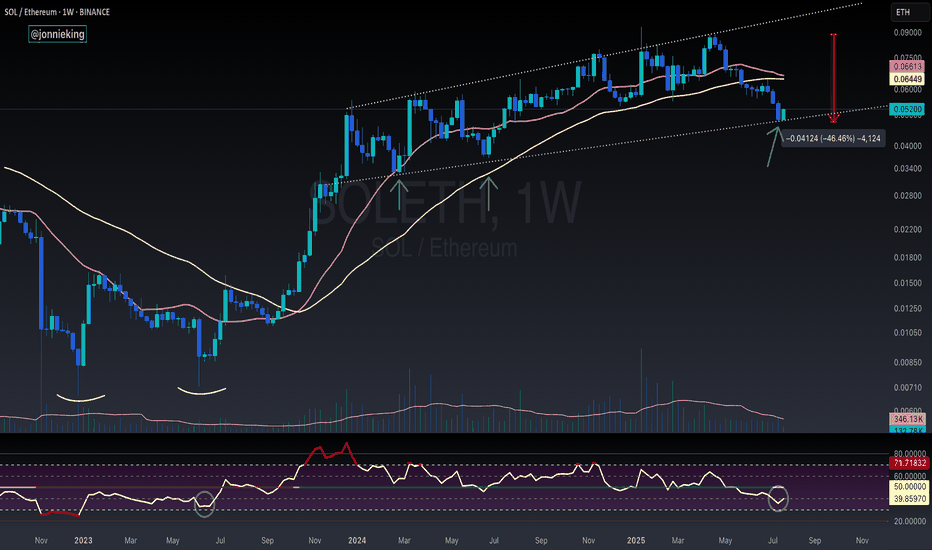

SOL / ETH - Reversal Signs FormingI suspect CRYPTOCAP:ETH has a bit more gas in the tank, but the early signs for the real Alt Season are nearing.

RSI on the weekly is nearing the June 2023 bottom which kicked off the massive bull flag formed on SOL / ETH for the next 2 years.

Still too early to call at this point tho.

Need volume to really burst through in the next week or two.

I’d also like to see BOATS:SOL close the week with a massive bullish engulfing candle.

The bearish cross on the 20 / 50WMA should mark the bottom when it occurs soon.

50wma

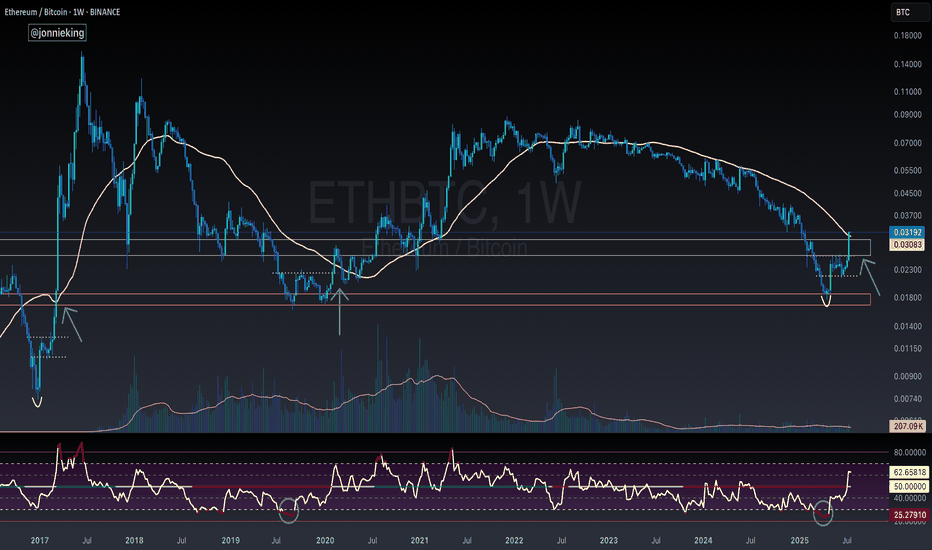

$ETH Closes Above the 50WMA - Alt Season Signal ALT SEASON ALERT 🚨

CRYPTOCAP:ETH Closed the Week ABOVE the 50WMA

Historically this has signaled the start of ALT SEASON.

*NOTE* 2020 had the pandemic hiccup.

This bottoming pattern looks very similar to the 2017 explosion.

Also the RSI matches the 2019 bottom.

Dare I call it yet bros? 🤓

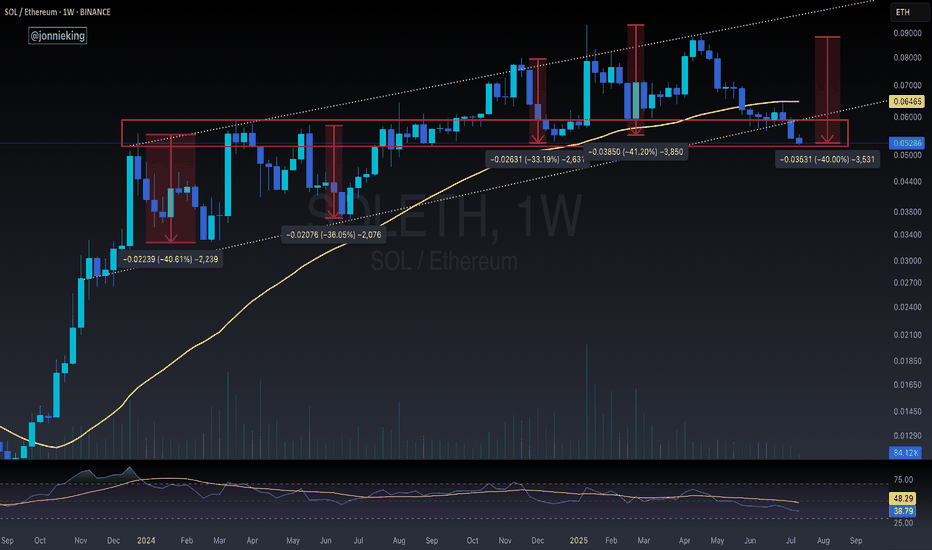

SOL / ETH at Critical Inflection PointSOL / ETH loses the 50WMA.

Has been trading below it for the past 7 weeks, something we haven't seen since 2021.

Has also broken down from the 8 month bull flag / parallel channel. Retesting the key POI I've been eyeing.

HOPIUM: We've seen great rallies after CRYPTOCAP:SOL goes down ~40% vs CRYPTOCAP:ETH , which it is at now. We SHOULD see a turnaround here soon.

And I still believe SOL will greatly outperform ETH this cycle, especially when the ETF launches and Alt Season kickstarts.

Right now we're seeing a typical market cycle BTC > ETH > Large Caps > Mid Caps > Micro Caps

$BTC Not Out Of The Weeds Yet - Must Break $84kIf CRYPTOCAP:BTC can break back above ~$84k then we could continue to follow my OG setup (yellow) and rip,

but since PA dumped slightly below the 50WMA it technically invalidated my inverse h & s idea.

A rejection of $84k would dump us back to ~$78k to form the right shoulder (red) and complete the setup.

nonetheless, i believe we've seen the bottom 👋

$BTC Inverse Head and Shoulders Finally FormedAnd just like that, the Death Cross has formed the right shoulder for the Inverse H & S idea I formed on March 14th

We may sit a bit more downside to retest the 50WMA at $76k for confirmation

If we get a V-shaped recovery tomorrow, this very well could be the bottom for CRYPTOCAP:BTC

$BTC Critical Support Retest at 50WMA - Must Read!50WMA is a CRITICAL SUPPORT to watch for ₿itcoin.

Historically, if CRYPTOCAP:BTC closes below it for more than one week, it signals the beginning of the BEAR MARKET.

We’ve only seen BTC close beneath the 50WMA once in its history during a Post-Halving year, and that was in 2021, but then rallied to a new ATH.

People often ask me what would invalidate my bull market thesis;

this is one of them.

I’ll be watching this support very closely, and if BTC closes below it for more than 2 weeks, i’m probably selling a good portion of my stack until we get more clarity in the market.

However, this could very well have been the bottom of this correction.

BTC is known to have a big Q1 drawdown in Post-Halving years.

2013 was a massive -82% correction over a week.

2017 gave us two.

January -34% over 7 days.

March -33% over 14 days.

January 2021 gave us -31% over 14 days.

The current correction we’ve seen with BTC has been the longest over 35 days with -28%.

$75k would be a -31% correction, which would line up perfectly with the previous cycle.

That’s the line in the sand for me.

If we did see the bottom with this 28% correction, that would line up with the diminishing return theory.

SOL Biggest Bargain Buy Opp at 50WMAI wrote my thesis on Solana in July 2023 when it was at $25 and memecoins weren't even a thought.

No one even knew what BONK was, but the developer community was thriving, and all the best dApps were being built there.

Now that people are tired of rinsing themselves clean at the casino, it's funny to see them call CRYPTOCAP:SOL ded ~$180💀

SOL is up 625% since I first wrote about it 😂

The blockchain has tremendously improved in every metric, with a plethora of new advancements on the near horizon, including Firedancer 🔥

Buying SOL here at the 50WMA is an absolute gift.

Target is still, and always will be $700-850 within the next 9 months.

BTCUSD: Time for a correctionOutlook for the remainder of the year. The ETF inflows have generally remained positive at new ATH levels, while volume remains low and price remains flat. This suggests considerable distribution from OTC sellers, namely longer-term holders, per HODL waves analysis.

It's been 3 months since breaking ATH in March, with price unable to move higher. The consolidation at higher levels remains bullish until $60K is broken to the downside (foodgates moment), which would confirm the current range ($60K-70K) as longer-term distribution, rather than accumulation.

First stop will likely be a re-test of the 50 Week MA around $50K after the floodgates for selling opens below $60K. With relatively low accumulation volume, I'm not expecting it to hold as support, but instead return to the 200 Week MA around $40K, likely after a re-test of previous support in order to confirm it as new resistance (around $60K). The 20 Week MA is currently around $63K, so below this level, there will already likely be an increase in selling pressure.

The Weekly RSI is otherwise facing rejection from overbought levels >70, similar to late 2021 (minus the strong bearish divergence back then). The culmination of breaking the 20 WMA and confirming RSI rejection by returning to $60K, would be the catalyst for the break of support. As also noted (N.B.) the Mid Pi Cycle Top occurred in march, around $68K-$70K, with price unable to maintain the momentum above this rising MA multiplier, unlike in December 2020 at $21K.(1) The post-halving "Miner Capitulation" has also been signalled by Hash Ribbons indicator, not so dissimilar to summer 2020 that encouraged consolidation and a miner correction.(2)

I'm not particularly expecting Path B to play out, unless there is a catalyst for a more full-blown capitulation, leading to a 65% haircut in price. Examples include ETF holders getting cold feet leading to panic as price goes below opening ETF prices , or otherwise some negative regulatory news. A -45% move down to $40K should otherwise be more then sufficient to build up momentum for a 2025 bull market reaching $100K+. Should price reach GETTEX:25K to $30K levels (path B), there could be a "delay" within the usual cycle, with higher parabolic prices nearer to $200K. After the 3x from 2017 to 2021 ATH, 2x seems reasonable in 2025 however ~$138K.

(1) www.lookintobitcoin.com

(2) capriole.com

Bitcoin: A New HopeBitcoin broke out downwards through 42k. It looks like daily close will be below the 200d MA so right now I'm looking at the next heavy support between 30-35k and also at the 50W ma .

It has been a rough week but this could be very bullish news. The hashribbon is very close to flashing BUY . Last time this happend we had a big price increasement so I will wait for this to happen.