4-year

Gold Futures ready to popKeeping an eye on the relationship between the Gold Futures and the US 10 Year Yields.

Currently, the yields are coming off their highs, but the Gold hasn't reacted yet. If we get a breakdown in the US dollar, that will be the catalyst I am sure and currently, the US dollar index is finding resistance from old support.

Jobs data was good today, but there is a chance that NFP doesn't meet expectations as there are some lofty numbers being pushed around.

Cyclical activity: getting into the statsStatistics (all ranges in percentages)

EURUSD from Jan 2001 to Dec 2020

AUDJPY Apr 2003 to Mar 2021

USDCAD from Jan 2001 to Dec 2020

EURGBP from Jan 2001 to Dec 2020

Summary

January, May, September, October have the largest OC ranges;

February, June, July, August, have the smallest ones;

January, March, October, November have the largest HL-OC;

April, May, September, December have the smallest ones;

June has the worst OC/(HL-OC) of them all;

April, May, September have the best ratios;

March, June, August, November the worst ones.

What I might deduce is April typically has a small but solid trend that maintains its gains, May continues it (strongest of all months), then in June it ends and corrects.

February I can't draw any preliminary conclusions, March trends average but fails hard eventually, if Feb starts a trend March will end up, probably in gross sideways chopiness.

September starts a trend and goes from 0 to 100 the fastest, unsurprising.

October continues the september trend and also is a big trend ender.

The data I checked sort of confirms my bias.

I can predict a bit in February,

January, March, April are not very active

May-June are good, I've been predicting reversals

July-August it depends

September & October the best, september trend but even reversal and those go far

February reversals don't count on them to continue...

March is unpredictable afaic but catching a move can be a 10-bagger+

Starting from late Feb actually, to mid-late March I'd say, then exit

I expect nothing out of November & December

So....

Another one, summing up how I see when to follow, when not too, and when to hold a little a lot or not at all:

April going to be calm but not too calm hopefully. I wonder if it is the same with stocks? European ones? I wonder what I can do about it?

The year is mostly done in February (sometimes January too), May-June, September-October, and sometimes the summer is easy. 5-8 months / 12.

What to do the rest of the time? Sell strangles? It's not simply of lower volatility it is much more random with sometimes the same ATR.

Just backtesting and analysis and learning? What industry is active in March-April & November-December, vacations?

This has to be studied but perhaps I can buy in April a call or put with a June expiry in anticipation of a trend.

This looks like a retest of the 1.32-1.5 bottom range we saw This looks like a

retest of the

1.32-1.5 bottom

range we saw from

2012-2016

usual we test a old low as a new high.

I am not saying we cant go higher we can but we could also go sideways for years

but

I hope we head back down to new lowers lows, why would i hope for such a bad thing?

I have my reasons.

Not financial advice.

This is my personal trading journal.

I'm lucky if I get 3 likes.

10 year bond - OverboughtRSI overbought

and I think 10 year bond is in a cup and handle formation.

I see a crash or big correction in 6-10 months in the stock market.

Conclusion is that short on bond and still bullish in the stock market and I think we will push back to higher level in short time in stock market.

Gold Longs / Charts flipped Calling longs ahead of NFP tomorrow. Pretty controversial for the retail industry, but my mind works different... And I have a diff edge in this market. Don't trust me? Im I a crazy as* mf ? Maybe ... But if you want to win im urging you to go long... IF you want to get wacked keep selling your trend based on your shitty mainstream information. Anyways good Luck. Hold into the prev year highs if you want but you need some strong balls to do that, im doing it... as my profile says im a investor not a retail day trader. Lets make the bag babyyyy

10-year TN futures buy opportunity ZN a large breakout of the VWAP indicator with a strong green candle and a wicked low plus the breakout of the trading range with a large candle that is higher than the other candles this means that the buyers have entered this market and the start bullish trend.

signal buy .

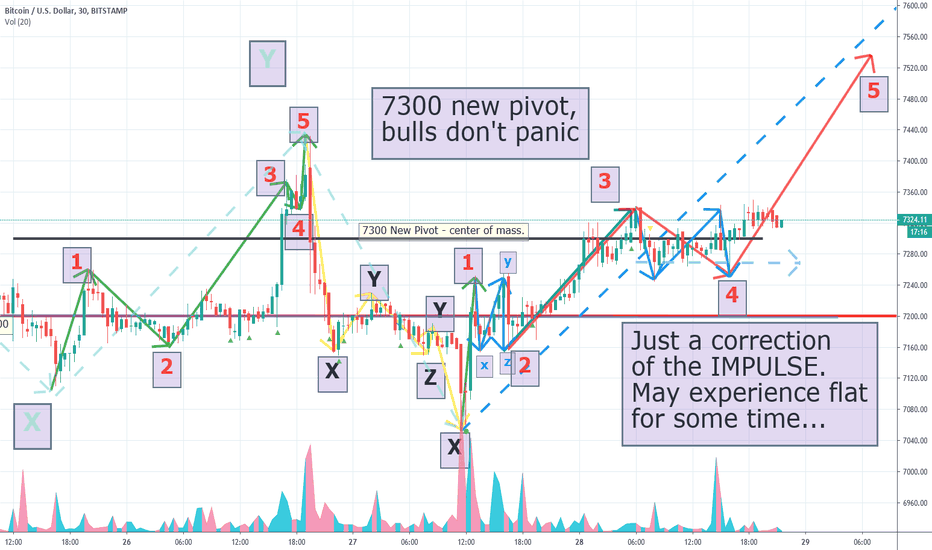

Bullish confirmation came in.Remember what happened earlier...

1. We have been continuously defending 7200 pivot,

and all the shorters in the world couldn't bring us down to 7100!

2. All previous bearish moves, all consisted out of typical correction forms

which proves that bears finally lost their power.

Bitcoin is now considered cheap if it is sold at 7200.

3. We have been experiencing a prolonged flat around pivot 7300.

This flat accumulated a lot of orders, both sell and buy.

Nevertheless we rocketed up to 7550 and even then! We didn't fall

(as we certainly would if the bears were strong).

4. Now we can observe a little slide back down to 7350,

defending the 7400 pivot. If this flat will continuously bounce around

7400 pivot(7387-7425 levels), then It becomes clear,

that big players are no longer shortening!

A few hours 'till the asians wake up at 00:00 UTC and we will definitely

see a lot of volume kicking in.

There may be a pump up to 7600-8100 or a bottom retesting at 6900.

In any case here it comes!

Trading The End Of Year Cycle, Is This A Major Low?Many people have pointed out that BTC has a history of making a major chart transition at the end of December of each year going back at least to 2016 when it broke to the upside and never looked back. Then it made a major top around 20k around the end of December 2017, then a major low the end of 2018, and now recently it just crashed but snapped back the end of December 2019.

The only time it made a continuation to the down side at the end of the year in the chart was in 2014. All other times if it declined at the end of the year it was only after having run up a huge amount which made the end of the year a top.

So since BTC has recently been declining I am looking for this to be a low.

Even if this does turn out to be like 2014 and it continues lower, the pattern would be that the next two years would be huge continuations to the up side with few pullbacks to get in.

The two most likely paths are:

1.) This is a major low and next year ends much higher (green path on chart)

2.) This is a continuation downside, then next year is a major low followed by two continuatons to the upside and a major top in 2023.

In either case the next major top is likely to be far higher than current prices so I think this is an area for long term accumulation and not capitulation for my long term accounts.

Cryptos as a whole are making inroads in places they never existed before, such as the ECB, Facebook, the US Congress, etc.

Therefore I am looking to gradually dollar cost average on any continued weakness for the next full year.