3m

3M (MMM) Bear Flagging into EarningsIn this January bullish market, bear flag breakdowns have mostly led to flat lines rather than massive drops, but given 3M's China business, and a week already full of dismal earnings reports, it can be expected that this bear flag will play out as a minor decline in the short-term stock price. There is fresh demand in the low to mid 180's, and even if it falls below our target of 187 (very possible), it will likely bounce back into a mid-range demand zone.

I'd short it with or without earnings tomorrow.

Large scale look at MMMI actually am not doing anything with it. Just sharing.

This is the massive pic of the 3M stock. Note that there is a large scale channel down pattern. However, I think that it will get squeezed in between the resistance of that channel down pattern and the Fibonacci retracement level, which is shown on the chart.

MMM ShortI did a discounted cash flow valuation on 3m assuming a revenue growth rate of 5%, in line with 10, 5, and 3 year historical averages and it produced a valuation of $135. A 41% downside valuation... When I saw this I questioned the legitimacy, but played around with revenue growth rates and found, that, to justify it's current valuation of $236.55, MMM would need to see top-line growth of 12% YoY.

Leave a comment and let me know what your thoughts on MMM are, for now I'm short them, but would love to hear some other view points.

3M-LongThis chart shows that a MACD crossover will happen soon and recent price action is positive. This follows the Dow and could see resistance at 240. However, this company has better than expected earnings and strong growth. Therefore I am long with calls. Up 70% in three days.

Target is 249. Happy hunting.

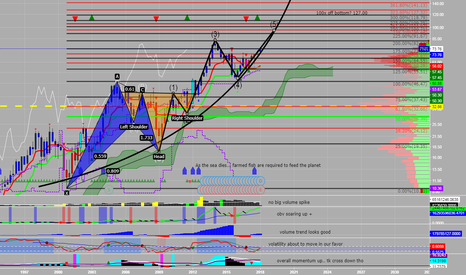

PNR Quarterly ChartPentair makes all kinds of equiment for fish farms which will be required in the not too distant future to maintain population growth as the seas continue to decline.

I see 30% pretty easily in the next few quarters. 100x off the bottom is 127 dollars another key level to watch if we dont correct very much after my (potential) wave 5 completes

Be sure to manage your risk

gl hf

xoxo

sn00p

3M, Good time to buy or just getting started?3M's earning report came up a bit short, however they have had continuous growth. Looking at this trend in the long term I believe we've hit a temporary top. I believe we will test sub $190 prices before we potentially continue the bull trend. I also don't think it's unreasonable for it to tap $175-$180 although I do think that's unlikely.

I would look to go long around the $185 mark with a target of $205, it could hit $225 if trend continues.

DOW JONES OVERVIEW: 3M RISKS TO TEST 10-YEAR TREND3M price is in a very tricky situation...

On long term basis it failed its 5-year (260 weeks) uptrend test by falling below the 1st upper standard deviation from 5-year mean. It's 10-year uptrend is still intact, as price is trading above upper 1st standard deviation from 10-year (520 weeks) mean.

On short term price is in downtrend on quarterly basis (below 1st st deviation from quarterly (66-day) mean, which is now allinged with upper 1st standard deviation from 5-year mean)

Price has also fallen below upper 1st standard deviation from 1-year (264 days) mean, risking downtrend on 1-year basis.

Thus if 3M continues to trade below 1st standard deviation from quarterly mean (149) and below 1st standard deviation from 1-year mean (144.75), it risks to retest the 10-year trend border, marked by the upper 1st standard deviation from 10-year mean (130)