Bitcoin has dropped 9%, could go to 3 000$Bitcoin just dropped 9%. It has not reached the point where its bearish trend is confirmed in the coming months. That point is <5k more than 3 days. The November 19 candle on the weekly chart will give us the information.

Technically, there is now much more probability of a downtrend than an uptrend, with the price most likely heading towards its MM210, which would be approximately a price of $3,000.

Strategy , same as before

Bearish Positions: If you are a long-term investor, you could go short at -5,000 with targets of 3,000 and thus take advantage of the bearish trend with a reverse trade.

Bullish Positions: Long positions for average should not be positioned if the trend is not >8k.

2019

Dow Jones & World Markets - Bullish & Averaging LongWe are averaging our derivative positions for the next few months when the RSI crosses the 51 level on the DJI weekly chart. We will only cancel averages if prices stay longer than 3 days <24k. The inverted shoulder-head-shoulder pattern can be seen in most world indices.

I take this opportunity to reaffirm our outlook for the markets in the coming months, being a bullish stock market, bearish commodities, a bullish dollar and a bearish euro. As for blockchain, it will be decided in a break very probably in December.

Nasdaq, Bullish, DecemberThe price is crossing the bullish MM70 over another bullish MM210 on a weekly chart.

The most likely scenario is a price pullback until an inverted shoulder-head-shoulder is formed and a bullish break in December.

This is correlated with the signals published in the previous posts.

Bitcoin, playing with fireThe waited break of the price will be very probably at the begging of December.

Technically, there are more probabilities of a bearish trend; adding the fundamentals, there are similar probabilities.

In the short term is better to be prepared to both bullish or bearish scenarios.

Strategy

Sell Stop: 5 200

Stop Loss: 6 200 (<=1.5% loss)

Take Profit: 2 200

Horizon: 2-3 months

Buy Stop: 8 000

Stop Loss: 6 200 (<=1.5% loss)

Take Profit: No

Horizon: Long-term

Crude Oil, Short to 52 - Horizon of 4 MonthsOil, correlated with most commodities, will most likely drop to its support of 52 in the coming months.

The price crossed down a shoulder-head-shoulder at the end of last month. Now it is below its support of 61 and crossing down the MM70 on the weekly chart. The price should fall to the MM210 level in the coming months.

This is correlated with the uptrend of the dollar and stocks in the medium term, as well as the downtrend of the euro and commodities, in the medium term.

We will be averaging down to the market price.

Enter: sell market price, 60.9

Stop: 64 (0.3% loss)

Profit: 52 (70%), -50 (30%)

Ratio R/B: approx. 1/3.1

Horizon: 4 months

NIKKEI, Long, 4-6 MonthsKIKKEI225 will keep being very probably bullish in the next months as most of the stock markets.

The bull trend should start when RSI crosses>53. The price already has crossed upwards a bullish MM70 over the MM210.

Averaging upwards at market price.

Target: 26 000+

Stop: 20 609

Opened: 22 200

Bitcoin Almanac 2018-2020Hey guys!

This is what I think might happen from 2018 to 2020.

I believe Bitcoin may touch down on the critical trend lines as seen in the chart, sometime in late December or the beginning of 2019.

From now until that happens, I think we'll just see sideways action from Bitcoin, with Altcoins increasing in value.

As we can see, volume is also reducing, further drawing the point of sideways action til Bitcoin touches down on the major trend line.

Good luck,

and Remember,

Patience is paramount!

Silver - Short 2019Silver has crossed down in a triangle pattern the MM210 in the Monthly graphic, an ultra-bearish trend signal. If it breaks down the 13.500 support it could fastly be going down to its 10 support since 2008. Possibly MM70 will cross down the MM210 in the next months until it crosses up again in 2020 for a bullish market in commodities, but now there are good opportunities for shorting.

Once we are in the last months of 2019, it could start the commodities bull trend. This need to be correlated with stocks bearish cycle. Due to markets still being in a bull trend, the most favorable scenario is this one.

Strategy

Short position: At the market price, 14.13

Stop loss: 15.34

Take Profit: 10.50

Ratio R/B: 1/3

Wallet Risk: <1%.

When silver costs 10, it is the best moment to buy and hold long-term physical silver.

DAX30: Weekly - Long-term chart targeting 1566 till year 2020This is the main idea of the final wave for DAX30 and the indices similar to it based on the 90-year cycle from 1929 (Great Depression) + 90 years = 2019

90 years as in 90°down in the markets. The 90-year cycle is also the 90-year debt cycle.

The 90-year cycle is one of the most powerful cycles out there and it causes huge drops as DAX30 and other indices similar to its pattern has reached a triangle formation, the steam off the bull market runs out and the only way becomes down when the formation is so prevalent on the log chart.

At the same time a 'Wolfe Wave' pattern has been in the making for the past 30 years and is now finalizing the triangle just before it drops till year 2020 with the 90-year debt cycle.

Wolfe Wave Example

i.imgur.com

This crash will most likely be a fast one because of the algorithms in the markets today. The fundamentals can be linked to anything associated at the time but Deutsche Bank ($DBK) which is the most obvious contagion to date will likely be the cause to this next financial crisis because of the amount of debt that the bank holds within the banking system.

What's important to remember is that a graph is a graph and that technicals shows you everything you need to know about the future, regardless of the time frame when a pattern like the 'Wolfe Wave' is so prevalent on the Weekly log chart a drop follows, especially when a big cycle like the 90-year debt cycle expires around that date together with this wave.

After year 2020 it will be a good time to re-invest in the world's stock markets again till year 2026 and 2033.

Deutsche Bank ($DBK): Weekly - Default Risk before year 2020 This is the real market risk, the most obvious contagion to date that will most likely cause the next financial crisis because of the amount of debt that the bank holds within the banking system when this stock moves down the market also follows.

Technically below that trendline and Deutsche Bank moves towards default and 0.11€

Bitcoin Trend 2019There are similar odds that Bitcoin and the token market will break bullish or bearish in the next 2 months.

In my opinion, it will be bullish, although for long-term investors it is important to also prepare a possible bearish scenario.

For those who are not within the asset, I recommend to prepare buy stops at 8k and sell at 5k, 30% of trailing stops at <=1% of wallet loss.

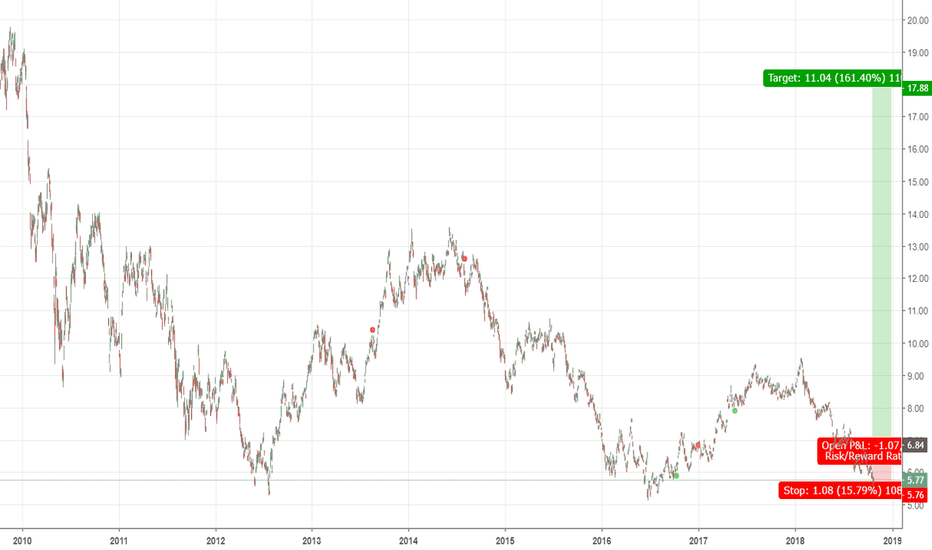

VIPS - LONG Opportiunity by Abdolreza SadreddiniVIPS - Vipshop Holdings Limited has very good potential for long term profit if bounce back and close a daily candle above $7.10.

Obviously, the stop loss would be set under knee the lowest point and TP will be over $30.00 in long term.

Setting a buy stop at $7.10 would be a smart move.

Market Report by Abdolreza Sadreddini

BBVA -Long Opportiunity- By Abdolreza SadreddiniBBVA - Banco Bilbao has very good potential for long term profit if bounce back and close a daily candle above $6.80.

Obviously, the stop loss would be set under knee the lowest point and TP will be over $25.00 in long time.

Setting a buy stop at $6.80 would be a smart move.

Market Report by Abdolreza Sadreddini

TSLA most likely to hit $397 by fourth quarter of 2019Company Summary

Tesla, Inc. (formerly Tesla Motors, Inc.) is an American automotive and energy company based in Palo Alto, California. The company specializes in electric car manufacturing and, through its SolarCity subsidiary, in solar panel manufacturing. It operates multiple production and assembly plants, notably Gigafactory 1 near Reno, Nevada, and its main vehicle manufacturing facility at Tesla Factory in Fremont, California. As of June 2018, Tesla sells the Model S, Model X and Model 3 vehicles, Powerwall and Powerpack batteries, solar panels, solar roof tiles, and related products.

Tesla was founded in July 2003, by businessmen Martin Eberhard and Marc Tarpenning, under the name Tesla Motors. The company's name was derived from physicist Nikola Tesla. In early Series A funding, Tesla Motors was joined by Elon Musk, J. B. Straubel and Ian Wright, all of whom are retrospectively considered co-founders of the company. Musk, who serves as chairman and chief executive officer, said that he envisioned Tesla Motors as a technology company and independent automaker, aimed at eventually offering electric cars at prices affordable to the average consumer. Tesla Motors shortened their name to Tesla in February 2017.

The Tesla Factory is an automobile manufacturing plant in south Fremont, California, and the principal production facility of Tesla, Inc.. The facility was formerly known as New United Motor Manufacturing, Inc. (NUMMI), a joint venture between General Motors and Toyota. The plant is located in the East Industrial area of Fremont between Interstates 880 and 680, and employed around 10,000 people in June 2018.

Growth

It has been state that Q3 2018 was a historic quarter for Tesla. Model 3 was the best-selling car in the US in terms of revenue and the 5th best-selling car in terms of volume. With average weekly Model 3 production through the quarter (excluding planned shutdowns) of ~4.3K units per week, Tesla has achieved GAAP net income of $312M. Tesla has also delivered on its internal cost efficiency targets, leading to GAAP Model 3 gross margin of ~20%, surpassing its guidance. Finally, Tesla has increased its total cash in hand by $731M and it had free cash flow (operating cash flow less capex) of $881M despite less than 10% of that amount coming from key working capital items (payables, receivables, and inventory). Model 3 is attracting clients of both premium and non-premium brands, making it a mainstream product.

Tesla's Revenue & Gross Margin has been stated as follows:

Automotive revenue in Q3 increased by 82% sequentially over Q2, mainly due to an increase in Model 3 deliveries. In Q3, Tesla has recorded $52M in ZEV credit sales compared to zero in Q2.

With the adoption of the new revenue recognition standard starting January 1, 2018, lease accounting generally applies to vehicles directly leased by Tesla without using bank partners. Only 3% of vehicles delivered in Q3 were subject to lease accounting.

GAAP Automotive gross margin improved to 25.8% in Q3 from 20.6% in Q2, while non-GAAP Automotive gross margin improved to 25.5% in Q3 as compared to 21.0% in Q2.

At an average Model 3 production rate of about 4.3K per week in Q3 (excluding planned shutdowns), Model 3 gross margin grew to above 20%. The mix of the Model 3 Performance version was only slightly higher than the Performance mix of Model S and X. This margin growth was driven by a higher production rate while keeping fixed costs stable, significant reductions in manufacturing costs through lower labor hours per unit, lower scrap rate, lower material costs, and higher average selling price.

Gross margin of Model S and X continued to improve sequentially even though the average selling price per vehicle declined slightly. Model S has been in production for over six years, yet Tesla continues to achieve efficiencies in material cost and other manufacturing costs.

Service and Other revenue in Q3 increased by 21% compared to Q2. This was mainly due to higher used car sales.

Service and Other gross margin loss in Q3 was less than in Q2. Total gross loss of Service and Other remained relatively stable. This was in line with Tesla's expectations.

Total GAAP operating expenses decreased to $1.11B in Q3, which was 11% less than in Q2. Excluding one-time restructuring and other costs, operating expenses decreased by 5% sequentially as Tesla is seeing the benefit of ongoing cost reduction efforts.

Interest and Other expenses were $145M in Q3.

There were approximately 171M basic shares outstanding at the end of Q3.

Forward-Looking Opinions

Electric Vehicle CAGR is approximated at 23.1% by 2024, to pass $500B market size, thereby it is a proven growing sector. Additionally, Tesla has been a settled pioneer and relatively successful first mover in the sector, and Audi, Mercedes-Benz and NIO are also joining to back this initiative up as first mover companies in the sector. It is without the doubt that one of Tesla's competitive advantage is deeply rooted tax benefits, in the triangle of energy, manufacturing, and research, wherein the U.S. has been continuously suffering from in the past decade, especially the manufacturing sector, which is a key economical factor, affecting the entire capital markets.

Chief Financial Officer

Mr. Deepak Ahuja brings more than 20 years of global automotive financial experience to the Tesla team. As Chief Financial Officer, Mr. Ahuja brings invaluable insight of a well-versed industry veteran to help Tesla become a leading automobile company in the world.

Prior to originally joining Tesla Motors in 2008, Mr. Ahuja was the Controller of Small Cars Product Development at Ford with the goal of bringing several exciting fuel-efficient automobiles to the North American market. Previously, Mr. Ahuja was CFO for Ford of Southern Africa, a $3 Billion subsidiary where he oversaw the finance, legal and IT functions. Prior to that, Mr. Ahuja served as CFO for Auto Alliance International, a joint venture between Ford and Mazda with over $4 billion in revenue. His career at Ford included assignments in all aspects of the business, including Manufacturing, Marketing and Sales, Treasury, Acquisition and Divestitures. Before joining Ford, Mr. Ahuja worked as an engineer for Kennametal, Inc. near Pittsburgh, PA for almost 6 years and developed two new ceramic composites cutting tools for machining of aluminum alloys in aerospace and automotive industries. Mr. Ahuja was Tesla’s CFO between 2008 and 2015 and returned to Tesla as CFO in February 2017.

Mr. Ahuja holds bachelor's and master's degrees in Materials Engineering from Banaras Hindu University and Northwestern University, respectively and an MBA from Carnegie Mellon University.

Financial information are summarized as follows:

Statistics

Shares Outstanding: 171M

Average Daily Volume: ~11M

Market Cap: ~53B

52-Week High: $244.59

52-Week Low: $387.46

Forward PE: NA

Annual Dividend/Dividend Yield: $0.00 / 0.00%

Annual Revenue: ~$7.0M

Institutional Ownership: ~68.3%

1-Month Return: ~8.9%

3-Month Return: ~23.2%

Next Earnings Report Date: NA

ESP: -$6.45

Revenue Per Employee: ~$431,681

Money Flow Ratio (Balance at 1.00): ~1.08

Profitability (~Sector Average %)

Revenue Growth: ~67.9% (~5.9%)

Gross Margin: ~16.5% (~15.3%)

Return on Equity: -42.8% (~14.8%)

Net Margin: -3.0% (~3.2%)

Debt (~Sector Average %)

Current Ratio: 0.8 (~1.0)

Debt-to-Capital: 65.1% (~68.4%)

Interest Funding: ~420% (~11.5%)

Interest Coverage: ~1.2 (~6)

Dividend (~Sector Average %)

Dividend Growth: NA (~2.4%)

Dividend Payout: NA (~30.5%)

Dividend Coverage: NA (~8.3)

Dividend Yield: NA (~0.00%)

Relevant Tickers

Audi (OTCPK:AUDVF, OTCPK:VLKAY)

BMW (OTCPK:BMWYY)

Carvana Co (CVNA)

Electrameccanica VEHS ORD (NASDAQ:SOLO)

Ferrari N. V. (NYSE: RACE)

Fiat Chrysler Automobiles N.V. (NYSE: FCAU)

Fiskars Oyj Abp (FSKRS.HE)

Ford Motor Company (NYSE: F)

General Motors Company (NYSE: GM)

Harley-Davidson Inc (NYSE: HOG)

Honda Motor Company, Ltd (NYSE: HMC)

Kandi Technologies Group Inc (NASDAQ: KNDI)

Kia Motors Corporation (KRX: 000270, 000270.KS)

Lincoln National Corporation (NYSE: LNC)

Mercedes-Benz (OTCPK:DDAIF)

Nio Inc (NYSE:NIO)

Nissan Motor Co Ltd (NSANY)

Porsche Automobil Holding SE (PAH3.DH)

Rev Group Inc (NYSE: REVG)

Spartan Motors Inc (NASDAQ: SPAR)

Tata Motors Ltd (NYSE: TTM)

Toyota Motor Corp (NYSE: TM)

12-Month Price Target

Mean: $397.32

High: $441.08

Low: $298.60

Earnings Surprise

Positive (+9.3%)

Trade and Investment Gradings

Stock gradings from strongest (+++) to weakest (---) are as follows:

60-Month Investment: +++

36-Month Investment: +++

12-Month Investment: +++

6-Month Investment: ++

3-Month Investment: +

1-Month Investment: +

1-Day Trade: +

2-Day Trade: Neutral

7-Day Trade: Neutral

1-Day Short-Sell: -

2-Day Short-Sell: --

7-Day Short-Sell: ---

aicody.com

BTC bull run might have to wait a little longer...is locked into a reasonably fixed pattern (emphasis on reasonably), and there's a bit more scooping/accumulation to take place before a bull run. This extended accumulation phase will not mirror last year's bull run, hence either we will see a smaller bull run or wait a bit longer for a strong one. Unfortunately times have changed since last year and patience may be something we all need. I certainly don't like patience, but i'm not seeing any other option jump out at me.

euro/usd will fell more join in the trend ...the downtrend Hey there ,

I am here to help you to make some money but it is in your choice what scenario you will choose i dont sell anything .

So we see like Head and Shoulders ,thats the reason that technical the euro fall because it reversal the trend and the traders some of them have emotions , haha i laugh , they see 4 days joined in with 55reputation , i trade 2 years and 1 month on forex and crypto . But let get me in chart ,

reversal ,diamond fell from the back days , i had more win trade the previous day so we continue to be short .

Maybe a little consideration of the price in the level that we are now , expect more down on the london session !!!

Support and first easy target drawing with fibonacci retracement the price tomorrow maybe go up maybe go down in hourly timeframe

but we go to short it with first target of 1.15850 maybe 1.15950 and then i believe we have more ,the price will light the path .

Thank You , I am John V. i will take over the forex 2019 .

Follow and send pm for join in.

Clue to BTC going up to $28000 in March 2019It is crisp by the waves of Elliot on the monthly chart we are at the end of wave 2 then there for the month of December to January beginning wave 3 taking the BTC up to $ 24000 and then going up to $ 28,000 in March and then dropping to $ 15,000 in April.

Sorry for my bad english

VTC next bull cycle starting summer 2019If we look into the past VTC had a very long consolidation period. If we take this to reference next cycle should start in the summer of 2019 and lead to prices above 20 USD. I think VTC bottomed out here but will do absolutely nothing for the next year or so. Just move on and ignore this project until the chart tells us something different. With not being added to binance it just lacks in publicity and volume. Great long term project tho.

Halfway through the downtrendFollowing the previous cycles BTC, I belive BTC will find its bottom around 3K on march 19, followed by a few months of accumulation before rallying again. 2k seems like an hard bottom I can't really see going further that point...

This is only based on history as the chart do not suggest any imminent bull run. And is only valid through my eyes IF BTC keeps the lead (market cap wise) during accumulation phase, otherwise I don't believe there will be another rally to the red upper line or beyond.

This is all just (amateur) opinions. Not financial advice.