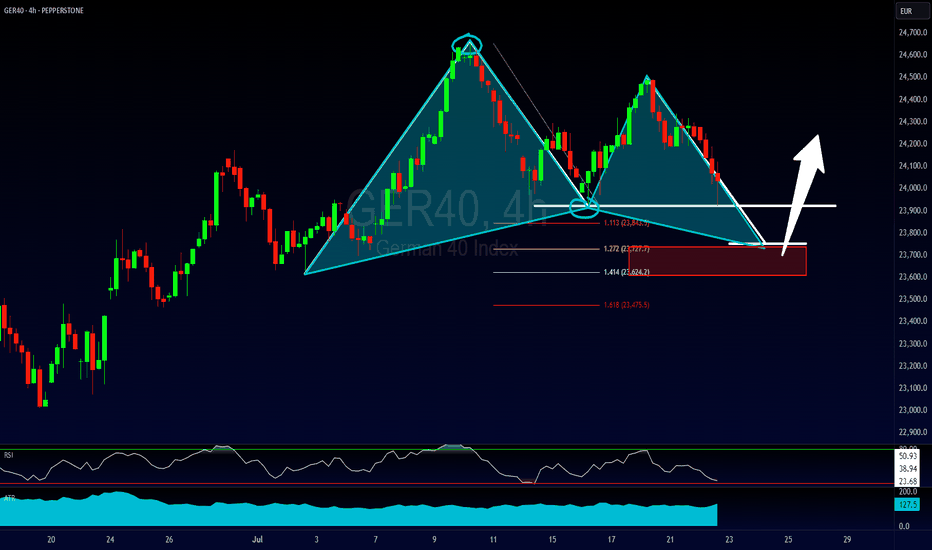

The Kiss of Death Trade & Other Reasons for EntryFollowing up on the 2618 opportunity that we looked at on the FOREXCOM:GER40 this past weekend the market has now created more potential trading opportunities to get involved.

1) A bullish bat pattern that has completed due to a result of a complex pullback into the original double bottom.

2) A potential Kiss of Death trading opportunity

3) A bigger potential bullish gartley pattern IF the current 2618 opportunity is violated.

Please leave any questions or comments below & feel free to share your opinion on the setup.

Akil

2618 Trade

(W) Bearish Setup in PlayNYSE:CPAY – BEARISH 2618

Weekly chart confirms a Technical Double Top pattern around $370–$380, followed by a textbook Bearish 2618 retracement.

🔍 Key Confluences:

Double Top confirmed, neckline broken.

Price retested 0.618 Fib retracement at $350.51 (aligning with weekly resistance).

Bearish 2618 pattern projects downside potential toward $227.13.

First support to watch: $313.97, followed by $269.02.

🧭 Bearish outlook favored unless weekly close reclaims $355+. As long as price stays below that level, sellers remain in control.

$EURUSD Analysis | Bearish Confluences in PlayPEPPERSTONE:EURUSD

The Fiber is currently testing multiple technical barriers, including the golden Fibonacci zone, channel resistance , and bearish harmonic patterns. A lower-degree double top has led to a potential bearish 2618 setup, suggesting short-term downside risk.

📉 Fractal Structure Zones

🔸 Daily fractal resistance (short-term): 1.1631

🔸 Weekly fractal resistance (mid-term): 1.1573

🔸 Intraday resistance (4H): 1.1569

🔸 Intraday support (4H): 1.1523

🔸 Daily fractal support: 1.1371

🔸 Monthly fractal resistance (long-term): 1.1213

🔸 Weekly fractal support: 1.1065

🔸 Monthly fractal support: 1.0177

A rejection below intraday support may validate the bearish setup, while a sustained break above daily resistance would question the harmonic scenario.

Happy Trading,

André Cardoso

$EURUSD 60-Minute Chart: Bullish Technical Setup in Play🚀 EURUSD Analysis (60-Minute Timeframe):

🔹 After the formation of a technical double bottom , confirmed by the breakout above the neckline at 1.0422, the pair is likely to move towards the 200% Fibonacci extension at 1.0476.

🔹 New resistance formed at 1.0447, still below the previous fractal support at 1.0453.

🔹 A bullish 2618 pattern is unfolding, with recent lows near the crucial 61.8% Fibonacci retracement at 1.0382. 📊

🔹 This setup depends on the earlier double bottom formation to hold. 🔄

⚠️ A break below the daily fractal support would invalidate this bullish setup, with targets aligned with the default target for the double bottom. Let's monitor this reversal pattern closely as it could trigger a significant upward move. 📈

GOLD 2618 TRADE AFTER CPIGOLD 2618 TRADE AFTER CPI

Hello Guys, Long time no see

After CPI data, Gold break down 2340 and fell

to 2319, Now the price pull back to 0.618 level

which is great place to short!

Aim 2290 and 2200

SL above 2360

FED is unlikely to cut the rate before Sep

DXY will be strong in the next few months

📉 Bearish ABCD Pattern: Short Signal on NASDAQ 1-Hour Chart!In this 1-hour timeframe, NASDAQ has formed a bearish ABCD pattern, with the reversal point aligning with the previous peak. It rejected it strongly. This signifies a strong resistance zone formed around the 15250 area and it suggests that bears might be gaining control. Additionally, a notable 2.618 setup has emerged, characterized by two peaks followed by a retracement to the 0.618 Fibonacci level, a pattern known for its high success rate in signaling reversals.

The 2.618 formation being represented with blue lines

With price retracing to this optimal shorting area, I am entering a short position, targeting 14950 as my first take profit level, followed by 14870 as the second, and ultimately aiming for 14750 as my target. 📉

Feel free to share your toughts in the comments section, follow me for updates and don't forget to press the like button if you think this insight was helpful 🚀💪

Complexity of an AnalysisOKX:LRCUSDT.P

First for the bullish side;

We have 2618 + Libra + Bullish Gartley we just need a last price action signal.

After position opened if it would be possible indeed, Bearish Cypher will be the maximum target and we will reverse the position.

Looking for a price action signal is very important.

May the force be with you!

Bearish 2618 Short Setup with an Ancillary Long SetupOKX:1INCHUSDT.P

Bearish 2618 is the main setup as you can see on the graph.

The level is also a support & resistance transformation zone.

Current price accumulation indicates that if the blue line breaks with solid momentum, it will be easy to reach the level which we prepare to short.

So, an experienced trader (who can stop the position if needed) may open a long position through the level at which we intend to open a short position.

May the force be with you...

Ready for Short EOSBINANCE:EOSUSDT

Strong Resistance @Mulitple Top Levels are about 1.30

Strong sell of and after recover with a Bat formation which completes @ 618 retracement

With a price action signal the setup has already in execution plan but If blue arrow happens, the position arrangement will be very easy for risk reward plan.

Good Luck Everyone!

EURJPY - 2618 PatternA 61.8% pull back after the market double bottom on the daily chart. I'm waiting for a buying opportunity on the double bottom retracement zone.

As I went down the timeframe, I've spotted an opportunity. An ABCD Pattern form and completed near the bottom of the preferred retracement zone I'm waiting for. Let's see how this trend ends.

NZDJPY - Bullish ButterflyIf you had joined us last night, you would have seen how we use the Double Top Retracement zone and project a Bullish Butterfly completion that hit our final target level.

The market sort of did a rebound after it "woke up" from the ungodly hour.

Check out the live stream and you can see how the analysis was done at , you could watch from the start and learn how the zone was plotted.

www.tradingview.com

GBPUSD-Weekly Market Analysis-Aug21,Wk1An emerging bullish bat is about to form within the buy zone(blue box) is usually a great setup for a buying opportunity I will engage. However, this setup wasn't the Grade A setup and that is because Point C is a double-top, for such a setup it poses a threat of a break and closes beyond Point D completion.

As a thinking trader, I will be waiting for a candle confirmation at Point D, before engaging the buy trade, and even better, if the market retraces back to 1.3950 before the Bat Pattern completion, I will head for the shorting opportunity.

NATGAS Gartley HarmonicNATGAS, has produced a Gartley pattern after testing resistance, could be a good time to short it down if price action agrees. Targets towards $3 could produce risk reward ratios of 1:3.

EURUSD-Weekly Market Analysis-Jun21,Wk3If you have missed the Bearish Shark setup which completes at 1.2260 that I've shared on 16 May 2021; short on Parallel Channel at 1.2190 that I've posted on 6 Jun 2021; you probably won't want to miss to short within the range of 1.2150-2.2159 or at 1.2167 on the 1hourly chart, that's the price range and it's potential for a pull-back.

Click follow so you won't miss such an opportunity again.

Coincidently, my student share the same thoughts on the trading strategy, have a look, link at the bottom.