GBPJPY: Bullish 5-0 Setup on the 4-Hourly ChartFrom a higher-timeframe perspective, GBPJPY might seem like it's perfect for a shorting opportunity, but that doesn't mean there aren't great opportunities to go long as well.

Right now, on the 4-hourly chart, I've spotted an interesting Bullish 5-0 setup. To many traders, this might look like an invalid entry. But here’s the catch—if you know how to interpret candlestick patterns correctly, this is exactly the kind of setup that can pay off.

Here’s the Plan:

Bullish 5-0 Pattern Entry: Keep an eye on candlestick confirmations at the current zone.

Risk Management: Identify the key levels clearly—once price reaches these levels, shift your stops to entry to achieve a risk-free trade.

Key Reminder:

It’s not always about being right in direction; it’s about spotting clear entry setups, managing your risk effectively, and protecting your capital.

👉 Golden Rule: Secure a risk-free trade as soon as possible!

Have you traded the Bullish 5-0 before? Do you have similar experiences spotting opportunities against the broader trend?

Let’s discuss below! Happy trading, everyone! 🚀

5-0patterns

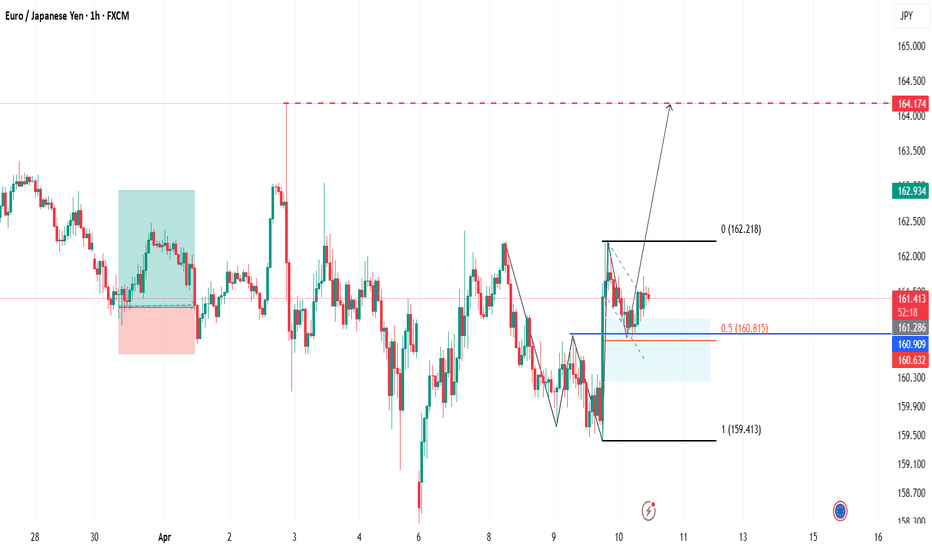

EUR/JPY Technical Outlook: Demand Zone Bounce Sets Up RallyGood Morning Traders,

Trust you are good.

Below is my analysis of the EURJPY pair.

Overview

Price is currently at 161.243, showing signs of a bullish rebound following a sharp drop. A clear bullish structure is forming, characterized by higher lows and a breakout from a recent consolidation zone. The demand zone between 160.900 and 161.100 has held strong, acting as a reliable support level.

Idea

A recent bullish impulse broke above minor resistance, followed by a healthy retracement into the demand zone—shaping a potential bullish flag or continuation pattern. This retracement aligns with the 50% Fibonacci level, providing added confluence for a continuation to the upside.

The projected target is 164.174, a level likely to contain buy-side liquidity and act as a magnet for price in the short term.

Conclusion

Despite macro uncertainty due to ongoing trade tensions, recent news of a 90-day tariff pause from Trump has eased some pressure, allowing the EUR to show resilience. As a result, EUR/JPY may continue its bullish push toward the 164.174 target. However, a break below 160.245 would invalidate this outlook.

Cheers and happy trading!

Nifty has technical potential to reach 20,300 by end of June'25With the current situation of Nifty and Global market, Nifty has formed 5-0 pattern.

There are following conditions that can lead Nifty towards 20,300 by end of June'25. There is a gap of 4th Dec'23 and potentially it can be filled.

Target1; 21840 If Nifty close below 23250 on Week Time Frame

Target2; 21000 and it will be strong support

Target3; 20300 to fill gap of 4th December 2023

Bullish Flag Breakout and 5-0 Pattern Combo TradeI'm closely monitoring AUDCAD, and here's why:

1. Bullish Flag Channel Breakout on 4-hourly chart:

- AUDCAD has recently broken out of a Bullish Flag Channel on the 4-hourly chart.

- This breakout suggests a potential bullish move in the market.

2. 5-0 Pattern on 1-hourly chart at 0.8829:

- Waiting for a retracement, I'm eyeing the completion of a 5-0 Pattern at 0.8829 on the 1-hourly chart for a potential long opportunity.

- Utilizing a combo trade strategy to manage risk and enhance returns.

This combo trade involves combining the breakout from the Bullish Flag Channel with a harmonic pattern entry on a lower timeframe (1-hourly 5-0 pattern).

Feel free to share your insights and trade plans for AUDCAD in the comments below. Check the chart link for a visual representation.

Bullish 5-0 vs. Type2 Bearish Shark PatternIf you're navigating conflicting biases, here are two potential setups:

1. Bullish 5-0 Pattern at 149.96: Long Opportunity

- Engage in a long position based on the completion of the Bullish 5-0 pattern at 149.96.

- This pattern signals a bullish bias, providing an opportunity for traders expecting an upward move.

2. Type2 Bearish Shark Pattern at 150.67: Shorting Opportunity

- Consider a short position if the Type2 Bearish Shark Pattern completes at 150.67.

- This approach factors in the possibility of Fed rate cuts in June, potentially influencing a bearish move.

As a trader, it's essential to weigh the conflicting signals and align your strategy with your overarching market outlook. Feel free to share your preferences and insights on these setups.

Navigating Contrasting Trends for Optimal Trading StrategiesThe 4-hourly chart showcases a compelling Bullish 5-0 Pattern retest accompanied by an RSI Divergence.

While direct engagement in the trade is an option, I'm personally inclined towards waiting for a Bullish Gartley Pattern retest around 186.39.

This approach significantly mitigates risk while still allowing for favorable profit potential—a strategy centered on lower risk for higher returns.

What are your thoughts or trade plans on this opportunity?

Feel free to share below!

Navigating Contrasting Trading OpportunitiesGBPUSD is currently indicating a Weaker Bull Trend . Here are potential strategies for different trading approaches:

Trend Traders :

Waiting for a Bullish 5-0 Pattern on the 4-hourly chart at 1.2334 might align with your strategy as it complements the ongoing bullish trend.

Counter-Trend Traders :

For those seeking a counter-trend opportunity, a shorting opportunity off the Bearish Shark Pattern retest at 1.2453 or the completion of a Bearish Gartley Pattern on the 1-hourly chart at 1.2478 could be of interest.

Each approach carries its risks and rewards. Ensure to align these strategies with your risk tolerance and trading plan. Best of luck with your trading decisions!

A Promising Trading StrategyThe star trade of the week. I'm currently waiting for a shorting opportunity on the bearish shark pattern off the weekly chart.

Trading off the weekly chart directly would send my initial risk through the roof. While we could always reduce our trading size when trading off the higher timeframe, it doesn't make sense to me.

I'll be waiting for a bearish 5-0 pattern to complete at 110.56. My initial stop-loss is at 110.96, which is approximate -40pips or -400USD/lot.

My first target is at 109.96, which is approximately 1,000USD/lot.

However, there's also a bullish shark pattern that has completed at 109.96, so there's no reason why you can't engage on that as well.

Remember, it's important to plan your trade and trade your plan. Never follow any trader blindly.

ADBE: Bearish 5-0 Bearish Entry Anticipating PPO ConfirmationBack in December 2021, ADBE gave us a Bearish ABCD entry that led us into a Shark BAMM Pattern. Once it made it to the BAMM target, it bounced back up to where it is now. The interesting thing is that the PPO is looking like it's ready to roll over, and it happens to be at what would be a Potential Bearish 5-0 entry. If the PPO crosses below the upper extremes, we could see this go for a lower low, and if we are to judge how far it can go harmonically, I'd say it could go all the way to the 1.414, which would be the PCZ of a Potential Bullish ABCD.

For additional context, I have left the Bearish Entry setup from 2021 in the Related Ideas Section below.

Correlation Matters No More

For the longest time, I've been saying that the correlations between the currency pairs have been weakened.

Traders have asked me why I have NZDJPY and NZDUSD in my portfolio. Doesn't it move in the same direction?

Over the years, these correlated pairs move pretty differently. And recently, the WTI and Gold have no longer moved in an inverse relationship.

So yeah, I'm treating them as their own.

Although both the 4-hourly and 1-hourly charts show buying opportunities through a potential Bullish Bat Pattern and a Bullish Shark Pattern, I'm more interested in waiting for a shorting opportunity on the 5-0 Pattern.

What's your take on the NZDUSD?

Trading within the 2 zonesThis could be interesting!

If you are looking to short, you have a Bearish Shark Pattern that has completed at 174.50, you could wait for a pull back off the lower timeframe, like the 15-minutes chart or the 8-range bar chart for a shorting opportunity.

Alternatively, you could wait for a buying opportunity on the 5-0pattern a 100pips later at 173.50.

Which trade would you take? And why?

comment down below.

One last SHOT!!If you have been following, you should know I've been getting into the long position on the AUDCAD to take a ride on the Weekly Chart's 5-0 Pattern.

If you aren't familiar with harmonic patterns,it means I'm looking to have a ride on the bullish trade from a mid to long-term perspective. (approx 2mths)

There are a couple of attempts, and not all went to loss, it fact I'm pretty profitable with these trading ideas when I didn't get what I want.

This is probably the last or the last is near for these trading ideas to work.

I'd engaged the bullish bat pattern on the 4-hourly chart and see if it able to take me to my final target for the 5-0 patterns and beyond.

My Bullish Bias RemainsUSDJPY Shorting Opportunity Looming, But My Bullish Bias Remains Strong

In the midst of a Type 2 Bearish Bat Pattern on the daily chart and a Bearish Shark Pattern on the 1-hourly chart, traders may be eyeing a shorting opportunity for the USDJPY. However, my bullish bias on this currency pair remains steadfast.

Rather than jumping on the bearish bandwagon, I am patiently waiting for a prime buying opportunity on the USDJPY. I'm closely monitoring a Bullish 5-0 pattern that could potentially complete at 134.71, presenting an ideal entry point for a long position. Stay tuned for further updates on this developing trade opportunity.

The Reason Behind My Strong Inclination to Buy AUDCADIf you have been keeping up with my previous analysis, you would have known that my strong interest in buying the AUDCAD is not a crazy obsession, but a well-informed decision based on market trends and patterns.

In fact, if you had engaged in the trade last week, you could have earned a substantial amount of profit, up to 139pips or approximately 1,390 USD per lot .

This week, the market will be testing the 5-0 pattern on the 1-hourly chart for the first time, which could potentially provide another opportunity to hop on this bullish trend.

By identifying the right confirmation pattern, you could take advantage of the Bullish 5-0 Pattern on the weekly chart and not miss out on this trade once again.

Don't underestimate the power of staying informed and being prepared to make strategic moves in the market.

Multiple Buying OpportunityUpon analysis, there are multiple factors that indicate a potential buying opportunity for AUDCAD.

Firstly, the bullish 5-0 pattern on the Weekly chart was identified and discussed in my previous report.

Secondly, various trading strategies have also pointed towards a buying opportunity.

For example, the 4-hourly chart shows a tested support level at 0.8954, which has been tested three times. If this support level is broken, there is a complete AB=CD Harmonic Pattern at 0.8940.

On the 1-hourly chart, a bullish deep crab pattern is observed with a retest at 0.8952, providing an opportunity for traders. The only factor that could deter this trade is a potential market gap when the market opens on Monday.

Nonetheless, with the aforementioned indicators in place, a potential buying opportunity for AUDCAD presents itself.

This could be a Big OneAs an experienced trader, I've identified a significant trading opportunity that I'm eager to execute. My strategy involves a buy and hold approach, with a focus on minimizing risk and maximizing rewards. Rather than setting multiple targets, I prefer to extend my targets and remain flexible based on the market conditions and candlestick patterns that emerge.

This comprehensive trading plan enables me to minimize the time I spend monitoring the markets, allowing me to focus on other important aspects of my work. With a keen eye for detail and a commitment to achieving my goals, I'm excited to see what the future holds for this trade.

Seize the Day: Aggressive Traders Can Short GBPAUD with 5-0Despite the current bullish trend in GBPAUD, the market is showing signs of a potential shorting opportunity on the 5-0 pattern, with the 3-bar reversal pattern. This presents a unique trading opportunity for aggressive traders to engage in a short-term trade at 1.8577, with a stop loss set above 1.8605 and an appropriate buffer.

What's even more enticing about this setup is when executed correctly, this trade could yield a profit factor of 2, making it a potentially lucrative opportunity for savvy traders looking to capitalize on market movements.

Unique Combo Trade!Probably a trade that has a 20:1 Reward: Risk trading setup.

On the 1-hourly chart, we have a Bullish Gartley Pattern that comes inline with our 4-hourly chart, the Bullish Shark Pattern retest and on the Weekly Chart, the Bullish 5-0 Patterns.

If I stretch the final target to the Weekly Chart completion, the returns would be stunning, but this trade could take up to 2 months or a month.

Furthermore, we might have more stop-out then hitting the target in 1 U-Turn, so it is NOT a trade for traders who won't afford to have their trade stop out multiple times and still looking for buying opportunities.

If you are thinking of risking more than you usually do; or you plan to follow the trade blindly; or even worst, not putting your stop-loss, this is not the trade for you.

As a full-time trader, I've been very patient to look for the trade that suits my profile and the trade I'm planning.

I couldn't stress any more by saying trading is more like a business than a job. It is not the number of deals you do, but the 1 you chose to take and the 1 you chose not to participate.