5thwave

LINK/USDT is in a very interesting spot

LINK/USDT is in a pretty interesting spot right now!

If we use The Elliot wave principle we can understand that the price is in the middle of it's 5th impulse wave so It is expected that the price would increase as high as the 3rd impulse wave!

Another thing that makes this signal stronger is that there is a Pennant and a flag pattern as well so the creation of another flag pattern might happen

Note: there is also a regular bearish divergence as well(-RD) which Means the price must decrease so Link's price might fall a little bit and than completes the 5th impulse wave!

Trading The Behaviour with Stocks - ETSY perfect exampleIn this quick video recap we discuss using our ElliottWave Indicator suite when trading the behaviour of stocks after profit taking pullbacks. As they say, when its trending - its trending. You just need a set of tools to measure the behaviour in a simple and consistent way. ETSY is behaving very well this last 12 months and is a great example of trading the 5th wave move of an elliottwave sequence.

Idea for five waves of the BTC Grand SupercycleThis is an alternative scenario to my optimism towards a historical pattern of BTC ATH breakouts (check: "After 16th Dec, 1M BTC is beautiful as fuxk, to the Moon, boi!"). In this scenario, the period from November 2011 until December 2017 interpreted as 3rd, longest wave, 4th lasting until December 2018, and currently we're in 5th one, and it should finish at some point, with the pullback, if symmetrical with 4th wave, could reach the area between approximately 8000 to 13000 USD

1st wave - Jul2010 - Jan2011

2nd wave - Jan2011 - Nov2011

3rd wave - Nov2011 - Dec2017

4th wave - Dec2017 - Dec2018

5th wave - Dec2018 - ?

Neo Bullish 5th WaveRealy good entry for swing trading.

Weekly Chart.

Stochastic: Crossing up

Volume: decrease when price goes down (4th Wave)

Price stopped at 0.618 FIb Retracement of all the swing and 3 Weekly Candles confirms the bull move.

I Think it's a good entry.

Everyone has to do their own analysis, that's only my vision.

Neo 5th Eliott Wave EntryDMI: Weekly dominance before a 4th wave.

Stochastic: on bottom starting a cross.

If Neo can consolidate over the Weekly 20 EMA ($15.9) i see a good entry with good R/B.

SL: over 50 EMA ($14.2)

1ST TARGET: 0.618 FIB ($23,7) +46%

Adjust SL 0,236 FIB Ret ($20.5) Securing +26% if stop going down entry over 100 EMA .

2ND TARGET: 1 FIB ($30.1) +86.67%

Neo 5th Eliott Wave EntryDMI: Weekly dominance before a 4th wave.

Stochastic: on bottom starting a cross.

If Neo can consolidate over the Weekly 20 EMA ($15.9) i see a good entry with good R/B.

SL: over 50 EMA ($14.2)

1ST TARGET: 0.618 FIB ($23,7) +46%

Adjust SL 0,236 FIB Ret ($20.5) Securing +26% if stop going down entry over 100 EMA.

2ND TARGET: 1 FIB ($30.1) +86.67%

SHCOMP into 5th waveWave B (red) of 1 (blue) equals 1.618 of wave A (red). Wave C of 4 (blue) equals 1.618 of wave C of 2 (blue). Wave 1 through beggining to high of wave B equals 0.382 of wave 3 extended (blue).

So now, I think 5th wave, then correction. I think correction will be reflected in decline in major stocks, after dji, ndx, spx will complete 5th wave, but still right now we are in a 5th wave and going to break the high of a 3rd wave.

GBPCAD, daily timeframe, 5th wave of Elliott WaveHello my friends,

Today i noticed some good setup from GBPCAD. Previously this pair make an inverted shoulders head pattern and then push straight to the upside for 700 pips in 2 weeks.

I tried to fit some fibonacci tools into it and count the waves according to Elliot Waves principle. Surprisingly, it looks like this pair just finished with the 4th Wave.

Wave-4 is the shortest wave and usually it stopped at 38.2 fibonacci retracement.

We could possibly see wave-5 from this point onwards and usually it ends at 127% fibonacci retracement of Wave-4

Wave-4 could never touch the area of Wave-1 so we could use stop loss a little below Wave-1. In this case, my stop loss is at 1.7200

Buy GBPCAD 1.7395

Stop loss 1.7200

Take profit 1 @1.7675

Take profit 2 @1.7870

Into 5th Wave Extension Territory! Bull Market Waking Up!BNB is going parabolic, this price action is an unusual elliot wave called an extended 5th or 5th wave extension. It's a statistical anomaly and happens so infrequently that usually you would have expected an ABC correction around the 1.618 region by now.

I'm really excited to see this because it validates the idea that we're at the cusp of a giant bull market. Yesterday I had been planning on shorting BNB on the failure of the 5th wave but the count showed it was likely to continue and I scalped it long for a nice one day trade, shown in attached chart.

I am not going to chase it here and I am not going to stand in front of the train either. I've got most of my long term accounts topped off so I really don't need to do anything.

For shorter term trading I will wait for a consolidation phase and then do another count. No need to force trades especially when the market is starting to act a little unusual.

ORBEX: USDMXN Correction Hints to Further DownsideUSDMXN is currently correcting towards the golden Fibonacci retracement of the last impulse wave to the downside. This follows the completion of corrective minor wave 4.

It could be then followed by a final 5th impulse leg in the minor degree, eying the 100% Fibonacci extension of waves 1 and 2, near 18.34.

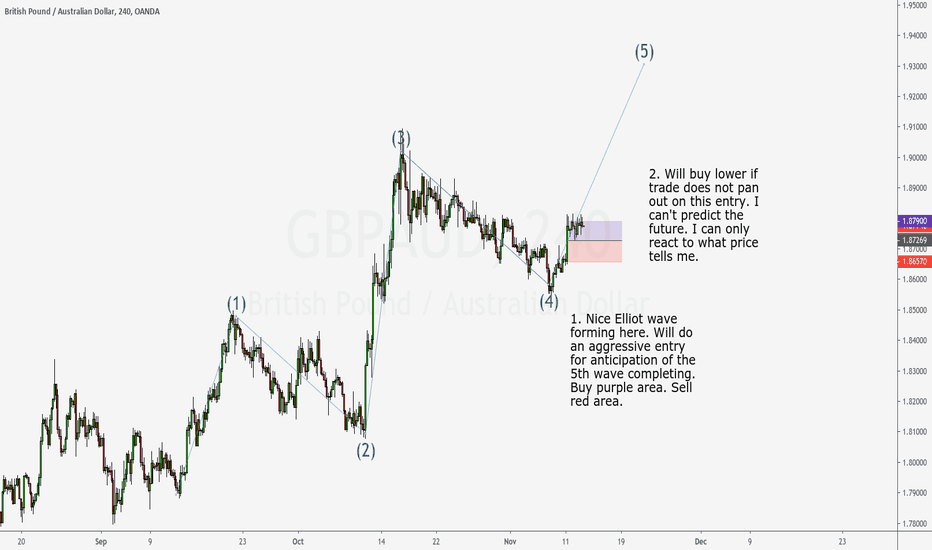

GBPAUD - 5th Elliot WavePlease refer to text on chart.

Price is forming a nice Elliot wave pattern here, I'll do an aggressive, low risk entry. However if the trade doesn't work and get in lower. The R/R for this trade is amazing so I don't mind having to take a few tries.

** Remember, we do not predict future price. We simply react to current price movements based on our interpretations of past data.