Advanced Auto Parts | AAP | Long at $64Advanced Auto Parts NYSE:AAP has gone through an exquisite shakeout of shareholders. Currently trading near $64, the stock is currently testing my "stock crash" simple moving average (seen green SMA lines). From a technical analysist standpoint, it's in a personal buy zone. This stock has tested this simple moving average level a few times in the past and recovered very well. Will history repeat?

Target #1 = $88.00

Target #2 = $110.00

Aap

Looking for an immediate buy on AAP! 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Advance Auto Parts Sells Worldpac for $1.5 BillionAdvance Auto Parts (NYSE: NYSE:AAP ), one of North America's leading automotive aftermarket parts providers, has made a significant strategic decision to sell its wholesale arm, Worldpac, for $1.5 billion. The sale, made to funds managed by the Carlyle Group, is a critical part of Advance Auto Parts’ ongoing efforts to streamline its operations and sharpen its focus on core business areas as it faces industry challenges and pressure from activist investors.

The Sale of Worldpac: A Game-Changer for Advance Auto Parts

The decision to divest Worldpac, a major revenue driver with approximately $2.1 billion in revenue and $100 million in EBITDA over the last 12 months, is a bold move by Advance Auto Parts (NYSE: NYSE:AAP ). The sale is expected to be finalized by the end of the year, providing Advance with much-needed financial flexibility. This capital infusion will allow the company to intensify its efforts in turning around its core retail and commercial operations, particularly the Advance blended box business.

Shane O’Kelly, CEO of Advance Auto Parts, emphasized the importance of this transaction, stating, “The sale enables our team to sharpen their focus on decisive actions to turn around the Advance blended box business. Proceeds from the transaction will provide greater financial flexibility as we continue our strategic and operational review to improve the productivity of the company’s remaining assets and better position the company for future growth and value creation.”

Pressure from Activist Investors and Industry Challenges

The sale comes at a time when Advance Auto Parts has been under significant pressure from activist investors to divest non-core assets like Worldpac to improve shareholder value. The sale to the Carlyle Group is seen as a strategic response to these pressures, allowing the company to focus on its core strengths in retail and commercial auto parts.

The automotive aftermarket industry has been resilient, largely due to the increasing age of vehicles on the road. With the average car now 12 years old, there is sustained demand for parts and services, even as new car production faces challenges. Worldpac, with its focus on wholesale distribution, was well-positioned in this market, but its sale allows Advance Auto Parts to focus more closely on its retail and commercial customers, where it faces stiff competition from rivals like O’Reilly Automotive and AutoZone.

Financial Performance: A Mixed Bag

Advance Auto Parts (NYSE: NYSE:AAP ) also released its second-quarter 2024 financial results, highlighting both the challenges and opportunities ahead. Net sales for the quarter totaled $2.7 billion, flat compared to the same period last year. Comparable store sales saw a modest increase of 0.4%, reflecting the company’s ability to maintain its customer base despite a challenging demand environment.

However, the company’s gross profit decreased by 2.3% to $1.1 billion, with gross profit margins narrowing from 42.5% to 41.5%. This decline was primarily due to strategic pricing investments and higher product costs, which the company will need to manage more effectively in the future.

Operating income also took a hit, dropping to $71.8 million, or 2.7% of net sales, down from 4.7% in the previous year. Despite these challenges, Advance Auto Parts saw an improvement in cash flow, with net cash provided by operating activities increasing to $87.8 million, compared to a cash outflow in the same period last year.

Looking Ahead: A Focus on Core Operations

With the sale of Worldpac, Advance Auto Parts (NYSE: NYSE:AAP ) is now better positioned to focus on improving the performance of its core operations. The company’s next steps will involve a thorough strategic and operational review aimed at enhancing the productivity of its remaining assets and driving stronger returns for shareholders.

As the company navigates this transition, it will need to leverage its strengths in the retail and commercial sectors while continuing to innovate and adapt to the evolving needs of its customers. The sale of Worldpac is a significant milestone in this journey, providing the company with the financial flexibility and strategic focus needed to thrive in a competitive market.

Technical Outlook

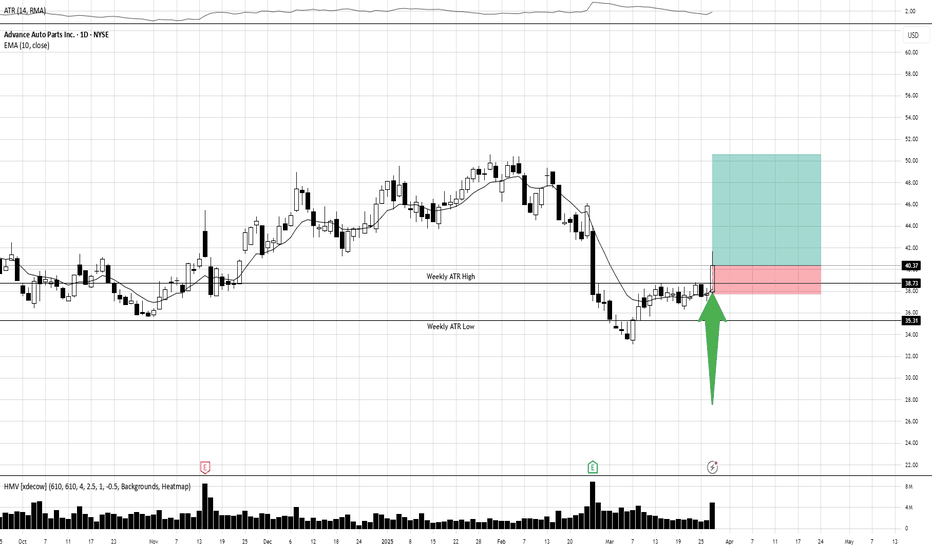

Advance Auto Parts (NYSE: NYSE:AAP ) has experienced a notable decline in its stock price, which is currently down 15.92% during the trading session on Thursday. This decrease reflects a significant amount of selling activity, leading to the stock being classified as oversold at present. The Relative Strength Index (RSI) for the stock stands at 31, which is quite low and suggests that there is considerable selling pressure affecting its value. Furthermore, when analyzing the daily price chart, we observe a distinct downward gap pattern that has emerged. This pattern is typically interpreted as a strong bearish reversal signal, indicating that the stock may continue to face downward momentum. However, historical trends suggest that such gaps are often filled over time, and we anticipate this will occur in the near future as market conditions evolve.

Conclusion

Advance Auto Parts’ (NYSE: NYSE:AAP ) decision to sell Worldpac marks a pivotal moment in the company’s history. While the sale comes with its own set of challenges, it also presents an opportunity for Advance Auto Parts to refocus its efforts on its core operations, ultimately positioning the company for long-term growth and success. As the company continues its strategic review and operational improvements, stakeholders will be watching closely to see how these changes impact the company’s performance and shareholder value in the coming quarters.

Advance Auto Parts, Inc stock Nosediving to New Support LevelThe recent decision by Palm Valley Capital Fund to divest its position in Advance Auto Parts, Inc. (NYSE: NYSE:AAP ) has sparked interest and raised questions about the future trajectory of this automotive replacement parts and accessories provider. As investors dissect the rationale behind this move, it's imperative to explore the factors influencing Palm Valley's decision and assess the implications for Advance Auto Parts moving forward. This led Advance Auto Parts, Inc. stock ( NYSE:AAP ) to slide by 1.60% trying to set foot on new support level at the $73.05 Pivot.

Understanding the Decision:

Palm Valley Capital Fund's decision to exit its position in Advance Auto Parts during the first quarter of 2024 was rooted in a nuanced assessment of the company's prospects. While the fund realized a modest gain on the investment, concerns about the challenges facing Advance Auto Parts' ( NYSE:AAP ) profitability weighed heavily on their decision-making process.

Key Factors:

One significant factor contributing to Palm Valley's decision was the perceived difficulty in achieving a robust recovery in Advance Auto Parts' profits. Despite initial optimism surrounding the investment, observations made since the stock's acquisition in 2023 led the fund to reassess its outlook. As the automotive industry undergoes rapid transformations, including shifts towards electric vehicles and changes in consumer preferences, the path to sustained profitability for traditional auto parts retailers like Advance Auto Parts appears increasingly uncertain.

Additionally, Palm Valley expressed reservations about the potential impact of the company's divestiture of its Worldpac wholesale distribution business. While this move is expected to generate material proceeds, uncertainties loom regarding the profitability of Advance Auto Parts' remaining retail store operations. Concerns about thinning margins in the retail segment further dampened Palm Valley's confidence in the company's ability to deliver strong financial performance in the future.

Market Insights:

Advance Auto Parts' ( NYSE:AAP ) absence from the list of 30 Most Popular Stocks Among Hedge Funds underscores the mixed sentiment surrounding the company among institutional investors. While the stock remains held by a substantial number of hedge fund portfolios, recent trends indicate a slight reduction in investor interest, reflecting a degree of caution regarding the company's prospects.

Looking Ahead:

As Advance Auto Parts ( NYSE:AAP ) navigates these challenges, investors are keen to observe how the company adapts its strategy to address evolving market dynamics. Key areas of focus may include initiatives to enhance operational efficiency, expand product offerings, and capitalize on emerging opportunities in the automotive aftermarket.

Technical Outlook

Despite trading above the 200-day Moving Average (MA), Advance Auto Parts ( NYSE:AAP ) stock is down by 1.50% as of the time of writing with a weak Relative Strength Index (RSI) of 47.79. indicating a selling bias.

AAP Autoparts Retailer Retraces and Reverses down SHORTAAP on a 240 minute chart has completed a Fibonacci retracement of the previous trend down

which covered April to October 2023. Support was retested for a month or so. The retracement

starting in December is now to the standard level and price is being rejected there. The faster

RSI topped out at 65 while the slower RSI line ( black ) never got over 50. As an aside,

AAP is weak compared with AZO, its peer and leader in the market sector. I am looking for

stocks to short to get synergy from and general market downturns. I have found one. This short

trade is supported by the predictive algorithm of LuxAlgp.

AAP Advance Auto Parts, +130% Upside potentialHUGE UPSIDE POTENTIAL

Fundamentals are there. So it TA.

The inverse head & shoulder pattern has spoken: first target is $109.

Then possible pull back & consolidation at our breakout level of ~$80

I expect a return to $200 at the end of summer 2025 but timing market is just 🔮🤷🏻

NYSE:AAP #AAP

Interesting data being formed in long term charts $CSCO $PYPL +Have been looking at a ton of some setups looking for UNDERVALUED & UNDER LOVED #equities.

Have been opening them up to Weekly & Monthly charts.

What has been found is quite INTERESTING.

Here's 4 (only NASDAQ:PYPL shown here - Please see profile for more data)

NASDAQ:CSCO forming a head & shoulder pattern.

NYSE:AAP severely beaten up but improving technical data.

NASDAQ:PYPL money flow is improving. (nibbling here for entry position)

NASDAQ:INTC improved, kind of like CSCO, dropped & rallied. (Spoke on Intel some time ago & has performed well).

AAP Advance Auto Parts Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AAP Advance Auto Parts prior to the earnings report this week,

I would consider purchasing the 70usd strike price at the money Puts with

an expiration date of 2023-9-1,

for a premium of approximately $5.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

AAP BreakoutBLUF: 20% swing for 2 months at a 5% risk with the potential for a trend breakout.

Whether or not you "believe" in a recession in 2023, the idea of one on the horizon should alter how we pick stocks. Jim Cramer has been pushing bargain retailers for months and TJX is up over 40% since May of 2022. Taking the idea of a recession and the movement of money into the bargain or overstock companies can lead us to the auto industry. Benzinga posted on 30 Dec, 22 how much the major car companies have been down. With the decrease in consumer spending on vehicles, the idea here is that the money will shift from new cars to repairing current vehicles through auto parts stores. The three big companies focused on keeping used cars running are Autozone (AZO), Advance Auto Parts(AAP), and OReilly Automotive (ORLY).

AZO and ORLY have been performing nicely for multiple years, while AAP is at its Jan 21 low. The company president and CEO stated in the Q3 earnings report that "we're not at all satisfied with this outcome (lagging top-line growth)" and "as we develop plans for 2023 and beyond, we've done a deep dive on the competitive environment and the actions necessary to accelerate growth". This could be the inflection point and turn the company around from a leadership and financial perspective.

Turning to the chart. The stock has been following a negative trend since January 2022. The stock has tested and bounced off the $143 low from January 2021. Since this decline began, it has tested the lower trendline and rebounded sharply to the upper trendline lasting, 56, 60, and 36 days.

I believe the stock has the chance to continue trending toward the upper trend line over the next two months. If it can break the upper trend and we see continued signs of a recession, it could break out of the negative channel AAP is currently in.

The downside is about 5.5% to the recent lows with a 20% upside to the upper trendline.

The stock also has a 4% dividend.

AAP - Future Price SketchingPlotting future price action with the bars pattern tool

I have plotted two scenarios, one in green that takes off in the sharper up channel

And the second one in white where price rolls over and breaks down to the middle of the white channel

This second scenario is the less bullish of the two

Weekly chart

AAP - 6.79% Potential Profit - Ascending TriangleClear uptrend Support with an Ascending Triangle formed within.

Target price set at a new potential resistance line.

New support confirmed multiple times on the 5-min chart.

- 5-month uptrend

- RSI + Stoch well above 50

- MACD below Signal (!)

Suggested Entry $155.33

Suggested Stop Loss $152.88

Target price $165.88

Note that I tend to adjust stop losses in order to secure profits early and preserve capital. This means that the target price is going to be achieved as long as there are no strong pullbacks that trigger my new adjusted stop loss.

$AAP Advance Auto Breakout Pre-Earnings$AAP Advance Auto breaking out of a long term downtrend Friday on strong volume.

Earnings coming up this week - before the open Tuesday 8/18.

$ORLY O'Reilly Auto Parts crushed earnings a couple weeks ago...many are expecting solid numbers from $AAP.

Looking at options, open interest Put/Call ratio stands at 0.50 currently. Or in other works, for every put held in open interest there are two calls.

This week expiration specifically, there's a significant amount of ITM calls in open interest compared to almost no puts.

I expect we see $170 at a minimum this week if not higher.

Note: Educational, not investment advice.

AAP, earnings play. Generally stock is oversold on RSI , and about to get positive divergence on MACD. It's all depends on earnings.

Holding cheap mid apr exp calls, about to add more if things are going to get interesting. Tight stop loss. Stock is sitting on significant support /resistance so if it slips - it will slump hard -10/-20$. So obviously earnings is a trade direction reverse spot to watch.