AAPL

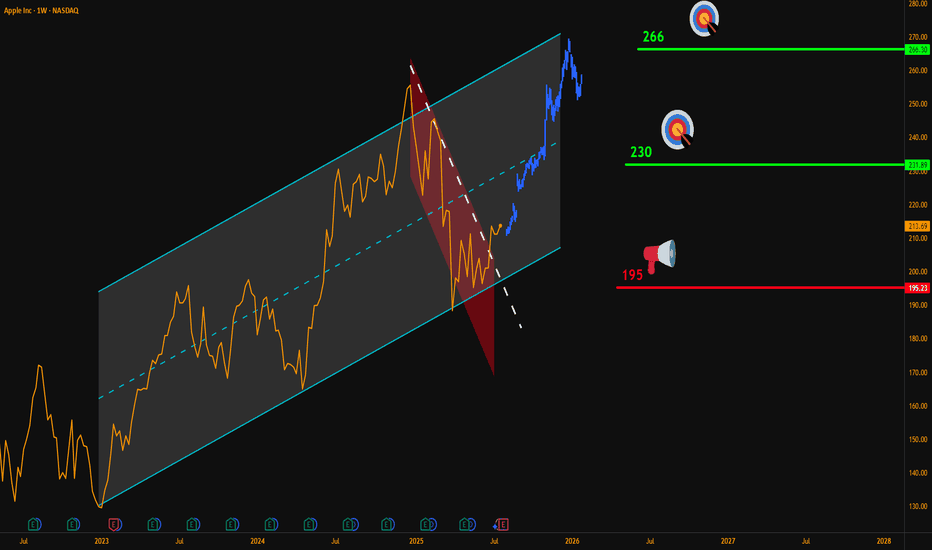

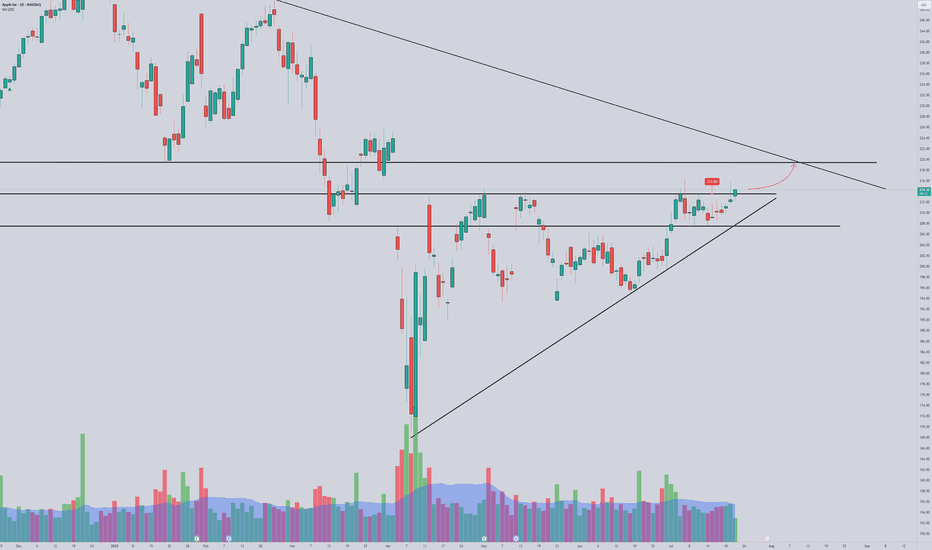

AAPL Weekly Breakout – Targeting $266Hello Traders,

Here’s my latest analysis on Apple (AAPL) based on the weekly chart.

🔍 Chart Breakdown:

Main Uptrend Channel (Blue): Price has respected this channel since 2023.

Red Downtrend Sub-Channel: Recent corrective phase is now broken.

Breakout Signal: Last week, AAPL closed above the sub-channel’s upper line, confirming bullish momentum.

📌 Updated Trade Setup Section:

Entry Zone: Around $215 (current price)

Stop-Loss: Weekly close below $195 (Risk = $20)

Targets:

✅ $230 (Reward = $15 → R:R = 0.75:1)

✅ $266 (Reward = $51 → R:R = 2.55:1)

Always confirm with your own strategy before entering a trade. Position sizing and risk control are key.

💬 Do you think AAPL can reach $266 before Q4 2025? Share your thoughts below!

NASDAQ:AAPL

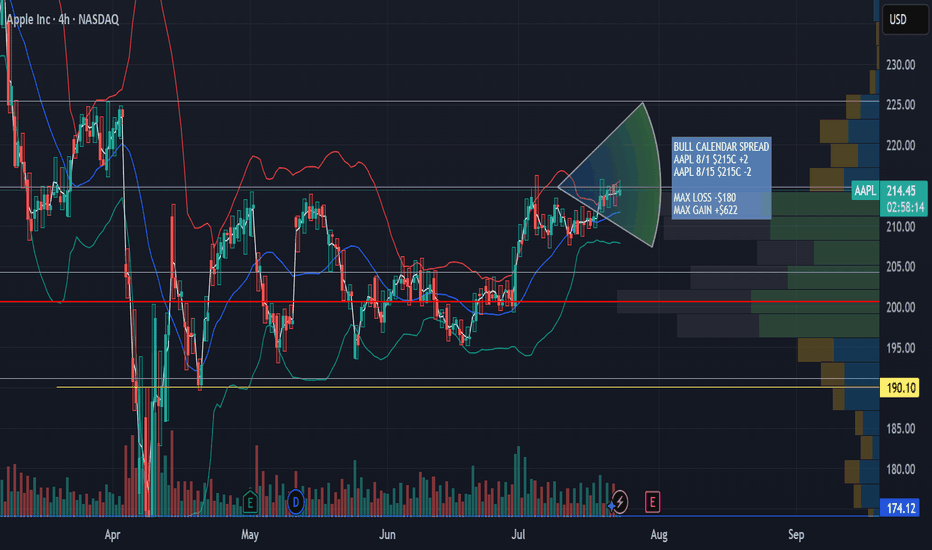

AAPL Aug 1st - Aug 8th 215 Calendar Call SpreadAAPL Aug 1st - Aug 8th 215 Calendar Call Spread

AAPL earnings after market close 7/31/25. Looking for an upward move into earnings with resistance at $225 then retesting support at $215. This zone falls between the .5 and .618 fib retracement. Great risk/ reward ratio 3.5:1

Apple (AAPL) — Expected 20% GrowthThe fundamental outlook for Apple stock remains positive: the upcoming fall presentation and anticipated AI-related announcements are driving bullish sentiment.

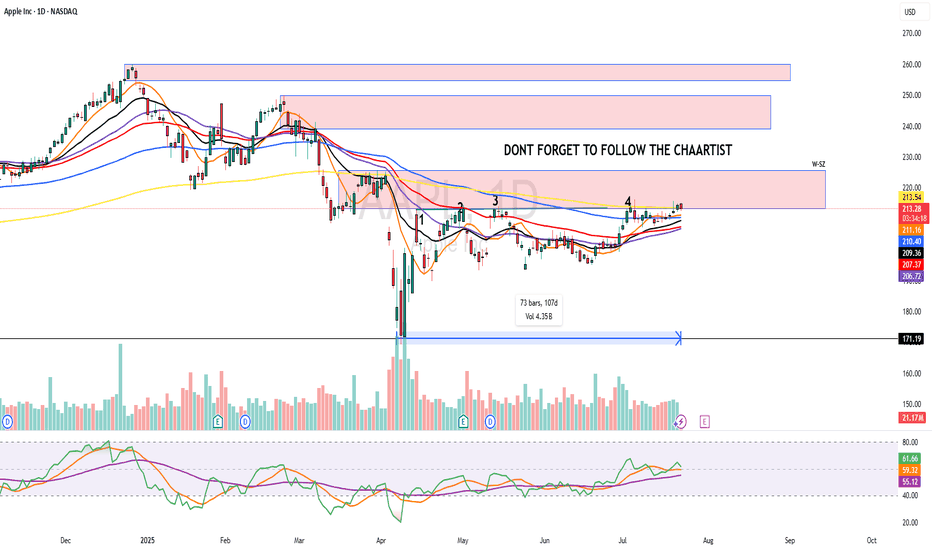

Technical picture:

The price has broken through a key trendline, signaling a shift in momentum toward growth.

Near-term target: a move toward the 225.0 level.

Next step: a possible pullback to 214.0 for a retest of the support level.

Long-term scenario: after the correction, I expect a rise toward 250.0, which could bring approximately 20% growth within 1–2 months.

This growth potential may coincide with Apple’s upcoming earnings report and further AI news.

Apple - The next major push higher!🍎Apple ( NASDAQ:AAPL ) will head for new highs:

🔎Analysis summary :

Apple has been underperforming markets for a couple of months lately. However technicals still remain very bullish, indicating an inherent and substantial move higher soon. All we need now is bullish confirmation and proper risk management and this setup looks very decent.

📝Levels to watch:

$200, $300

🙏🏻#LONGTERMVISION

Philip - Swing Trader

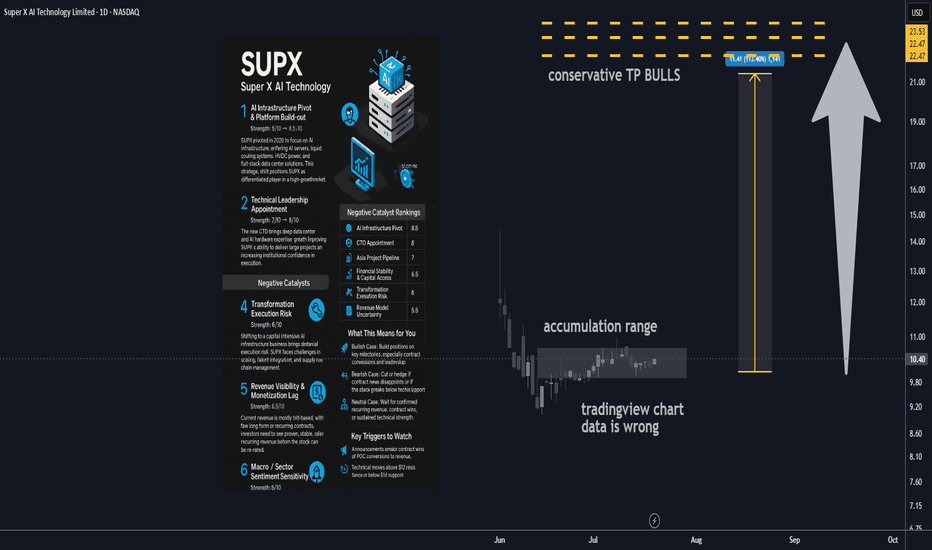

Super X AI Technology Ltd AI Infrastructure Stock 100% upside🔋 1. AI Infrastructure Pivot & Platform Build-out

Strength: 8/10 → 8.5/10

SUPX has made a major pivot in 2025, transitioning from a legacy business into next-gen AI infrastructure. The new focus includes AI servers, liquid cooling systems, HVDC power, and full-stack data center offerings targeting the rapidly growing demand for AI compute in Asia. This shift positions SUPX as a differentiated player in a high-growth market, opening doors to larger contract values and broader verticals.

________________________________________

🤖 2. Technical Leadership Appointment

Strength: 7/10 → 8/10

A major recent step forward is the hiring of a seasoned CTO with deep data center and AI hardware experience. This upgrade significantly enhances SUPX’s execution ability and credibility in enterprise infrastructure. Institutional investors and potential partners will see this as a sign SUPX can deliver on its technical roadmap and close major deals.

________________________________________

📈 3. Asia Institutional Partnerships Pipeline

Strength: 6.5/10 → 7/10

SUPX is developing a solid pipeline of institutional AI infrastructure projects across Asia, especially with established banks and tech companies. While many projects are still in proof-of-concept or pilot stages, these early relationships can drive high-margin, recurring business if successfully converted to long-term contracts.

________________________________________

💰 4. Capital Structure & Financial Health

Strength: 6/10 → 6.5/10

The company’s cash position has improved after new equity raises, giving SUPX a runway for continued R&D and expansion. While the business is still operating at a loss and share dilution remains a factor, debt levels are manageable and financial flexibility should support continued transformation and growth.

________________________________________

________________________________________

⚠️ Negative Catalysts

🛠️ 5. Transformation Execution Risk

Strength: 6/10 → 6/10

Transitioning from a legacy model to a complex, capital-intensive AI infrastructure business brings substantial execution risk. SUPX must navigate operational scale-up, talent integration, and supply chain challenges, with no guarantee of seamless delivery. Any delays or setbacks could erode investor confidence.

________________________________________

🌐 6. Revenue Visibility & Monetization Lag

Strength: 5.5/10 → 5.5/10

Most current revenue is still pilot-based, with few long-term or recurring contracts secured. The business model relies on successful conversion of its pipeline and faster ramp-up in recognized sales. Investors will need to see evidence of stable, recurring revenue before the stock is re-rated.

________________________________________

🔁 7. Macro / Sector Sentiment Sensitivity

Strength: 5/10 → 5/10

As a small-cap AI/infra play, SUPX is highly exposed to swings in broader market sentiment. Any downturn in tech or risk-off moves in global markets could lead to outsized stock volatility, regardless of execution progress.

________________________________________

________________________________________

🚀 Refreshed Catalyst Rankings

Rank Driver Score

1 AI Infrastructure Pivot 8.5

2 CTO Appointment (Execution) 8

3 Asia Project Pipeline 7

4 Financial Stability & Capital Access 6.5

5 Transformation Execution Risk 6

6 Revenue Model Uncertainty 5.5

7 Macro / Sector Volatility 5

________________________________________

📊 Analyst Ratings & Price Outlook

• No major Wall Street coverage; visibility remains driven by news flow and early institutional/retail adoption.

• Technicals: The stock has established higher lows since its business model pivot. Resistance sits near $11.50–12, with support at $9.80–10.00.

• Price target: A $20 target remains plausible if SUPX delivers on growth milestones and secures new capital or contracts, representing a potential doubling from current levels.

________________________________________

🗞️ Recent Developments

• Hired a proven CTO to drive the new AI/data center focus.

• Company rebranded and fully pivoted its business model in 2025, shifting all resources to AI infrastructure.

• Implemented a new equity incentive plan to attract and retain top tech talent.

• Announced a robust pipeline of institutional projects across Asia, although most are not yet recognized as revenue.

________________________________________

🔍 Summary Outlook

SUPX is an emerging transformation play, now fully aligned with surging demand for AI infrastructure. Its success depends on management’s ability to scale, close institutional contracts, and prove out recurring revenue. While the story is compelling and early traction is positive, the company remains high-risk and execution-dependent at this stage.

Bull Case:

If SUPX converts pilots into revenue, delivers operationally, and continues to attract top talent, the stock could re-rate to the $15–20+ range as its business model is validated.

Bear Case:

Stumbles in execution, monetization, or funding could send the stock back to $7–8 support.

Neutral:

Many investors may choose to wait for confirmation of contract wins, recurring revenue, or sustained technical strength before committing.

Technical Levels to Watch:

• Bullish breakout if it clears and holds $11.50–12.00.

• Bearish risk if it fails to hold $9.80–10.00, with possible drop toward $8.

________________________________________

✅ What This Means for You

• Bullish: Build positions into execution milestones, focusing on contract conversions and leadership updates. Upside potential to $20 if catalysts align.

• Bearish: Cut or hedge exposure on failed contract news or technical breakdown.

• Neutral: Stay on the sidelines until more evidence of recurring revenue, confirmed contract wins, or positive sector momentum.

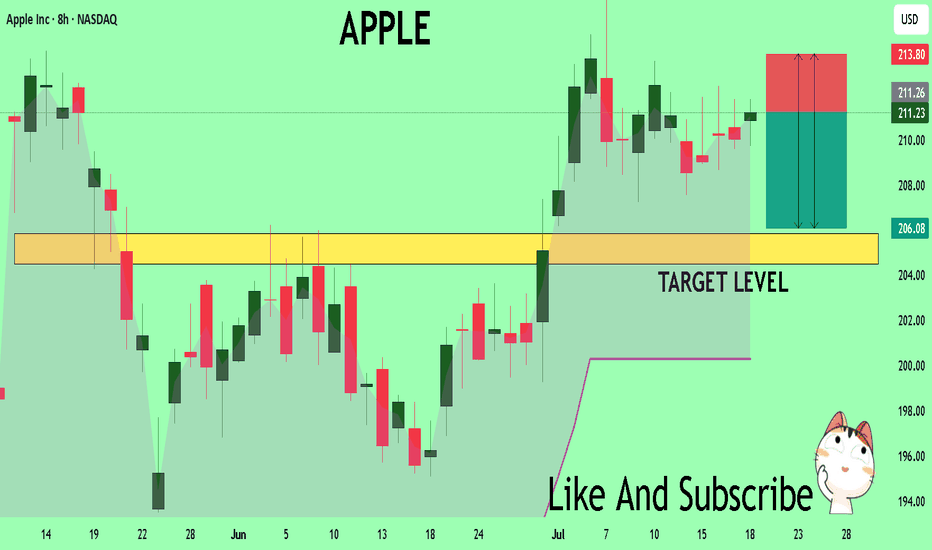

APPLE A Fall Expected! SELL!

My dear friends,

My technical analysis for APPLE is below:

The market is trading on 211.18 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probableBearish continuation.

Target - 205.87

Recommended Stop Loss - 213.80

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

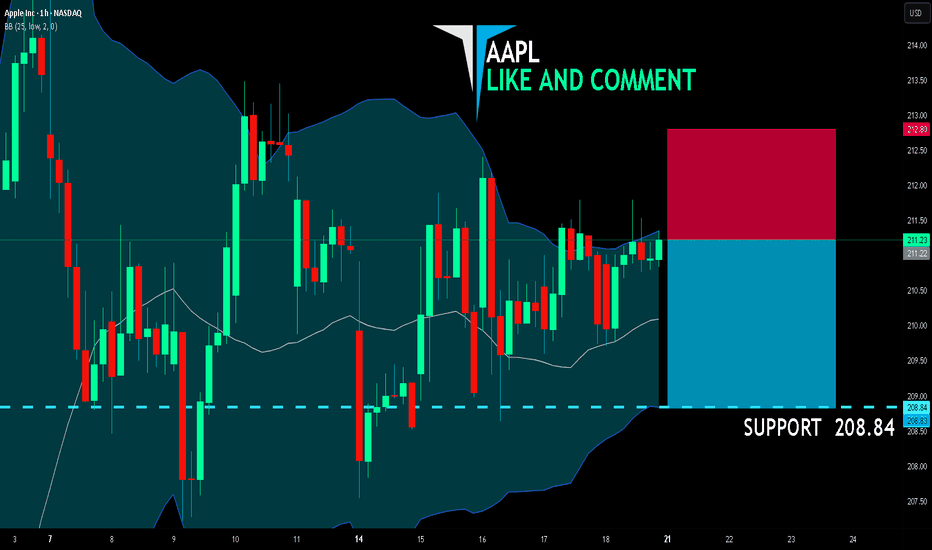

AAPL BEARS WILL DOMINATE THE MARKET|SHORT

AAPL SIGNAL

Trade Direction: short

Entry Level: 211.22

Target Level: 208.84

Stop Loss: 212.80

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AAPL Set for a Breakout? | Technical Checklist & Projections

▍Observation & Context

▪ AAPL has been moving sideways within a clearly defined range for the past three months .

▪ On July 07 , price tested the range resistance decisively, showing some interest in the upside.

→ Let's first explore the bullish breakout scenario.

▍What Makes a Good Breakout ?

Before we talk about targets, let’s define what a good breakout looks like:

▪ A strong bullish candle breaking through the resistance in one clean move .

▪ Followed by a retest of the broken resistance (now acting as support).

▪ After that, price should ideally:

1. Form a higher low , and

2. Reach the next resistance or target zone before pulling back.

▍Target Price – Method 1: Extension of the Range

🔹 Near-Term Target: 1.5–1.618x Fibonacci Extension

- A common zone where momentum often pauses.

- Aligns with the previous high from the last downtrend.

- Technically, to reverse a trend, price needs to take out the previous high. Even though the range has “cooled off” the pressure, we still respect that level.

🔹 Ultimate Target: 2x Range Extension

- Represents a 100% projection of the previous range.

- Commonly used in range breakout targets.

🔹 Dream Target: 2.618x Fibonacci Extension

- Aligns with the start of the last downtrend , adding significance to the level.

- Often marks the exhaustion point of strong trends.

▍Target Price – Method 2: Projection from Higher Low

Note: The new higher low is not yet confirmed at the time of writing. The levels below assume an upward breakout without dropping below 207.22 . However, the same logic can be applied once the higher low forms.

🔹 Near-Term Target: Same as Method 1

🔹 Ultimate Target: 100% Projection of Prior Swing

- Projecting the prior swing (from previous low to recent high) from the new higher low .

- This level also aligns with the 1.5–1.618x Fibonacci extension of that swing, increasing its significance.

🔹 Dream Target: Another 100% projection

- Rare, but happens when momentum is very strong .

- In such cases, price might skip any retracement and launch directly into a second leg , equal to the previous swing.

- Here, the level aligns perfectly with the start of the last downtrend , just like the 2.618x extension in Method 1.

▋Mental Notes

▪ No one knows for sure if the breakout will be real or fake. But when it happens, knowing what to look for and where price might go next gives us a clear plan of action .

▪ The market will always find ways to surprise. Stay open and follow the flow.

▋Not Financial Advice

The information contained in this article is not intended as, and should not be understood as financial advice. You should take independent financial advice from a professional who is aware of the facts and circumstances of your individual situation.

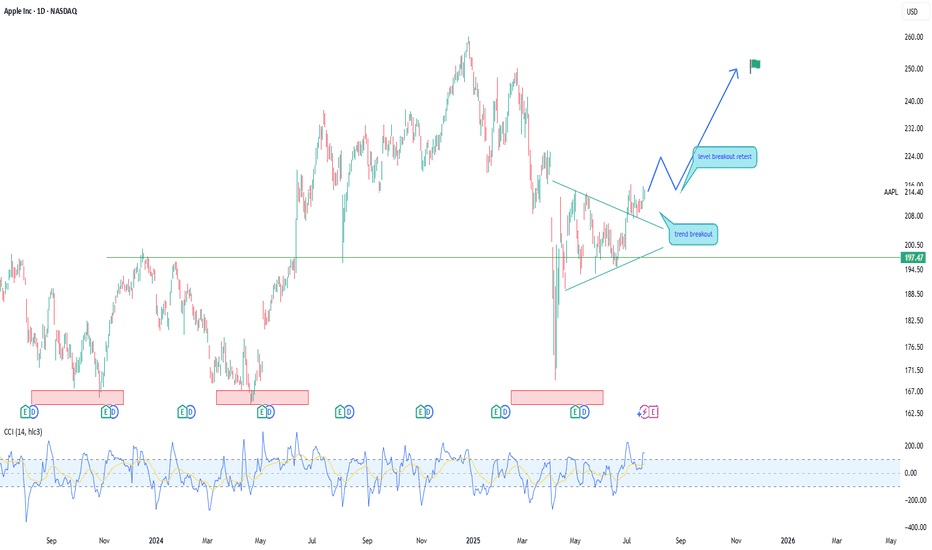

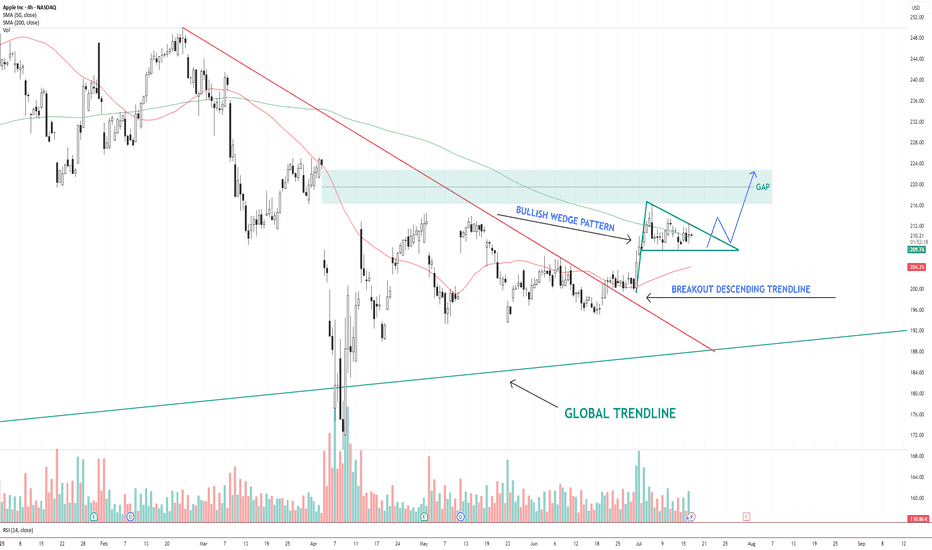

AAPL – Bullish Wedge Breakout Setup Toward Gap FillAAPL NASDAQ:AAPL has broken out of a descending trendline and is now consolidating inside a bullish wedge pattern . Price is holding above the 200 SMA and hovering near the 50 SMA.

The structure suggests a potential breakout above the wedge, with a clear gap area between $216–$224 acting as the next upside target.

Key levels:

Support: $206 (wedge base / 50 SMA)

Resistance: $216–$224 (gap zone)

Trend structure: Bullish consolidation after breakout

A clean breakout from the wedge with volume could trigger a continuation move toward the gap zone.

📌 Watching for confirmation and potential entry on a breakout + retest.

This is not financial advice. Always do your own research.

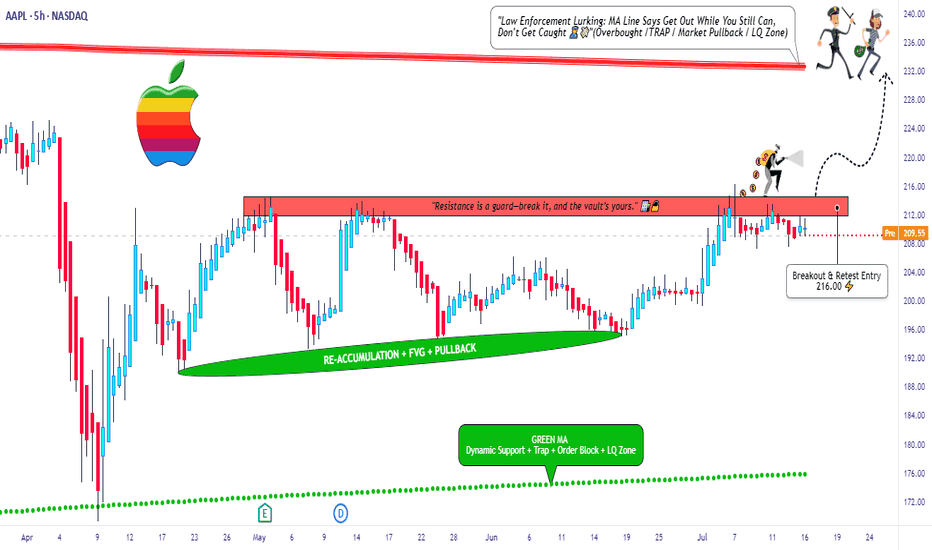

Apple Inc Long Setup – Break, Ride, Exit Like a Pro🕵️♂️💼 “The Apple Heist: Thief Trader's Masterplan for a Clean Escape” 💸🚀

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome, Money Makers & Market Thieves! 🤑💰💸✈️

This ain’t your average stock analysis — this is a high-level blueprint for the Apple Inc. (AAPL) market heist, built using the Thief Trading Style 🔥📊.

We've scouted the field using a mix of technical patterns, market sentiment, and fundamental fuel, and we’re ready to make our move. The plan is set: go long once the resistance wall cracks, and aim for a clean getaway just before the danger zone hits.

🎯 THE PLAN: INFILTRATE, ESCAPE, PROFIT

Entry Point:

💥 “The vault’s cracking – the breakout begins at 216.00!”

Place Buy Stop orders just above the resistance wall or wait for a pullback to recent swing zones (15M–30M charts work best).

📌 Set your alerts early – you don’t want to miss the opening.

🛑 STOP LOSS - YOUR BACKUP PLAN

🔊 “Listen up, crew: No stop loss until the breakout confirms! Once you’re in, place SL wisely – use the 4H swing low (200.00). Your risk, your rules. Don't get caught slippin’.”

📍 Adjust SL based on lot size, entry volume, and trade size. Protect your stash.

🏁 TARGET ZONE:

🎯 Heist Target = 232.00

(Or bail early if the heat's on – you know the drill.)

⚠️ SCALPERS & SWINGERS

💸 Long side only – don’t fight the wave.

🧲 Scalpers: Get in, grab the cash, trail the stop.

📈 Swing Traders: Hold firm. This setup has legs.

🔎 WHY WE’RE ROBBING THIS CHART:

Apple’s bullish momentum is fueled by:

📌 Strong institutional sentiment

📌 Earnings strength

📌 Index rotation and positioning

📌 COT data & macro tailwinds

Get the full scope: fundamentals, macro outlook, positioning data, sentiment, and intermarket dynamics 🔗📊.

Stay sharp – stay informed.

📰 NEWS ALERTS & POSITION MANAGEMENT

🚨 Avoid new entries during high-impact news releases.

🏃 Use trailing SLs to lock profits and exit clean.

💖 BOOST THE CREW — STRENGTH IN NUMBERS

🚀 Hit that BOOST button if this helped you steal a profitable trade. Your support powers our heist team.

Let’s keep making money the Thief Way – with style, planning, and confidence. 🎉💪🏆

📌 NOTE FROM HQ:

This analysis is for educational purposes. It’s not personalized financial advice. Manage your trades responsibly. Conditions can shift quickly — stay updated and flexible. Stay in the shadows and move smart. 🐱👤

💬 Drop a comment, hit like, share with your gang – the market's a vault, and we’re the codebreakers.

See you on the next heist, Thief Fam. 🤑🔥🕶️💼

APPLE Set To Fall! SELL!

My dear friends,

APPLE looks like it will make a good move, and here are the details:

The market is trading on 211.08 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 206.69

Recommended Stop Loss - 213.91

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Nvidia (NVDA) 2025+ Catalysts & Risks: Analyst Views🚀 Nvidia (NVDA) 2025+ Catalysts & Risks: Analyst Views

🔑 Key Catalysts Driving Nvidia’s Stock Growth (2025+)

1. 🏆 AI Chip Dominance

Nvidia maintains >90% market share in data-center AI chips (Blackwell, Hopper, Rubin). Its CUDA ecosystem and relentless innovation keep it as the “default” supplier for advanced AI, giving NVDA massive pricing power.

2. 🏗️ Surging Data Center Demand

Cloud and enterprise AI spending remains white-hot. Tech giants (Meta, Microsoft, Amazon, Google) are collectively pouring $300B+ into 2025 AI CapEx. Data center revenues are at all-time highs; analysts expect this uptrend to extend through 2026 as “AI infrastructure arms race” persists.

3. 🌐 Mainstream AI Adoption

AI is now integrated in nearly every industry—healthcare, finance, logistics, manufacturing, retail. As companies embed AI at scale, NVDA’s hardware/software sales rise, with “AI everywhere” tailwinds supporting 15–25% annual growth.

4. 🤝 Strategic Partnerships

Big wins: Deals with Snowflake, ServiceNow, and massive sovereign/international AI collaborations (e.g., $B+ Saudi Arabia/“Humain” order for Blackwell superchips; UAE, India, and Southeast Asia ramping up AI infrastructure using Nvidia).

5. 🚗 Automotive/Autonomous Vehicles

NVDA’s automotive AI segment is now its fastest-growing “new” business line, powering next-gen vehicles (Jaguar Land Rover, Mercedes, BYD, NIO, Lucid) and expected to surpass $1B+ annual run rate by late 2025.

6. 🧑💻 Expanding Software Ecosystem

Nvidia’s “full stack” software (CUDA, AI Enterprise, DGX Cloud) is now a sticky, recurring-revenue engine. Over 4M devs are building on Nvidia’s AI SDKs. Enterprise AI subscriptions add high-margin growth on top of hardware.

7. 🌎 Omniverse & Digital Twins

Industrial metaverse and simulation/digital twin momentum is building (major partnerships with Ansys, Siemens, SAP, Schneider Electric). Omniverse becoming the industry standard for 3D AI/simulation, unlocking new GPU/software demand.

8. 🛠️ Relentless Innovation

Blackwell Ultra GPUs debuting in late 2025, “Rubin” architecture in 2026. Fast-paced, aggressive product roadmap sustains Nvidia’s tech lead and triggers constant upgrade cycles for data centers and cloud providers.

9. 📦 Full-Stack Platform Expansion

Grace CPUs, BlueField DPUs, and Spectrum-X networking mean Nvidia is now a “one-stop shop” for AI infrastructure—capturing more value per system and displacing legacy CPU/network vendors.

10. 🌏 Global AI Infrastructure Buildout

Recent US export rule rollbacks are a huge tailwind, opening up new high-volume markets (Middle East, India, LatAm). Nvidia remains the “go-to” AI chip supplier for sovereign and enterprise supercomputers outside the US, supporting continued global growth.

________________________________________

📈 Latest Analyst Recommendations (July 2025)

•Street Consensus: Overwhelmingly bullish—~85% of analysts rate NVDA as “Buy/Overweight” (rest “Hold”), with target prices often in the $140–$165 range (post-split, as applicable).

•Target Price Range: Median 12-month PT: $150–$160 (representing ~20% upside from July 2025 levels).

•Key Bullish Arguments: Unmatched AI chip lead, accelerating enterprise AI adoption, deep software moat, and a robust international/sovereign AI order pipeline.

•Cautious/Bearish Notes: Valuation premium (45–50x P/E), high expectations priced in, geopolitical and supply chain risks.

________________________________________

⚠️ Key Negative Drivers & Risks

1. 🇨🇳 US–China Tech War / Chip Export Restrictions

• US restrictions: While the Biden administration eased some export bans in May 2025 (allowing more AI chip exports to Gulf/Asia partners), China remains subject to severe curbs on advanced NVDA AI chips.

• Workarounds: Nvidia is selling modified “China-compliant” chips (H20, L20, A800/H800), but at lower margins and lower performance.

• Risk: If US tightens controls again (post-election), China sales could fall further. Chinese firms (Huawei, SMIC, Biren) are also racing to build their own AI chips—posing long-term competitive risk.

2. 🏛️ Political/Regulatory Risk

• Election year: A US policy shift (e.g., harder tech stance after Nov 2025 election) could re-restrict exports, limit new markets, or disrupt supply chains (especially TSMC foundry reliance).

3. 🏷️ Valuation Risk

• NVDA trades at a substantial premium to tech/semiconductor peers (45–50x fwd earnings). Any AI “spending pause” or earnings miss could trigger sharp volatility.

4. 🏭 Supply Chain & Capacity Constraints

• As AI chip demand soars, there’s ongoing risk of supply/delivery bottlenecks (memory, HBM, advanced packaging), which could cap near-term revenue upside.

5. 🏁 Competitive Threats

• AMD, Intel, and custom in-house AI chips (by Google, Amazon, Microsoft, Tesla, etc.) are scaling up fast. Loss of a hyperscaler account or a successful open-source software alternative (vs CUDA) could erode Nvidia’s dominance.

6. 💵 Customer Concentration

• A small handful of cloud giants account for >35% of revenue. Delays or pullbacks in their AI spending would materially impact results.

________________________________________

📝 Summary Outlook (July 2025):

Nvidia’s AI chip monopoly, software moat, and global AI arms race create a powerful multi-year growth setup, but the stock’s high valuation and US-China chip tension are real risks. Analyst consensus remains strongly positive, with most seeing more upside as data-center and enterprise AI demand persists—but with increased focus on geopolitical headlines and potential supply chain hiccups.

________________________________________

Apple Stock Is Surging! Here’s What Most People MissWhen it comes to trading, we don’t care about the latest news headlines or whether some analyst has upgraded or downgraded Apple stock. We focus on one thing and one thing only: the undeniable forces of supply and demand imbalances on higher timeframes.

Right now, Apple’s monthly chart is a textbook example of how waiting for a strong demand imbalance pays off. That $178 monthly level is no random number. It’s the exact origin of a massive bullish impulse that happened in June 2024 — the kind of move that only happens when smart money and big institutions step in, creating an imbalance that pushes the price away rapidly.

📈 It’s Not About Fundamentals. It’s About Imbalances.

Most retail traders waste time chasing news, earnings, or rumours about iPhone sales. But if you think about it, all those factors are already priced in once a strong imbalance is formed. Institutions don’t wait for tomorrow’s news — they plan their positions weeks or months ahead, and those footprints are visible right on your chart.

The $178 level indicates a significant drop in supply and a surge in demand large enough to propel Apple higher, marked by consecutive large bullish candlesticks. That’s our signal — nothing more, nothing less.

AAPLAAPL price is near the support zone 195-193. If the price can still stand above 193, it is expected that the price will rebound. Consider buying in the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

AAAPL: Updated Outlook and Best Level to BUY/HOLD 70% gains________________________________________

Apple Outlook: July 2025–Q1 2026

After peaking near $200 in late May, Apple (AAPL) remains under correction territory despite pockets of resilience, closing July around $193. The current correction is projected to persist until Q1 2026, as global macro and policy headwinds weigh on the broader tech sector. Technicals suggest AAPL could find its cycle low between Q3 and Q4 2025, potentially setting the stage for a renewed bull run into late 2026. Pullback until 170/175 USD. 📉

Catalysts Shaping Apple’s Stock Price in 2025–26

1. AI Integration and Apple Intelligence

Strength: 9/10

The roll-out of on-device Apple Intelligence features—including an upgraded Siri, ChatGPT integrations, and generative AI tools—continues to build anticipation for a major iPhone upgrade supercycle. Initial adoption has been strong, but broader impact will hinge on Q4 developer and enterprise feedback. 🤖

2. Services Segment Growth

Strength: 8.5/10

Apple’s Services business (App Store, iCloud, Apple Music, AI-powered subscriptions) is projected to post double-digit growth into Q4 2025, with consensus revenue estimates at $25–27B for the quarter. Analysts see upside from new AI-driven service bundles, which could add $5–8B in annualized revenue by 2026. 💡

3. Gross Margin Expansion & Cost Efficiencies

Strength: 8/10

Apple’s gross margin is forecast to improve by up to 60 basis points in Q4 2025 as the product mix tilts toward higher-margin services, and as component costs ease. Operational efficiencies from supply-chain automation may further cushion profit margins amid macro uncertainty. 📊

4. iPhone 17 Product Cycle

Strength: 7.5/10

The iPhone 17 lineup—rumored to include advanced polymer batteries and potential foldable form factors—is expected to launch Q4 2025, giving Apple a competitive hardware edge versus Android rivals. Early channel checks point to pent-up demand, though upgrade rates may lag previous cycles due to consumer caution. 📱

5. Vision Pro & Hardware Diversification

Strength: 7/10

Next-gen Vision Pro headsets and new AR/VR devices, boosted by Apple Intelligence, are expected to drive incremental growth in Q4 2025. However, high price points and limited mainstream adoption keep near-term impact contained. 🥽

6. Share Buybacks & Dividend Policy

Strength: 7/10

Apple’s $110B share buyback authorization and steady dividend growth provide valuation support, but recent market volatility has prompted a more cautious pace of repurchases. Yield-seeking investors are watching closely for any pivot in capital return policy if macro pressures persist. 💵

7. Supply Chain & Trade Policy Risks

Strength: 6.5/10

Escalating U.S.–China trade tensions—including the risk of expanded tariffs or tech export bans—remain a top concern. Apple is accelerating its assembly shift toward India and Vietnam to diversify risk, but any new policy shocks in Q4 could hit margins and unit volumes. 🌏

8. Regulatory & Antitrust Pressures

Strength: 6/10

The EU’s Digital Markets Act and potential U.S. antitrust probes could force Apple to further open up its iOS ecosystem by year-end, potentially capping Services revenue growth and adding compliance costs. ⚖️

9. Macro & Interest-Rate Environment

Strength: 5/10

With the Fed signaling “higher for longer” rates through mid-2026, tech sector valuations remain under pressure. Analysts see this limiting multiple expansion even if EPS growth resumes in late 2025. 📈

10. Smartphone Market Competition

Strength: 5/10

Aggressive pricing and innovation from Samsung and Chinese OEMs are intensifying competitive pressures, especially in emerging markets. Apple’s share gains are likely to slow until the macro environment improves and new hardware cycles fully materialize. 🥊

________________________________________

Analyst Projections for Q4 2025:

• Consensus Revenue: $108–112B (up ~4% YoY)

• EPS Estimate: $2.30–$2.42

• Gross Margin: 45–46%

• iPhone Unit Growth: 2–3%

• Services Revenue: $25–27B

Morgan Stanley and JP Morgan maintain “Overweight” ratings, but expect rangebound performance until macro and trade uncertainty clears. Most price targets for Q4 2025 hover between $195–$215, with upside potential post-correction into 2026. 📊

________________________________________

Analyst / Firm Date Rating Price Target (USD)

Barclays 06/24/2025 – 173 ()

Jefferies (E. Lee) 07/01/2025 Hold (Upgraded) 188.32

UBS (D. Vogt) 07/03/2025 – 210.00

J.P. Morgan (S. Chatterjee) 06/26/2025 Overweight 230.00

Morgan Stanley (E. Woodring) 03/12/2025 Overweight 252.00

Evercore ISI 01/31/2025 – 260.00

Redburn Partners 01/31/2025 – 230.00

D.A. Davidson (G. Luria) 05/02/2025 – 250.00

TradingView Consensus (avg) – Consensus 228.98

TipRanks Consensus (avg over 3mo) – Consensus 226.36

Apple Is Climbing the Fibonacci Channel Ladder – Step 5 Ahead?On the monthly chart, Apple (AAPL) is steadily moving within a well-defined ascending Fibonacci channel, like climbing a ladder — step by step.

The price is currently testing Step 4 , a zone that has acted as a strong resistance barrier.

Despite the pressure here, the structure still appears bullish, and even a minor pullback might simply be a pause before the next move.

If momentum picks up, we could soon see a breakout toward the next step — targeting 234 at Step 5.

The trend remains technically intact unless the channel is broken, and the overall formation still leans toward continuation.