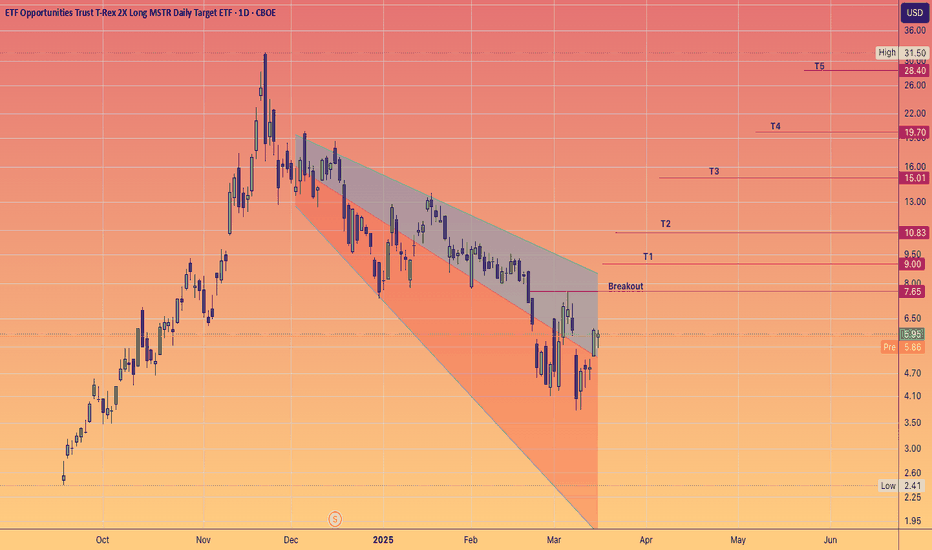

Double down like Michael Chad Saylor - MSTR ----> MSTU 2X"Are you convicted?"

Of Bitcoin achieving a new All time high if so Saylor will greatly rewarded and lauded.

MicroStrategy's unwavering focus on acquiring Bitcoin through unconventional financing methods, rather than building a sustainable revenue-generating business, carries significant risks, especially if a major bear market were to hit the cryptocurrency sector again. This exposure to Bitcoin offers a distinctive investment opportunity for those looking to gain leverage in the crypto space without direct participation.

While MicroStrategy's inherent volatility may deter more traditional investors, it also provides a platform for those eager to engage with market dynamics. The MSTU adds an additional layer of volatility, but unlike options, it does not have an expiration date.

Investors should closely monitor Bitcoin's market fluctuations, as these directly influence MSTR's stock price, potentially creating advantageous entry points for savvy traders.

2x

$ZIM has 50-100% Upside from $20- This is a shipping company in Israel whose fundamentals are getting stronger.

- It has 3500+ employees as per linkedin.

- It's trading at P/E of 1.82

- Stock based compensation isn't the issue has outstanding shares have remained stable for last 4 years.

- Trump in office will lead to stability in the middle east and high probability of negotiation and ceasefire.

- There are lot of tailwinds to push this company's stock higher.

- Discounted cash flow analysis estimates a fair value of $66.11, indicating the stock may be undervalued.

- Using Peter Lynch's valuation method, calculates a fair value of $298.57, implying significant undervaluation.

Bull Flag On The DailyWell well well, this looks familiar. I wonder where I seen this before? Beautiful Bull Flag on GME daily. Once we fill the bottom of this wedge around the $20 mark, its go time back to $30. If we break $30, this could head straight back to $60... Once again, get your tickets, because this is a show you're not going to want to miss.

$ALT will become a #100 coin easily. Last i took a trade on KRAKEN:JUPUSD around $0.5 (now $1.60+) and i think all of those coins will easily 2x the marketcap.

Yesterday i bought Altlayer on the backtest. Not for fast gains, because we can go lower. But in the end this coin will easily do a 2x to $1. 3-5 months. Maybe faster depends on the market.

MAPLE COIN BUY ALERT!! 70% - 100% GAIN!!!Looking at MAPLE's current condition, it has been falling since the bear market and has taken a brutal hit ever since. However, price have been gradually increasing, especially the beginning of 2024.

Analysis:

Price has traded and broke old highs, causes people to believe it will increase in price, causing people to FOMO and invest at the top. Price dips down, cause people to sell for a LOSS. I strongly believe, this will now give the room it needs to pump upwards to 70% - 100% GAIN.

Part of all this is thinking like a bank would, If I owned most shared, I would want to drive price and take peoples money and then trigger their buy stops, dip it back down so people can sell off so I can buy more and aim for higher prices!

Price has been showing to reach new highs. Respecting +OB and not filling in the gaps. Currently, it is at a Discount price, hitting a +OB and GAP fill. I believe this the most perfect time to get in on this.

HOOK/USDT 2x Potential HOOK breaks the wedge. Two trades can be entered with a pullback towards the wedge. Additionally, a long trade can be made when the candle close is above 1.05. Horizontal lines are possible TP points.

These are my personal transactions, they do not contain any investment advice.

ETHBTC is about to make a historical moveAnything that follows is not to be taken as financial advice.

This is the Binance weekly chart for ETHBTC, with a single indicator loaded on: the Bollinger Bands Width Percentile.

The BBWP is a volatility indicator that measures whether or not we should be looking for the price action of the examined asset to contract or expand in relation to its own past volatility, calculated by the BBW.

Simply put, it tells us if we should be expecting the asset to be in a mostly sideways price action, or if it's appropriate to look for expansion.

Make no mistake, volatility is a direction-neutral indicator, meaning it's inherently neither bullish nor bearish.

We can see some flashing red and blue bars in the background, they're there to warn us about an extremely high (red) volatility environment, or an extremely low (blue) one.

Generally, when the asset is in an extremely high volatility environment, it's wise to expect it to cool off, therefore looking for price action to generally reduce its turbulent behavior.

This implies the exact opposite for when the volatility is extremely low.

With default settings, which I'm running, extremely high volatility is considered to be between 98% and 100%, while extremely low volatility is found between 0% and 2%.

Let's focus on the blue bars for this analysis.

Only once in the history of this chart, two weeks straight of extremely low volatility can be observed.

From there, the expansion led to an initial move up, and then ultimately a move down of -26.95% from the open of next week to the lowest point of the move.

Right now, ETHBTC is waiting for a massive expansion after twelve weeks straight of extremely low volatility.

If it was to expand to the downside from this point, a move of roughly the same impact would see this asset retest the june 2022 low.

However, spending more time contracting, usually means having a more explosive move when the time comes.

In the case of a downside move, I don't think it would be too crazy to look for a retest of Q1 2021 highs, anywhere around the 0.045 level.

That would make for about a -33% move from here, but I'd say there's fair concern for said move ending up being more destructive than that.

This could happen along with BTCUSD breaking into a new bull market while ETHUSD fails to catch up just like it did in the past, although that's just speculation on my part.

Remember, volatility is direction-neutral, while price action might look bearish right now, there is no way to tell where a future sustained volatility expansion might lead this asset to.

Personally speaking, I believe that if it were to expand to the upside, a retest of the ATH would definetely be within reach, seeing as ETHBTC has been consolidating for about 22 months.

It would certainly result in a massive move, more than a 2x from here, since the ATH is around 0.15 and the asset is now trading at around 0.067, but we've seen crazier things in crypto.

Whenever the expansion happens, and wherever it brings ETHBTC to, good luck and stay safe.

EPIK Potential 2X from hereEPIK cryptocurrency is currently displaying a double bottom pattern within a falling wedge formation, indicating the potential for a bullish reversal. This technical setup suggests that the selling pressure may be diminishing, and a price recovery could be in store.

Based on this analysis, there is a possibility for Epik to experience a potential 2x increase from its current level.

Looking forward to read your opinion about it.

XAUUSD 2XFirst, a global economic crisis could lead to a loss of faith in traditional currencies, driving investors to seek the stability of gold. Additionally, geopolitical tensions could escalate, leading to increased demand for safe-haven assets like gold. Another possible factor could be advancements in technology, which increase demand for gold in electronics manufacturing. Finally, a decrease in global gold supply due to declining production or increased mining regulations could also contribute to a rise in gold prices. Regardless of the reasons behind such a surge, it would undoubtedly have significant implications for the global economy and financial markets.

DINO Coins will OUTPREFORM BTC! (And no I don't like BCH)DINO Coins will OUTPREFORM BTC! (And no I don't like BCH but the Charts NEVER lie.)

Sitting above Daily 200 EMA with strong momentum still.

Euphoria is entering the market.

KEEP AN EYE ON DINOS!

This is the 3rd Example of 2x plays that can possibly play out by Mid FEB!

ENTRY:

100-125$ and HOLD

SL open or 25-30% of DCA Entry.

TP 1/8 50%

1/8 75%

1/2 100%

Remaining runner 150%

Signs why Below:

Buy above 4h 200 EMA

(With Smaller Bullish patterns)

Confirmed Breakout

(Look at RSI , Trendlines , Volume )

Look for catalyst News

(Anything that rehypes the shitcoin, or it's bluechip chain)

Buy SPOT ONLY and HODL!

Swing until 2x profit, or weakness. no SL but if needed a loss of 50% would be a SL

FIND THIS IN OTHER SHITCOINS AS WELL!

PLAY THEM ALL

BTW there is an order to this, I will not share it, you will need to DYOR.

but this is a prime example which will likely 2x by MID Feb

CELOUSDT - Oversold (2x - 5x return)Consider the 2D USDT pair above:

1) RSI is in oversold, "buy zone"

2) Bullish divergence as drawn

3) Price and RSI breakout on 3D BTC pair

4) Dragonfly doji printed on 5D BTC pair after large downtrend, signifying trend reversal

Targets (initial): 1.5 - 1.6 - 2.3 USDT

Timeframe: Weeks (don't know exact number)

Leverage: 3-4x ( if we get a green candle close above the dragonfly's close in the 5D BTC pair chart, then chances of upside are even larger. Carefully manage risk. )

Big R/R for loom, worth a tryloom might be worth a shot here for bounced from long-term BTC pair support area

$XRP Primed For A Big Run$XRP is on the verge of breaking out of upward resistance from April of 2021. After two rejections from this resistance, the price has finally broken through. There was a breakout on the daily yesterday as well as a successful retest. If the price can close above the resistance on the weekly, we are primed for a big run. As you can see, there is a lot of room to run on the weekly RSI as well. A 2X run up to $0.91 is minimum in this spot. The next two targets are $1.35 (3X) and $1.97 (4.5X).

I will be keeping a close eye on this one over the coming days.

DEGO/USDT huge gains expected Hi guys , BINANCE:DEGOUSDT is undervalued , low market cap

Right now I can see there is a great movement

Entry : 1.9

SL: 1.81

Tp1: 3

Tp2: 4

I would prefer hold this gem for 2 or 3 weeks , if it close above ema 200 , then you can expect more gains , as well as " 15 September is important day for dego"

" LAST time I gave FIDA/usdt , which went to 20% in 2 days

* NOTE : This is not a financial advice

Thanks , please like my idea

Antusdt %50 just less than one week go to the Moon 🌕🌕🌕🌕Ant have big potancial

7 USDT short term target 🎯🎯🎯

Time to buy again and wait.

Good luck 😃🤞😃🤞

MaticUSDT shot %90 so close 🎯🎯🎯Magic fastes reaction,

Trying to break upper trends now,

If it's can,% 90 target so close, just flow.

Uranium Preparing for an 80% Move UpwardsThe SPROTT Physical Uranium Trust TSX:U.U is showing a triangle formation on the daily chart. There is a number of reasons why I am inclined towards higher Uranium prices:

1. Rising inflation.

2. Rising commodity prices.

3. Supply chain problems (although doesn't apply to Uranium that much).

4. Energy Crisis!

5. The world starting to see that Nuclear energy is the proper choice forward until we can transition to fully renewable energy infrastructure in 50 years or more. (this one will not affect price soon of course).

6. Uranium is not expensive as fuel at all. It costs only 5% of the annual expenditure of a nuclear plant. So price has a lot of room to go up before it's considered too expensive.

7. We have a Physical Uranium Trust now. So the market has direct exposure to physical uranium that was never there before.

With all that, the move hasn't yet been confirmed because we haven't broken the top of the triangle yet. Keep watching this post as I update it. If you are interested in this trade, set up an alert on TradingView and follow me for an update for my trade setup.