P :

$0.0117 (Weak resistance): This level represents a modest obstacle where price might temporarily pause before potentially resuming its upward trajectory.

$0.0127 (Medium resistance): A more significant barrier that could trigger a temporary consolidation or pullback in price.

$0.0139 (Strong resistance): This level presents substantial resistance and may require robust buying activity to surpass.

$0.0158 (Strongest resistance): The highest resistance identified, indicating a formidable barrier where sustained buying pressure is needed for further upward movement.

Monitoring these levels is critical for detecting potential signs of exhaustion or reversal, particularly if repeated attempts to breach these levels prove unsuccessful.

Support Levels:

Conversely, support levels denote areas where buying interest is expected to emerge, potentially leading to price stabilization or a rebound. Here are the identified support levels for PHEMEX:1000PEPEUSDT.P :

$0.0076 (Weak support): A minor support level capable of temporarily arresting downward movements.

$0.0059 (Medium support): A more substantial support level where significant buying activity could help stabilize the price.

$0.0046 (Strong support): Represents a critical level historically associated with strong buying interest, often triggering significant price rebounds.

$0.0039 (Strongest support): The most robust support level identified, indicating a solid foundation where price has consistently found buyers in the past.

These support levels are pivotal for identifying potential entry points for long positions, especially when price approaches these levels and shows signs of stability or reversal.

Trading Ideas:

Armed with a clear understanding of these key support and resistance levels, traders can implement effective strategies tailored to current market conditions:

Long Position Strategy: Consider initiating long positions when the price consolidates near a strong support level, indicating potential for a rebound and continuation of the uptrend.

Short Position Strategy: Look for opportunities to initiate short positions as price approaches strong resistance levels and displays signs of exhaustion or reversal, such as the formation of a third top combined with RSI divergence.

Advanced Strategy - Neutral Grid Bots: For traders with advanced technical skills, deploying neutral grid bots can provide a strategic advantage. These bots are designed to capitalize on price fluctuations within a specified range, enabling traders to benefit from both upward and downward movements without committing to a single directional bias.

By integrating these strategies into their trading approach, intermediate traders can effectively navigate market volatility and capitalize on opportunities presented by key support and resistance levels.

Note: Do check out Phemex website for our Neutral Grid Bots that is specially crafted for Sophisticated, Advanced Traders, like you.

Disclaimer: This article is intended for educational purposes only and does not constitute financial or investment advice. Readers are encouraged to conduct their own research (DYOR) and consider their financial situation and risk tolerance before making any investment decisions. Phemex does not assume responsibility, directly or indirectly, for any potential damage or loss incurred or claimed to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned in this article.