Apple (AAPL) Shares Jump Following Earnings ReportApple (AAPL) Shares Jump Following Earnings Report

Yesterday, after the close of the regular trading session, Apple released its earnings report, which surpassed analysts’ expectations:

→ Earnings per share: actual = $1.57, forecast = $1.43;

→ Revenue: actual = $94.04 billion, forecast = $89.35 billion.

As a result, AAPL shares surged in the post-market, rising from $207.57 to $212.51.

Media Commentary:

→ The company reported a 13% year-on-year increase in iPhone sales.

→ However, according to Tim Cook, tariffs have already cost the company $800 million and this figure could exceed $1 billion in the next quarter.

Technical Analysis of the Apple (AAPL) Stock Chart

Following the volatility in April 2025, price action has justified the construction of an ascending channel (marked in blue). The $216 level, which has acted as a key reference point since March, remains a significant resistance area, because:

→ It has consistently prevented AAPL from reaching the upper boundary of the channel;

→ Even in the wake of a strong earnings report, the price failed to break through this level in post-market trading.

If the $216 level continues to cap gains in the coming days – despite the positive report – the stock might pull back towards the median line of the blue channel (following the post-market rally). This zone often reflects a balance between supply and demand. While such a retracement would appear technically justified, it may raise concerns among shareholders, particularly when compared to the more aggressive price rallies seen in the shares of other tech giants, such as Microsoft (MSFT), as we discussed yesterday.

From a more pessimistic perspective, peak A may turn out to be yet another lower high within a broader bearish structure that has been forming on the AAPL chart since December 2024, when the stock reached its all-time high around the $260 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Aaple_trade

AAPL EARNINGS TRADE SIGNAL (JULY 31)

### 🍏 AAPL EARNINGS TRADE SIGNAL (JULY 31) 🚀

📊 **AAPL Call Play** — Earnings Strategy

🧠 Multi-model conviction: **75% Bullish Bias**

---

### 🔍 Fundamental Drivers

✅ TTM Revenue: +5.1%

✅ Gross Margin: 46.6%

✅ 8 straight earnings beats

⚠️ Sector shift: growth → value = caution

📉 TTM EPS Est: \$8.31 (+29.4% growth est.)

🧮 **Score**: 8/10

---

### 💰 Options Flow Breakdown

🔥 IV Rank: 0.70

🔵 Bullish OI @ \$220C = 25,950 contracts

🔻 Skew: Heavy puts @ \$197.5 / \$200

⚠️ Gamma squeeze possible near \$220

📈 **Score**: 8/10

---

### 📉 Technicals

📍 RSI: 39.3 (Oversold)

📉 Trading below 20DMA (\$211.64)

🟥 Low volume pre-earnings = low conviction

📌 Support: \$207.5 | Resistance: \$220

📉 **Score**: 6/10

---

### 🌐 Macro Setup

⚠️ Supply chain pressures

⚠️ Regulatory risk ongoing

🔄 Growth → Value rotation still underway

🌐 **Score**: 5/10

---

### 🧠 Trade Setup (Call Option)

* 🎯 **Strike**: \$220

* 💵 **Entry**: \$0.87

* 📅 **Expiry**: 08/01 (2DTE)

* 📈 **Target**: \$2.61

* 🛑 **Stop**: \$0.43

* ⚖️ **Risk**: 2% of portfolio

* ⏰ **Timing**: Enter before close, report after market

🧮 Expected Move: ±5.0%

🔒 Confidence Level: 75%

---

### ⚙️ Exit Plan

✅ Profit: Exit @ \$2.61

❌ Stop: Exit @ \$0.43

🕒 Time Exit: Force close within 2 hours post-earnings

---

📣 **EARNINGS SCALP PLAY**

— AAPL is oversold w/ strong EPS beat history

— Bullish OI stacking at \$220

— High gamma setup, low IV risk = 💥

\#AAPL #EarningsTrade #CallOption #TradingView #0DTE #OptionsFlow #GammaSqueeze #UnusualOptions #AppleEarnings #SwingTrade #TechStocks

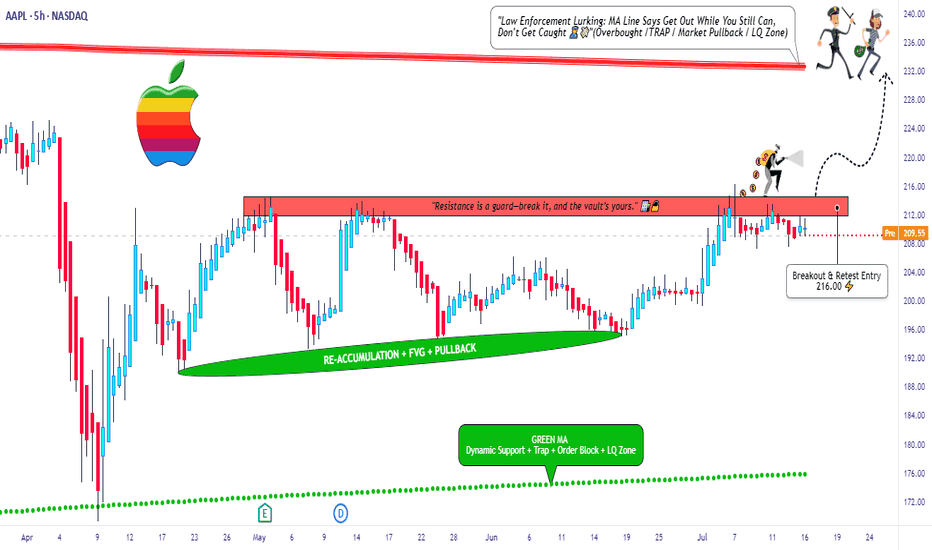

Apple Inc Long Setup – Break, Ride, Exit Like a Pro🕵️♂️💼 “The Apple Heist: Thief Trader's Masterplan for a Clean Escape” 💸🚀

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Welcome, Money Makers & Market Thieves! 🤑💰💸✈️

This ain’t your average stock analysis — this is a high-level blueprint for the Apple Inc. (AAPL) market heist, built using the Thief Trading Style 🔥📊.

We've scouted the field using a mix of technical patterns, market sentiment, and fundamental fuel, and we’re ready to make our move. The plan is set: go long once the resistance wall cracks, and aim for a clean getaway just before the danger zone hits.

🎯 THE PLAN: INFILTRATE, ESCAPE, PROFIT

Entry Point:

💥 “The vault’s cracking – the breakout begins at 216.00!”

Place Buy Stop orders just above the resistance wall or wait for a pullback to recent swing zones (15M–30M charts work best).

📌 Set your alerts early – you don’t want to miss the opening.

🛑 STOP LOSS - YOUR BACKUP PLAN

🔊 “Listen up, crew: No stop loss until the breakout confirms! Once you’re in, place SL wisely – use the 4H swing low (200.00). Your risk, your rules. Don't get caught slippin’.”

📍 Adjust SL based on lot size, entry volume, and trade size. Protect your stash.

🏁 TARGET ZONE:

🎯 Heist Target = 232.00

(Or bail early if the heat's on – you know the drill.)

⚠️ SCALPERS & SWINGERS

💸 Long side only – don’t fight the wave.

🧲 Scalpers: Get in, grab the cash, trail the stop.

📈 Swing Traders: Hold firm. This setup has legs.

🔎 WHY WE’RE ROBBING THIS CHART:

Apple’s bullish momentum is fueled by:

📌 Strong institutional sentiment

📌 Earnings strength

📌 Index rotation and positioning

📌 COT data & macro tailwinds

Get the full scope: fundamentals, macro outlook, positioning data, sentiment, and intermarket dynamics 🔗📊.

Stay sharp – stay informed.

📰 NEWS ALERTS & POSITION MANAGEMENT

🚨 Avoid new entries during high-impact news releases.

🏃 Use trailing SLs to lock profits and exit clean.

💖 BOOST THE CREW — STRENGTH IN NUMBERS

🚀 Hit that BOOST button if this helped you steal a profitable trade. Your support powers our heist team.

Let’s keep making money the Thief Way – with style, planning, and confidence. 🎉💪🏆

📌 NOTE FROM HQ:

This analysis is for educational purposes. It’s not personalized financial advice. Manage your trades responsibly. Conditions can shift quickly — stay updated and flexible. Stay in the shadows and move smart. 🐱👤

💬 Drop a comment, hit like, share with your gang – the market's a vault, and we’re the codebreakers.

See you on the next heist, Thief Fam. 🤑🔥🕶️💼

Apple (AAPL) Shares Consolidate Ahead of WWDCApple (AAPL) Shares Consolidate Ahead of WWDC

Today, 9 June, marks the start of Apple’s Worldwide Developers Conference (WWDC) — an event that traditionally attracts significant attention from investors and traders.

It is fair to say that WWDC 2025 begins against a rather negative backdrop:

→ Since the start of 2025, AAPL stock price has fallen by 19%, and Apple has lost its title as the world’s most valuable company, now trailing behind Microsoft and Nvidia.

→ Expectations raised by last year’s conference — particularly regarding new AI features in the iPhone — were not fully realised. As Barron’s noted, in March, an Apple spokesperson admitted that the new Siri “will take longer than we thought to implement these features. We expect to roll them out next year.”

Technical Analysis of the AAPL Chart

AAPL price movements are forming a narrowing triangle pattern:

→ The red trendline highlights sustained downward pressure on AAPL shares in 2025 — partly driven by concerns over the impact of the ongoing trade war;

→ On the other hand, the area below the psychological $200 level may attract buyers willing to take on risk.

WWDC 2025 could well provide fresh hope for the bulls and prompt an attempt to break out upwards from the triangle pattern.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Apple (AAPL) share price slips towards psychological $200 levelApple (AAPL) share price slips towards psychological $200 level

Yesterday, Apple shares (AAPL) fell by 2.5%, edging closer to the key psychological threshold of $200. Moreover, the stock is underperforming the broader market, which reached new highs earlier this week — a move AAPL has yet to replicate.

Why is AAPL’s stock price declining?

According to media reports, investors may have grown concerned after OpenAI acquired a startup founded by Jony Ive, Apple’s former chief designer, for $6.5 billion.

The move is being interpreted as OpenAI’s first step toward launching a physical AI-powered device — one that could, eventually, pose a challenge to Apple’s hardware, even if not in the near term.

Technical analysis of the AAPL chart

Bulls may be hoping the AAPL price finds support at the confluence of two key levels:

→ the psychological $200 mark;

→ support from the second half of May (the lower blue trendline).

However, the broader technical context raises some bearish concerns:

→ the $215–222 zone, which previously acted as support, is now capping price advances (as highlighted by the arrows);

→ the red descending channel appears to define the current trend trajectory — and its relevance may be reinforced if the price drops and consolidates near its median line, signalling a balance between buying and selling pressure.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AAPL Technical Analysis and Trade IdeaOn the monthly time frame, #AAPL exhibits a bullish trend with a recent retracement into an equilibrium zone. As we delve into lower timeframes, a base formation becomes evident. Specifically, we observe a double bottom setup followed by a break below the previous lows, a robust rally, and subsequently, a higher low formation.

As we continue analyzing the shorter timeframes, we notice a potential shift in the current downtrend. This change in character suggests the possibility of a structural break. My focus lies on identifying a buy opportunity if we witness a breakout and subsequent retest of the previous high on the 15-minute timeframe.

However, it’s paramount to acknowledge the inherent risks associated with trading. Always conduct thorough research, considering both fundamental market drivers and the broader macroeconomic landscape, in addition to your technical analysis. Implement sound risk management strategies to safeguard your capital.

Disclaimer: This analysis provides a technical perspective on AAPL and should not be construed as investment advice. Tailor your trading decisions to your specific risk tolerance, informed by comprehensive market research and a holistic assessment of all relevant factors.

AAPL Technical Analysis and Trade IdeaRecent rallies in AAPL have stalled, with the 1D chart indicating a possible bearish shift.

Key observations:

- Market Structure Break: A clear break of market structure to the downside, including a lower low followed by a lower high, signals a potential downward trend.

- Fibonacci Retracement: Price action has retraced to the crucial 61.8% - 78.6% Fibonacci zone. This area often acts as a strong support or resistance level.

- Trading Strategy: Consider short entry points within the Fibonacci optimal entry zone throughout February and March. This offers a short-term opportunity with a stop-loss placed above the previous high. Target the previous downswing low as a potential profit-taking point.

Additional Considerations:

Macroeconomic Factors: Stay informed about broader market conditions and news that could impact AAPL's price.

Disclaimer: This analysis is for informational purposes and not financial advice. Always conduct your own research and risk assessment before trading.

#AAPL: Possible continued uptrend!Dear Traders,

Apple's stock prices are undervalued while we still think company is in well positioned to continue the bullish trend in upcoming months. While also looking at the current news event the new line up for the new iPhone also suggest that demand of apple products has increased.

AAPL - AnalysisAAPL

Time for correction?

W1 – A triangle pattern may form. If this changes the direction of the trend, we could see a move towards the lows to 123.61 in the longer term.

The grounded option is a correction, and we see the price moving towards the level of 156.87. If the price retests the level of 171.22, then the road to a fall is open.

What can you expect?

Movement to the levels 168.24 - 156.87 - after breaking through the boundaries of the triangle.

Short

Goals – 168.24 – 160.64 – 153.69

Long-term (retest required) – target values 156.87 – 145.08 – 123.61.

Long – will be revised if the situation changes

AAPL's next target is $176.40

The short-term resistance for AAPL is at $157.40, and the current market is very close to it after experiencing an uptrend. The market sentiment is bearish, but as others fear, I am greedy. Although there is a need for adjustment in the market, the probability of AAPL continuing to rise and break through in the future is higher. Short-term profits can be taken, but the view of being bullish on AAPL in the medium and long term remains unchanged.

Personal suggestion: Continue to enter the market for long positions near $150, with a target of $176.40 and a medium to long-term layout. It requires a certain amount of capital pressure resistance and a good mentality. I will continue to update my views on AAPL in the future, please stay tuned.

Sorry AAPL lovers - the STOCK is set to fall this week The AAPL stock has been moving up really nicely from 125 since the beginning of this year. Unfortunately it has come to a point where the market is telling us it has no energy to move up further.

Here is why the stock is set to go down.

1) There is strong resistance at 155.10 to 157.80

2) There is a triple top in H4 with divergence

3) RSI is overbought on H4 and D1.

The reality of another round of rate hikes in March (Perhaps another 0.5%) has also spooked the market. Inflation isn't abating with the last one being at 6.4% which was higher than the Fed and market expected so don't be surprised if we see a few weeks of weak stock market movements.

As for me, I will go short on the stock with stop losses above 165 and aim for the 125 price range.

AAPL pulls back, back to bearish move?$AAPL pulls back along with the market, just before President Biden speaks. on top of the power hour few minutes before the market close. aapl release

a news about laying off their contractors as part of mass tech layoffs. if you notice lately, most of the tech layoffs sometimes make positive effects on

company stocks. making it to bounce up from the bad news. In 1hr chart AAPL is entering the squeeze momentum. and it looks like it will continues to

pulls back tomorrow depending on the market conditions volatility.

AAPL average price move per day is $3 TO $4 per day depending on market volatility and catalyst.

Below is the price level I'm looking for entries and exit for AAPL

Buy call above 153.97 and sell at 155.49 or above

Buy puts below 152.59 and sell at 151.49 or below

make sure that you set up alerts on those key level so you wont miss the move.

and always to take your profits as you see one.

Another honorable mentions for bearish setups are semis:

$AMD , $QCOM, $TSM and $META

Apple Analysis 11.01.2023Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next few days and weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

Thank you for watching and I will see you tomorrow!

You can also check out my previous analysis of this asset:

Apple Shark StrategyWe see that the previous harmonic pattern pushed prices back to the fib 2.24 level.

I think he's trying to complete a harmonic pattern again now.

Moreover, I think that a pattern that repeats itself can be formed with the fractal.

When we simulate the first main pattern that may occur, prices will appear as follows.

When we look at the fractal image, I predict that the intermediate prices will be as follows.

When we measure the fractal back test from the internal image tp2, I think the prices will encounter a sell reaction from $ 160.

We can think that it will continue its upward movement again with support from the $ 150 levels.

It is also possible to predict that prices returning from the $180 levels may fall to the $120 levels as the pull back of the main pattern.

Never mind what I've written so far. I think what I have to say now is more important.

When we examine the chart in monthly and weekly time periods, I see that this is not an upward trend, but a downtrend.

It turns out in the measurements that the harmonic pattern on the graph is also a shark. Considering that my words will not affect your investment decision, I can say the following.

Prices will most likely rise as high as $160 and get a selling reaction from there. I think prices will fall from the $160 levels to the $120 levels. Of course, this is my opinion. Just a prediction

Note: This is not investment advice.