3D Stocks waking up to a post-Covid worldHas been steadily breaking out if this not too pretty inverted head and shoulder formation. After that the real work begins to get past the base constructed since the slump of 2014. This could still be a bumpy road, perhaps even see construction of another shoulder before eventual break out. For now on its way to its target of 12.38

3d

XRP 3D - Monthly ResistanceCurrently at the monthly candle closes this huge spike, still think we need to pull back to sub $0.20 before any major $1 moves in my opinion.

Either this moons in January or November i don't see it being this year though it would be nice, a cross point has just shown itself now.

Lets see if this fib plays out and how these daily canldes closes, the weekly also closes tomorrow so this could be a huge turning point, I think we're parabolic above $0.65 but for now lets not get too greedy.

See how tomorrow ends init 🤞🤞

XLM (Stellar) - 3D ChartOut of all the pairs, XLM seems to have the cleanest set up for the bias I still have, XRP has done bits this week which I was not expecting but I still dont think this is a parabolic bull run.

Another drop across the majority of cryptos abiding by this current fib retracement and hopefully the extension as well being a huge buying opportunity again.

If we keep flying I can only hope you were here in March.

I’ve started a little Trading private group Containing quality updates and profitable opportunities. We just started this week and you are welcomed to join us . First 25 members get a special price...check my profile.

P.s. you get your money back within 30 days if I’m not bringing YOU quality IN TRADING .

NNDM testing yesterdays moveHello, everyone and like before warning of a dump was common in a penny stock catagory and well we got it, so should you buy, hold, or sell? Well you know me the tech with company is amazing and I believe its undervalued as a whole. I have re-entered a postion at 2.7 and 2.5. Now looking at the chart we are testing the range of a support area at that 2.98 range this morning, but its premarket. Most of the investors are bearish cause of the "undervalued" buy at $2 NNDM did.

Now about this offering this was in talks assuming it started at the $.75-$1 range, which me made to think this idea that NNDM was actualy getting a great deal at the time, until they got that technology breakthrough which nobody can predict when stuff like that happens. I'm still bullish on the fact that they spent more money on R&D than their earnings. They even cut operation cost. Now I'm probably hyping you guys up so sorry, but lets go on to TA than more discussion on why the bullish out look is the strong.

TA

-We are testing that 2.98 range premarket and have pumped instead of dump, yet its 50/50 yet I don't believe we will hit $2 if we do dump

-EMA is at the $2 area ironically, but is bullish, yet a dump to $2.12 could happen, so put buys around $2.20-$2.30 if you dca

-We already had a pretty good correction at 2.40 giving it a 50% correction, but like the graph shows a 70% to $1.44, for my crypto friends. Is a possibility, yet i think sub $1 is out of the picture for now.

-MACD is bearish, but could be turning bullish on market open.

-RSI is overbought, yet we are dealing with an unusually moment.

-Target is $4.09 if we are gonna go sideways and weed out the moon buyers.

Now the news

-NNDM has tweeted out that the US air force is looking into using 3D technology on is future weapons, which on money saving its the smartest this thing they can do to cut military spending, so NNDM technology could be used to design the next military weapons and even gear.

-The $2 offering of roughly $35million dollars go live today, not public one investor. i think this is good and shows that investors have confidence in NNDM for the future.

-Alot of analyst are putting this as a buy and some have taken NNDM out of the penny stock territory and valuing this as actual company.

Now again im long on NNDM long term and see great potential, yet it was the moon investors, that have been caught and has increased our selling preasure. I believe my postion at 2.50 is safe, yet 2.7 might test my manhood on holding. I do see more bullish momentum the next 60 days.

#gold - Sideways/Slow Rise to continue?Hello Traders,

after Gold has been doing well recently, it made a rather poor breakout attempt on high volume and got declined (for now) but NOT being pushed back below the key-level and is now floating

without producing any major bearish signals here. It is absolut within possibilities we see a slow further side / rise up to the Pivot Cluster R3-Q and R1-Y, and this could fairly take months!

We have seen on this ride up twice the same situation regarding bullish signals on supports of MA50 and cloud combinations. Stops: Considering $1530 for Swingtrades a good one, simply cause chance are high you can buy back lower if this price is reached again.

For long-term investors this is a different story: $1446 is a range, but also likely keeps you within the growing process and if it falls below the Yearly Pivot, you really wanna be out.

Cheers guys.

Neru

#xauusd - Does the rise find an end soon? #goldMight be a little disbelief right now, that the formerly mentioned "pump" really happened, but yes, it did and is the question are we finding a resistance now or are we going further up to the Yearly Pivot Resistance 1.

Gold is trying hard to overcome the mid term trend line (red) and I am clearly going to warn about possible fake outs at this point.

Whoever of you has been riding this after the break-out, should become more cautious towards possible profit taking now.

The Year started green all over, but January has not to end like this. There are all three options completely open here, though to also mention, Gold is has been overshooting overbought conditions and has been rising in demand.

As usual I have marked possibilities and important mid term levels to look at, watch out for things as engulfings or large wicks on 3D possibly turning this bullish picture. The most likely are where stop losses are situated at the moment is just around 1550-1530$.

So no need to panic sell at this moment.

Neru

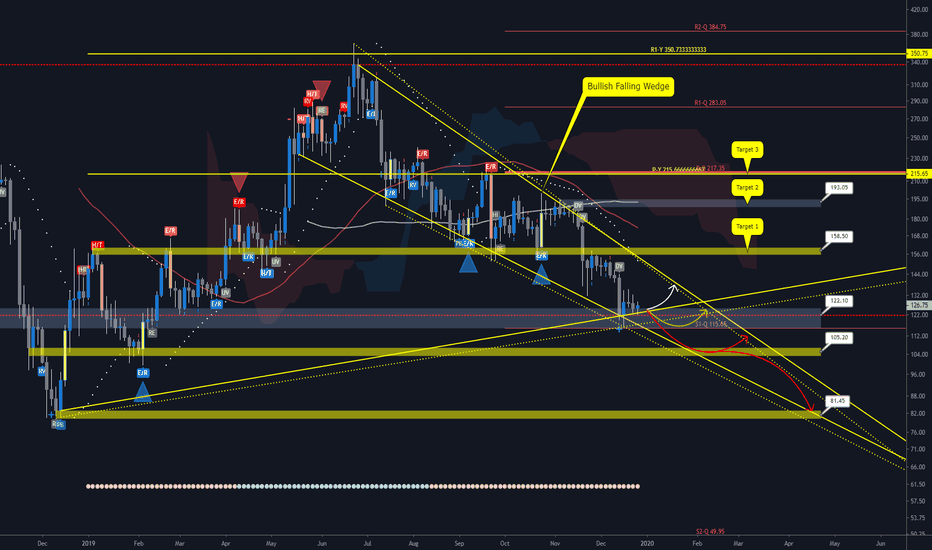

#ethereum - 3D outlook, #bullishfallingwedgeHello guys,

been a while since I updated Ethereum, so here we go on a higher timeframe, my favourite the 3-Day.

As you can see, the gigantic bullish falling wedge is still forming out. The big question is: Has it found bottom now, or is it going to go lower, even down to levels such as $80.

Recently the Quarterly Support 1 Pivot has given Ethereum some form of stability to maybe able to grow back to the out falling trendline, where the next decision hotspot is located.

I have marked possible ways and all significant levels for you as usual.

If ETH is going to lose key-level in this area, it is very likely we will see the minimum $100 as psychological possible turn around, this is entirely open and strongly depends on Bitcoin´s

start of the Year 2020. Please be aware the last falling wedge resolved bullish and went to target 2on Daily.

_________________

Neru

#bitcoin - 3D Overview Good morning guys,

first of all a very happy new year 2020 to all of you, I hope you are going to have a healthy, blessed, joyful and successful year and will achieve your personal goals.

My holiday is over as well. Over the next days we will have a look at different assets on different time frames to get a better overview of things happening.

We are starting off with Bitcoin on the 3D interval.

With an oversold Bitcoin mid December and a channel bottom line bounce (Daily Downtrend Channel), we received a potential long-entry by forming out a proper bullish engulf on 3D and recently also on the Daily.

For now, also a key-level above $7k seems broken. So big question, are we totally bullish just yet? Sadly the answer is still no.

I have pointed out a couple of times that the new Pivots Quarterly and Yearly will be very similar and together with the key-level been forming since June 2019 building a massive massive resistance zone between $7.700 and $8200 roughly.

As long as this is not broken with proper volume increase (or at least afterwards), the picture remains very unstable in terms of possible drops.

This is a danger-zone and January is famous for bigger drops consecutively. (Obviously history does not have to repeat)

As usual I marked important levels.

__________________________________

Neru

LONG - LEND - Bullflag1d chart showing a bullflag with good volume and ready to go. Inside the 3D ichimoku with a tenkan cross, good r/r.

Entry: 0.00000147

TP 1: 0.00000185

TP 2: 0.00000221

SL: 0.00000129

CryptoCue is not providing investment advice and is not taking subscribers’ personal circumstances into consideration when discussing investments. Investment involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire position.

CryptoCue is not registered, licensed or authorized to provide investment advice and is simply providing an opinion, which is given without any liability or reliance 1.71% whatsoever. The information contained here is not an offer or solicitation or recommendation or advice to buy, hold, or sell any security. CryptoCue makes no representation as to the completeness, accuracy or timeliness of the material provided and all information and opinions provided by CryptoCue are subject to change without notice and provided on a non-reliance basis and without acceptance of any liability or responsibility whatsoever or howsoever arising. You hereby irrevocably and unconditionally waive, release and discharge: (a) any and all accrued rights and/or benefits you may have against CryptoCue in respect of any opinion expressed or information conveyed by CryptoCue at any time; (b) any and all Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time; (c) CryptoCue from all and any claims (whether actual or contingent and whether as an employee, office holder or in any other capacity whatsoever) including, without limitation, Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time. ("Claims" shall include any action, proceeding, claim, demand, judgment or judgment sum of whatsoever nature or howsoever arising.) You hereby agree to indemnify and hold harmless CryptoCue in respect of any and all Losses paid, discharged, sustained or incurred by CryptoCue in the event of bringing any Claim against CryptoCue. (“Losses” shall include any and all liabilities, costs, expenses, damages, fines, impositions or losses (including but not limited to any direct, indirect or consequential losses, loss of profit, loss of earnings , loss of reputation and all interest, penalties and legal costs (calculated on a full indemnity basis) and all other reasonable professional costs and expenses and any associated value-added tax) of whatsoever nature and/or judgement sums (including interest thereon).)