Dow-n Memory Lane: Is History About to Repeat Itself?🚨 Breaking News Alert! 🚨

The Dow Jones might be partying like it’s 1929 again! 🎉 Except this time, the crash might make your portfolio flatter than a pancake at a bodybuilder's breakfast. 🥞💪

Let’s talk about the elephant in the chart 🐘—every time the Dow hits the ceiling of this oh-so-perfect wedge pattern, it nose-dives harder than your New Year’s resolutions by February. 📅💔

1906: Boom. Bust. Dow said, "Thanks, but I’m good at -90%."

1929: The OG crash. If you survived this one, congrats—you’re probably immortal now. 🧓💀

2008: The market went "Oops, I did it again" like Britney, wiping out fortunes faster than you can say "subprime mortgage." 🏚️💵

2020: "Hold my beer," said a microscopic virus, and the market tripped like it was wearing untied shoelaces. 🍺😷

Now? The chart suggests we’re flirting with another epic freefall. 🚀⬇️

🧐 How bad could it get?

Well, if history decides to copy-paste itself, we’re looking at a potential 90% drop. Yes, NINETY. PERCENT. That’s like seeing a Tesla go for the price of a second-hand bicycle. 🚲🔋

👉 What can YOU do?

Panic? Sure, if you want, but that doesn’t help. 🫠

Diversify? Probably smart. 📊

Buy gold? Maybe, if you’re a fan of shiny things. 🪙✨

Short the market? 🐻 You rebel, you.

But hey, no pressure. It’s only all your hard-earned savings on the line. 🫣💸

So, are we about to witness the Great Crash 2.0, or will the Dow keep defying gravity like a magician’s top hat? 🎩 Stay tuned, folks, because when this market sneezes, the whole world’s economy catches a cold. 🤧🌍

💬 Drop your hot takes below—because let’s face it, speculating about doom is more fun than living it! 😎🔥

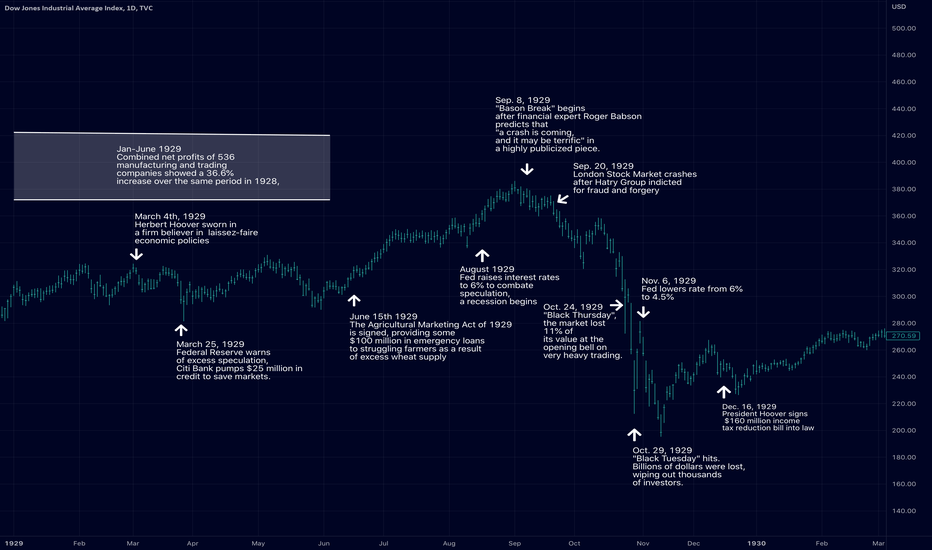

1929

My Stock Market Crash FantasyOn the left we see 29 trading days from peak. On the right we see 29 trading days from peak before the historical stock market crash of 1987.

It is a stock market crash fantasy because huge stock market crashes are very rare events that are most likely not to occur.

That being said, IF a crash is going to occur it would more than likely *only* start very soon after an extreme rally up.

Secondly, if it is going to occur in a manner similar to the 1987 and 1929 crashes, then there is only a short window of opportunity for it to occur. The time window of 29 days to final peak is now in alignment from 1929, 1987 and 2024.

Will it occur? It probably will not occur if we start to rally from this point forward. But if we start right NOW to get some hard down days and stronger lower low and lower high days going into the first week of September, then maybe just maybe the stock market crash fantasy won't be a fantasy anymore.

Some technical notes:

we continue to have many and plenty of Carl V bearish technical patterns on major indices that points to a test of the August 5 lows. A move down to those lows into the the first week of September would be a very bearish sign for markets, but it is unknown whether such a big decline could happen that fast again.

Rate Cut 1930 - Pattern Recognition: 30s vs Today In 1930, when the Fed cut interest rates, the market crashed further. In today's tutorial, we will be comparing the 30s and today’s market to identify some of their similarities.

Where exactly are interest rates’ direction pointing us?

As we may have read, many analysts are forecasting that there will be a few rate cuts in 2024. Is this the best option?

My work in this channel, as always, is to study behavioral science in finance, discover correlations between different markets, and uncover potential opportunities.

Micro Treasury Yields & Its Minimum Fluctuation

Micro 2-Year Yield Futures

Ticker: 2YY

0.001 Index points (1/10th basis point per annum) = $1.00

Micro 5-Year Yield Futures

Ticker: 5YY

0.001 Index points (1/10th basis point per annum) = $1.00

Micro 10-Year Yield Futures

Ticker: 10Y

0.001 Index points (1/10th basis point per annum) = $1.00

Micro 30-Year Yield Futures

Ticker: 30Y

0.01 Index points (1/10th basis point per annum) = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

S&P 500 long-term trend?Since the Great Depression the S&P 500 tracks U.S. GDP, both log graphed here such that the slope of the channel is the log slope of U.S. GDP.

Looking for some kind of pattern, there might be a ~33 year wave-like pattern repeating twice since 1929 and hypothetically a third time, as depicted.

The likelihood of the third repetition happing I have no confidence for or against, it's just a possible pattern I'm proposing in the data.

1929 Market Rise / Crash OverlayJust a quick post here. What if we saw a repeat of a similar pattern to what was witnessed during the 1929 stock market rise and crash that led to an extended economic depression?

If that were the case, we might see something unexpected here:

- an epic rise when everyone is expecting a crash, now

- an epic and extended market crash after having reached the "euphoria" phase of the psychological market cycle

That's not to say we haven't already seen both of those things. This is just a "what if" thought, for fun. Would be hilarious if it actually does this.

If you want to see what I actually think will occur, look at DXY and it's relation to DJI or SPX, here's a post I made indicating we're in for more immediate downside (also see related links below for more info on DXY and SPX):

SPX 2000 When market conditions change people are usually positioned for the past 10 years and think that this can continue into the future.

If we know that Powell wants to be Volcker 2.0 we can assign probabilities of outcomes as follows:

Period Like The 1970s: 10%

Period Like 2000-2008: 30%

Period Like 1929: 60%

The reason i believe the 1929 period is the most probable is because nobody thinks it can happen again. As well as the fact that we have created the largest monetary policy bubble in US history. Given the historically cyclical nature of markets and humans, the odds that something like 1929 happening again almost exactly 100 years later, are high.

Really hope im wrong. 1929 vs 2022Fed stepped in and printed money in 1929. Fed stepped in and printed money at the covid lows. Charts look identical in structure minus the new all time highs in 2021.

Massive speculation at the top in 1929. Massive speculation at the top in 2021.

Everyone was acting rich driving around their new Ford Model T's in 1929. Every one was driving around there new Tesla Model 3 in 2021

Bearish engulfing 6month in 1929. Bearish engulfing 6 month in 2022.

Lots of similarities that are hard to not see.

SPX us500 Is The US market crash coming ?Is The US market crash coming ?

We have 3 types of “crashes”

Correction <15% downward movement in a major indicy

Bear Market <20% downward movement in a major indicy

Black Swan event, something very unexpected that tanks the market, think 1987, 1929, challenger disaster, 911 and so on.

The fourth type is the 1919, 1929, 1999 and 2008 scenario that people generally refer to as a “crash” 2022 a new one ?

Sincerely L.E.D In Spain On 2/05/2022

DJI - Preparing For The Last Blow Of Top Before Big DepressionDJI is continuing to follow fractal from the "roaring twenties". While it clearly shows that we are about to experience one of the biggest financial reset, we should first get the last euphoric blow of top, sending DJI into 38-40k area. I highly doubt we will go much higher than 40k.

Be careful, don't laverage the euphoria, instead think of exiting the market as DJI starts to break into new ATH.

I am not a financial advisor so non of this should be taken as a financial advice.

DJ:DJI

S&P looking sketchyThis market has been pumping non stop for a couple years now, but it's foundations are just debt and printed money. I hope that the economy doesn't collapse because, well, that wouldn't be too fun, but with an RSI as high as this and a 25%+ gain YTD in the middle of a pandemic, I don't think this can go much further. Let's just hope that Jerome Powell stop's flushing the American economy down the drain.

1929 Crash Fractal in the DJIA ?In one of my previous posts I was trying to see if we would get a 1987 plunge in the markets. This did not happen, but we did get a fairly standard decline and market correction.

The question now is, will the mini bear down move be over and off to new highs? Or do we have something much more sinister in store for us as far as the DJIA.

Google gets some blowout earnings and the mood seems to be improving on the recent snap back rally.

But now we are faced with a key question as far as the DJIA goes. The DJIA will soon hit the bear down trend line.

Not only that but the decline in the DJIA in terms of form, looks similar to the form of the beginning of the 1929 style CRASH. The time symmetry is lacking, but here is what is similar:

A. The 1929 final rally was a fib .618 retracement that got STOPPED right under the bear down trend line, then after that was the 45% plunge

B. The number on the current DJIA pricing for a .618 retracement is 35,500. WATCH that number very closely in the DJIA to see how it reacts to it and does it get STOPPED there.

During the fierce rallies in the market it always seems like the bear scenarios die quickly. And that may actually be the case. In fact the market could bust up through the downtrendline sometime next week and blast higher. So the key will be to watch the price action very carefully for STALLING.

If I see enough stalling then I may go heavily short at what may be a critical FINAL high in the market.

The backdrop is still murky. We have rates rising. The TLT bond etf looks like it will soon CRASH down which means rates crash UP. The size of the bond market is orders of magnitude larger than the stock market. And if I recall correctly what really tanked the USA in 1929 was that the bond market collapsed and that took the stock market down with it.

The MARCH 14th,15th this year is a very important date for a couple reasons.

First it is the next fed meeting and the one where rates are supposed to go up. It is also a key cycle date from a man named Armstrong. So both from a rate inflection point date (fed meeting) and a cycle point, it is a forward looking event and we have to wonder if it could be a magnet date to go down into.

Obviously it will not be a date for the market to go down into if we see the market break north above the down trend line.

Note also the position of RSI and MACD.

RSI is near 50 zone. In 1929 the market got STOPPED at the 50 zone before the 45% plunge.

We are at 50 now, so it would seem that level should hold the market if it is to remain bearish.

The MACD in the current DJIA is about to cross upside bullish. That same situation occurred in 1929 but AT PRECISELY OF WITHIN A FEW DAYS OF THE FINAL PEAKING IN PRICE BEFORE A 45% CRASH.

So my point is we could right now be very close to a peaking point in the DJIA. INTRADAY of course you can see big up and down. But it is the CLOSING Price that matters the most over the next 5 days.

Will this scenario fail like most of the crash scenarios do? or will it be different this time ???

One final note... the drums of war seem to be beating louder.... that is a potential black swan that could rapidly change market sentiment, possibly severely.

Do not fight the Fed Market is setting up to crashThere a millions of market viewpoints. The nice thing about tradingview is that for the most part the viewpoints are technical in nature.

Put simply the technical viewpoint I want to show in the chart here is that the nasdaq composite is under heavy selling pressure. We had a rebound today January 10th, 2022, but it was nothing more than an intraday rebound. The weight of the evidence still points to down market and accelerating down.

The narrative too often even from technicians is that the market will bounce, is due for a bounce, will bounce make a new high first, finds support etc etc.

Well guess what, sometimes the market does not bounce that much or even find much support. Sometimes it falls really hard and *drops like a ROCK*. Sometimes it just goes down and *stays down*. Sometimes it will go down 5 limit down days in a row without barely a bid.

So the chart pretty much says it all. If we view the peak in the Nas composite as November 22, 2021 then we count the number of days until we reach last support and then peak selling climax. The current nasdaq time frame is *barely* holding onto support. Today's one day reversal candle was not a victory, just an intermission.

The key aspect of the overall chart is the *Final Rally* that occurred in December 20th, 2021 to December 28th 2021. That rally was a suckers rally and was orchestrated so that the big money can sell and sell really hard. That same final suckers rally also occurred in 1987. It gave the appearance to most market participants that the market was setting up for another new high, new bull trend, new rally and all is well. And yet those dreams were dashed, and then came the rapid bearish engulfing with a speed and force that most are not prepared for. The SPEED of the price action down is what causes most people to not be able to react quickly enough and get out in one piece.

I certainly do not wish a decline as severe as 1987 but we just have to look at the technical price structure and make an honest assessment and take it from there....

Using Daily moving-averages on $SPX (and children)Hello all,

Not a financial advisor, i just trade full-time. I can share some stuff that I look at.

TL;DR

Look at crosses, touches and space

--------------------------------------------------------------------------------------------------------------------

Please also pull up my other idea on $SPX timeframe'd weekly, linked (scroll down to bottom for links | also, to open the link in a NEW TAB, hold the control ( CTRL ) key down and then click the link).

- The traffic light time-axis markers are borrowed from the weekly time-frame.

If you need to manage your position with $SPX or your children, then this is for you.

References:

MA = moving average.

DMA = daily moving average

The calculations in this study are from TradingView, I am unsure how they are calculated. Who cares! We just like to draw on charts, right?

Orientation:

We are on a $SPX weekly BASELINE chart (values are from the week of 03/16/2020 for baseline)

We have the S&P 500 (or 505, if you know) drawn up 4 times

----Each one of these lines represent the percent of stocks ABOVE their relative moving average

-----There are 4 daily moving averages: 20, 50, 100, 200.

-------For example, the BLUE line represents the percentage of stocks inside of the $SPX that are trading above their 20 DMA (daily moving average).

snowy, elkenpolar-branded traffic light time-axis markers from $SPX weekly

Two highlighted boxes mapping the $SPX weekly corrections to 25 EMA.

EDIT: I didn't use it, but the RSI is based on the 20 DMA. I just noticed a couple neat things there, look for yourself.

Our baseline is the bottom of the market in March, 2020. This is a great time to start looking because this was a huge shift in...well, just about everything.

The boxes highlight some periods of volatility in the $SPX. The first box (yellow) is the first (double) correction to the $SPX 25 weekly MA. The red box highlights a very volatile correction to the 25 weekly MA.

Yellow Box

This is EXCITING! We can see some indecision and faltering to the 25 weekly here. Notice how the 20/50 percent line form a cross in the first red rectangle. They also bounce off the 100 DMA line. The second box is a SNAPPY correction and notice how this one falls off a cliff to the 200 DMA line.

Red Box

Here we highlight the correction in purple. You can see a cross in the couple of week before hand. A leading indicator to what was possible in the next couple of week. We then got a RSI divergence on the weekly $SPX price chart and a correction. Notice the difference between the two 'major' highlighted boxes though - i.e. we did NOT touch the 100 or 200 DMA percentage lines. What could this mean?

To Note

Notice when our 'short' or 'small' moving average (% of above 20 DMA) crosses over our 'long' or 'tall' MA (50 DMA) it may lead one to turn off the playstation and open up a chart, with crayons.

Also note other convergences, divergences and, you know, funny shapes.

Observations

Later on we can see some similar stuff lining up this month.

We had a bearish cross (blue crossing below red), a bullish cross (blue crossing ABOVE red) and now we are kinda in this place of "Ruh Roh". Do I have a crystal ball? No, but my system tells me to sell/heavy hedge right now, so that is what I am doing. This doesn't just apply to my positions in this asset class either.

Look at crosses, touches and space

What does it mean, Mason?

Well, that is going to have to be decided for you. I can tell you what I did, I bought naked long puts. For Monday. What will I do this week? Probably more crayons. We are in turbulence and the best way to ride a turbulent airplane is with nothing in your tray and it *securely* stowed into the seat in front of you. Unless you got one of those fancy flying-beds.

If you make this chart and use it, be sure to correlate this chart with a price action chart from $SPX.

Please leave me any questions or if you would like something explained further below.

And what do you think? Link me your charts.

Thanks

Black Elk Speaks, Crazy Horse:

"imagine using smoke signals in 1998" *chuckles*

SPX Printing A MASSIVE Bubble. Be Very Careful !!On the left side of the chart i've compared a chart from 1891 - 1935 to show the similarities between chart back then and todays after the dot-com bubble. The orange chart is not stretch out or anything. It is there to show that when the bubble popped, price did eventually fall below the bottom of the previous sideways range (orange box). In '29 chart also reached above all the fib. extension levels, just like it is doing right now as it is preparing for the final blow of top which is in my opinion only a few % away.

I did the same price comparisment with DJI index in one of my ideas, where the price behaves almost the same as it was from 1915-1929. Really scary stuff if you think about it. Wonder how will that effect the crypto market as it has never experienced a REAL stock market crash.

I am not a financial advisor so non of this should be taken as a financial advise. Be well.

SP:SPX

The Bubble Could Pop Like It Did In 1929I and others who try to spot patterns in charts are starting to see a lot of similarities compering bull run from the 2008-2021 and the one from 1921-1929. You can clearly see that patterns are profoundly which to be honest, it keeps me up at night. Stock market as well as crypto market are VERY high. In last few years/months. everyone wants to become a day-trader or whatever, and having a mindset that everything can only go up from here. It was the same mindset back in 1928-1929 where everyone knew about the stock market, getting overleveraged and promoting it as it could make you rich over night. It is the same now so i want to worn people about all this. Don't listen CNBS and financial media as they are only there to create liquidity for the institutions so they can sell when the time comes. That time is right around the corner.

Also a fib. extension levels extended over previous fall in 2008 takes us to around 11-13% above where we currently are with DOW. Don't be naive and say that this time is different. It's not. Maybe the fall will not be that dramatic as the bubble is not as big as it was in 1929 but we certainly could and probably will fall below the bottom of 2008 ( roughly to 6k), so don't be surprised if it turns out this bear market is longer and deeper, because we need such correction for the market to stay healthy.

I am not financial advisor so non of this is a financial advise, just a BIG warning to you all.

DJ:DJI

1987 crash then and nowI am on watch for signs of a resumptin of the downtrend this week. A repeat of 1987 seems very unlikely. However I am open minded. Look for a couple of doji candlesticks early this week or flat close. Then be on watch for a big red down bar that closes back down UNDER the downtrend line. If this happens, and it happens very swiftly, we must be open minded to a possible crash or mini crash scenario.

Other factors that could support this case are :

* The two recent gaps we had in the SPX, perhaps they want to get filled soon.

* 10year yield start to accelerate higher next few weeks ?

* October is not quite over yet. There is this idea that yes, stocks bottom in October and it is bull time again into bullish seasonal end of the year... but maybe it is different this time.

* the recent breakout, if it was fake could be a very painful trap to many in the market and lead to heavy selling on the realization ( or late realization) that the breakout was a trap

DJI - Worst crash and best recovery in history. Here’s why.It’s been a while since I last posted. 1968 struck me as a wonderful year it seemed nice all through the 70s. The problem was the ramp-it inflation all the way through the early 80s.

And as we all know the best of things come in three’s . Like threesomes! No but seriously guys and gals we have a black swan event on our hands in the next few weeks.

Do yourself a favor go back and look at the DJI weekly from 68-76. See something …. Similar? Like exactly the same?? So odd how history rhymes. We shall see. Am I right or am I wrong?

If I’m right I’ll post a picture of my new Bentley truck I’ve been wanting but just haven’t been able to justify. The wife would want one as well. If I’m wrong , I’ll probably just write another post in a few months and pretend it didn’t happen.

But seriously people next two weeks are critical. If we don’t go lower , then expect to go to the literal moon through 2022. If we do go lower. Turn on CNN and enjoy the panic.