1929

HYPOTHETICAL: BITCOIN - $30,000 BY 2024?The volatility of Bitcoin on anything less than a 4H chart, hides its path of momentum. On this monthly chart I show what I see. Move chart to left to see more. The path is more probably up in the long term based on monthly momentum. In my hypothetical $30,000 is possible - but I make no predictions. I previously made other speculations.

If we hit a 1929-type depression in the next few years - and fiat becomes meaningless as in 1929, what will we use to exchange value? I think it could be Bitcoin - or possibly some other crypto(s). I can't say it won't be Ethereum.

Some argue that 1929 is gone and the scenario would never happen again. I'm not so sure. When I look at the factors that contributed to 1929, I'm seeing them right now as the COVID-crisis evolves.

This post does not mean that you should rush out and purchase or invest in Bitcoin or cryptos.

Disclaimers : This is not advice or encouragement to trade securities. Chart positions shown are not suggestions. No predictions and no guarantees supplied or implied. Heavy losses can be expected. Any previous advantageous performance shown in other scenarios, is not indicative of future performance. If you make decisions based on opinion expressed here or on my profile and you lose your money, kindly sue yourself.

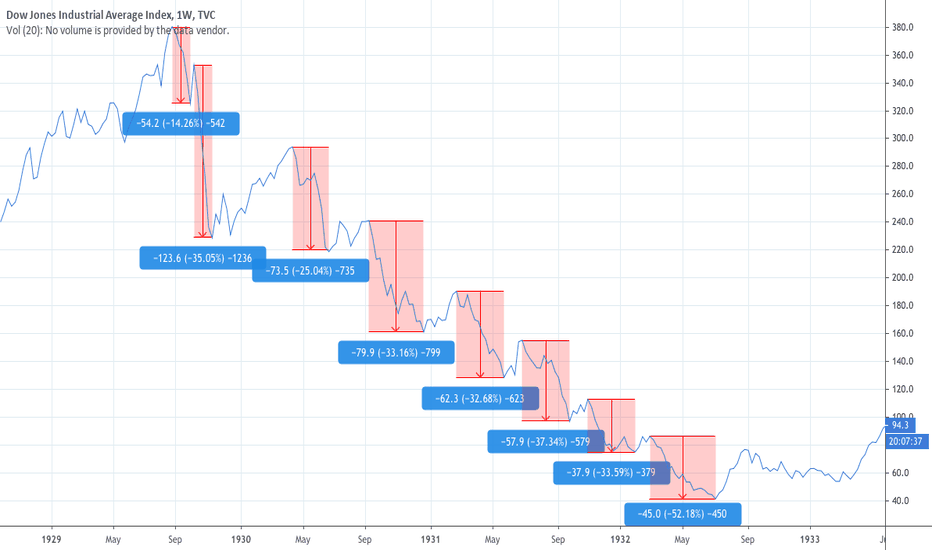

A Look at the 1929 DJIA CrashThe past doesn't repeat exactly, and I don't expect a repeat of 1929... however, in my opinion we're in a similar deflationary environment and we're 4 months or so from the March bottom of the 2020 crash. I thought it might be interesting to look at the 1929 crash from the point of view of 4 months from the 1929 crash bottom when the market had been rallying. What exactly came next? Take a look.

s&p 500 with -50% crush at 1500 till end of the 2020SPX crushes never stopped above MA 200.

Even FED pump of 3 trillion into market, buying even stocks of companies that are in bankruptcy, would be over.

Earlier or later the crush of -50% will happen as of people will need to sell something to pay bills - already 20% unemployed, 30% not paying rent or mortgage bills in time.

As long FED pumps money to keep the dead market breathing as hard would it be when the market will awaken.

In 1929 it was the speculators who pumped the market 4 times from 7 to 30 and it crushed below 7.

History Doesn't Repeat But it Often RhymesA new possibility has arisen due to the FEDeral reserve's actions to stabilize the market.

The first half of this period will look like 1929 however throughout value will be lost relative to price.

We could see halfway through the collapse inflation takes over and prices go crazy.

This will be especially damaging to index investors who simply see prices rising and stand still till thinking the worst is over until they begin to see the price effects on their daily lives and make the connection triggering selling and a rush to hard assets.

I hope I am wrong but this is looking more and more like a possibility and thus I feel the need to share the idea.

Any comments are appreciated.

S&P 500: short/mid/long term Forecast. Conclusion: We are fuckedFirst of all: These are all just considerations on my part and should not be regarded as financial tips.

I have been very concerned with the problem in the past few weeks and see a good chance that my forecasts will come true.

I mostly refer to the Great Depression because all of the older predictions turned out to be correct.

Short-term: We will see a smaller dump. Various triggers, further unemployment rates, economic decline of 12% etc.

Mid-term: Investors continue to trust the Fed, which will continue to print money. The general population will also start investing as many will believe it can only go higher.

Long-term: The corona virus was only a trigger for the bursting of the bubble. The little upswing we will see is also called "Death Cat Bounce". It gets bad. I don't have to say more.

All right, if you disagree, just write a comment. Liken doesn't hurt either. Thanks (:

The Corona Crash was just the beginning of a deflationary phase.Short-term: We will probably see the beginning of market stabilization next week.

Midterm: The shareholders have already been able to predict the crash. The unemployed news will not lead to another drop

Long-term: It will be similar to the 1929 financial crisis. A deflation that will go on for several years. Government inflation is unlikely to stop the case.

We can only believe in God ...

Australia - Watch for a Rally - Then Jump ShipLet's start with the broader picture first

I understand the market looks horrific at press time, but the first thing that you must know about markets is this, nothing every goes in one direction forever, no matter how bad it seems.

For context here are the three major US stock crashes.

2008 Crash

2000 Tech wreck

1929 Great Depression

The second thing that you must know is that a market will TYPICALLY, not always, but typically will retrace 50% of the first wave before continuing lower, as seen in the above charts.

In the most recent price action, this would entail a bounce to around 5400-5900, this is a prime opportunity to lighten exposure and prepare for another leg lower. Now, we may not get a bounce to the 50% fib level, but a move to the 38.2% is highly likely, at this point i would begin to lighten exposure and begin to buy shorting instruments, i.e. Puts.

Now, where do i see the potential low?

If the prior crashes throughout history are any gauge, then a top to bottom move of 50% is very likely, with the 1929 crash closer to 90%, i expect at worst we could see a middle ground, call it around 70%. This would be heavily dependent on Covid19 being far worse than governments are expecting, and a extended period of lock-down, which at press time, must not be discounted.

That being said, the first targets are a "typical" 50% move from the peak, as you can see, this would erase ALL gains from the past 20 years, taking the index back to levels first reached in 2001.

The third thing you must know about markets is that they go up in the long-term, emphasis on LONG-TERM.

After the 2007 peak, it took over 4,300 DAYS to retread those levels.

Do you have 12 years to wait?

Bear in mind also, this index is not inflation adjusted, if one inflation adjusts the index we never made new highs, in other words, it has been over 13 years and we are yet to make new highs.

What about Real Estate?

I have long maintained the Australian real estate market is a bubble, ready to burst, with valuations in some areas exceeding over 10:1 income to Value ratios (IVR), this was inevitable and the bubble appears to be finally bursting, so no, your equity in your house will not save you.

In fact, real estate priced in gold, is breaking out of a decade long slumber, what this means is that your home may gain nominal value, as governments feebly attempt to print enough money to cover the cracks, but your home will in reality be hemorrhaging real purchasing power.

Welcome to the word of relative values, where your house can both go up AND down in value, simultaneously.

In short, Australia has a weak economy, i have not even touched on the consumers and households overburdened with debt, the over reliance on the services industry as a primary source of GDP or the super fragile banking system, which by the way, have a huge number of "interest only loans" switching to principle and interest, over the next 18 months.

Hmmm... wonder how the general households will deal with those.

-TradingEdge

Interest only loans:

www.rba.gov.au

1929 FractalThey say history repeats, we had a pandemic in 1820 and 1920. We had a crash in 1929, so we could be near a same fractal. I compared the 1929 crash and if it were similar this is the path it would take. Down to first major support (2100 area support), than major bounce up in between the .5-.667 fib where people unload and then it continues to fall for 3 years, hopefully this time is different.

Crash Comparison - 1929, 2000, 2008 and 2020

1929 - Crash

2000 - Crash

2008 -Crash

2020 - Crash

Which of the prior three major crashes most closely resemble the 2020 crash?

Certainly, not the 2000 crash, the initial drop is of equal magnitude, however the 2000 crash took over 365 days to reach that low from the highs, the 2020 crash has plumbed lower than 30% in just over 30 days.

Similar story for the 2008 initial crash, the final leg down in 2008 after the collapse of Lehman Brothers would be the closest match, but this is still not equal to the magnitude drop we are experiencing in 2020, when you consider that the post Lehman drop was 48% over 150 days, this equates to roughly 0.3% a day, the 2020 drop by comparison is closer to 3x times the rate of drop, at over 1.0% per day in decline.

Even the initial 1929 stock market drop, that eventually lead to the great depression took 3x times as long to reach the 30% range.

Yes, the macro environments for these drops were very different, i understand this.

But it is worth considering just how unique these markets are at present time, with a combination of automated trading, real-time news feeds, easier access for retail investors and far higher leverage than ever before, this creates a highly volatile trading environment that can pivot at a moments notice.

My personal belief is that the pain is not over, there will be a bounce at some point, however i will not be participating in that rally, i will be waiting to short.

I think the ultimate bottom will be between the three crashes highlighted here, not quite the 90% devastation of the 1929 crash, but also not a 'typical' crash of 50% either.

It may sound crazy now, but, i do believe that the SP-500 "COULD," emphasis on "COULD" be lower than at the 2008 peak before the market bottom, in other words, i believe that the last decade of market gains may very well be erased.

This will obviously be dependent on the handling of Covid19 by governments around the world, this is not due to the loss of life (although that would be a global tragedy), it is instead due to the wave of defaults and bankruptcies that could flow out of this crisis as a result of the social distancing policies that governments will HAVE TO, not may have to, but have to employ in order to flatten the curve.

This will include businesses closing for for several weeks, potentially even several months, this in turn will cripple airlines, cruise ships, hotels, casinos and a host of other industries. Many of which are currently looking to the federal government for a bailout, this is also not mentioning the small businesses and how they will be impacted, or the knock on effects that this will have on employment, or lack thereof.

In short, the economic impacts and the societal impacts that will flow from the Covid19 virus are far-reaching, the macro environment is nothing like 2000 or 2008, the system is MORE unstable, not less, couple this with the potential for 1929 style unemployment and you have a recipe for disaster.

-TradingEdge

Generational Transfer of WealthThe boomers have lived their lives fucking over the millennial, now is their turn to "feel the Bern" lol.

I prefer white path for maximum opportunity.

Maybe FED saves the day and nukes this idea and we can make a larger blow-off top for a -99% decline.

***Not investment advice.

Dow Jones 1929 market crash reminder- First spike lasted over 2 months reaching -50% drawdown from ATH

- Then there was +52% dead cat bounce within 5 months, before the worst...

- Finally the market went into 27 months bear market reaching -89% drawdown from its ATH

During this bear market worldwide GDP fell 15%, for comparison in 2009 fell only 1%.

This is how The Great Depression started lasting until 1939

Historical analysis of stock market crisis - 1929Please open this link: symonsez.files.wordpress.com

Stock market will initially crash around -46% then move up to ~2700$ and finally down to >450$ per share.

We are entering a Great Depression just now!

In the same time Gold (XAUUSD) will keep moving up to double the price of Dow Jones: www.macrotrends.net it measn DJI will be ~4500/5000$ while Gold will go up to 8500-10,000$oz

DJI and SPX500 History: 1929 Parabolic ManiaOnce again, notice how orderly and well-respected the trendlines are throughout a 21 and 24-year expansion. Show these US stock market charts to anyone who tells you that technical analysis doesn't work.

Study these time periods and become well-acquainted with the stock market parabolas throughout history.