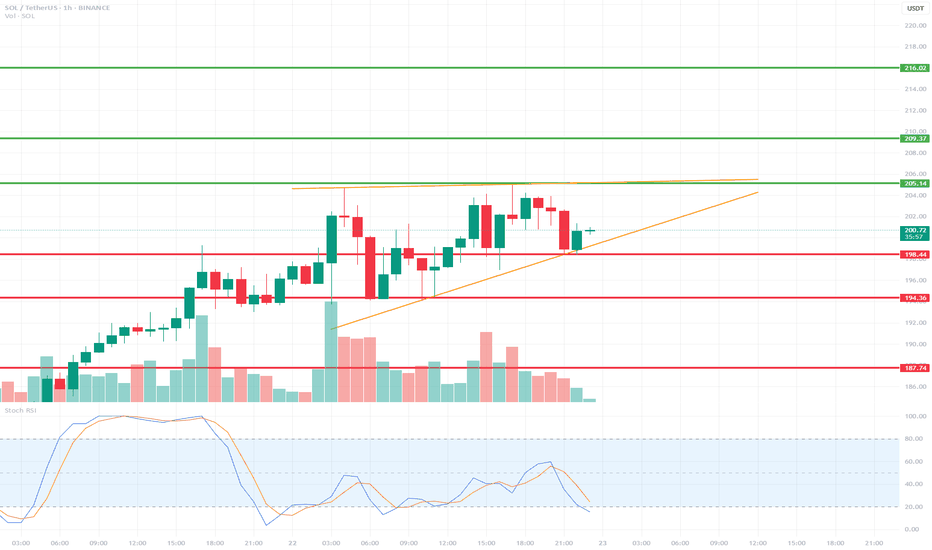

SOLUSDT 1H Short-Term🔍 Technical Structure:

Short-Term Trend:

SOL is currently in an uptrend, with local higher lows. This is evident from the orange uptrend line, which has been tested multiple times.

Local Resistance:

205.14 USDT – yellow line – a resistance level that the price has touched several times but failed to break (this could be a double-top formation).

Local Support:

198.48 USDT – the price is currently testing this level as support.

194.36 USDT – lower, more crucial support (stronger upon a trend breakout).

187.74 USDT – important support that would be tested in the event of a larger breakout.

📉 Oscillator – Stoch RSI:

The Stoch RSI is currently in oversold territory (below 20), suggesting the possibility of a local rebound.

However, there has been no upward crossover yet, so there is no strong buy signal.

🔊 Volume:

We are observing a decrease in volume during the current correction, suggesting that the declines are relatively weak – there is no strong supply impulse.

🧠 Short-term scenarios:

✅ Bullish scenario:

Price is rebounding from the trend line (orange) and the 198.48 USDT level.

A break of the 205.14 USDT resistance could open the way to:

209.37 USDT

216.02 USDT (next target)

❌ Bearish scenario:

A break of the trend line and the 198.48 USDT level with the 1-hour candle closing below.

Possible decline to:

194.36 USDT (first support)

and further to 187.74 USDT if selling pressure increases.

1hrchart

DOGE/USD 1H Short-term1. General situation on the chart

Trend: The last few dozen candles show a sideways movement with a stronger upward impulse, which was quickly corrected. We are currently seeing declines after the previous upward wave.

Current price: Approx. 0.1847 USDT.

Last structure: After the upward movement (peak around 0.205), the price dropped quite a bit, now consolidating below 0.19.

2. Formations and structures

Formation:

No clear classic formation (e.g. head-and-shoulders, triangle, flags) on the last candles.

However, something like a local peak ("double top") is visible around 0.203–0.205 — the price touched these areas twice and fell off, which suggests that this is a strong resistance.

Support and resistance:

Support: 0.1800–0.1820 — here is the last local low and the area where the price stopped before the previous upward movement.

Next support: 0.1740–0.1750 — the next low from the previous movements.

Resistance: 0.1900–0.1910 — here was the last consolidation, and then a sharp decline.

Strong resistance: 0.2030–0.2050 (recent highs).

3. Indicators

RSI:

RSI value close to 40 and is heading slightly down, but it is not oversold yet. This may suggest that there is potentially room for further decline.

MACD:

Histogram below the 0 line, MACD line below the signal, the bearish signal is still maintained.

4. Signals and potential scenarios

Base scenario (downside):

If the price breaks below 0.1820, the next target is around 0.1750.

Stop loss in this scenario: above the last resistance, e.g. 0.1910.

Alternative scenario (rebound):

If the price does not break 0.1820, and a demand reaction occurs - we may see an attempt to return to 0.1900, or even to the peaks in the area of 0.2000–0.2050.

Stop loss below 0.1800 (in the case of a long play).

5. Potential targets (by price action):

Short:

TP1: 0.1820 (nearest support, you can take some profit)

TP2: 0.1750 (next low, main target)

Long:

TP1: 0.1900 (nearest resistance)

TP2: 0.2000–0.2050 (highs, if the movement is strong)

Summary

Currently, the chart suggests a bearish scenario.

This is confirmed by the candlestick pattern, negative dynamics and indicators (RSI, MACD).

Key level to watch: 0.1820 – if it falls, we will probably go down to 0.1750.

If there is strong demand for 0.1820, a rebound to 0.19+ is possible.

BTC/USD 1H chartHello everyone, let's look at the 1H BTC chart for USD, in this situation we can see how the price moves over a strong growth trend line. However, let's start by defining goals for the near future the price must face:

T1 = 109164 $

T2 = 110207 $

Т3 = 111463 $.

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 107264 $

SL2 = 106314 $

SL3 = 105578 $

SL4 = 104781 $

Looking at the RSI indicator, we see

Return above the upper limit, which can cause an attempt to relax at the coming hours.

BTC-USD 1h chart targets and stoplossHello everyone, let's look at the 1H BTC chart to USD, in this situation we can see how the price dropped below the local upward trend line. Going further, let's check the places of potential target for the price:

T1 = 109196 $

T2 = 110644 $

Т3 = 111850 $ t4 = 112951 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 108351 $

SL2 = 107537 $

SL3 = 106390 $

SL4 = 105455 $

Looking at the RSI indicator, we see staying over the upper limit, which can give price drops, while the MacD indicator lasts at the bottom of the range and is close to returning to the upward trend.

Equity Research Report – TVS Motor Company Ltd.📌 Timeframes Analyzed: 15-Minute and 1-Hour

📅 Date: May 5, 2025

📍 CMP: ₹2,774.40

📈 Setup: Bullish breakout from falling channel with EMA crossover

🔹 Technical Highlights

Pattern: Descending channel breakout (1H)

Moving Averages: Price is trading above the 20-EMA and 50-EMA with bullish crossover

Volume: Breakout confirmed by increasing volume

RSI (Momentum): RSI is trending up above 50 with positive divergence

🟢 Trade Plan – Intraday to Short-Term Swing

✅ Buy Levels (Confirmation Entry)

Buy Above: ₹2,780 (breakout confirmation level)

🎯 Targets

Timeframe Target 1 Target 2 Target 3

15-min ₹2,810 ₹2,835 ₹2,860

1-hour ₹2,850 ₹2,880 ₹2,920

🔻 Stop Loss

Intraday SL: ₹2,745 (below channel support and 50-EMA)

Swing SL: ₹2,720

ETC/USDT 1H Chart ReviewHi everyone, let's look at the 1h ETC to USDT chart, in this situation we can see how the price has fallen below the uptrend line, and what's more we can see the first attempt to return above the trend line, however we can see the place that rejected the price.

Let's start by defining the targets for the near future that the price has to face:

T1 = 20.79 USD

T2 = 21.09 USD

Т3 = 21.60 USD

Т4 = 21.95 USD

Now let's move on to the stop-loss in case the market continues to fall:

SL1 = 20.19 USD

SL2 = 19.73 USD

SL3 = 19.26 USD

SL4 = 18.90 USD

On the Stoch RSI indicator we can see how the energy is decreasing and staying in the lower part of the range, keeping the price from a bigger drop for now.

XRP 1 HR POSSIBLE SCENARIOS 🚨 XRP 1-Hour Analysis 🚨

Here’s what we’re watching:

📈 Upside Targets:

• TP1:2.190

• TP2: 2.235

📉 Downside Targets:

• TP1: 2.08

• TP2: 2.04

So we have to watch out for level. If XRP stays below 2.12 - 2.14 then you can target downside targets and if above then you can target above levels mentioned as TP(take profit)

Keep an eye on key levels and trade smart! 💹

BITCOIN 1 HR POSSIBLE SCENARIOS 🚨 BITCOIN 1-Hour Analysis 🚨

Here’s what we’re watching:

📈 Upside Targets:

• TP1:94650

• TP2: 95150

📉 Downside Targets:

• TP1: 93380

• TP2: 92400

So we have to watch out for $93900- $9400 level. If BTC stays below then you can target downside targets and if above then you can target above levels mentioned as TP(take profit)

Keep an eye on key levels and trade smart! 💹

What’s your take? Drop a comment below and share this with your trading crew! 🚀

ETHEREUM 1 HR ANALYSIS 🚨 ETHEREUM 1-Hour Analysis 🚨

Here’s what we’re watching:

📈 Upside Targets:

• TP1:3400

• TP2: 3450

📉 Downside Targets:

• TP1: 3300

• TP2: 3266

So we have to watch out for $3370- $3350 level. If ETH stays below then you can target downside targets and if above then you can target above levels mentioned as TP(take profit)

Keep an eye on key levels and trade smart! 💹

What’s your take? Drop a comment below and share this with your trading crew! 🚀

DOT/USDT 1H chart Hello everyone, let's look at the 1H DOT to USDT chart, in this situation we can see how the price is moving in a sideways trend channel, creating lower and lower highs.

Let's start by setting goals for the near future, which include:

T1 - $10.83

T2 - $11.35

T3 - $12.19

AND

T4 - $13.52

Now let's move on to the stop-loss in case the market continues to decline:

SL1 = $10.48

SL2 = $10

SL3 = $9.53 AND

SL4 = $8.8

XAUUSD 1 HR STRUCTURE CHANGEXAU/USD on the 1-hour chart has shifted its structure back into the established range, signaling a period of consolidation. With the Non-Farm Payroll (NFP) release on the horizon, there is a high probability of a liquidity hunt around the 2655 level. Traders should exercise caution and wait for clear confirmations before entering positions, as volatility is likely to spike during the NFP event. This could present opportunities for sharp moves, but patience and a well-defined strategy will be key to navigating these conditions effectively.

EURUSD 1HR CHART UPDATEThe euro (EUR) has shown mixed performance recently, with potential for further pullbacks depending on evolving economic factors. Market sentiment is cautious due to persistent weaknesses in the Eurozone's manufacturing and services sectors, especially in key economies like Germany and France. Furthermore, the European Central Bank (ECB) is expected to maintain a dovish stance, including possible rate cuts in the near term, which could limit upward momentum for the euro.

On the other hand, if U.S. Federal Reserve policies lean toward easing interest rates in 2024 due to moderating inflation, the dollar could weaken, providing some support to the euro. Analysts forecast the EUR/USD pair could reach a range of 1.15 to 1.21 by late 2024, but downside risks remain if Eurozone economic recovery falters or if the ECB signals more aggressive monetary easing.

This scenario underscores the importance of closely monitoring central bank policies and economic indicators for trading or investment decisions.

1HR Time frame (GOLD) Analysis I'm not really liking how gold looks this morning. There seems to be a significant imbalance, so I’m definitely considering that it will be filled. I plan to look for long positions into the imbalance before considering short positions out of it. However, right now, the 5-minute chart appears quite messy.

I need to wait for a clear trend to develop on the lower time frames during the London session.

BTC/USDT 1H chartHello everyone, let's look at the current BTC situation considering the one hour interval. In this situation, we can see how the price has moved higher from the local downtrend line above which it remains.

Let's start by setting goals for the near future, which include:

T1- 60252$

T2- 62340$

T3- 64922$

Now let's move on to the stop-loss in case the market continues to decline:

SL1 = $58,076

SL2 = $56,190

SL3 = $555,256 AND

SL4 = $54,044

Looking at the RSI indicator, we see a movement at the upper limit, which may influence an attempt to recover or give a temporary sideways trend.

BTC/USDT 1H chartHello everyone, let's look at the current BTC situation considering the one hour interval. In this situation, we can see how the price has moved higher from the local downtrend line above which it remains.

Let's start by setting goals for the near future, which include:

T1- 60252$

T2- 62340$

T3- 64922$

Now let's move on to the stop-loss in case the market continues to decline:

SL1 = $58,076

SL2 = $56,190

SL3 = $555,256 AND

SL4 = $54,044

Looking at the RSI indicator, we see a movement at the upper limit, which may influence an attempt to recover or give a temporary sideways trend.

Gold on the Brink: Major Price Shift Expected – Will It Surge?Key Observations:

4HR Channel:

The price is operating within a larger ascending channel on the 4HR timeframe. This channel is guiding the overall bullish momentum seen in the price action.

Weekly Flag:

The upper trendline of the weekly flag intersects with the current price movement, suggesting that this is a significant resistance level. The price is showing a potential reversal as it interacts with this upper boundary.

15M Channels:

Ascending Channel at the top of the 4HR channel: This smaller ascending channel within the larger 4HR channel might suggest a short-term bullish continuation, but it's also positioned at a critical resistance level, indicating a possible exhaustion point.

Descending Channel: Indicates a corrective phase within the overall uptrend. The price broke out of this descending channel, which led to the recent upward momentum, aligning with the weekly trend.

Potential Scenarios:

Bullish Continuation:

If the price manages to break above the ascending channel at the top of the 4HR channel, it could signal a strong bullish continuation. The price may retest the upper trendline of the weekly flag before further advancing.

Bearish Reversal:

Given the significant resistance from the weekly flag’s upper trendline and the upper boundary of the 4HR channel, a rejection here could lead to a decline. This might trigger a correction back down towards the lower liquidity zones (LQZ) marked on the chart.

Considerations:

Liquidity Zones (LQZ):

The 15M LQZ around 2,485-2,477 is crucial. A break below these levels might confirm a bearish reversal, while a bounce could suggest accumulation before another upward push.

Mass Psychology:

As price approaches the upper resistance levels, watch for potential signs of exhaustion or overbought conditions, which could reflect a shift in trader sentiment, leading to a reversal.

Strategic Approach:

Risk vs. Reduced Risk Entry:

If looking to enter a trade, consider the possibility of a reduced risk entry on a corrective pullback to the lower 15M LQZ if the price respects these levels. Alternatively, if the price breaks above the ascending channel, a riskier entry might be taken on the breakout, with stops placed just below the channel's boundary.

Multi-Touch Confirmation:

Watch for a third touch or more on either the upper resistance or lower support levels to confirm a potential reversal or breakout, as per the rule of three discussed in your uploaded materials.

This setup requires careful monitoring, especially at critical support/resistance levels, to determine the next directional move with confidence.

ELROND current 1HR timeframe Bullish Head n Shoulders

On the 1HR chart for Elrond, which I must point out is currently very thin volume, but I think this volume will pick up soon, you can see here on the 1HR that the H & S bullish pattern on 1HR price appears to be retracing & retesting the H & S setup zone near neckline.

Possible Trade Idea: Scale in with some Buy small orders just in case it winds back to $25 when I believe it will start to really move up again. But this H & S pattern on the 1HR may be the momentum upwards it needs.

BNB/USDT 1HInterval Chart ReviewHello everyone, let's take a look at the BNB to USDT chart considering the one hour time frame. As we can see, the price is approaching the point of exiting the triangle, after the current recovery.

Let's start by determining the support line, as we can see, the price is based on a significant support at the level of $672, in case of breaking the support, the next support is $656, and then a very strong support at the level of $632.

Looking the other way, you can see the resistance at the price of $682, then there is a point at the price of $696, the third resistance is significant and has doubled the price increase at the level of $720, further resistance can be identified at the price of $736.

When we look at the RSi indicator, we will see that the energy is approaching the lower limit. We have a similar situation on the STOCH indicator, but here we are bouncing off the bottom of the mark, which slows down the decline.

BTC/USDT 1HInterval Chart ReviewHello everyone, let's look at the 1H BTC to USDT chart, as we can see the price is moving in an upward trend channel, defined by white lines.

Let's start by setting goals for the near future that we can include:

T1 = $67,339

T2 = $68,015

T3 = $68,493

AND

T4 = $69,168

Now let's move on to the stop loss in case of further market declines:

SL1 = $66,722

SL2 = $66,186

SL3 = $65,836

SL4 = $65,370

AND

SL4 = $65,370

Looking at the RSI indicator, we can see a movement towards the middle of the range, which still leaves room for a price increase, and when we look at the STOCH indicator, we can also see room for an upward movement.

ETH/USDTHello everyone, let's look at the 1H ETH to USDT chart as we can see that the price is moving below the local uptrend line.

Let's start by setting goals for the near future that we can include:

T1 = $3,454

T2 = $3,603

T3 = $3,710

AND

T4 = $3,845

Now let's move on to the stop loss in case of further market declines:

SL1 = $3,189

SL2 = $3061

AND

SL3 = $2,884

Looking at the RSI indicator, you can see how we remain low below the downward trend line, while the Stoch indicator approached its trend line, which may trigger a rebound again, it is worth watching whether the downward trend will be broken.

BTC/USDT 1HInterval Chart ReviewHello everyone, let's take a look at the BTC to USDT chart on a one hour time frame. As we can see, the price has broken lower from the local upward trend line.

Let's start by determining the support and, as you can see, first we have a visible support zone from $69,984 to $69,553, and then there is support at the level of $68,307.

Looking the other way, we see the price rising above the first resistance level at $70,147, the next one is at $70,678, and then it is worth marking the resistance zone from $71,067 to $71,561.

Looking at the volume indicator, you can see two green candles, but they are much weaker than the previous red candles, indicating a local downward trend. On the RSI indicator, we have approached the middle of the range, which still leaves room for a price decline.

Will BTC break through the first resistance zone?Hello everyone, let's take a look at the BTC to USDT chart on a 1 hour time frame. As you can see, the price has moved above the downward trend line.

Let's start by determining support and as you can see, the first support in the near future is $68,540, in case of breaking the support, the next support is $67,089, and then it is worth defining the support zone from $64,856 to $64,576.

Looking the other way, we can see how the price is fighting against the strong resistance zone from $69,660 to $71,064, and when it breaks above it, we can see another attack towards the ATH to the zone from $73,638 to $74,323.

Looking at the RSI indicator, we can see how it goes beyond the upper limit in the one-hour interval, which may result in a deceleration of growth, also when we look at the STOCH indicator, we will see an exit from the upper limit, which may also cause a change in direction.

BNB?USDT 1HInterval Chart ReviewHello everyone, let's take a look at the 1H BNB to USDT chart, as we can see the zena is staying above the upward trend line, and locally we can see an upside exit from the triangle.

Let's start by setting goals for the near future that we can include:

T1 = $570.8

T2 = $592.50

T3 = $608.4

AND

T4 = $627.6

Now let's move on to the stop-loss in case of further market declines:

SL1 = $547.1

SL2 = $535.3

SL3 = $514.6

AND

SL4 = $482.4

Looking at the RSI indicator, it can be seen that it has returned to the upward trend, with room for a possible continuation of growth. However, on the STOCH indicator we can see that it is approaching the upper limit, but it also has some room before recovery.