200dma

$FLL Looks Set To Keep Climbing The Charts$FLL has not been a great investment for long-term holders, but the worst looks to be over.

The price action the past 2 days has been positive with both days green on higher than normal volume.

$FLL looks to be a worthwhile punt at current levels.

Full House Resorts, Inc. owns, develops, operates, manages, leases, and/or invests in casinos, and related hospitality and entertainment facilities in the United States. The company owns and operates the Silver Slipper Casino and Hotel in Hancock County, Mississippi, which has 920 slot machines and 26 table games, a surface parking lot, approximately 800-space parking garage, and 129 hotel rooms; a fine-dining restaurant, a buffet, and a quick-service restaurant, as well as oyster, casino, beachfront bars; and 37-space beachfront RV park. It also owns and operates the Bronco Billy's Casino and Hotel in Cripple Creek, Colorado that has gaming space, 36 hotel rooms, and various acres of surface parking, as well as 1 steakhouse and 4 casual dining outlets. In addition, the company owns and operates the Rising Star Casino Resort in Rising Sun, Indiana, which has 917 slot machines and 25 table games; a land-based pavilion with approximately 30,000 square feet of meeting and convention space; a 190-room hotel; a 56-space RV park; surface parking; an 18-hole golf course on approximately 311 acres; and 5 dining outlets, as well as a leased 104-room hotel. Further, it owns and operates the Stockman’s Casino that is located in Fallon, Nevada, which has 225 slot machines and 4 table games, a bar, a fine-dining restaurant, and a coffee shop, and approximately 300 surface parking spaces; and the Grand Lodge Casino that has 270 slot machines and 17 table games, which is integrated into the Hyatt Regency Lake Tahoe Resort, Spa and Casino in Incline Village, Nevada on the north shore of Lake Tahoe. Full House Resorts, Inc. was founded in 1987 and is headquartered in Las Vegas, Nevada.

As always, trade with caution and use protective stops.

Good luck to all!

$MU Is A Buy On Dips To $40$MU selloff looks to be overdone in our opinion. Other analysts agree with this assessment.

Needham raised its Micron (NASDAQ:MU) target from $50 to $60 after Micron's earnings report.

Taking note of Micron's downside gross margin guidance - attributable to the excess NAND inventory and related pricing - Needham nevertheless sees several upcoming catalysts for the memory cycle, including 5G and a normalized supply/demand.

More action: Piper Jaffray raised its MU target from $36 to $46, but notes concerns over NAND supplies and ASP pressure.

More action: Rosenblatt jacked its price target to $80 from $60.

Micron Technology, Inc. manufactures and sells memory and storage solutions worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Storage Business Unit, and Embedded Business Unit. It offers memory and storage technologies, including DRAM, NAND, NOR Flash, and 3D XPoint memory under the Micron, Crucial, and Ballistix brands, as well as private labels. The company provides memory products for the cloud server, enterprise, client, graphics, and networking markets; memory products for smartphone and other mobile-device markets; SSDs and component-level solutions for the enterprise and cloud, client, and consumer SSD markets; other discrete storage products in component and wafer forms for the removable storage markets, as well as 3D XPoint memory products; and memory and storage products for the automotive, industrial, and consumer markets. It markets its products through its internal sales force, independent sales representatives, distributors, and e-tailers; and Web-based customer direct sales channel, as well as through channel and distribution partners primarily to original equipment manufacturers and retailers. The company has strategic collaboration with BMW Group. Micron Technology, Inc. was founded in 1978 and is headquartered in Boise, Idaho.

As always, trade with caution and use protective stops.

Good luck to all!

#Yolo play on $TAHO call optionsThis is more of a long term yolo as GOLD continues to recover.

TAHO - Entry of January 2020 $7 strike call options.

Range of $0.01 - $0.05 (Entry at $0.02 average)

This has a huge potential to sky rocket as gold continues to recover into the 1300's and higher. TAHO is also right under the daily 200sma which is key resistance for more buyers to come flying in. Projecting a minimum 500% gain in the next 8 months.

ES1!: Watch for the breakdownWith the ES1! trading around the 2,750 region, it is time to revisit and look for another set up. This time round we are looking at an ascending wedge formation with the apex coinciding with the 200-days moving average. Ascending wedges are by definition a bearish pattern while the 200-dma happens to coincide with a congestion zone between Nov to Dec. I know there is some hate in relation to moving averages but I personally feel there is some information value especially when taken in context with other forms of support/resistance.

Since I called for taking money off the table around the 2640's region, the ES1! has rocketed up another 100pts on diminishing odds of rate hikes, a second US government shutdown and higher Chinese tariffs. So what will be the bogey man this time round? I don't really know, but the whole backdrop of slower growth in the absence of tax cuts and global trade tensions just suggest buying at these levels appears to be misguided, especially with a debt refinancing wall round the corner. It is too simple to use traditional PE and PB ratios which would suggest valuations are cheap; These indicators are not adjusted for rates nor debt. Once adjusted, valuations remain elevated near the +1 standard deviation levels.

My preferred stance would be to position for a risk-off trade with an initial ABCD target of 2260.

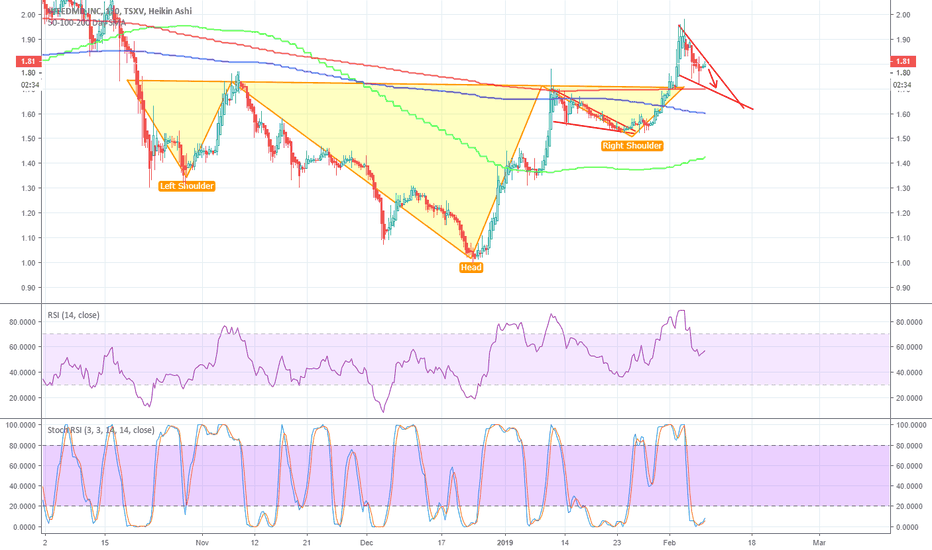

WeedMD Slight Pullback Then LongBurst through H&S and previous resistance, forming bull flag. WEED closed +1.5% today, with WMD closing -0.5%. Divergence between these two never last. Likely pullback to 200D SMA (last support), before breaking through bull flag.

BTC strong resistance on 200 day EMAHi all, lets analyze hourly chart for BTC where we are now struggling with STRONG resistance at 200 day EMA. Breaking the level and then finding the support on top of 200 day EMA could be considered as good indicator for the end of the bear market.

Currently BTC is in uptrend, having 7 consecutive higher highs and higher lows. Breaking the below the previous low at $7728 would mean a collapse of this uptrend pattern and thus bearish movement could be anticipated (this could also be a catalyst for dropping over what some analysts see as bear flag forming on 4h chart).

Very important development on BTC is going to unfold. Be alert!

Bitcoin touched the 200 Day Moving Average This is the first time it's reached the 200 DMA since March 25, 2017 where it dipped to $895. Before that, it went below the 200 DMA on 8/2/2015 to $470.

This is the real test in terms of chart plays. Could bounce here or we could be entering a bear market.

USD/CHF Swissy longer term short play off 200dmaWe got a lovely rejection wick off the daily on Friday and it beautifully bounced off the 200dma and a falling trend line. Great bit of confluence. Stops above that wick and shoot for a 50% retrace on that type of move the 50 back gives us a RR ratio of 3.5-1. Might even get down to previous lows if wanted to stretch for longer targets but don't be greedy.

FIT BottomSupporting a bullish business/product narrative are constructive technicals including: Jun - Aug triple bottom, Above 200 Day MA, bullish RSI, ascending triangle breakout, reward > risk (see levels: break $6.72 then $7.15, opens up $9.79 then $12.67). Check out my developing story at xdaystogo.com .

USO at 200DMA, observing resistanceDefinitely bearish feelings here, $DXY has found support the past week and along with the small recent USD rally we find $USO has run up against the 200DMA.

The 10DMA (drawn in blue) has provided support in the past, so waiting for a break down there would be wise IMHO, although I suspect we're about to roll out the red carpet soon.

The previous oil chart I did calling for a short bounce lasted longer than I suspected, as $DXY has been weak since the beginning of the year and has just started to find something that resembles strength.

Thanks for reading, good luck to all

Apple Heading Up? AAPL cleared two hurdles today - it closed over both the 200 day moving average as well as a resistance line that has been capping the stock starting in July 2015. We've had a recent false breakout over the 200 day average before (November 3-4 2015) so we will have to give this a couple of days to make sure it's for real. Also, the stock didn't close over the April 4 high of $112.19. Nonetheless, today's advance is particularly interesting since the break over the 200 day average is coupled with a push through that multi-month trendline. Apple reports earnings in less than 2 weeks, which could be decisive in setting the short/medium term direction.

Bullish RSI divergence, 200DMA breakWeekly Chart with daily MAs.

Simple 200DMA break trade, these seem to be pretty successful.

Chose some old resistance to serve as a profit taking point, might even want to trim ~$27 and put the money to better use... if there's a fluke and we even make it there from here ;)

bullish RSI, support trend, MA convergenceThe 100DMA is converging on the 200MA, RSI has been establishing a bullish support/resistance area and price is bottoming at support again.

Leaning long with a month long horizon, entry potential at $5, or on a 200DMA break up on volume