Laugh now, Cry Later QQQ Buyers have a week to prove me wrong.

As you can see this does not look good, buyers seem to have delusions of grandeur.

I'm sitting in cash slowly shorting assets I see weakness in, you will see what happens soon

Cryptocurrency will crash by the way when Satoshi trial happens.

NASDAQ:QQQ

TVC:NDX

CURRENCYCOM:US100

SP:SPX

AMEX:SPY

FOREXCOM:SPXUSD

OANDA:SPX500USD

CRYPTOCAP:TOTAL

COINBASE:BTCUSD

COINBASE:ETHUSD

2000

RUT (Russell 2000 ETF) - Resistance, Support, Trend - 09/05/21RUT has been consolidating between $2123.55 and $2348.03, for this year 2021.

Bullish scenario:

-RUT price breaks up above resistances to new all-time-highs.

-Resistance levels: $2348.03, $2392.66.

Bearish scenario:

-RUT price pulls back down to test supports below (horizontal and trendline supports).

-Support levels: $2240, $2123.55, $2060.54.

Note: On the Weekly chart, RUT price has always been consolidating sideways for 2021.

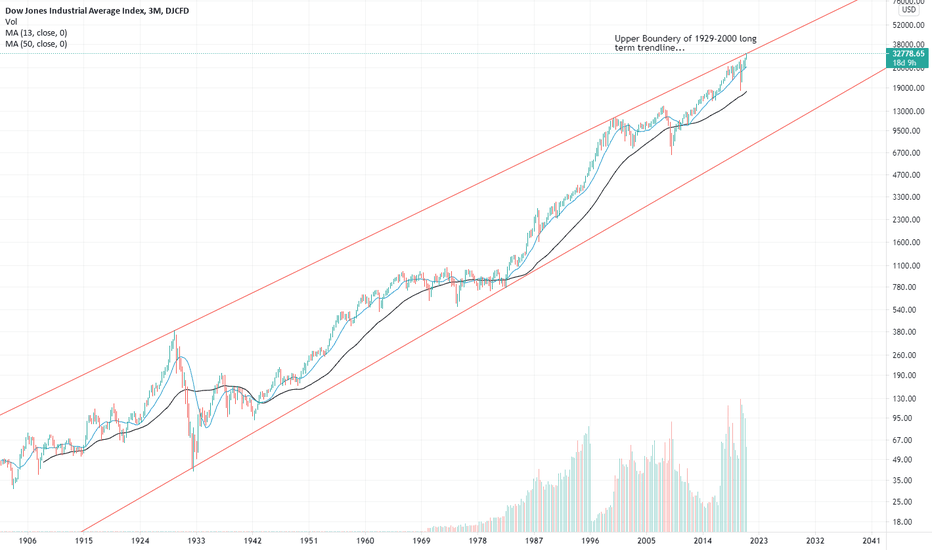

DJI at critical point on 3-month chartJust remarkable and noteworthy to look at.. The DJ industrial index just arrived at a critical zone of potential resistance on a ulta long term timeframe. This is the line between betwwen the 1929 top and the 2000 top . Indeed: The two school examples of big stock market crashes.

I was wondering where the rally of the DJ industrial index came form. Just had a look at long term on a logarithmic scale chart..

How exciting is that...

!

XAUUSD - 3D FibonacciGold loves the 78.6, lets see $2000 again and cause some FOMO.

The fib now shows the last high at the start of Nov to be at the 61.8, the daily shows this clearer,

Ideally this high would be wiped out before we see a move lower.

Fundamentals may play a key role with this pair with election results being clarified this month (aka Trump W)

Bullish until if this 78.6 holds then we can sell this after receiving confirmation of a LH forming.

Australia - Watch for a Rally - Then Jump ShipLet's start with the broader picture first

I understand the market looks horrific at press time, but the first thing that you must know about markets is this, nothing every goes in one direction forever, no matter how bad it seems.

For context here are the three major US stock crashes.

2008 Crash

2000 Tech wreck

1929 Great Depression

The second thing that you must know is that a market will TYPICALLY, not always, but typically will retrace 50% of the first wave before continuing lower, as seen in the above charts.

In the most recent price action, this would entail a bounce to around 5400-5900, this is a prime opportunity to lighten exposure and prepare for another leg lower. Now, we may not get a bounce to the 50% fib level, but a move to the 38.2% is highly likely, at this point i would begin to lighten exposure and begin to buy shorting instruments, i.e. Puts.

Now, where do i see the potential low?

If the prior crashes throughout history are any gauge, then a top to bottom move of 50% is very likely, with the 1929 crash closer to 90%, i expect at worst we could see a middle ground, call it around 70%. This would be heavily dependent on Covid19 being far worse than governments are expecting, and a extended period of lock-down, which at press time, must not be discounted.

That being said, the first targets are a "typical" 50% move from the peak, as you can see, this would erase ALL gains from the past 20 years, taking the index back to levels first reached in 2001.

The third thing you must know about markets is that they go up in the long-term, emphasis on LONG-TERM.

After the 2007 peak, it took over 4,300 DAYS to retread those levels.

Do you have 12 years to wait?

Bear in mind also, this index is not inflation adjusted, if one inflation adjusts the index we never made new highs, in other words, it has been over 13 years and we are yet to make new highs.

What about Real Estate?

I have long maintained the Australian real estate market is a bubble, ready to burst, with valuations in some areas exceeding over 10:1 income to Value ratios (IVR), this was inevitable and the bubble appears to be finally bursting, so no, your equity in your house will not save you.

In fact, real estate priced in gold, is breaking out of a decade long slumber, what this means is that your home may gain nominal value, as governments feebly attempt to print enough money to cover the cracks, but your home will in reality be hemorrhaging real purchasing power.

Welcome to the word of relative values, where your house can both go up AND down in value, simultaneously.

In short, Australia has a weak economy, i have not even touched on the consumers and households overburdened with debt, the over reliance on the services industry as a primary source of GDP or the super fragile banking system, which by the way, have a huge number of "interest only loans" switching to principle and interest, over the next 18 months.

Hmmm... wonder how the general households will deal with those.

-TradingEdge

Interest only loans:

www.rba.gov.au

Crash Comparison - 1929, 2000, 2008 and 2020

1929 - Crash

2000 - Crash

2008 -Crash

2020 - Crash

Which of the prior three major crashes most closely resemble the 2020 crash?

Certainly, not the 2000 crash, the initial drop is of equal magnitude, however the 2000 crash took over 365 days to reach that low from the highs, the 2020 crash has plumbed lower than 30% in just over 30 days.

Similar story for the 2008 initial crash, the final leg down in 2008 after the collapse of Lehman Brothers would be the closest match, but this is still not equal to the magnitude drop we are experiencing in 2020, when you consider that the post Lehman drop was 48% over 150 days, this equates to roughly 0.3% a day, the 2020 drop by comparison is closer to 3x times the rate of drop, at over 1.0% per day in decline.

Even the initial 1929 stock market drop, that eventually lead to the great depression took 3x times as long to reach the 30% range.

Yes, the macro environments for these drops were very different, i understand this.

But it is worth considering just how unique these markets are at present time, with a combination of automated trading, real-time news feeds, easier access for retail investors and far higher leverage than ever before, this creates a highly volatile trading environment that can pivot at a moments notice.

My personal belief is that the pain is not over, there will be a bounce at some point, however i will not be participating in that rally, i will be waiting to short.

I think the ultimate bottom will be between the three crashes highlighted here, not quite the 90% devastation of the 1929 crash, but also not a 'typical' crash of 50% either.

It may sound crazy now, but, i do believe that the SP-500 "COULD," emphasis on "COULD" be lower than at the 2008 peak before the market bottom, in other words, i believe that the last decade of market gains may very well be erased.

This will obviously be dependent on the handling of Covid19 by governments around the world, this is not due to the loss of life (although that would be a global tragedy), it is instead due to the wave of defaults and bankruptcies that could flow out of this crisis as a result of the social distancing policies that governments will HAVE TO, not may have to, but have to employ in order to flatten the curve.

This will include businesses closing for for several weeks, potentially even several months, this in turn will cripple airlines, cruise ships, hotels, casinos and a host of other industries. Many of which are currently looking to the federal government for a bailout, this is also not mentioning the small businesses and how they will be impacted, or the knock on effects that this will have on employment, or lack thereof.

In short, the economic impacts and the societal impacts that will flow from the Covid19 virus are far-reaching, the macro environment is nothing like 2000 or 2008, the system is MORE unstable, not less, couple this with the potential for 1929 style unemployment and you have a recipe for disaster.

-TradingEdge

SPX - GOLD/SPX Ratio - Divergence Signals Meltdown or Melt Up?This is a a very interesting chart today, on the left we have the SPX as of present time (monthly), in the middle we have the SPX/ GOLD ratio (monthly) and on the right we have the SPX chart during the period of the tech wreck (monthly) from 1996-2001.

SPX: Then and Now

Firstly i want to draw your attention to the previously stated rising support and resistance lines, on both SPX charts, the similarities are undeniable. With one major difference, the purple vertical line marks the Repo overnight rate spike and the subsequent global CB liquidity dump into the markets, if we examine the charts prior to this point, the SPX appeared to be in the last wave of the 10 yr bull market, in fact corporate earnings reflected this, as earnings failed Q1, Q2, Q3 and Q4.

The pattern of three slightly higher highs is self evident, albeit the lowers were more extreme during the 2018 topping pattern, with the second down wave being 15% compared with 10% of the 2000's second wave.

What can we conclude from this?

Well, i think that if it were not from the CB pivot to easing monetary policy and a indiscriminate lender in the Fed via the Repo market, then the SPX very well may have retested the lower trendline at around 2,500. Instead the SPX has piled on an additional 410 points onto the index, but the risks have not been alleviated, far from it.

SPX/ GOLD Ratio: Trendline break

The SPX/ GOLD ratio tells quite an interesting story, the ratio has been in a steady uptrend since 2012, in other words, stocks have been decisively outperforming gold for that period of time (no surprises so far).

But as you can see, there has been a clear trend break in June-July 2019, the ratio dropped quite suddenly, before reversing and going up to test the trendline from below, the point at which the ratio reversed and began climbing again was during the Repo/ liquidity dump, this is not surprising at all, however, the fact that the ratio has been unable to reclaim the trend before falling away again is quite interesting.

This would suggest, at least according to the ratio, that the SPX may very well have peaked and begun the roll over into a "gold measured" bear market. I want to stress something however, this does not mean much AT ALL, when it comes to the dollar denominated index, what this means, if true, is that gold will also be benefiting from this move higher (should stocks continue higher) and we may very well be entering a "Melt Up" Phase, whereby most if not all asset classes are carried up in a sea of liquidity (for stocks and risk assets) and weaker fundamentals such as gold.

It is worth noting that although stocks are grossly overvalued, as a trader i must acknowledge that billions of dollars will be injected to prevent a 2000/ 2008 style melt down, this may very well result in the most insane rally in equities in modern history.

Bankers know the damage that stock market crashes can do and governments are now dependent on a rising stock market, both politically and financially, therefore i expect to see a sea of liquidity enter the market at the first signs of trouble. But, even a 20% drop from these levels would still be within the two trendlines, so the point at which the liquidity will come, is still uncertain.

-TradingEdge

This doesn't look like 2000 and 2008 at allThere are too many people expecting a crash nowadays, because there are some indicators showing a similarity to the 2000 and 2008 stock market crashes.

I am convinced however, that if too many people expect something, it will not happen. Quite the contrary will happen.

I am not a stockmarket shill, I don't even own any stocks. I started learning TA when I started with bitcoin 6 years ago. So I might not be an expert on stocks, I fully admit that.

It just is very interesting to make some observations. And it really was noteworthy how this time everyone expected a crash.

The difference is, that in 2000 and 2008, almost nobody was expecting a crash of this magnitued.

Such stuff always takes people by surprise.

I see the situation now more like in the 80s. Nasdaq had some two strong dips back then, where it immediately recovered and made new highs.

I see a similar situation now.

The yearly picture is bullish anyways, see my other chart here:

And the motnhly picture as you can see also looks very healthy.

And this bounce here directly goes on making new all time highs.

Quite different from 2000 and 2008.

We soon shall see, but I just don't see a crash happening when everyone is shorting and expecting it. Market psychology is truly fascinating.

A massive sell off coming up, 50 % dropBlue lines are the average of BTC's most boring days. We stayed at 6400 for 2 months before it dumped to 3140, so let's say an estimate of 50 % drop. Now the story looks very similar, from 24th November till now we've been hanging around 3680, few dollars up and down which is caused by bots trading. So I can think of only one outcome. Another 50 % drop which will take us to 1900 support. I also used a triangle (pink lines) to make it more visible where we are at right now. My gut is telling me that a massive sell off will happen at the start of next week. I've been sitting in Tether since 4100 so let's see how this plays out.

2000 - 2400$ is our absolute bottom.This number is just not a random number, there are many indicators that are leading us to this number.

1/ In the previous bear market. Bitcoin's price retraced precisely to the 0.887 level (88% retracement) from the previous all the time. If in the current bear market, if Bitcoin also retraces to 0.887 level, it'll lead the price to the 2400$ area.

2/ In the previous bear, Bitcoin hit the mean blue line twice before it starts a new bull cycle.

3/ The Rsi still not form the bullish divergence on Weekly candle, which indicates that Bitcoin still have plenty of room to go down.

I am almost certain that Bitcoin will eventually hit the 2000$-2400$ area. ( I will seriously consider selling my house and buy all the possible BItcoins at that price range )

Revised Bitcoin Stance Overall: Bitcoin's last gasp for air $12KThe Traders Dynamic Index when used properly works like a Godsend.

Basing myself uniquely on patterns found in it for different time frames on Bitcoin...

I find myself in the obligation of saying what will surely happen, now that I have an in-depth look into the future, have to announce...

Bitcoin will see resistance between $11,000 - $13,000, or basically ~$12,000 and it will be the last gasp of air before its descend below $7,000 again as I allude to August 2014.

Will occur within 2-4 months from now.

A cross of RSI/TSL downward on a 2 month chart WILL NOT LIE

This, I base on my new Traders Dynamic Index overlay and combining its use with KK_TDI_BH.

You got the message, just accept I warned accurately.

It will go down as pure minimum of ~$2,000 for ~ 1 year

~$12,000 is the take profit for the big money before its descent into its stone age and then we'll be ready.

By November 2019 the lowest will have formed ~$2,000 and, I predict people will continue to be uneducated and confused as they are now, others in their ignorance and arrogant boasts >:D

They'd say it be going to $0, but they'd be wrong again.

By October 2021 will be the outstanding highest record-breaking high = ~$100,000

Unless cash flow for crypto purchases were blocked it will be in such a manner explained.

BTC on a course to 2000-3100This is just a healthy correction similar to those we have seen multiple times in BTC's history.

I will be setting buy orders at 2500-3100. If you want to cast a wider net you can expand your range to upper limit of 3450 and lower limit to 2000.

I believe that after we reach these levels, bitcoin will consolidate sideways for a while and then moon to new all time highs over the next year or so, at the very least.

This is not financial advice.