DXY - 18Apr2022DXY - 18Apr2022

On the weekly, DXY is at RSI resistance. On the daily, it is forming negative bearish divergence where price action is indicating higher highs but RSI indicating lower highs.

On the H4, price bounced back after a dovish ECB last Thursday. That price action looks more like the completion of Wave 4 correction. Now we are waiting to see where the last impulsive Wave 5 will end. For now we should be cautious on further upside as H4 RSI is also indicating negative bearish divergence. Price action could end up reversing any moment.

This is for personal work record purposes only, not financial advise or solicitation of trade.

17apr22

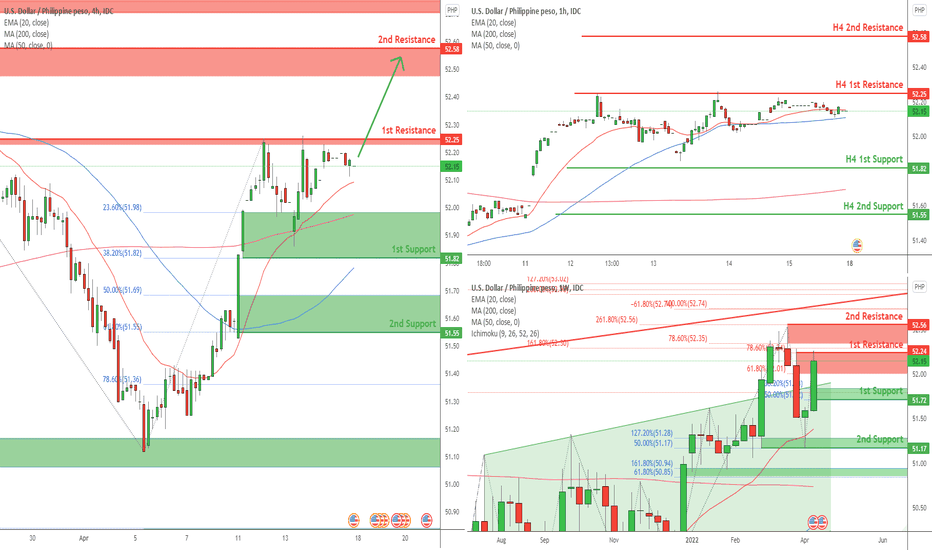

USDPHP - 18Apr2022USDPHP - 18Apr2022

On the weekly, USDPHP is well above 61.8% Fib retracement at 51.79. We could expect it to bounce further to 78.6% Fib resistance at 52.95 soon.

On the H4, price is consolidating just below the 1st Resistance at 52.25. With the rebound of strength in DXY, USDPHP could very well break above this level to 2nd Resistance at 52.58 next week.

This is for personal work record purposes only, not trade / financial advise or solicitation of trade.