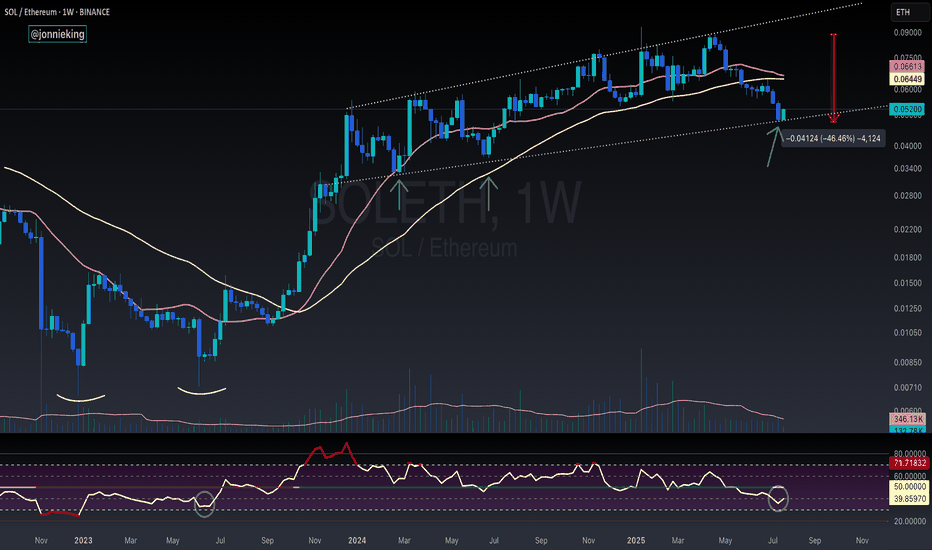

SOL / ETH - Reversal Signs FormingI suspect CRYPTOCAP:ETH has a bit more gas in the tank, but the early signs for the real Alt Season are nearing.

RSI on the weekly is nearing the June 2023 bottom which kicked off the massive bull flag formed on SOL / ETH for the next 2 years.

Still too early to call at this point tho.

Need volume to really burst through in the next week or two.

I’d also like to see BOATS:SOL close the week with a massive bullish engulfing candle.

The bearish cross on the 20 / 50WMA should mark the bottom when it occurs soon.

20wma

Crypto $TOTAL Market Cap Hopeful Weekly CloseWhat a wild close to the Week for the Crypto CRYPTOCAP:TOTAL Market Cap

Closed just above the 50% Gann level within the POI, but failed to close above the EMA9.

Strong bounce off the SMA20 still shows bull have some gas left in the tank, but I suspect we go lower with such a massive bearish candle on the week.

SMA50 is ~2.8T

$TOTAL Crypto Market Cap Massive Weekly Close Above 20WMA Massive Weekly Close for the CRYPTOCAP:TOTAL Crypto Market Cap above the .618 Fib and previous cycle's ATH.

RSI still has room to push higher to retest this cycle's ATH.

Price also closed above the 20WMA, which was the signal for the +70% Nov '24 Trump Pump 🚀

UpOnly Season for every coin only happens when the TOTAL Market Cap goes HIGHER.

Otherwise we are stuck in a rotational cycle, where money from one narrative pumps then moves onto the next

ie RWA, DePin, AI, Memes etc

BTCUSD: Time for a correctionOutlook for the remainder of the year. The ETF inflows have generally remained positive at new ATH levels, while volume remains low and price remains flat. This suggests considerable distribution from OTC sellers, namely longer-term holders, per HODL waves analysis.

It's been 3 months since breaking ATH in March, with price unable to move higher. The consolidation at higher levels remains bullish until $60K is broken to the downside (foodgates moment), which would confirm the current range ($60K-70K) as longer-term distribution, rather than accumulation.

First stop will likely be a re-test of the 50 Week MA around $50K after the floodgates for selling opens below $60K. With relatively low accumulation volume, I'm not expecting it to hold as support, but instead return to the 200 Week MA around $40K, likely after a re-test of previous support in order to confirm it as new resistance (around $60K). The 20 Week MA is currently around $63K, so below this level, there will already likely be an increase in selling pressure.

The Weekly RSI is otherwise facing rejection from overbought levels >70, similar to late 2021 (minus the strong bearish divergence back then). The culmination of breaking the 20 WMA and confirming RSI rejection by returning to $60K, would be the catalyst for the break of support. As also noted (N.B.) the Mid Pi Cycle Top occurred in march, around $68K-$70K, with price unable to maintain the momentum above this rising MA multiplier, unlike in December 2020 at $21K.(1) The post-halving "Miner Capitulation" has also been signalled by Hash Ribbons indicator, not so dissimilar to summer 2020 that encouraged consolidation and a miner correction.(2)

I'm not particularly expecting Path B to play out, unless there is a catalyst for a more full-blown capitulation, leading to a 65% haircut in price. Examples include ETF holders getting cold feet leading to panic as price goes below opening ETF prices , or otherwise some negative regulatory news. A -45% move down to $40K should otherwise be more then sufficient to build up momentum for a 2025 bull market reaching $100K+. Should price reach GETTEX:25K to $30K levels (path B), there could be a "delay" within the usual cycle, with higher parabolic prices nearer to $200K. After the 3x from 2017 to 2021 ATH, 2x seems reasonable in 2025 however ~$138K.

(1) www.lookintobitcoin.com

(2) capriole.com

Fib. channel fitted on linear scale and a 20W extension20W moving average (and a white shadow of a 21W EMA) has historically indicated a good near term cost basis. With a fitted fibonacci slanted channel (and more-or-less randomly extending the 20W average) we can plot a possible path for BTC, dancing between past fib level trend lines for resistance at important price levels, while also holding support at this imagined 20W SMA extension.

Of course, depending on the weekly close, this can breakdown form 20W SMA, in which case we continue our crab, I think.

#SPX - its all about the 20 week smaEver since recovering from the pandemic lows last year, we have seen the SP500 retreat and test its 20 week moving average (Middle Bollinger) on various occasions. Every attempt has been supported by the market. While there is very apparent macro risk which lingers, on a technical view it looks very much of the old same. Should we break below this 20 week ma then you can with more confidence say the trend has changed. The 20 week sma has been a golden level of support for the SP500 and we shall see if it manages to hold up again and attempt a new rally into year end.. (as they say.. 'the trend is your friend till it bends')

BTC/USDT DEATH CROSS (I am not doing anything)BINANCE:BTCUSDT TF 1D

Sometimes Lazy is good, We rode that 31K you saw our previous Chart.

Yet to admit I really acted like a whale getting greedy to the Death cross momentum and

get the 20WEEK MA be Gold Cross for everyone not just for me and for you as well.

Open your eyes it is being fished we are fished by whales. Why not let the whales vs whales...

Let sit at the bottom of the ocean floor and buy the whale that will crash. Let's not fight it.

REMEMBER WE CAME FROM THIS TO HERE WHERE WE AT SITTING WHERE THIS DEATH CROSS; it's Inevitable!

15/6/2021

> G7 Leaders Ask Russia to Urgently Identify Those Who Abuse Cryptocurrency in Ransomware Attacks.

> Experts: Regulatory Uncertainty and Slow Embrace Hampering Crypto Growth in Kenya. Here

> Crypto Not a ‘Viable Investment,’ Goldman Sachs.

> Johannesburg Stock Exchange Rejects Bitcoin ETF Application, Cites Lack of Regulatory Framework.

> MicroStrategy could hold more than $4B in Bitcoin after latest private offering and crypto purchase.

> Bitcoin price hits $40K as Paul Tudor Jones slams Fed inflation claims.

> Lack of crypto regulations alarming, says Italy's stock market regulator.

> Bitcoin sell pressure may hit zero in July thanks to Grayscale’s giant 16K BTC unlocking.

> China debuts blockchain-based digital yuan salary payments in Xiong’an.

> Korean banks will need to classify crypto exchange clients as ‘high risk’.

> Paul Tudor Jones on the Fed, Inflation and Why He Recommends 5% in Bitcoin.

> Bitcoin Remittances to El Salvador Surge 300% Ahead of BTC Becoming Legal Tender.

> New Zealand already had a bank recognize to accept El Salvadors National Currency (btc) as an act of now waging war against them.

> Elon musk is operated by his own company. He is what he is and he does what his company needs, getting the news out and riding the obvious and claim he did it, and he caused that major movement at the market. (we know he did not)

> French Football Federation launches official player NFTs with Sorare.

Psych : they will use FUD to really push that price down until they fill in the depression stage where whales will be profitable on that death cross.

It is programmed to happen and it must, to call it a healthy market. Tendency small to mid hands like you and me are making ways to snipe that cross and call for a short. Sometimes doing nothing is the best thing to do. start selling your spot 50% incase you got left out at the top use your investment and 50% you sold to buy that efing DIP... in anycase still that is just how I always do it and it is aggressive and safe at the same time. Going High risk to security stage putting stop loss even at spot. Auto selling this coins using tools that I use like coin panel.

First 19000, then 30% correction. Buy zone at 14000.This is a mid-term analysis.

First, excuse me for oversaturated chart. There are too many lines but I just wanted to share my plan to trade Bitcoin because I think everything just lines up so nicely. I didn't have time to make new chart so I hope you can read this one as is.

Bitcoin could go straight to 19300 (white arrow) or fall to Fibonacci Golden pocket at 16640 and bounce there (yellow arrow). Near future will tell that.

Either way, after topping out between 19300 and 19600 , 30% correction will follow. All the way to another Golden pocket (white dashed line). I have buy orders between 14000 and 13300. If the 20-Weekly Moving Average holds, Bitcoin will shoot above ATH. The 20-Weekly MA and its projection are blue lines.

I'm just starting to post my ideas so I would appreciate a like. You can also follow this idea to get future updates.

Why BTC could be going MUCH lower. Part 1: The Hammer strikesMoving averages. Whether you love them or hate them, trade with them or without them the fact of the matter is that some of them are very significant, even on their own as they can act as support and resistance. Once they cross however, their power can absolutely make or break a market as seen countless times in the stock and gold market but also with Bitcoin and, most recently, its death cross in April of 2018.

What surprises me at this point in time is that not a lot of people, even the analysts that I follow and look up to, are talking about the impending MA cross that is about to happen.

The 20 weekly (red) acted as support during the entire bull market and as heavy resistance during the current (and also previous) bear market. We are currently right below it and so far failed to push (decisively) through.

The 200 weekly (green) is perhaps the most important MA in all asset classes across all time frames and, in relation to Bitcoin, represents a line that has literally NEVER been broken and in fact was the point at which the previous bear cycle bottomed/ended.

In short, these two are probably THE MOST important MAs when it comes to Bitcoin, period.

And they are about to have a cross.

Since this has literally never happened before I can only guess what the outcome of this will be. I can tell you one thing though, expect some absolutely massive volatility. Think of it like a giant hammer, ready to either demolish everything in its way or produce a spectacular piece of metal art work.

Timeframe? Assuming the MAs dont change trajectory significantly, expect the cross to happen as early as on the 8th of April but no later than on the 22th of April (blue box).

My personal opinion is that we are getting closer to our final capitulation stage. Be on the lookout for Part II and III of the series where I will further expand on my extremely bearish views for the short and mid - term.

Thank you!

1wk 200MA Strong Support vs Strong Resistance of 1wk 20maOn the weekly chart we can see the weekly 200 simple moving average(in blue) has provided amazingly strong and as of now unbroken support. On the flip side of the spectrum, we can also see extremely strong resistance from the 20 week simple moving average(in orange) we have had 2-3 months here of very little volatility but we can see that both of those strong moving averages will be converging soon most likely resulting in an extremely volatile breakout either upward above the 20 weekly or a big breakdown below the weekly 200ma. Considering the price has already broken above the 20 weekly moving average a couple times, that is favorable for the 200ma being the one that holds support and breaks above...however we can also see on the weekly stoch rsi that we are very close to a bearish cross on the weekly stochrsi which adds to the probability of the 20 maintaining support and the price action instead breaking down below the weekly 200ma....either way the decision is gonna have to be amd one way or another very very soon here and currently both the bulls and the bears have a very good chance at prevailing here...keep a close eye on boh of these weekly moving averages the enxt few weeks here because they are currently the main event heavy weight matchup in crypto.